R K Swamy, a leading integrated marketing service group in India, is set to launch its IPO, offering investors an opportunity to tap into the burgeoning marketing services market in India. Through R K Swamy IPO Review, we try to understand the business in 10 key points.

#1 R K Swamy IPO Review: Diverse Service Offerings

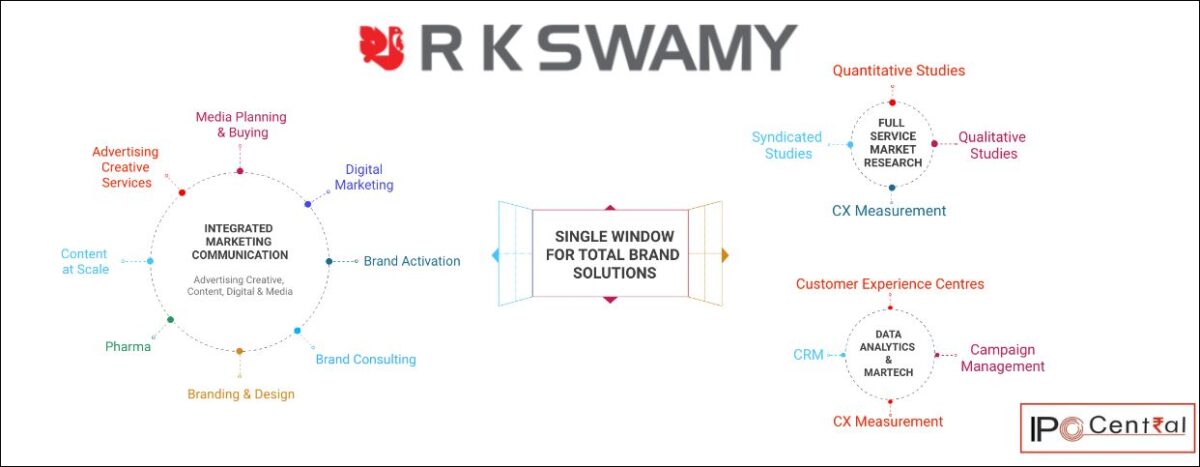

R K Swamy offers a comprehensive suite of services across three interrelated business segments: Integrated Marketing Communications, Customer Data Analytics and MarTech, and Full-Service Market Research. This diverse portfolio positions the company as a one-stop solution provider for clients’ marketing needs.

The company operates under two prominent brands – ‘R K Swamy’ and ‘Hansa’, catering to different segments of its business. This branding strategy ensures clear positioning and enables effective communication of its diversified offerings.

#2 R K Swamy: Strong Market Position and Opportunity

According to CRISIL Reports, R K Swamy is ranked 8th in terms of operating revenue among integrated marketing communications service groups in India. This underscores the company’s established presence and competitive standing in the industry.

The marketing services market in India has witnessed significant growth, reaching INR 1,936 billion in Fiscal 2023. Projections suggest a CAGR of 12.5 – 14.5% till Fiscal 2028, driven by increased corporate spending on marketing activities and the expanding digital ecosystem.

Segment-wise Growth: R K Swamy operates in three key segments, each poised for growth:

- Integrated Marketing Communications: The industry is expected to grow at a CAGR of 13 – 15% to reach INR 1,700 – 1,800 billion by Fiscal 2028, fueled by digital advertising’s rising prominence.

- Customer Data Analytics and MarTech: The industry is expected to grow at a CAGR of 13 – 15% to reach INR 200 – 230 billion by Fiscal 2028, driven by demand for personalized client experiences and targeted marketing strategies.

- Full-Service Market Research: The industry is expected to grow at a CAGR of 9 – 10% to reach INR 140 – 150 billion by Fiscal 2028, buoyed by factors such as rapid digitization and the rise of digital marketing and e-commerce.

#3 R K Swamy IPO Review: Strong Client Relationships

R K Swamy boasts longstanding relationships with a large and diversified client base. With over 475 clients serviced during Fiscal 2023, and 93.72% of revenue from repeat clients for the six months ended September 30, 2023, the company demonstrates its ability to consistently meet client needs and deliver value.

As of 31 March 2023, the average duration of relationships with the top 10 clients stands at approximately 19 years, while for the top 50 clients, it’s around 11 years. Notably, 83.73% of the revenue for Fiscal 2023 and 84.06% for Fiscal 2022 were derived from repeat clients, referencing the preceding fiscal period.

R K Swamy has catered to esteemed clients, including Aditya Birla Sun Life AMC Limited, Dr. Reddy’s Laboratories Limited, Havells India Limited, Hawkins Cookers Limited, Himalaya Wellness Company, Hindustan Petroleum Corporation Limited, Mahindra and Mahindra Limited, Oil and Natural Gas Corporation Limited, Royal Enfield (a unit of Eicher Motors), Shriram Finance Limited, Tata Play Limited, Ultratech Cement Limited, Union Bank of India, and more.

#4 R K Swamy IPO Analysis: Data-Driven Approach

R K Swamy prides itself on being a data-driven integrated marketing services provider. During Fiscal 2023 and the six months ended September 30, 2023, the company released over 818 and 438 creative campaigns, respectively on behalf of the clients across various media outlets, handled over 97.69 and 140.05 terabytes (cumulatively for Fiscal 2023 and the six months ended September 30, 2023) of data and have conducted over 2.37 million and 1.44 million consumer interviews across quantitative, qualitative and telephonic surveys. This emphasis on data analytics underscores its commitment to delivering targeted and effective marketing solutions.

#5 R K Swamy IPO Analysis: Offer Details

The R K Swamy IPO is scheduled for 4 to 6 March 2024, with a price range of INR 270 to 288 per share. The IPO consists of an Offer for Sale (OFS) of 8,700,000 shares, valuing the offering between INR 234.90 – 250.56 crores, and a Fresh Issue of 6,006,944 shares, amounting to as much as INR 162.19 – 173 crores. The minimum bid size is 50 shares, priced at INR 14,400, and retail investors are allotted 10% of the shares. The IPO will be listed on both BSE and NSE.

#6 R K Swamy IPO Review: Objects of the Issue

The net proceeds of the Fresh Issue, i.e., gross proceeds of the Fresh Issue less the company’s share of the Offer related expenses (Net Proceeds) are proposed to be utilized in the following manner:

- Funding working capital requirements of the company – INR 54.0 crore

- Funding capital expenditure to be incurred by the company for setting up a digital video content production studio (DVCP Studio) – INR 10.99 crore

- Funding investment in IT infrastructure development of the company, and its Material Subsidiaries, Hansa Research and Hansa Customer Equity – INR 33.34 crore

- Funding for setting up of new customer experience centers (CEC) and computer-aided telephonic interview centers (CATI) of the company – INR 21.74 crore

- General corporate purposes

#7 R K Swamy IPO: Financial Performance & Valuations

Financial performance is one of the most important factors in analyzing a company and it is no different in R K Swamy IPO Review. With a stable financial profile, R K Swamy has demonstrated profitability and healthy cash flows, bolstering investor confidence in its IPO.

| FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 | |

| Revenue | 173.55 | 234.41 | 292.61 | 141.10 |

| Expenses | 154.39 | 200.55 | 237.01 | 121.58 |

| Net income | 3.08 | 19.26 | 31.26 | 7.93 |

| Margin (%) | 1.77 | 8.22 | 10.68 | 5.62 |

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 0.69 | 4.33 | 7.03 |

| PE ratio | – | – | 38.41 – 40.97 |

| RONW (%) | 3.13 | 17.20 | 22.20 |

| NAV | 22.09 | 25.18 | 31.67 |

| ROCE (%) | 8.58 | 20.08 | 28.95 |

| EBITDA (%) | 15.73 | 18.13 | 20.97 |

| Debt/Equity | 22.63 | 3.09 | 0.76 |

#8 R K Swamy IPO Review: Outlook

As the marketing services industry continues to evolve, R K Swamy is well-positioned to capitalize on emerging opportunities. Its focus on innovation, client-centric approach, and market expertise bodes well for its future growth and shareholder value.

Conclusion

In conclusion, R K Swamy’s IPO Review presents investors with a chance to participate in India’s dynamic marketing services sector. With a strong market position, diversified service offerings, and experienced leadership, the company is poised for continued success in the years ahead. Investors keen on tapping into India’s growing marketing landscape should consider R K Swamy as a potential investment opportunity.