TReDS Full Form

The Trade Receivables Discounting System (TReDS) is a platform designed to facilitate the financing and discounting of trade receivables for Micro, Small, and Medium Enterprises (MSMEs) through multiple financiers. TReDS Portal allows MSMEs to manage their cash flow more effectively by enabling them to receive payments quickly for invoices issued to various buyers, including corporations, government departments, and public sector undertakings (PSUs).

It’s important to clarify that TReDS is a general term encompassing the entire system and should not be mistaken for “A Treds Limited,” which is specifically linked to one of the TReDS platforms operating in India.

Table of Contents

What is the TReDS Portal?

In a rapidly developing economy like India, Micro, Small, and Medium Enterprises (MSMEs) are vital contributors to the nation’s GDP. To thrive and fulfil this role, these enterprises need access to formal sources of affordable working capital. The Trade Receivables Discounting System (TReDS) addresses this need by enabling MSMEs to obtain financing based on the creditworthiness of their buyers, thus removing the necessity for direct negotiations with financiers. This mechanism ensures a smooth flow of liquidity for MSMEs and helps bridge the credit gap they often face.

Launched by the Reserve Bank of India (RBI) in 2018, TReDS serves as an electronic platform that allows MSMEs to quickly access financing with lower annual interest rates tailored for small businesses. The primary aim of TReDS is to provide short-term finance to MSME sellers through invoice discounting against large corporations, thereby assisting them in effectively managing their working capital needs.

Read Also: 7 Top Multibagger Stocks for 2025

What Is Invoice Discounting with TReDS?

Businesses can leverage invoice discounting to quickly access funds tied up in outstanding invoices, effectively utilizing the value of their sales ledger. This practice, often referred to as bill discounting, has been refined over several decades.

At its essence, bill discounting is a simple process: when a business issues an invoice to a customer, it frequently encounters payment delays that can last from 60 to 90 days. During this waiting period, the business can secure short-term financing against the invoices issued to reliable customers. In a bill discounting arrangement, lenders provide a percentage of the invoice amount, enhancing the company’s cash flow and facilitating smoother working capital management.

Invoice discounting operates similarly to a series of short-term loans secured by invoices. Essentially, the lender recognizes the likelihood of payment against the invoice and is willing to advance a significant portion of it before the customer completes the payment.

For small and medium-sized enterprises (SMEs), waiting for clients to settle invoices can put considerable strain on cash flow. Utilizing invoice discounting through the TReDS portal presents an effective solution to alleviate this challenge.

Read Also: Difference Between IPO and FPO – Is there an Actual Difference?

What are Operational TReDS Platforms?

The central bank initially issued guidelines for establishing and running TReDS in 2014. Subsequently, in 2017, the government authorized and granted licenses to three platforms to utilize the TReDS mechanism in India.

The three active TReDS platforms in India are:

1. RXIL (a joint venture of NSE and SIDBI)

RXIL, or the Receivables Exchange of India, is an RBI-authorized platform focusing on invoice discounting for MSMEs. It facilitates the sale of trade receivables through a digital marketplace, enabling businesses to access immediate funds against their outstanding invoices. Recently, RXIL introduced the International Trade Financing System (ITFS) to facilitate early payments for MSMEs against export invoices. The company anticipates facilitating trade financing worth USD 50-60 million through the ITFS in FY24, indicating a strong focus on improving financial access for MSMEs involved in international trade.

Additionally, RXIL has partnered with DBS Bank to offer a pre-shipment financing solution that streamlines the credit decision process for MSMEs, enhancing their access to funds. This revision maintains the original meaning while enhancing readability and flow.

2. M1xchange

M1xchange is an RBI-regulated electronic platform for trade receivable discounting. Similar to RXIL, it allows businesses to convert their invoices into immediate cash by facilitating a bidding process among multiple financiers. The platform operates under the Trade Receivables Discounting System (TReDS), ensuring transparency and speed in transactions, with payments processed within 1 to 2 days after invoice validation. M1xchange has experienced significant growth, reporting financing of INR 1,40,000 crore in bills through TReDS platforms in the last financial year, marking a substantial increase from previous years.

3. Invoice Mart (owned by A TReDS Limited – a joint venture between Axis Bank and mjunction services)

Invoice Mart is an online platform that provides invoice discounting services primarily targeting MSMEs. It enables businesses to convert their unpaid invoices into cash quickly, helping them manage working capital effectively. By allowing MSMEs to sell their invoices to financial institutions at a discount, Invoice Mart enhances liquidity and reduces the waiting period for payments from clients. The platform emphasizes ease of use and quick processing times, making it an attractive option for small businesses looking to improve their cash flow without resorting to traditional loans.

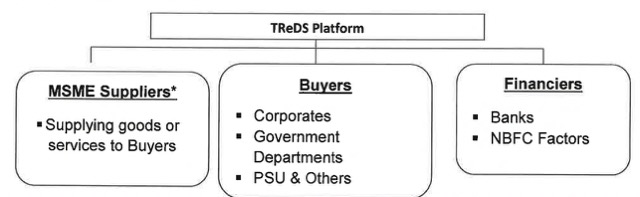

TReDS Participants

| Participants | Description |

| Buyer | Corporates, government departments, and public sector undertakings (PSUs) that approve the invoices submitted by MSMEs. |

| Seller | Micro, Small, and Medium Enterprises (MSMEs) that discount their invoices to access immediate funds. |

| Financier | Banks, non-banking financial companies (NBFCs), and other financial institutions authorized by the Reserve Bank of India (RBI) to provide funding based on the creditworthiness of buyers. |

Advantages of TReDS Platforms

Benefits To Buyers

- Cost Savings: Competitive pricing reduces procurement costs.

- Stronger Relationships: Timely payments improve vendor relationships.

- Regulatory Compliance: Adheres to MSME support regulations.

- Stable Cash Flow: Ensures suppliers maintain healthy cash flow.

- Lower Administrative Burden: Streamlined processes cut down on overheads.

- Flexible Payment Terms: Options for extended credit periods enhance cash flow management.

Benefits To Sellers

- Quick Cash Flow: Immediate access to funds from outstanding invoices.

- Better Rates: Competitive bidding results in favourable discount rates.

- No Collateral Needed: Financing without requiring additional security.

- Faster Payments: Shorter processing times lead to quicker invoice payments.

- Efficient Processes: Digital transactions reduce paperwork and enhance efficiency.

- Improved Liquidity: Better management of working capital.

- No Payment Follow-Ups: Eliminates the hassle of chasing payments.

- Diverse Financing Options: Access to multiple financiers increases chances for better terms.

Benefits To Financier

- Broader Market Access: Opportunity to finance a variety of MSME clients.

- Lower Costs: Automation reduces operational expenses.

- Reduced Risk: Financing based on verified invoices mitigates lending risks.

- Higher Profit Potential: Increased transaction volume can lead to greater profits.

Read Also: White Label ATM – Meaning, Example, Regulations, Operators

Treds Features

The TReDS platform offers the following features:

- Automation and digitization of processes.

- Completion of all transactions online.

- Quick access to funds without the need for extensive paperwork.

- Streamlined procedures and policies for a smooth flow of operations.

- Competitive and attractive discount rates.

- Zero collateral is required, providing working capital without pledging any assets.

- Working capital can be obtained in as little as 72 hours, shortening cash cycles through quick access to funds.

- Off-balance-sheet transactions, ensuring no negative impact on financial books (balance sheet) when using collateral-free invoice discounting.

- Easy access to working capital, supporting the expansion and growth of MSMEs.

How to Avail Working Capital Using TReDS?

Steps to Avail Working Capital through TReDS

- Register on a TReDS Platform:

- Sign up on platforms like RXIL, M1xchange, or InvoiceMart.

- Create a Factoring Unit (FU):

- Input details of outstanding invoices for discounting.

- Submit Invoices:

- Upload the invoices to be discounted on the platform.

- Buyer Acceptance:

- The buyer (corporate or government) accepts the Factoring Unit.

- Bidding Process:

- Financiers bid on the Factoring Unit; the seller can view and select bids.

- Financing Agreement:

- Sign an agreement with the selected financier detailing terms.

- Receive Payment:

- The financier disburses the agreed amount to the MSME seller.

- Repayment by Buyer:

- The buyer pays the financier directly on the due date.

Establishment and Operational Criteria for TReDS

To establish and operate TReDS services, an entity must fulfill specific criteria as follows:

Budget Requirements: TReDS must maintain a minimum paid-up equity capital of INR 25 crores, as it is not permitted to assume credit risk. Additionally, no single entity, apart from the promoters, can hold more than 10% of the equity capital of TReDS. In cases of foreign ownership, the TReDS will be subject to and governed by the prevailing foreign investment policy.

Due Diligence of Promoters: According to the SEBI’s Issue of Capital and Disclosure Requirements regulation from 2009, any organization or its promoters intending to operate as TReDS must be considered “fit and suitable.” The Reserve Bank of India (RBI) assesses the applicants’ status based on their historical performance, including sound financial credentials and integrity over a minimum period of five years. Additionally, feedback may be sought from other regulatory and enforcement agencies, such as the CBI, Income Tax Department, Enforcement Directorate, and SEBI, regarding the applicants.

Technology Capabilities: To facilitate smooth operations, TReDS must have strong technical capabilities and provide all participants with a digital platform. It should also feature a comprehensive business plan that includes surveillance mechanisms and a disaster recovery site. This setup is essential for monitoring data related to prices, positions, and volumes, helping to prevent any potential system manipulation.

Read Also: Call Money Market In India: All Important 7 Points

Treds Platform FAQs

What is a TReDS portal?

TReDS portal enables MSMEs to get short-term finance through invoice discounting against major corporations, allowing them to efficiently manage their working capital requirements.

How many TReDS platforms are operational in India?

Currently, India has three operational TReDS platforms (i) RXIL (ii) M1Xchange and (iii) InvoiceMart.

What are capital requirements for TReDS platforms?

Minimum paid-up equity capital requirement for setting up a TReDS platform is INR 25 crores.

What is TReDS full form?

TReDS full form is Trade Receivables Discounting System and the system facilitates credit availability to MSMEs.

Good initiate by Government

Great insights on the TReDS Portal! I appreciate the clear breakdown of its meaning and significance. The eight points really helped me understand its importance in streamlining transactions for MSMEs. Looking forward to more such informative posts!