As Sanstar Limited prepares for its initial public offering (IPO), potential investors have a unique opportunity to delve into the financial and operational strengths of one of India’s prominent manufacturers of plant-based specialty products and ingredient solutions. Through this Sanstar IPO Analysis, IPO Central tries to find out more about the company’s business, financial performance, and more details.

Table of Contents

Sanstar IPO Analysis: Market Position and Production Capacity

Sanstar is a key player in India’s maize-based specialty products sector, ranking as the fifth largest manufacturer with an impressive installed capacity of 3,63,000 tons per annum (1,100 tons per day). This scale of production underscores Sanstar’s ability to meet significant market demand both domestically and internationally. According to a Frost & Sullivan report, Sanstar’s robust production capacity positions it competitively within the industry.

Sanstar IPO Review: Business Overview and Offer Details

Incorporated in February 1982, Sanstar Ltd is one of the manufacturers of plant-based specialty products and ingredient solutions in India for food, animal nutrition, and other industrial applications. Promoted by Gautam Choudhary, Sanstar Group (SG) comprises 2 entities, namely Sanstar Ltd and Sanstar Bio Polymers Ltd (SBPL). The group is engaged in the manufacturing of maize-based specialty products and ingredient solutions and its co-products such as Gluten, Germ, and Bran. Sanstar Ltd and Sanstar Biopolymers Ltd, were merged on 23 November 2023.

Sanstar IPO is scheduled for 19 to 23 July 2024 and is priced in the range of INR 90 – 95 per share. The public issue consists of an Offer for Sale (OFS) of INR 113.05 crore and a Fresh Issue amounting to INR 397.1 crore. Retail investors will be allotted 35% of the shares. The IPO will be listed on both BSE and NSE.

Latest Content From IPO Central

- How Many IPOs Have Withdrawn In India?

- Motilal Oswal Home Finance Q2 FY25 Performance

- The Exciting Upcoming IPOs in December 2024 You Can’t Miss!

- Eleven IPOs Next Week – Market Set to Witness Over INR 18,000 Cr Fundraising Action

- Vishal Mega Mart IPO Analysis

- Sai Life Sciences IPO Analysis

- Emerald Tyre IPO Allotment Today: What to Expect After 530.67X Subscription Surge

- Ullu Digital IPO – INR 135-150 Cr SME IPO to Launch by March 2025

- RBI’s NOD for Canara Robeco AMC IPO and Canara HSBC Life Insurance IPO

- Zepto Surpasses INR 1,000 Crore in Annualized Ad Revenue

- Dhanlaxmi Bank Rights Issue Dates, Price, Allotment, Entitlement

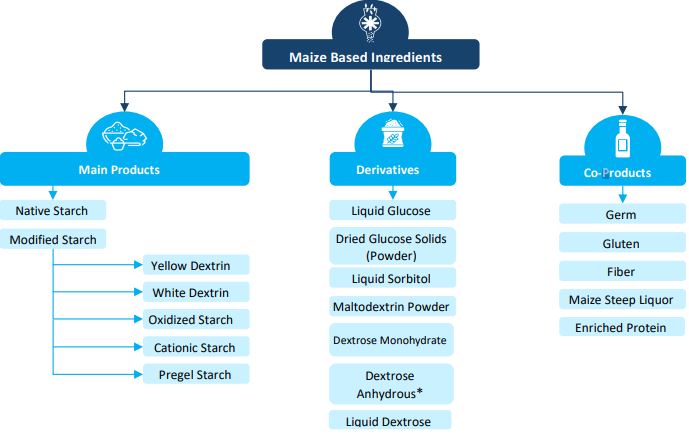

Sanstar IPO Analysis: Diverse Product Portfolio

Sanstar boasts a wide array of products that cater to various sectors, including food, animal nutrition, and industrial applications. Their product lineup features liquid glucose, dried glucose solids, maltodextrin powder, dextrose monohydrate, native and modified maize starches, and several co-products like germs, gluten, fiber, and enriched protein. These products serve multiple functions such as thickening, stabilizing, sweetening, emulsifying, and adding nutritional value.

In the food industry, Sanstar’s ingredients are used in bakery products, confectionery, kinds of pasta, soups, sauces, creams, and desserts. For animal nutrition, their products serve as vital nutritional ingredients. Industrial applications include their use as disintegrants, excipients, supplements, coating agents, binders, and more.

Read Also: Tata Sons IPO: Here is Why a Listing is Not Desirable

Sanstar IPO Review: Manufacturing Capabilities and Strategic Advantages

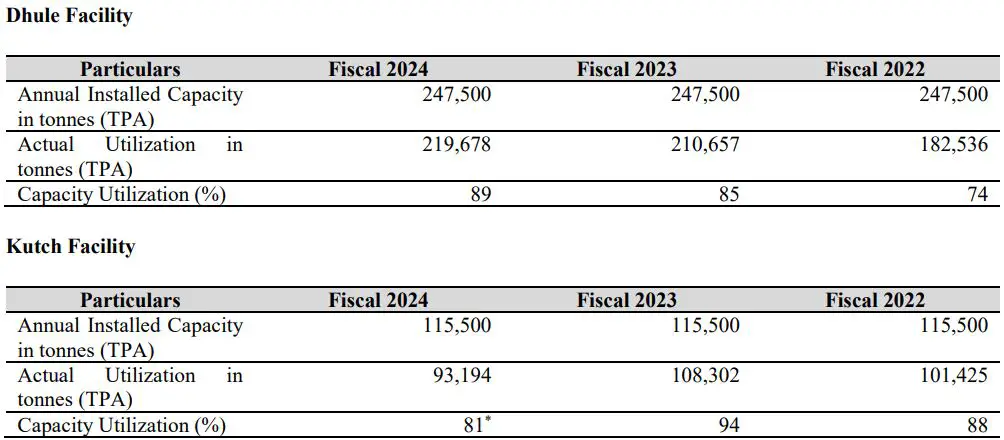

Sanstar’s manufacturing facilities in Dhule and Kutch are strategically located and equipped with state-of-the-art technologies. The Dhule facility, with an installed capacity of 247,500 tons per annum, is highly automated using Supervisory Control and Data Acquisition (SCADA) and PLC Automation Systems. This automation enhances manufacturing efficiency, reduces costs, and improves product quality. Additionally, the facility is sustainability-driven, with a bio-gas plant generating 1.56 megawatts of electricity and a solar plant with a 3.6 megawatt capacity.

The Kutch facility, operational since 2006, has a capacity of 350 tons per day and is registered with the United States Food and Drug Administration (USFDA). It also features a bio-gas plant generating 945 kilowatts of electricity. Both facilities have ample land available for future expansion, providing a competitive edge for scaling operations.

The following tables set forth the installed capacity, actual utilization, and capacity utilization for the Dhule Facility and Kutch Facility for the Fiscals 2024, 2023, and 2022.

Sanstar IPO: Financial Performance & Valuations & Margins

Sanstar has demonstrated robust financial growth over the past three fiscal years. The company’s revenue from operations increased at a Compound Annual Growth Rate (CAGR) of 45.46%, from INR 504.40 crore in FY 2022 to INR 1,067.27 crore in FY 2024. Profit after tax surged at an impressive CAGR of 104.79%, from INR 15.92 crore in FY 2022 to INR 66.77 crore in FY 2024.

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 504.40 | 1,205.07 | 1,067.27 |

| Expenses | 482.78 | 1,154.28 | 991.96 |

| Net income | 15.92 | 41.81 | 66.77 |

| Margin (%) | 3.16 | 4.45 | 6.26 |

| FY 2022 | FY 2023 | FY 2024 (Pre Issue) | FY 2024 (Post-Issue)* | |

| EPS | 1.08 | 2.98 | 4.75 | 3.66 |

| PE Ratio | – | – | 18.93 – 19.98 | 24.56 – 25.93 |

| FY 2022 | FY 2023 | FY 2024 | |

| RONW (%) | 32.51 | 28.00 | 30.92 |

| NAV | 3.32 | 10.63 | 15.37 |

| EBITDA (%) | 7.87 | 6.01 | 9.20 |

| ROCE (%) | 18.21 | 23.67 | 25.31 |

| Debt/Equity | 1.00 | 0.60 | 0.50 |

Read Also: Tunwal E-Motors IPO Subscription Status

Sanstar IPO Analysis: Export and Revenue Insights

Sanstar’s export strategy significantly contributes to its financial health. In Fiscal 2024, the company generated INR 394.44 crore from exports, accounting for 35.53% of its gross revenue from operations. Sanstar’s products reach 49 countries across Asia, Africa, the Middle East, the Americas, Europe, and Oceania. This extensive geographical reach highlights Sanstar’s global footprint and the international demand for its products.

Sanstar IPO Review: Objectives

The company proposes to utilize the Net Proceeds from the Fresh Issue towards funding the following objects:

- Funding the capital expenditure requirement for expansion of Dhule Facility – INR 181.56 crore

- Repayment and/or pre-payment, in part or full, of certain borrowings availed by the company – INR 100 crore

- General corporate purposes

Sanstar IPO Analysis: Customer Research and Development (R&D)

Innovation is a cornerstone of Sanstar’s growth strategy. The company’s in-house R&D team comprises ten personnel with a collective experience of over 40 years. The R&D facility, covering approximately 2,200 square feet, is well-equipped for research and testing. Sanstar’s R&D efforts have led to the development of innovative products like san-o-gel pre-gelatinized starch and san-o-mold starch, catering to the oil & gas and food industries, respectively. These innovations underscore Sanstar’s commitment to advancing product functionality and meeting industry-specific needs.

Sanstar IPO Analysis: Customer Base and Sales Channels

In FY 2024, Sanstar served over 525 customers, with 162 new customers added during the year. The company’s ability to maintain long-term customer relationships, with 96 customers placing repeat orders in each of the previous three fiscals, underscores its commitment to quality and customer satisfaction.

Sanstar’s diversified customer base includes manufacturers of end products, ingredients, and excipients, as well as distributors, traders, and aggregators. These clients span various industries, from confectionery and pharmaceuticals to animal nutrition and adhesives. This broad customer base ensures that Sanstar’s products are utilized in numerous consumer and industrial applications, stabilizing revenue streams and reducing dependence on any single market segment.

Sanstar has a reputed clientele of companies such as AB Mauri, ITC, Capital Foods, Hindustan Unilever, Godrej Agrovet, and Zydus Wellness in the domestic market. The company has a strong presence in the states of Maharashtra, Gujarat, and Andhra Pradesh.

As Sanstar moves forward with its upcoming IPO, investors have the chance to participate in the future success of a dynamic and strategically positioned industry leader.