Hyundai Motor India Ltd (HMIL), a subsidiary of Hyundai Motor Company, is set to launch one of the largest Initial Public Offerings (IPOs) in India’s history and has filed DRHP with SEBI in this regard. As the second-largest auto original equipment manufacturer (OEM) in the Indian passenger vehicle market and the country’s leading exporter of passenger vehicles, Hyundai Motor India IPO marks a significant milestone in the Indian automotive industry. Here’s a comprehensive look at the Hyundai India IPO, highlighting critical aspects from DRHP that make it a promising investment opportunity.

#1 Hyundai Motor India IPO: Business Overview, and Key Shareholders

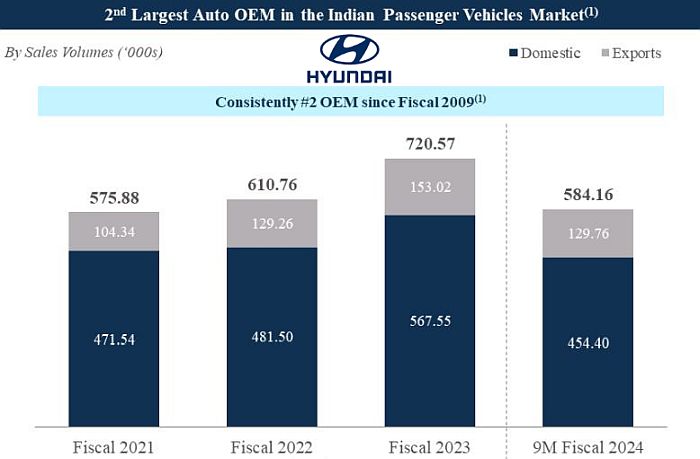

As mentioned above, Hyundai Motor India is the second-largest auto OEM in the Indian passenger vehicle market since fiscal 2009. The company manufactures a wide range of four-wheeler passenger vehicles, including sedans, hatchbacks, SUVs, and electric vehicles (EVs). HMIL is also India’s largest exporter of passenger vehicles, having exported the highest cumulative number of vehicles from fiscal 2005 to the first 11 months of fiscal 2024.

As of June 2024, HMC, the promoter, along with its six nominees, owns 100% of HMIL’s equity share capital. This strong parentage provides HMIL with substantial support in various operational aspects.

Also Read: All About SME to Mainboard Migration

#2 Hyundai Motor IPO: Manufacturing Plants

HMIL manufactures all its passenger vehicles and parts at its Chennai Manufacturing Plant. The company recently acquired the Talegaon Manufacturing Plant from General Motors India, which is under redevelopment and expected to commence commercial operations in the second half of fiscal 2026.

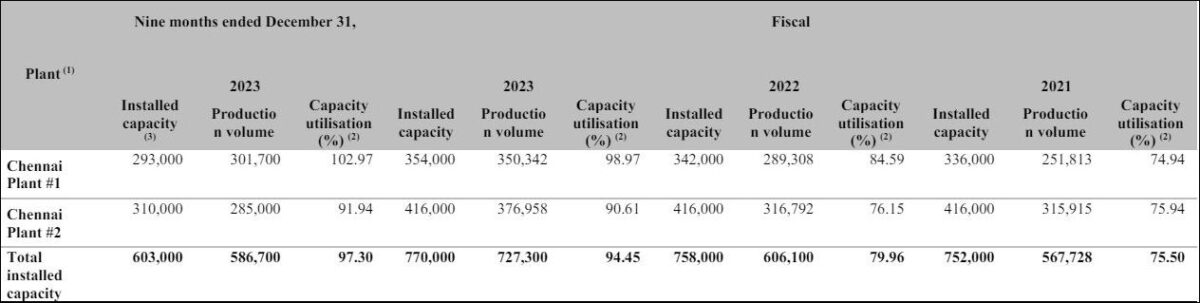

#3 Hyundai India IPO: Capacity Utilization

The company’s Chennai plant had an installed capacity of 770,000 units by the end of FY 2023, up from 758,000 units in FY 2022. The capacity utilization rates were 94.45% and 79.96% in FY 2023 and FY 2022, respectively. Manufacturing capacity utilization has faced disruptions due to various factors such as regulatory inspections, natural disasters, and strikes. For instance, the operations were suspended for safety reasons during the COVID-19 lockdowns in fiscal 2021 and 2022, leading to underutilization of capacity.

The following table sets forth its installed capacity, production volume, and capacity utilization across the Chennai Manufacturing Plant for the periods indicated:

Read Also: Best PMS in India in 2024 – All About PMS Services

#4 Hyundai Motor IPO: Offer Details

The Hyundai Motor India IPO is coming soon. The IPO consists of an OFS of 14,21,94,700 shares. It is worth highlighting that the company will not get any funds from IPO proceeds as it is an OFS. The retail investors are allotted 35% of the shares. The IPO will be listed on both BSE and NSE.

The company plans to sell 17.5% of its outstanding shares in the OFS. According to media reports, the total amount mobilized through the public offer is likely to be in the range of INR 20,000 – 25,000 crore. At this size, there will be enough shares to satiate the retail demand.

#5 Hyundai India IPO: Exports

HMIL is pretty high on exports which contributed 23.66% to its total revenue from operations during the nine months ended 31 December 2023. This is the highest export contribution for the company in the last 3 years. Hyundai India aims to leverage its manufacturing capabilities to become HMC’s largest foreign production base in Asia and an export hub for emerging markets, including South Asia, Latin America, Africa, and the Middle East.

Also Read: Top 10 Most Expensive Stocks In India

#6 Hyundai Motor India IPO: R&D and Supply Chain

HMIL benefits from HMC’s centralized R&D hub, which oversees global R&D initiatives, including investments in electrification, shared mobility, and autonomous driving. This collaboration enables HMIL to introduce new technologies and features in the Indian market swiftly.

Hyundai Motor Group’s largest supply chain outside Korea is in India, which as of 31 March 2024, comprised of 194 tier-1 and 1,083 tier-2 suppliers by location in India. In the nine months ended 31 December 2023, it sourced approximately 90% of its parts and materials in terms of purchase value in India from the four districts adjoining the Chennai plant. The company sources key supplies, including engine components and semiconductor chips, primarily from HMC and other companies within the Hyundai Motor Group.

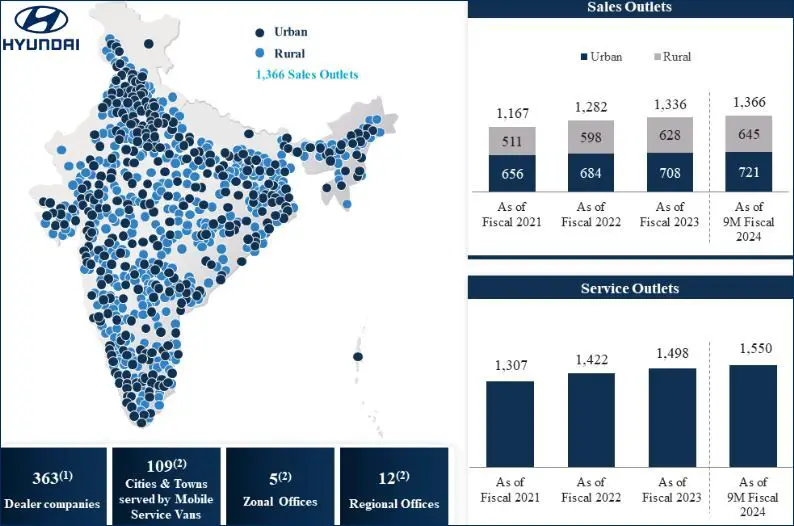

#7 Hyundai Motor India IPO: Sales Distribution and Aftersales Service Network

HMIL has an extensive sales and service network across India, with 1,366 sales outlets and 1,550 service outlets as of 31 December 2023. This network is next only to market leader Maruti Suzuki, ensures wide reach and customer support across rural and urban areas. For exports, the company relies on HMC’s marketing and sales network.

#8 Hyundai Motor India IPO: Revenues and Financial Performance & Margins

For the nine months ended 31 December 2023, HMIL reported revenue from operations amounting to INR 52,157.91 crore. This marks a significant financial achievement for the company within the given period. The revenue for fiscal 2023 stood at INR 60,307.58 crore, reflecting a robust year-on-year growth rate of 27.29% from INR 47,378.43 crore in fiscal 2022. During the nine months ending 31 December 2023, HMIL achieved a net profit of INR 4,382.87 crore. This profitability highlights the company’s efficient cost management and its ability to generate substantial returns from its operations.

The ongoing redevelopment of the Talegaon Manufacturing Plant and the company’s focus on expanding its product portfolio to include more electric vehicles (EVs) are expected to further enhance its market position and financial performance.

| FY 2021 | FY 2022 | FY 2023 | 9M FY 2024 | |

| Revenue | 40,972.25 | 47,378.43 | 60,307.58 | 52,157.91 |

| Expenses | 38,840.64 | 44,193.84 | 55,091.07 | 47,317.83 |

| Net income | 1,881.16 | 2,901.59 | 4,709.25 | 4,382.87 |

| Margin (%) | 4.59 | 6.12 | 7.81 | 8.40 |

Read Also: Nifty Pharma Stocks List With Weightage in 2024

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 23.15 | 35.71 | 57.96 |

| RONW (%) | 12.29 | 17.21 | 23.48 |

| NAV | 188.44 | 207.45 | 246.82 |

| ROCE (%) | 15.38 | 20.37 | 28.75 |

| EBITDA (%) | 10.36 | 11.58 | 12.52 |

| Debt/Equity | – | – | 0.06 |

#9 Hyundai Motor India IPO: Employees, and Customers & Customer Retention

As of 31 December 2023, the company had 5,475 full-time employees. HMIL employs a comprehensive training and development program for its personnel, including technical training and R&D support.

HMIL aims to enhance its brand as a trusted name in India through targeted marketing campaigns and inclusivity initiatives. The company plans to expand its customer base by tapping into new markets such as rural, tier-2, and tier-3 towns.

#10 Hyundai Motor India IPO: Royalty Agreement

HMIL has a royalty agreement with HMC, which grants HMIL a non-exclusive, non-transferable license to manufacture and sell passenger vehicles and parts in India. HMIL pays 3.5% of its sales revenue to HMC as royalty. This agreement requires HMC’s consent for export sales and may be terminated upon certain events, impacting HMIL’s manufacturing and sales operations.

Without doubt, Hyundai India IPO will be a closely watched development and investors will have high hopes from the offer. More so since the company is a well known brand in India. Keep checking IPO Central as we will make sure to cover all the major developments including grey market prices of this upcoming IPO.