Chennai-based Updater Services Limited (UDS) is approaching the primary markets and its IPO is scheduled to open on 25 September 2023. Things have moved really fast as the company received SEBI approval earlier this month only. As the company is gearing up to launch its IPO, it was an opportune time for IPO Central to dive into the prospectus and also get in touch with the management to get a nuanced understanding of the business.

Humble Beginnings

The business took shape as a partnership firm in 1990 and it was in 2003 that it was converted into a private limited company. Later on, in 2022, the company became a public limited company.

Initially, the company focused on undertaking contracts for housekeeping, building maintenance & catering and then gradually evolved into an Integrated Facility Management (IFM) service provider offering comprehensive services such as production support services, engineering services, industrial catering and higher value-added business support services.

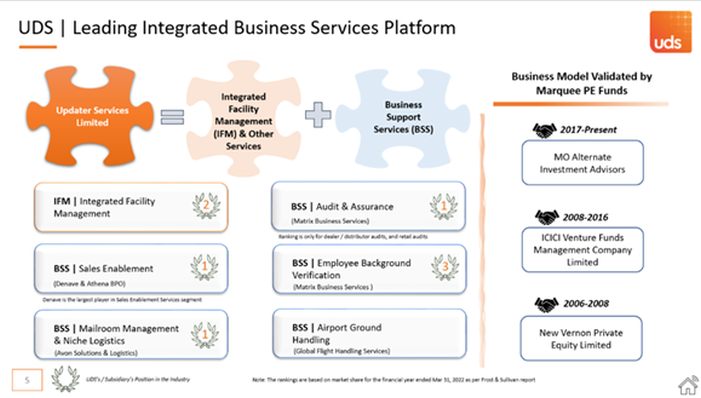

Now, Updater Services is engaged in a variety of businesses and caters to its customers’ distinct requirements and necessities. It is an integrated business services player and offers services in the segment of Integrated Facilities Management (IFM) services and Business Support Services (BSS).

These services are further distributed in sub-categories.

The Integrated Facilities Management (IFM) Services vertical of the company offers –

- Engineering Services

- Production Support Services

- Soft Services

The Other Services include –

- Warehouse Management

- General Staffing

- Institutional Catering

- Others

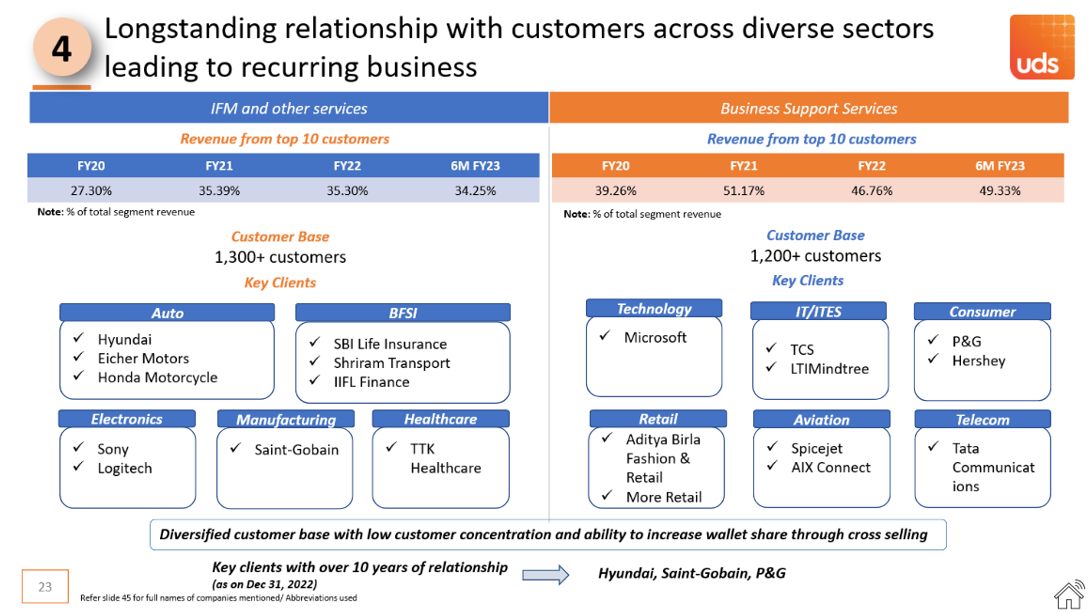

In the IFM Services segment, UDS has been a preferred choice of its 1,300+ customers for the past three decades. They are the second largest entity in the IFM Market with the most extensive service offering portfolio in the industry. These services are delivered to industries like Manufacturing, Auto, IT, BFSI, Infrastructure and Retail.

The BSS Vertical of Updater Services also contributes highly to the revenues and profitability of the organization and enables its overall growth. The services offered in the Business Support Services are –

- Sales Enablement Services

- Employee Background Verification Services

- Audit & Assurance Services

- Airport Ground Handling Services

- Mailroom Management & Niche Logistics Solutions

With its ever-growing operations, the organization has extended its services to multiple industries and segments like Manufacturing and engineering, Healthcare, Automobiles, FMCG, Banking, Financial Services, Insurance (BFSI), Information Technology/information technology-enabled services (IT/ITeS), ports, airports, infrastructure, logistics and warehousing, retail, and many more. Updater Services, today, has a reputation for quality, innovation, competitiveness and above all – for it’s well trained people, in all its offerings whether it is IFM services or Business Support Services.

Profitability, High volume and Operational excellence

Updater Services operates in a single digit-margin industry in its IFM business, but its growing focus on the higher margin Business Support services within the Business-to-Business (B2B) segment allows it to be the preferred partner of many high-quality customers and cross leverage its vast business services portfolio, which effectively translates into higher volume and margins in the business.

In IFM, the combination of single-digit margin, and high volumes puts a lot of responsibility on the execution side and this is where Updater Services shines. Running a tight ship is often difficult in the long-term, however, the company has not only managed to maintain its margins, but it has also ventured into new areas and expanded margins through a more value-added mix and a sharp focus on costs.

With its management efficiency and strong position in the market, Updater Services has sustained and continues to flourish with each operational year. It has set high-quality standards for service delivery and ensures adherence to the same through its extremely experienced and well trained people. The company has formed a strong and widespread network encompassing all India locations. Today, Updater Services is present in over 4,656 locations which are managed from 127 points of presence and 114 offices situated in different locations in India.

Acquisitions – The Pivotal Stone in Updater Services’ Strategy

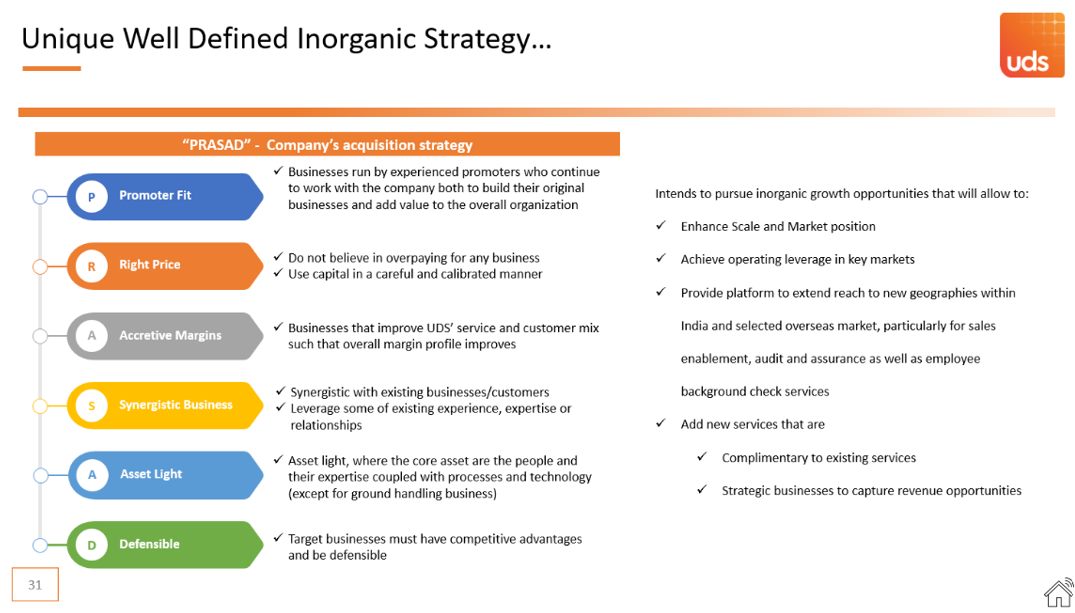

Throughout its history, Updater Services has broadened its range of services immensely. This type of business diversification has been possible through multiple – but well thought out acquisitions by the company. Updater Services has acquired various businesses and companies to cater to a wider customer base and to add more value-added services to their offerings. A good example is Denave which added capabilities like demand generation, lead management, inside sales while also facilitating the company’s entry into south-east Asia and certain European geographies. Similarly, Matrix provides Audit and Assurance services to customers in India as well as outside India.

The acquisition strategy has been fine-tuned to make it a very disciplined and powerful strategy for judicious capital allocation. The company has articulated this strategy clearly and has coined the acronym PRASAD for it, as seen in the image below. The PRASAD inorganic growth strategy relies on six pillars and aims to ensure disciplined acquisitions which enhance Margins, scale and market position as well as achieve operating leverage. This strategy has also ensured that every acquisition made by the company has a financial and business rationale and enhances margins.

The subsidiary companies (year of acquisition with initial tranche acquired) of Updater Services are engaged in offering complementary or supplementary services such as –

- Denave (54% stake acquired in FY 2022)

- Matrix Business Services India Pvt. Ltd. (75% shareholding acquired in 2019)

- Avon Solutions & Logistics Private Limited (51% shareholding acquired in 2006)

- Global Flight Handling Services Private Limited (70% stake acquired in 2018)

- Tangy Supplies & Solutions Private Limited

- Stanworth Management Private Limited (100% stake acquired in 2017)

- Fusion Foods and Catering Private Limited (65% stake acquired in 2017)

- Washroom Hygiene Concepts Private Limited (74% shareholding acquired in 2019)

- Athena BPO Private Limited (57% stake acquired in 2022)

This orientation towards acquiring leading businesses and great companies has benefited Updater Services in more ways than one. The company has explored new customer segments, geographies, and new business lines via its successful acquisitions over the years. At the same time, these acquisitions have created immense opportunities for the company to upsell and cross sell additional services to its existing customers. Further, this also leads to brand equity and diversified revenue streams for the business.

The end-result is an industry leading range of businesses which offer unique advantages to the overall business. A trend clearly visible in the image above is the shift from facility management in favor of higher-margin Business Support Services.

The model has also been validated by the investment of marquee private equity investors. Updater Services first received investment from New Vernon in 2006 which sold it’s stake to ICICI Venture Fund in 2008. Since 2017, Motilal Oswal Alternate Investment Advisors has invested in the company.

Updater Services’ Financial Performance

The total income of the company for the financial year ended 31 March 2023 is INR 2,112.1 crores (31 March 2022 is INR 1,497.9 crore) and the profits for the same period stood at INR 34.6 crores and INR 57.4 crore respectively. Adjusted EBITDA for the same period stood at INR 145 crores and INR 108.7 crores respectively. Adjustments primarily relates to fair value changes in liability payable/paid to promoters of acquired subsidiary and ESOP expenses. The total assets of the company are at INR 874.6 crore as of 31 March 2022.

Updater Services Limited ranks among the top IFM and Business services companies in India. It is also a leader in almost all of its Segments, which is testimony of its competitive strengths over other players in each of these segments. The company has integrated many aspects of its business and it’s service delivery and backend support services thus enabling Greater synergies and Lower costs. This broad business spectrum approach has also resulted in recurring business from the same customers in the long run.

UDS is a leading company in the business services space in India with – a very diversified range of value-added services; a very experienced manage team; a proven and disciplined business model; strong Governance and demonstrated execution capabilities. All of these put together has resulted in strong and sustained financial performance.