Last updated on March 11, 2024

Recently, the practice of option trading has gained significant popularity and now constitutes the majority of daily trading volume on our exchanges. Among those who engage in options trading, a significant portion of the high-volume transactions come from institutional traders and high-net-worth individuals (HNIs). However, it’s worth noting that a considerable number of retail investors also participate in options trading.

Within the community of retail traders, some individuals possess a strong aptitude for navigating the complexities of options trading. Conversely, some approach options trading like trading equities, and among them, some beginners are just starting on their options trading journey. In this article, we are going to discuss some of the best option trading strategies for beginners.

Read Also: Best IPOs that Doubled Investors’ Money

Intraday or Swing? What is the Best Choice for Options Trading for Beginners?

Options inherently possess a finite lifespan. Within this realm, we encounter weekly options, characterized by a mere 7-day window, and monthly options, extending their existence to 28 days. For index options and commodity options, the spectrum broadens, encompassing durations of 2 months, 3 months, 6 months, and beyond.

The realm of option trading strategies for beginners predominantly revolves around weekly and monthly options. Even within the domain of Bank Nifty option trading for beginners, a preference for weekly options persists. On a related note, you might want to check out our primer on options basics.

Traders aspiring to capitalize on options using purchasing should gravitate towards intraday transactions. This inclination arises from the rapid depreciation of premiums attributed to the succinct lifespan of options, a phenomenon aptly referred to as theta decay, which unfolds daily.

In contrast, a distinct category of traders engages in option selling to hedge positions and harvest premiums through theta decay. These adept practitioners often extend their positions until the options ultimately reach maturity, earning them the classification of swing traders.

Observations have revealed a notable trend among neophyte traders, who are enticed by the tantalizing potential of boundless profits achievable through option buying. It is, however, crucial to underscore that option buyers typically encounter monetary losses more frequently than not. Hence, our strategic focal point predominantly rests on amalgamating diversified strategies.

Read Also: Blue Jet IPO: All You Need to Know in 10 Points

Option Trading Strategies for Beginners

Here are a few option trading strategies for beginners. These strategies are also used for Bank Nifty option trading for beginners. There are many option strategies that traders use. Some of them are complicated strategies, and many of them are situation-based strategies.

Presented below are the most renowned and relatively secure strategies, valued for their versatility. Novice traders can seamlessly integrate these strategies into their repertoire and also avail themselves of margin facilities. These strategies are designed with a keen focus on risk adjustment, rendering them highly suitable for individuals at the beginner level.

Covered Call

A covered call is a strategic combination involving taking a long position in a stock or future and writing a call option at a nearby strike price.

Consider a scenario where the value of a stock or futures contract stands at INR 4,900. Our course of action involves procuring a single futures contract or acquiring the equivalent of 100 shares within the cash segment. We may choose to purchase 100 shares at INR 4,900 each or acquire a single futures contract at the same value, which encapsulates 100 shares.

Concomitantly, we proceeded to vend a single Call option (equivalent to 100 shares per lot) at the strike price of INR 5,000.

The rationale behind adopting this strategy is rooted in our anticipation of a potential upswing in the stock’s trajectory. Should the stock price experience a downturn, the sold Call option serves as a safeguard.

If the stock’s value ascends, our strategy entails liquidating the option at INR 5,000. While this action might result in a marginal loss from the Call option, the commensurate rise in the stock or futures price effectively offsets this loss.

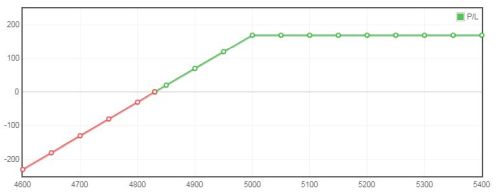

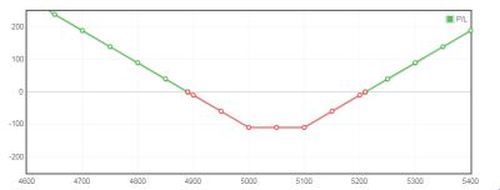

The anticipated profit and loss (P/L) diagram for a covered call strategy is illustrated as follows.

Factoring in the acquisition cost of the Call option at INR 70 each, we ascertain a substantial price range conducive to profitability. Upon expiry, even if the stock price retraces to INR 4,830, a balanced state is sustained, entailing neither profit nor loss. Beyond this threshold, profitability prevails until the price reaches INR 5,400. The pinnacle of maximum profit materializes at INR 5,000. Below INR 4,830, a deficit is incurred.

Read Also: Best Indicators for Options Trading

Protective Put

The Protective Put strategy constitutes another amalgamated approach. Within this framework, we initiate the acquisition of a stock or futures contract while simultaneously procuring a Put option. Notably, the protective Put strategy curtails potential downside risk to the premium disbursed for the Put option, thereby ensuring an unlimited upside potential.

Similar to the previous example, we buy the stock/ future at INR 5,000 and also buy a Put of INR 4,900 at a premium of INR 70.

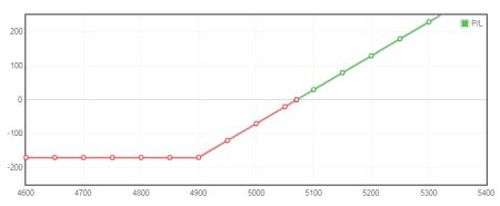

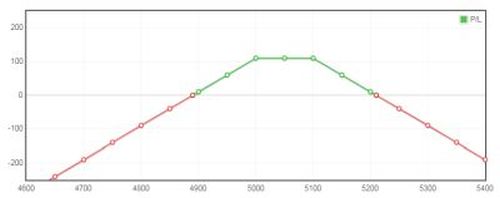

Let us proceed to examine the subsequent P/L diagram.

The calculation of the P/L can be derived as follows. The cumulative cost of the stock and the Put option amounts to INR 5,000 + INR 70, equating to INR 5,070. Consequently, INR 5,070 delineates the break-even point, above which profitability is attainable.

Sub-INR 5,070 constitutes the range within which losses are incurred, extending until the value of INR 4,900 is reached, culminating in a maximum loss of INR 170. Options trading strategies tailored for beginners must maintain a lucid and comprehensible nature, a criterion impeccably met by this strategy.

Read Also: All-time largest IPOs in India at a glance

Straddle

The straddle strategy, a fusion of a Call and a Put with identical strike prices offers a versatile approach. A straddle can manifest as either Long or Short.

In a Long Straddle, we initiate the acquisition of both a Call option and a Put option at the same strike price. This strategy comes into play when we anticipate heightened volatility and a substantial price movement in either direction. Such market dynamics are commonly observed preceding significant events (such as an annual budget announcement) or ahead of annual results, marked by crucial impending disclosures.

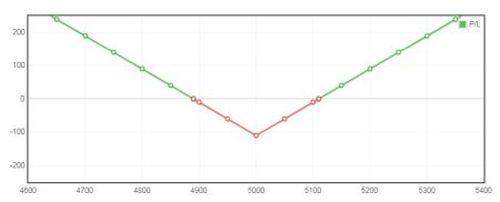

The P/L diagram of a Long Straddle looks like this.

Suppose we procure the Call option at INR 70 and the Put option at INR 40. Both the Call and Put options possess a strike price of INR 5,000.

So, the cost price is = INR70 + INR40 = INR110

As a result, the upper break-even point becomes INR 5,000 + INR 110 = INR 5,110, whereas the lower break-even point stands at INR 5,000 – INR 110 = INR 4,890.

If the stock price hovers between INR 4,890 and INR 5,110, we don’t get any profit. But, if the stock goes beyond this price range, we can have unlimited profit making it among the best option trading strategies for beginners.

The maximum loss is confined to INR 110 should the stock linger at INR 5,000, encapsulating the essence of the Long Straddle strategy.

Conversely, the Short Straddle strategy entails the writing of both a Call and a Put at the same strike price. Maximum profit aligns with the premiums accrued during option writing, exemplified by INR 110 at a stock price of INR 5,000 during expiry.

An option seller retains this profit if the stock remains steady at INR 5,000 during expiry. We take this strategy when we do not expect the market to move much within the expiry period. Short straddles are not just good strategies for options trading for beginners but experts as well.

Read Also: Best Intraday Trading Tips for Beginners

Strangles

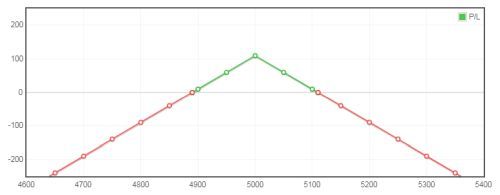

The strangles strategy involves a combination of options, specifically a Call option on the upper side and a Put option on the lower side, typically positioned at approximately equal distances from the current stock price.

This strategy offers both Long and Short versions. In the Long strangle strategy, two options, a Call and a Put, are purchased as previously outlined. This approach is chosen when we anticipate significant stock price movements in either direction, exceeding the requirements of long straddles.

For instance, if the stock stands at INR 4,950, within the Long strangle strategy, we acquire an INR 5,000 Put at INR 70 and an INR 5,100 Call at INR 40. The profit range encompasses values above INR 5,210 and below INR 4,980 because the cost price is INR 70 + INR 40 = INR 110. This strategy, characterized by a defined risk and the potential for unlimited profits in the event of substantial market movements, solidifies its position among the most effective option trading strategies for beginners.

Likewise, the Short Strangle employs a similar principle, yet with a focus on anticipating a confined range of stock price movement. In this approach, an INR 5,100 Call is written at INR 40, and an INR 5,000 Put is also written at INR 70.

Within the confines of the Short Strangle, the maximum profit range should be from INR 5,000 to INR 5,100 and the maximum profit is INR 110. Because when we wrote the options, we collected INR 70 + INR 40 = INR110 beforehand. Above INR 5,210 and below INR 4,890 during expiry, the loss is unlimited.

Read Also: Highest IPO Subscription

Wrapping Up

The aforementioned option trading strategies for beginners offer a level of simplicity and feasibility that becomes more accessible with practice. Before implementing these strategies, a trader should acquaint themselves with market expectations and trends. These strategies, applicable to Nifty and Bank Nifty trading, are particularly well-suited for novices entering the realm of options trading.

Many of these strategies for options trading for beginners prioritize risk management and are conducive to swing trading. However, a trader must exercise prudence by promptly exiting positions to mitigate losses if the market deviates from anticipated behavior. It’s important to note that while numerous advanced strategies exist, they often demand a higher level of comprehension and are thus not recommended for beginners.

Hi, Thanks for sharing such an useful Information about Best option trading strategies for beginners . As you know, there are two ways to trade in the stock market, through cash markets and derivatives.Most of these strategies ensure that loss is limited and the probability of booking profit is higher. Strategies employed by traders are based on their views about the expected price movement in the underlying asset.

Your blog post was a compelling read. I found the content to be engaging and thought-provoking, and I appreciated the thoughtfulness with which you addressed potential counterarguments.

Your blog post was a thought-provoking exploration of the topic. I appreciated the way you presented different perspectives and encouraged readers to think critically. To delve deeper into this subject, click here.

This is an outstanding piece of content. I’m impressed by how well you’ve explained the subject. If you want to learn more, click here.

I found great pleasure in reading your thoughtful blog article. The views and concepts you expressed were tremendously useful.

I thoroughly enjoyed reading your insightful blog post. Your perspectives and ideas were incredibly helpful.