India’s primary market is heating up again with more IPOs lined up in October and November. After gas distribution player IRM Energy’s IPO, Blue Jet Healthcare IPO is next in line with its primary offer scheduled to open this week.

Blue Jet IPO aims to raise INR 840.3 crore by way of an Offer For Sale (OFS) by existing investors. Here are the top 10 things to know about this Specialty pharmaceutical and healthcare ingredient company’s IPO.

#1 Blue Jet Healthcare IPO: Business Overview

Incorporated in 1968, Blue Jet Healthcare is a specialty pharmaceutical and healthcare ingredient and intermediate company. It has established a contract development and manufacturing organization (CDMO) business model with specialized chemistry capabilities in contrast media intermediates and high-intensity sweeteners.

Blue Jet Healthcare operations are primarily organized in three product categories:

- Contrast Media Intermediates: Contrast media are agents used in medical imaging to enhance the visibility of body tissues under X-rays, computed tomography (CT), magnetic resonance imaging (MRI), or ultrasound. The global contrast media formulation market had a market size of USD 5.9 billion in terms of moving annual turnover for June 2023. The market is expected to grow at a CAGR of 6-8% between the CY 2023 and 2025, with growth expected to be primarily led by volume. It is dominated by four contrast media manufacturers, namely GE Healthcare AS, Guerbet Group, and Bracco Imaging S.p.A and Bayer AG.

- High-intensity Sweeteners: High-intensity sweetener business involves the development, manufacture, and marketing of saccharin and its salts, which is backward integrated with the aim to ensure environmental sustainability with zero by-products and cost-effective production processes. Saccharin is primarily used in tabletop sweeteners, oral care products such as toothpastes and mouthwashes, beverages, confectionary products, pharmaceutical products, food supplements, and animal feeds. The global high-intensity sweetener market was estimated to be between USD 2.9 billion to USD 3.0 billion in size, as of CY 2023, comprising products such as sucralose, aspartame, saccharin, stevia, and neotame.

- Pharma Intermediates, and Active Pharmaceutical Ingredients (APIs): The CDMO activity in the pharma intermediate and API business primarily focuses on collaborating with innovator pharmaceutical companies and multi-national generic pharmaceutical companies by providing them with pharma intermediates that serve as building blocks for APIs in chronic therapeutic areas, such as the cardiovascular system (CVS), oncology and central nervous system (CNS), including new chemical entities (NCEs).

Also Read: Best Electric Vehicle Stocks in India

#2 Blue Jet Healthcare IPO: Offer Details

The Blue Jet Healthcare IPO is scheduled for 25 to 27 October 2023, with a price range of INR 329 to 346 per share. The IPO consists of an OFS of 24,285,160 shares, valuing the offering between INR 798.98 – 840.27 crore. It is worth highlighting that the company will not get any funds from IPO proceeds as it is totally an OFS. The minimum bid size is 43 shares, priced at INR 14,878, and retail investors are allotted 35% of the shares. The IPO will be listed on both BSE and NSE.

#3 Blue Jet IPO: Manufacturing Facilities and Accreditations

Blue Jet currently operates three manufacturing facilities which are located in Shahad (Unit I), Ambernath (Unit II), and Mahad (Unit III) in the state of Maharashtra, with an annual installed capacity of 200.60 KL, 607.30 KL, and 213.00 KL, respectively, as of 30 June 2023.

It also acquired a leasehold greenfield manufacturing site (Unit IV) in Ambernath in 2021 to build several multi-purpose blocks dedicated to the pharma intermediate and API business. Subject to obtaining approvals, the company expects this Unit IV facility to have an estimated installed capacity of 71 KL.

As of 30 June 2023, the company Unit I, Unit II and Unit III facilities have a total of 10 dedicated manufacturing blocks, each with varying levels of semi-automation.

Read Also: Best PMS in India in 2023 – All About PMS Services

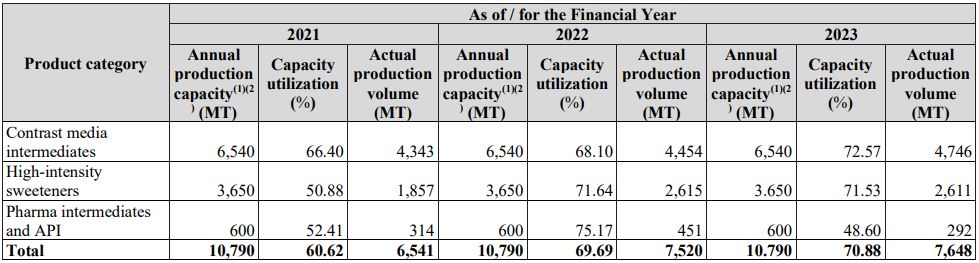

#4 Blue Jet IPO: Production Capacity, Volumes, and Capacity Utilization

The following table sets forth production data of its three primary product segments for the years/periods shown:

Also Read: Top 10 Most Expensive Stocks In India

#5 Blue Jet Healthcare IPO: R&D

The R&D laboratory is situated within Unit-II in Ambernath and focuses on new product development and complex molecules, cost improvement programs, and process improvements. This approach has resulted in the development of products through utilizing innovative and complex processes such as catalytic hydrogenation, iodination, bromination, chlorination, diazotization, esterification, and Hoffman re-arrangement.

The company has leveraged its expertise in R&D through all the aspects of Custom Process Development from lab scale to commercial quantities, which has also enabled it to strengthen the CDMO business and capture growth opportunities, as demonstrated by the year-over-year growth of the CDMO portfolio from 6 molecules as of 31 March 2020 to 43 molecules as of 30 June 2023. Blue Jet has been approved by the Department of Scientific and Industrial Research (DSIR) since 2018. As of 30 June 2023, it had a total portfolio of more than 100 molecules and has successfully commercialized a smaller select molecule portfolio on a large scale.

#6 Blue Jet IPO: Sales and Marketing

As of 30 June 2023, the sales and marketing team comprised six people who are based in India and interact regularly with domestic and international customers. The products are sold in both regulated markets such as Europe and the United States and emerging markets such as Latin America, Africa, and Southeast Asia.

A majority of the revenue from operations is derived from regulated markets. For the FY 2021, 2022, and 2023 and the three months ended 30 June 2023, the revenue from its largest customer was INR 311.03 crore, INR 425.83 crore, INR 456.82 crore, and INR 107.21 crore, respectively, and accounted for 62.34%, 62.30%, 63.36%, and 59.71% of the total revenue from operations, respectively.

Read Also: IdeaForge IPO: All you need to know about India’s top dronemaker

#7 Blue Jet IPO: Customers

As of 30 June 2023, Blue Jet Healthcare has catered to more than 400 customers in 39 countries. Blue Jet Healthcare has established long-standing strategic relationships with leading multi-national pharmaceutical and healthcare companies that have helped expand its product offerings and geographic reach. For example, its relationships with GE Healthcare AS, Guerbet Group, Bracco Imaging S.p.A, and Cambrex Karlskoga AB, in the contrast media area ranged from four to 24 years; Colgate-Palmolive India Limited, Unilever, Prinova US LLC, and MMAG Co. Ltd. in the high-intensity sweetener area ranged from three to 14 years; and Olon S.p.A., Hovione Farmaciência, S.A., and Bial – Portela & CA, S.A. in the pharma intermediates, API and CDMO area.

The company caters to three of the four largest industry leaders, including GE Healthcare AS, Guerbet Group, and Bracco Imaging S.p.A, directly, in contrast, media. According to the IQVIA Report, GE Healthcare AS, Guerbet Group, Bayer AG, and Bracco Imaging S.p.A contributed to more than 70% of the global moving annual turnover from June 2013 to June 2023.

#8 Blue Jet IPO – Financial Performance

The company’s revenue CAGR (calculated as growth of revenue from operations from FY21 to FY23) growth stood at 13% between FY 2021 and FY 2023. While this is quite impressive, the performance at the net income level isn’t great as profits grew at a slower clip.

| FY 2021 | FY 2022* | FY 2023* | Q1 FY 2024* | |

| Revenue | 498.93 | 683.47 | 720.98 | 179.54 |

| Expenses | 317.85 | 459.65 | 528.33 | 126.68 |

| Net income | 135.78 | 181.72 | 159.94 | 44.19 |

| Margin (%) | 27.21 | 26.59 | 22.18 | 24.61 |

* All Standalone Data

Read Also: Nifty Pharma Stocks List With Weightage in 2023

#9 Blue Jet Healthcare IPO – Valuations

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 7.98 | 10.47 | 9.23 |

| PE ratio | – | – | 35.64 – 37.49 |

| RONW (%) | 39.96 | 34.82 | 23.48 |

| NAV | 19.59 | 30.07 | 39.29 |

| ROCE (%) | 49.70 | 47.13 | 31.91 |

| EBITDA (%) | 41.30 | 36.47 | 30.39 |

| Debt/Equity | 0.16 | 0.00 | 0.00 |

#10 Blue Jet Healthcare IPO: Employees

The workforce is a critical factor in maintaining quality and safety, which strengthens the competitive position. As of 30 June 2023, the company had 407 permanent employees. Among the total employee base, it had attrition of 17.50%, 16.97%, 17.55%, and 2.95% for the FY 2021, 2022, and 2023 and the three months ended 30 June 2023, respectively.