In a significant development in India’s tech and food delivery industry, Swiggy has furthered its case for a public market listing. Given the changing fortunes in the food delivery industry, Swiggy IPO is poised to be one of the most anticipated stock market debuts in recent years.

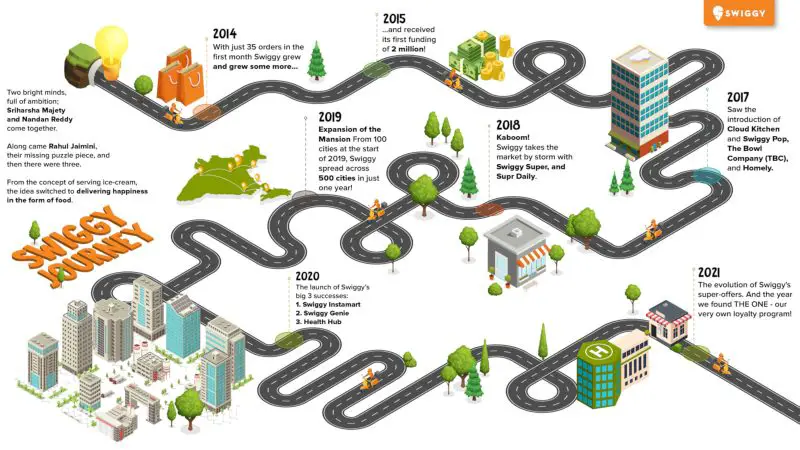

Founded in 2014, Swiggy has rapidly grown to become a key player in the food delivery services sector, rivalling other platforms like Zomato, its main competitor which went public in 2021. Swiggy’s move to launch an IPO is seen as a strategic step to capitalize on its expansive growth and solidify its market presence amidst increasing competition.

Table of Contents

Swiggy IPO Details and Financial Insights

Market reports suggest that the Swiggy IPO would be of the size of USD 1 billion (around INR 8,300 crores at the current exchange rate). The company is expected to file the draft red herring prospectus (DRHP) with the capital market regulator Sebi in the next few months. The funds raised will be directed towards expanding its core delivery business, enhancing its logistics infrastructure, and pushing into new verticals like instant grocery delivery under its Instamart service.

Going by the recently filed financial disclosures, the company has also made strides in reducing losses and improving operational efficiencies, which makes it an attractive proposition for potential investors. In the latest year ended 31 March 2023, the company reported a 45% increase in revenue to INR 8,265 crore. In the same time, Swiggy’s net loss increased by 15% to INR 4,179 crore.

Valuation Upgrade Before Swiggy IPO

Given the improvement in its operating metrics, Swiggy has received a shot in the arm from asset management company Invesco with a raise in the company’s valuation. Early this month, Invesco upgraded Swiggy’s valuation to INR 1,05,600 crores for third straight time. Invesco holds nearly 2% equity stake in Swiggy. Similarly, Barron Capital, which owns 7% equity in the food tech player, has also marked up Swiggy valuation to USD 12.1 billion (INR 100,430 crore).

Swiggy was last valued at INR 89,232 crore in January 2022 following its fundraising of INR 70 crore from a host of investors.

Pre-IPO Deals Taking Place at 20% Discount

Despite the improvement in operations, Swiggy unlisted shares are being reportedly sold at a 20% discount. According to a report by Entrackr, Swiggy’s appointed financial advisors are selling its shares to HNIs at INR 250 apiece, marking a hefty discount over its latest valuation. At this price, the company’s valuation turns out to be INR 80,000 crore.

While this represents a stark contrast from the fresh valuation levels, it may be a blessing in disguise for the company as its competitor Zomato was battered after its listing. Zomato declined as much as 60% over the next 12 months after listing at INR 126 per share.

Competitive Landscape and Future Strategies

With its main competitor Zomato already public, Swiggy IPO will likely intensify the competition as the latter gains access to public funds. Both companies have been in a fierce race to dominate market share by diversifying their offerings and enhancing user experience. Swiggy’s foray into quick commerce via Instamart and its expansion into new cities and towns across India are part of this strategic positioning. Moreover, Swiggy is heavily investing in technology and sustainability, aiming to make food delivery more efficient and environmentally friendly. The company has initiated several green projects, including the use of electric vehicles and eco-friendly packaging.

Zomato Vs Swiggy – How They Stack Up

In May 2023, Zomato had a total of around 30 million monthly active users (MAUs). Swiggy had 24 million. Despite having lower MAUs, Swiggy has a larger user base that transacts more frequently, or monthly transacting users (MTUs), when compared with Zomato. That is why Swiggy is ahead with revenues at INR 8,265 crore while Zomato had INR 5,507 crore topline in FY 2023.

| Key Metrics | Swiggy | Zomato |

| Establishment details | 2013 | 2008 |

| Listing status | Unlisted | Listed |

| Total market share | 43% | 55% |

| Market capitalization | INR 1,05,600 Cr. | INR 1,72,954 Cr. |

| Approx daily orders | 2,10,000 | 1,80,000 |

| Revenue | INR 8,265 crore | INR 5,506.9 crore |

| Other services | Swiggy One Instamart Genie Dineout | Zomato Gold Dining Blinkit Advertising Hyperpure |