Swiggy Unlisted Share Description – Swiggy, a well-known Indian food delivery company, was established in 2014 by Sriharsha Majety, Nandan Reddy, and Rahul Jaimini in Bengaluru, Karnataka, India. Bundl Technologies Private Limited, commonly known as Swiggy, stands as India’s premier on-demand delivery platform, prioritizing technological advancements in logistics and customer-centric solutions. With a widespread presence in more than 653 cities throughout India, serving approximately 13 milion users through a robust network of over 1,96,000 restaurant partners, encompassing numerous cities. Its dedicated workforce exceeds 5,000 employees, while its independent fleet of delivery executives surpasses 2,60,000, ensuring unparalleled convenience fueled by continuous innovation. Swiggy delivers a swift, seamless, and dependable experience to millions of customers across India.

In 2022, Swiggy broadened its offerings beyond Food Delivery by acquiring Dineout, enabling Swiggy to provide comprehensive experiences across the entire food consumption journey. Integrated within Swiggy, Dineout leads the dining-out category in 43 cities across India. Additionally, Swiggy’s out-of-home consumption business grew further with the launch of SteppinOut, enhancing users’ outdoor event experiences.

FY 2024 Review: Swiggy Overall Performance:

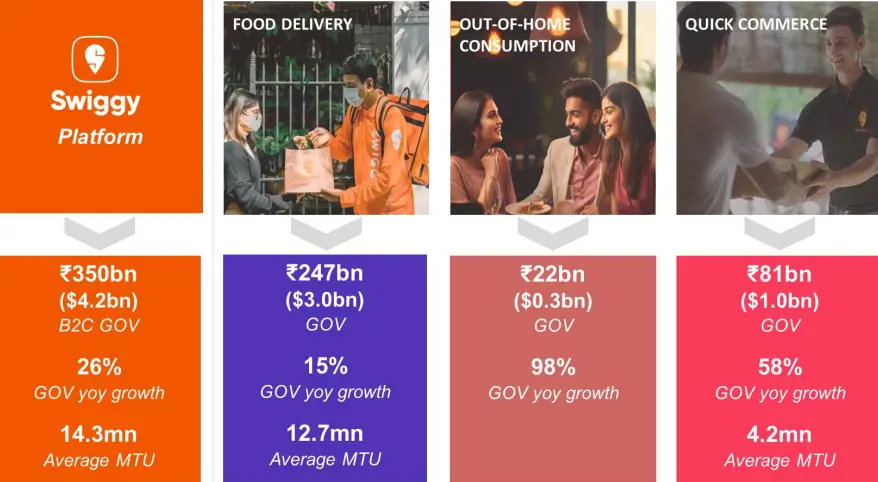

Swiggy has continued to scale up in recent years, driven by positive momentum in both demand and supply factors. Approximately 14 million users actively transact on the Swiggy platform at a high frequency of around 4.5 times, supported by a vast network of over 390,000 delivery partners. Profitability has shown significant year-on-year improvement as the peak investment phase in Instamart is now behind us, and the business continues to grow rapidly. Meanwhile, the relatively mature Food Delivery segment is scaling up profitably.

Food and grocery delivery giant Swiggy is gearing up to file its Draft Red Herring Prospectus (DRHP) this weekend, according to reports from Moneycontrol. Swiggy, the food delivery and quick commerce firm, is set to raise INR 5,000 crore (USD 602 million) in a fresh issue as part of its initial public offering (IPO). The Prosus-funded company has already targeted INR 6,664 crore through an offer for sale (OFS), with plans to seek board approval for the OFS in the first week of October.

However, Swiggy’s IPO size may vary, as the fresh issue mentioned in the latest resolution is 1.3X larger than the previously estimated INR 3,750 crore. The Bengaluru-based company is expected to file its draft red herring prospectus (DRHP) with SEBI soon.

Read Also: boAt Unlisted Share Price

Table of Contents

Products & Services of Swiggy

- Food Delivery

- Quick Commerce

- Hyperlocal Delivery

- Table Reservation

Swiggy’s Subsidiary Companies

- Scootsy Logistics Private Limited

- Supr Infotech Solutions Private Limited

- Lynks Logistics Limited

- Loyal Hospitality Private Limited (One Associate Company)

Key Highlights –

- Madhuri Dixit and Ritesh Malik jointly invested INR 3 crore in Swiggy, which was the minimum required investment. Each contributed INR 1.5 crore, making them equal shareholders in the company.

- Food and grocery delivery giant Swiggy is gearing up to file its Draft Red Herring Prospectus (DRHP) this weekend, according to reports from Moneycontrol.

- Swiggy’s revenue from operations (gross revenue) grew 36.09% to INR 11,247.3 crore during FY 2024 as opposed to INR 8,264.6 crore in FY 2023.

- Overall, the company’s total expenditure surged 8.25% to INR 13,947.38 crore in FY 2024 from INR 12,884.40 crore during FY 2023.

- Swiggy significantly reduced its Loss After Tax by 43.77%, bringing it down to INR 2,350.2 crore in FY 2024 from INR 4,179.30 crore in FY 2023. In tandem, the loss per equity share also showed marked improvement, decreasing to INR 10.70 in FY 2024 from INR 19.33 in FY 2023. This reflects the company’s solid progress in curbing its financial losses.

Read Also: TATA Technologies Unlisted Share Price

Swiggy Board of Directors

- Sriharsha Majety, CEO and Co-Founder

- Lakshmi Nandan Reddy Obul, Director

- Suparna Mitra, Independent Director

- Anand Kripalu, Independent Director

- Shailesh Haribhakti, Independent Director

- Sahil Barua, Independent Director

- Ashutosh Sharma, Nominee Director

- Anand Daniel, Nominee Director

- Sumer Juneja, Nominee Director

- Roger Clark Rabalais, Nominee Director

Read Also: NSE Unlisted Share Price

Swiggy Unlisted Share Details

| Name | Swiggy Unlisted Share Details |

| Face Value | INR 1 per share |

| ISIN Code | INE00H001014 |

| Lot Size | 100 shares |

| Demat Status | NSDL, CDSL |

| Swiggy Unlisted Share Price | INR 510 per share |

| Market Cap | INR 1,10,432.08 crores |

| Total number of shares | 2,16,53,35,043 shares |

| Website | www.swiggy.com |

Read Also: Capital Small Finance Bank Unlisted Share Price

Swiggy Unlisted Share Details – Shareholding Pattern

Details of shares held by the shareholder’s group:

| Shareholder Name | % to Holding |

| Times Internet Limited | 67.8 |

| IIFL Special Opportunities Fund | 15.3 |

| Elevation Partner V Ltd | 5.3 |

| Others | 11.7 |

Swiggy Unlisted Share Details – Financial Metrics

| Particulars | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

| Revenue | 2,546.9 | 5,704.9 | 8,264.6 | 11,247.39 |

| Revenue Growth (%) | (25.56) | 123.99 | 44.87 | 36.09 |

| Expenses | 2,189.7 | 9,574.0 | 12,884.0 | 13,947.38 |

| Net income | (1,616.7) | (3,628.9) | (4,179.3) | (2,350.24) |

| Margin (%) | (63.48) | (63.61) | (50.57) | (20.90) |

| EPS | (99.0) | (221.0) | (19.33) | (10.70) |

| EBITDA Margin (%) | (51.0) | (62.58) | (62.84) | (52.0) |

Read Also: HBD Financial Unlisted Share Price

Swiggy Unlisted Share Peer Comparison

| Company | 3-yr Sales CAGR (%) | EPS | Net Margin (%) | MCap (INR crore) |

| Swiggy | 64.06 | (10.70) | (20.90) | 1,10,432.08 |

| Zomato | 82.47 | 0.69 | 2.90 | 2,62,293 |

Latest Content From IPO Central

- How Many IPOs Have Withdrawn In India?

- Motilal Oswal Home Finance Q2 FY25 Performance

- The Exciting Upcoming IPOs in December 2024 You Can’t Miss!

- Eleven IPOs Next Week – Market Set to Witness Over INR 18,000 Cr Fundraising Action

- Vishal Mega Mart IPO Analysis

- Sai Life Sciences IPO Analysis

- Emerald Tyre IPO Allotment Today: What to Expect After 530.67X Subscription Surge

- Ullu Digital IPO – INR 135-150 Cr SME IPO to Launch by March 2025

- RBI’s NOD for Canara Robeco AMC IPO and Canara HSBC Life Insurance IPO

- Zepto Surpasses INR 1,000 Crore in Annualized Ad Revenue

- Dhanlaxmi Bank Rights Issue Dates, Price, Allotment, Entitlement

Swiggy Unlisted Share FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is Swiggy unlisted share price?

Swiggy unlisted stock price in October 2024 is INR 510 per share. Shares are purchased in lots of 100 shares.

Who determines Swiggy unlisted share price?

The unlisted share price is determined by a variety of factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

Insightful analysis on Swiggy’s unlisted share price! Your information provides valuable insight for investors. Thanks for sharing!