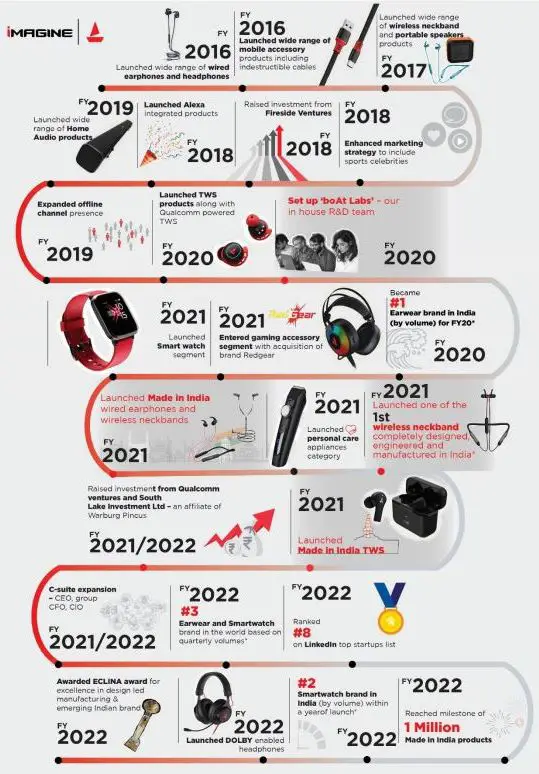

boAt Unlisted Share Description – Imagine Marketing, the company behind the boAt brand is a digital-first consumer products firm and ranks among the largest Indian digital-first brands by revenue. Established in 2013, the company has created a diverse portfolio of high-quality, aspirational lifestyle consumer products that are offered at accessible price points under its various brands.

The company’s products are distinguished by strong consumer engagement and significant market opportunities that are primed for disruption within the industry landscape. It intends to accomplish this by introducing products that offer a clear value proposition at affordable prices, specifically designed for the Indian market and targeted at the rapidly growing online demographic of young, digitally-savvy, and trend-aware consumers in India.

boAt held the top position in India for wireless wearables, both by value and volume, and ranked second among smartwatch brands in terms of volume. Furthermore, the company’s market share in the wireless wearables and smartwatch segments has shown a consistent upward trend over time.

Read Also: CSK Unlisted Share Price

Imagine Marketing Brand Portfolio

Imagine Marketing’s portfolio encompasses a range of products under its flagship ‘boAt’ brand, as well as several other brands. These include ‘RedGear’, which focuses on value-oriented gaming accessories; ‘TAGG’, known for premium audio and wearable devices; ‘Misfit’, a sub-brand dedicated to personal care and grooming; and ‘DEFY’, which offers value-oriented audio products.

Read Also: Sterlite Power Unlisted Shares

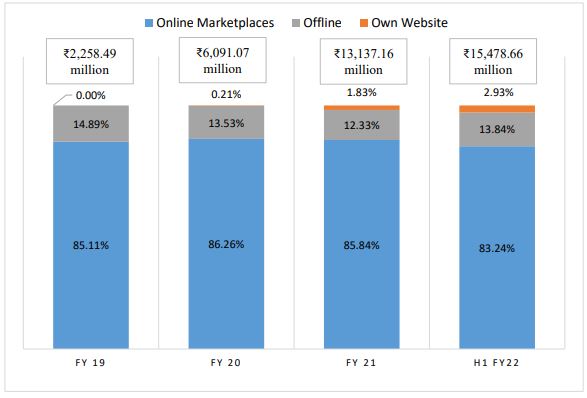

boAt Unlisted Share: Offline vs Online Sales

In FY 2024, boAt experienced a notable shift in its sales dynamics, with offline sales growth surpassing online sales for the first time. Here’s a detailed comparison of the two channels:

Offline Sales

- Growth: boAt’s offline sales are projected to account for approximately one-third of its total sales in FY 2024, indicating a significant increase compared to previous years. This growth is attributed to a post-pandemic resurgence in consumer preference for in-person shopping.

- Market Strategy: The company has invested heavily in an omnichannel distribution strategy, enhancing its physical presence through retail stores and exclusive brand outlets. This approach has become increasingly important as about 90% of Indian consumers still prefer shopping offline

Online Sales

- Performance: While boAt has traditionally relied on online sales through platforms like Amazon and Flipkart, FY 2024 saw a decline in this segment. The company’s audio business remained flat during the second half of the fiscal year, with a noted shift towards online channels but not enough to offset the gains from offline sales.

- Challenges: The headphone segment specifically faced a decline despite a low base, reflecting increased competition and market saturation in the online space. This has led to margin pressures due to steep declines in average selling prices amid fierce competition.

Products & Services

boAt began its journey focusing on wearable products within the audio category, but it has since expanded its offerings to include a diverse range of products across various price points and customer segments in multiple categories, which comprise:

- Audio (wired headphones and earphones, wireless headphones and earphones (neckbands), true wireless stereo (‘TWS’), Bluetooth speakers and home theatre systems and sound bars)

- Wearables (smartwatches)

- Gaming Accessories (wired and wireless headsets, mouse, and keyboards)

- Personal Care Appliances (trimmers and grooming kits)

- Mobile Accessories (chargers, cables, power banks, and other accessories)

Imagine Marketing’s Subsidiary Companies

- Imagine Marketing Singapore Pte Ltd

- HOB Ventures Private Limited

- Dive Marketing Private Limited

Key Highlights –

- boAt reported a revenue decrease from INR 3,258 crore in FY 2023 to INR 3,104 crore in FY 2024, marking a 4.75% decline overall. However, the company managed to cut its net losses significantly by 47%, indicating improved cost management despite lower revenues.

- Despite the challenges, boAt remains a leading player in both audio devices and wearables, holding substantial market shares of 42% in audio devices and 26.7% in wearables as of mid-2024.

- Approval of Draft Red Herring Prospectus (DRHP) in January 2022.

- The company is entering international markets of UAE, Nepal & South East Asia, primarily within the core audio and wearables categories.

- boAt has made substantial investments in local manufacturing, producing approximately 70-75% of its audio and wearable products domestically through partnerships with manufacturers like Dixon Technologies. This local manufacturing strategy not only supports the ‘Make in India’ initiative but also enhances supply chain efficiency

Read Also: Biggest Unlisted Companies in India

boAt Board of Directors

- Sameer Mehta, Co-Founder and Director

- Aman Gupta, Co-Founder, Chief Marketing Officer, and Director

- Vivek Gambhir, Director

- Anish Ashraf, Director

- Purvi Seth, Director

- Anand Ramamoorthy, Director

- Deven Waghani, Director

boAt Unlisted Share Details

| Name | boAt Unlisted Share Details |

| Face Value | INR 1 per share |

| ISIN Code | INE03AV01027 |

| Lot Size | 25 shares |

| Demat Status | NSDL, CDSL |

| boAt Unlisted Share Price | INR 1,570 per share |

| Market Cap | INR 15,095 crore |

| Total number of shares | 9,61,46,300 shares |

| Website | www.boat.com |

Read Also: Hero FinCorp Unlisted Share Price

boAt Unlisted Share Details – Shareholding Pattern

Details of shareholders holding more than 1% shares in the company as of 31 March 2024:

| Shareholder Name | % to Holding | No. of shares |

| Sameer Mehta | 39.91 | 3,83,70,000 |

| Aman Gupta | 39.91 | 3,83,70,000 |

| South Lake Investment | 19.25 | 1,85,10,000 |

| Others | 0.93 | 8,96,300 |

Read Also: TATA Technologies Unlisted Share Price

boAt Unlisted Share Details – Financial Metrics

| Particulars | FY 2022 | FY 2023* | FY 2024* |

| Revenue | 2,872.90 | 3,258.40 | 3,103.78 |

| Revenue Growth (%) | 118.68 | 13.42 | (4.75) |

| Expenses | 2,786.99 | 3,420.64 | 3,192.40 |

| Net income | 68.70 | (101.05) | (53.59) |

| Margin (%) | 2.39 | (3.10) | (1.73) |

| ROCE (%) | 9.29 | (3.57) | (0.60) |

| Debt/Equity | 1.51 | 2.41 | 1.82 |

| EBITDA (%) | 4.97 | (2.35) | – |

| EPS | 5.84 | (10.46) | (5.54) |

* All Standalone data

Read Also: HDFC Securities Unlisted Share Price

boAt Unlisted Share Peer Comparison

| Company | 3-yr Sales CAGR (%) | PE Ratio | ROCE (%) | Net Margin (%) | MCap (INR crore) |

| boAt | 33.19 | – | (0.60) | (1.73) | 15,095 |

| Pulz Electronics | 73.2 | 21.6 | 43.4 | 17.80 | 178 |

boAt Annual Reports

boAt Annual Report FY 2023 – 2024

boAt Annual Report FY 2022 – 2023

Imagine Marketing Unlisted Share FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is boAt unlisted share price?

boAt unlisted stock price in November 2024 is at INR 1,570 per share. Shares are purchased in lots of 25 shares.

Who determines Imagine Marketing unlisted share price?

The unlisted share price is determined by a variety of factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

When is the boAt IPO planned?

In January of the previous year, Imagine Marketing – parent of Boat – had filed the DRHP with Sebi to raise INR 2,000 crore through an IPO with a fresh issue of shares worth up to INR 900 crore and an offer for sale of shares worth up to INR 1,100 crore.