Sterlite Power Unlisted Share Description –

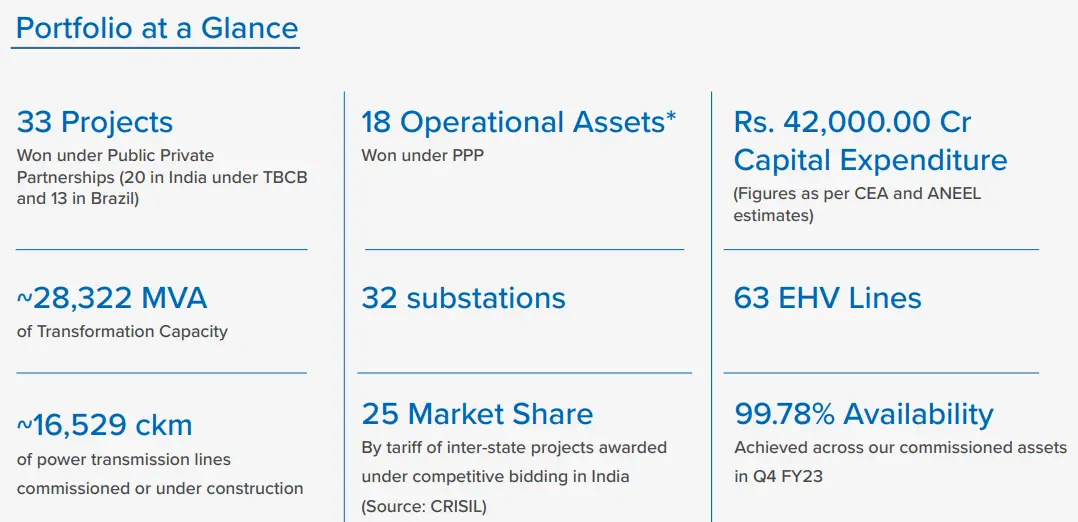

Incorporated in 2015, Sterlite Power is a leading private-sector power transmission infrastructure developer and solutions provider, operating in India and Brazil. The company is the largest private player in terms of project portfolio under the inter-state Tariff-Based Competitive Bidding (TBCB) route, with a market share of 25% of transmission projects awarded through the route.

Sterlite Power is a global leader in manufacturing power cables, conductors, and Optical Ground Wire (OPGW), catering to major utilities across India and exporting to over 70 countries. The company operates four advanced manufacturing facilities located in Silvassa, Jharsuguda, and Haridwar, ensuring high-quality production and innovation in power transmission solutions. Sterlite Power operates through two primary business units to develop integrated power transmission infrastructure and solutions: Global Infrastructure and Global Products & Services.

- Global Products & Services is responsible for providing essential components such as cables and conductors that facilitate the movement of electricity, ensuring that the infrastructure meets modern energy demands.

- Global Infrastructure focuses on the development, ownership, and operation of power transmission assets across India and Brazil, enhancing energy delivery efficiency.

In FY 2023-24, Sterlite Power achieved significant milestones across its operations in India and Brazil, solidifying its position as a key player in the power transmission sector. The company’s portfolio comprises 33 projects, spanning an impressive 16,529 circuit kilometers of transmission lines. Notably, its Indian operations include 20 projects covering 11,495 circuit kilometers, backed by a capital expenditure of approximately INR 26,724 crore, aimed at enhancing grid reliability and integrating renewable energy. Simultaneously, in Brazil, where Sterlite Power marked six years of operations, the company has developed 13 transmission projects stretching across 5,034 kilometers, with investments totaling INR 11,182 crore.

Sterlite Power is also the sponsor of IndiGrid, India’s first power sector Infrastructure Investment Trust (InvIT), listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

Read Also: Nifty Auto Index – Check the full list of important constituents

Products & Services of the Sterlite Power

- Conductors – Supply to 70+ countries, production capacity of 1,32,000 MT/year

- Optical Ground Wire (OPGW) – Capacity of ~24,000 km/year (14,912 miles/Year)

- Cables & Solutions – Wide product range covering 6.6 kV to 220 kV power cables

Sterlite Power Projects

- Jabalpur Transmission Company Limited (JTCL)

- Bhopal Dhule Transmission Company Limited (BDTCL)

- RAPP Transmission Company Limited (RTCL)

- Maheshwaram Transmission Company Limited (MTCL)

- Purulia & Kharagpur Transmission Company Limited (PKTCL)

- NRSS XXIX Transmission Limited (NRSS)

- East-North Interconnection Company Limited (ENICL)

- Gurgaon-Palwal Transmission Limited (GPTL)

- Khargone Transmission Limited (KTL)

- NER II Transmission Limited (NER-II)

- Odisha Generation Phase-II Transmission Limited (OGPTL)

- Goa-Tamnar Transmission Project Limited (GTTPL)

- Lakadia-Vadodara Transmission Project Ltd. (LVTPL)

- Udupi Kasargode Transmission Ltd. (UKTL)

- Mumbai Urja Marg Transmission Limited (erstwhile known as VNLTL)

- Nangalbibra Bongaigaon Transmission Limited (NBTL)

- Kishtwar Transmission Project Limited (KTPL)

- Fatehpur III Beawar Transmission Limited

- Fatehgarh-Bhadla Transmission line

- Neemrana II Kotputli Transmission Limited

Read Also: TATA Technologies Unlisted Share Price

Sterlite Power Transmission Unlisted Share: Key Highlights –

- Approval of Draft Red Herring Prospectus

- As of May 2024, Sterlite Power has secured INR 1,373 crore in funding for its Neemrana II Kotputli Transmission Limited (NKTL) project from the state-owned Power Finance Corporation.

- The company now has a total portfolio of 20 transmission projects in India, spanning more than 11,495 ckm, through a total capex of INR 26,724 crores.

- The company has developed a portfolio of 13 transmission projects in the fast-growing South American nation, spanning 5,034 ckm, through a total capex of INR 11,182 crores.

- Consistent and industry-best uptimes of OPGW, Colocations, and UG 99.99% with no compromise QHSE of 0% LTIFR and 100% NCR score.

- 10 new logos were added to the MTCIL & GMDA network (a total of 47 unique customers).

- INR 500+ crores Cumulative contractual portfolio OB.

- Sterlite Power has signed a contract with Rajasthan Rajya Vidyut Prasaran Nigam (RVPNL) for the O&M and monetization of its 17,343 kilometers of Optical Ground Wire (OPGW) assets.

Read Also: Biggest Unlisted Companies in India

Sterlite Power Board of Directors

- Mr. Pravin Agarwal, Chairman

- Mr. Reshu Madan, Whole-Time Director & Chief Executive Officer

- Mr. Pratik Pravin Agarwal, Managing Director

- Mr. Anoop Seth, Non-Executive and Independent Director

- Ms. Pooja Somani, Non-Executive and Independent Director

Sterlite Power Unlisted Share Details

| Name | Sterlite Power Unlisted Share Details |

| Face Value | INR 2 per share |

| ISIN Code | INE110V01015 |

| Lot Size | 25 shares |

| Demat Status | NSDL, CDSL |

| Sterlite Power Unlisted Share Price | INR 620 per share |

| Total number of shares | 12,24,29,957 shares |

| Market Cap | INR 7,591 crore |

| Website | www.sterlitepower.com |

Read Also: Motilal Oswal Home Finance Unlisted Share Price

Sterlite Power Unlisted Share Details – Shareholding Pattern

Top equity shareholders of the company as of 31 March 2024:

| Shareholder Name | % to Holding | No. of shares |

| Promoter and promoter group | 73.98 | 9,05,70,202 |

| Others | 26.02 | 3,18,59,755 |

Sterlite Power Unlisted Share Details – Financial Metrics

| Particulars | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

| Revenue | 2,092.39 | 5,197.48 | 3,278.65 | 4,917.89 |

| Revenue Growth (%) | (30.35) | 148.40 | (36.92) | 50.00 |

| Expenses | 2,023.74 | 4,640.72 | 2,880.65 | 4,448.20 |

| Net income | 869.77 | 440.14 | (32.73) | (216.88) |

| Margin (%) | 41.57 | 8.47 | (1.00) | (4.41) |

| ROCE (%) | 29.0 | 15.0 | 23.0 | 16.0 |

| ROE (%)* | 27.0 | 15.0 | 17.0 | 15.0 |

| EBITDA (%) | 85.71 | 26.05 | 18.26 | 10.00 |

| Debt/Equity* | 0.53 | 0.13 | 0.26 | 0.34 |

| EPS | 142.22 | 71.94 | (2.68) | (17.72) |

Read Also: Lakeshore Hospital Unlisted Share Price

Sterlite Power Unlisted Share Peer Comparison

| Company | 3-yr Sales CAGR (%) | PE Ratio | ROCE (%) | Net Margin (%) | MCap (INR crore) |

| Sterlite Power | 32.96 | – | 16.0 | (4.41) | 7,591 |

| Kalpataru Projects International | 14.9 | 36.1 | 16.0 | 2.63 | 18,649 |

| K E C International | 14.9 | 68.3 | 16.0 | 1.74 | 28,812 |

Sterlite Power Annual Reports

Sterlite Power Annual Report FY 2023 – 2024

Sterlite Power Annual Report FY 2022 – 2023

Sterlite Power Annual Report FY 2021 – 2022

Sterlite Power Draft Red Herring Prospectus

Sterlite Power Unlisted Share FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is Sterlite Power unlisted share price?

Sterlite Power unlisted stock price in December 2024 is INR 620 per share. Shares are purchased in lots of 25 shares.

Who determines Sterlite Power share price?

Unlisted share price is determined by various factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

When is Sterlite Power IPO planned?

Pratik Agarwal, Managing Director of Sterlite Power, said that given the volatility in the current markets and the limited window available under the currently filed DRHP, it has been decided to withdraw the DRHP.

last year I have purchased 300 shares @1700/share. i am in a huge loss. when will I get an exit opportunity. Pl help.

A stranded investor.

last year I have purchased 300 shares @1700/share of Sterlite Power Transmission ltd., i am in a huge loss. when will I get an exit opportunity. Pl help.

A stranded investor.