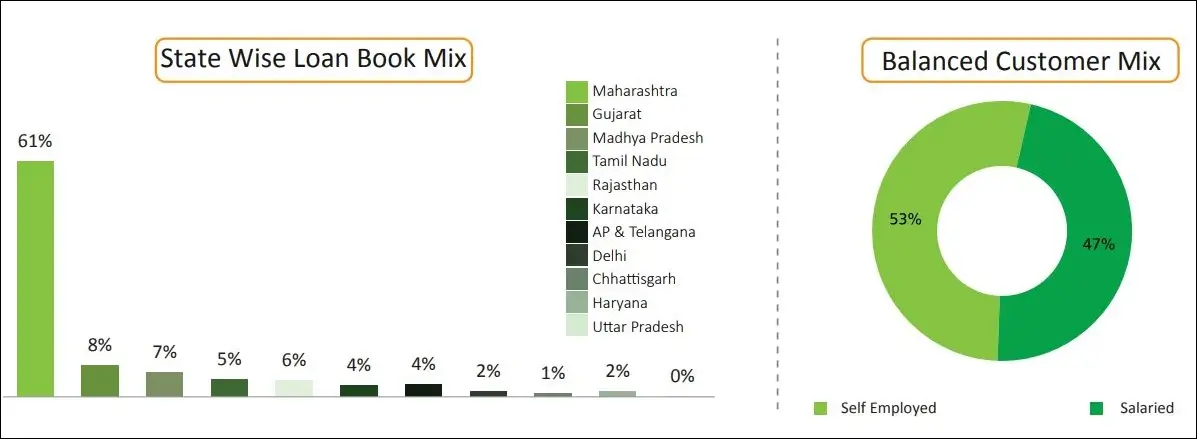

Motilal Oswal Home Finance Unlisted Share Description – Motilal Oswal Home Finance (MOHFL) is a public limited company established in October 2013 and headquartered in Mumbai, Maharashtra. As a subsidiary of Motilal Oswal Financial Services, MOHFL is registered with the National Housing Bank (NHB) and operates across 12 states in India, including Andhra Pradesh, Chhattisgarh, Gujarat, Haryana, Delhi, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, Uttar Pradesh, and Telangana. The company has established a network of 110 locations to serve its customers effectively.

MOHFL operates under a business philosophy centered on financial inclusion for lower-income families in India, aiming to provide them with access to long-term housing finance. As a subsidiary of Motilal Oswal Financial Services, a well-diversified financial services company, MOHFL is committed to enhancing the financial landscape for these families by facilitating their journey towards home ownership.

Motilal Oswal Home Finance is officially registered with the Reserve Bank of India (RBI) under Section 29A of the National Housing Bank (NHB) Act, 1987. This registration was formalized with the issuance of Certificate of Registration No. DOR-00111 on February 12, 2020. Before this, MOHFL was registered with the NHB under Certificate No. 05.0111.14, effective May 19, 2014.

Read Also: Axles India Unlisted Share Price

Products & Services of the Motilal Oswal Home Finance

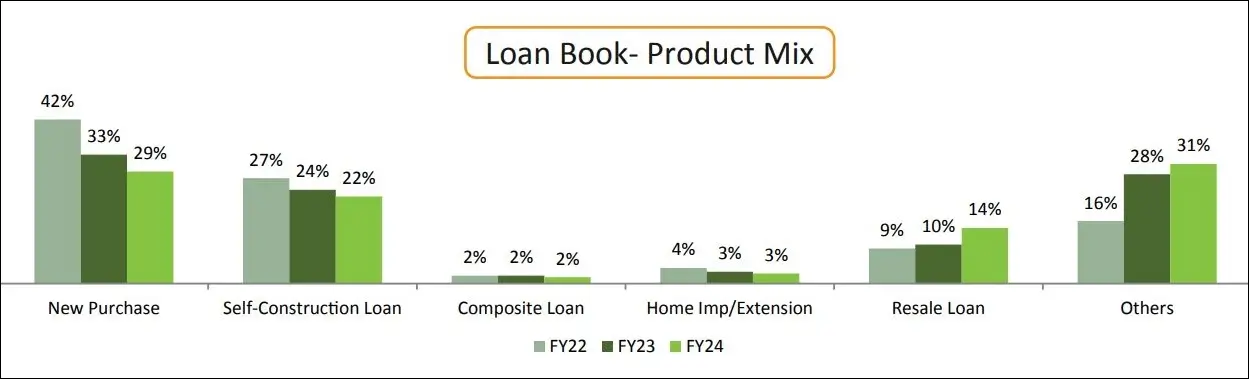

- Home Purchase Loans

- Home Construction Loan

- Home Improvement Loans

- Home Extension Loans

- Loan Against Property

- Pradhan Mantri Awas Yojana (PMAY)

Key Highlights

- Loan disbursements crossed the INR 1,000 crore mark, reaching INR 1,018 crore for FY 2024, indicating potential for stronger future growth.

- MOHFL maintained a robust AA/Stable rating from all three major rating agencies (CRISIL, ICRA, and India Ratings).

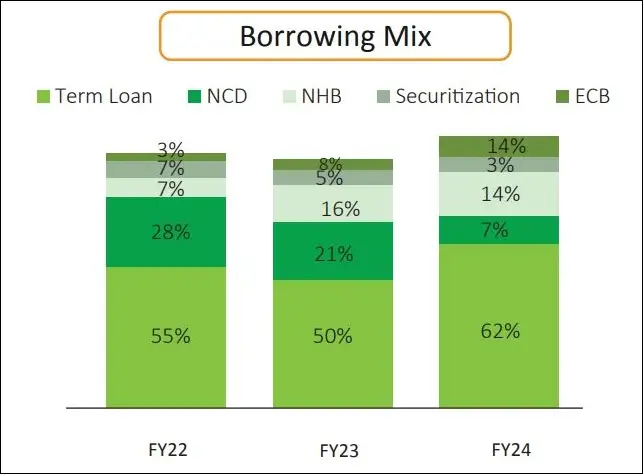

- Cost of borrowing stood at 8.3%. The company raised INR 1,337 crore of long and short-term funds in FY 2024.

- The company has an in-house Loan Management System (LMS), Loan Origination System (LOS), and separate mobile apps for sales, credit, and collection.

- Motilal Oswal Home Finance joined hands with the U.S. Development Finance Corporation, the world’s largest development finance institution, in FY 2022 and has received a commitment of USD 50 million. Received the balance tranches aggregating to USD 20 million during the year.

Motilal Oswal Home Finance Unlisted Share Business Performance

– MOHFL has disbursed loans INR 1,018 crore during FY 2024

– Geographical reach across 12 states/UTs with 109 branches

– Collection team of 600 members along with a robust legal team

– Catering to 47,500+ families

– Average LTV of 58% and FOIR of 42% for FY 2024

– Collection Efficiency (Total EMI Collected/1 EMI Due) of 103.8% in FY 2024

– Total staff count of 1,900+ employees

Read Also: HBD Financial Unlisted Share Price

Motilal Oswal Home Finance Unlisted Share Financial Performance

- Loan book grew by 6% YoY to 4,048 crore as of FY 2024

- Net Worth of INR 1,287 crore as of FY 2024

- Profit stood at INR 132.52 crore during FY 2024

- NIM – 7.6%, Spread – 5.9%

- GNPA – 0.9%, NNPA – 0.4%

- Stage 3 Provision coverage – 51%

- Net Debt to Equity – 1.96x

- Cost to Income – 46%

- Capital adequacy – 51%

Motilal Oswal Home Finance Board of Directors

- Mr. Motilal Oswal, Chairman & Non-Executive Director

- Mr. Raamdeo Agrawal, Non-Executive Chairman

- Mr. Sukesh Bhowa, Managing Director and Chief Executive Officer

- Ms. Divya Momaya, Independent Director

- Mr. P. H. Ravikumar, Independent Director

- Mrs. Neha Gada, Independent Director

Read Also: NSE Unlisted Share Price

Motilal Oswal Home Finance Unlisted Share Details

| Name | Motilal Oswal Home Finance Unlisted Share Details |

| Face Value | INR 1 per share |

| ISIN Code | INE658R01011 |

| Lot Size | 1,000 shares |

| Demat Status | NSDL, CDSL |

| Motilal Oswal Home Finance Unlisted Share Price | INR 13.60 per share |

| Market Cap | INR 8,211 crore |

| Total number of shares | 6,03,78,64,375 shares |

| Website | www.motilaloswalhf.com |

Read Also: Capital Small Finance Bank Unlisted Share Price

Motilal Oswal Home Finance Unlisted Share Details – Shareholding Pattern

Details of shares held by promoters/promoter group as of 31 March 2024:

| Shareholder Name | % to Holding | No. of shares |

| Motilal Oswal Financial Services | 75.30 | 4,54,64,13,025 |

| Motilal Oswal Investment Advisors | 4.27 | 25,78,44,836 |

| Motilal Oswal Wealth | 7.99 | 48,21,62,594 |

| Motilal Oswal Finvest | 9.94 | 60,00,00,000 |

| Others | 2.50 | 15,11,43,920 |

Motilal Oswal Home Finance Unlisted Share Details – Financial Metrics

| Particulars | FY 2022 | FY 2023 | FY 2024 |

| Revenue | 499.65 | 513.42 | 558.22 |

| Revenue Growth (%) | (5.62) | 2.76 | 8.73 |

| Expenses | 407.89 | 356.39 | 417.80 |

| Net income | 94.89 | 136.36 | 132.52 |

| Margin (%) | 18.99 | 26.56 | 23.74 |

| EPS | 0.16 | 0.23 | 0.22 |

| Debt/Equity | 2.59 | 2.52 | 1.96 |

Read Also: HDFC Securities Unlisted Share Price

Motilal Oswal Home Finance Unlisted Share Peer Comparison

| Company | 3-yr Sales CAGR (%) | PE Ratio | Net Margin (%) | MCap (INR crore) |

| Motilal Oswal Home Finance | 1.78 | 61.82 | 23.74 | 8,211 |

| Aptus Value Housing Finance India | 28.8 | 23.6 | 44.84 | 15,904 |

| PNB Housing Finance | (2.49) | 13.3 | 21.77 | 22,739 |

Motilal Oswal Home Finance Annual Reports

Motilal Oswal Home Finance Annual Report FY 2023 – 2024

Motilal Oswal Home Finance Annual Report FY 2022 – 2023

Motilal Oswal Home Finance Annual Report FY 2021 – 2022

Motilal Oswal Home Finance Unlisted Share FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is Motilal Oswal Home Finance unlisted share price?

Motilal Oswal Home Finance unlisted stock price in December 2024 is INR 13.60 per share. Shares are purchased in lots of 1,000 shares.

Who determines Motilal Oswal Home Finance unlisted share price?

The unlisted share price is determined by various factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.