Last updated on December 27, 2023

The call money market is a vital aspect of the financial landscape, focusing on short-term financial assets that closely resemble money and can be readily repaid on demand, making them highly liquid. This form of liquid money is primarily utilized by banks to fulfill their short-term capital needs and maintain financial stability. Before we delve into the specifics of the call money market, let’s first grasp the concept of the Money Market as a whole.

What Is Money Market?

The money market serves as an organized exchange market where individuals can lend and borrow short-term, high-quality debt securities with a maturity of one year or less. It facilitates governments, banks, and large institutions in selling short-term securities to fulfill their cash flow requirements.

Money market instruments typically include Certificate of Deposit (CD), Commercial Paper (CP), Inter Bank term Money, Bill Rediscounting, Call/Notice/Term Money, Inter Bank Participation Certificates, and Treasury Bills. The money market in India is regulated by the Reserve Bank of India (RBI).

Read Also: Electronics Mart IPO GMP, Price, Date, Allotment

What is Call Money Market?

The call money market stands as the most liquid segment within the short-term money market, with a maturity period of just one day. Call money loans can have tenures ranging from one day to fourteen days after the disbursement of funds by the lending institution. In the call money market, any amount can be borrowed or lent at a market-determined interest rate acceptable to both parties.

Call Money Market in India

The call money market caters to the day-to-day funding requirements, particularly in the bullion market and stock exchanges.

- Money lent for one day is referred to as call money.

- Money lent for more than one day and less than 15 days is called Notice Money.

- Money lent for more than 15 days is known as term money.

Also Read: Top Artificial Intelligence Stocks in India

Why do Banks Need Call Money?

Banks require call money for various purposes:

- Managing temporary funding mismatches

- Complying with the cash reserve ratio (CRR) and the statutory liquidity ratio (SLR)

- Meeting excess demand caused by a net outflow of funds from disinvestment or imports

Call Money Market Features

1. High Liquidity: The call money market provides exceptional liquidity and offers fixed income to investors with short-term maturities. Consequently, call money market instruments are considered close substitutes for money.

2. Secure Investment: These financial instruments are among the safest investment avenues available due to the high credit ratings of issuers and borrowers, ensuring minimal risk of losing invested capital.

3. Competitive Interest Rates: The interest rate charged on call loans between financial institutions is known as the call loan rate. Brokers use call money as a short-term source of funding to maintain margin accounts for leveraged investments. The interest rate charged on loans used to purchase securities varies based on the call money rate set by the RBI.

4. Easy Transfers: Funds can be swiftly transferred between lenders and brokerage firms, making call money the second most accessible asset in a balance sheet after cash. If the lender calls the funds, the broker can issue a margin call, which typically results in the automatic sale of securities in a client’s account (to convert the securities to cash) to repay the lender.

Participants of the Call Money Market in India

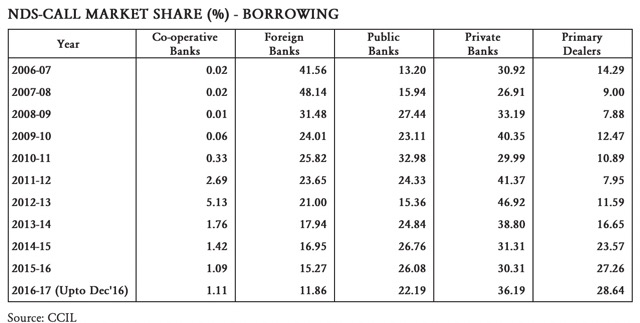

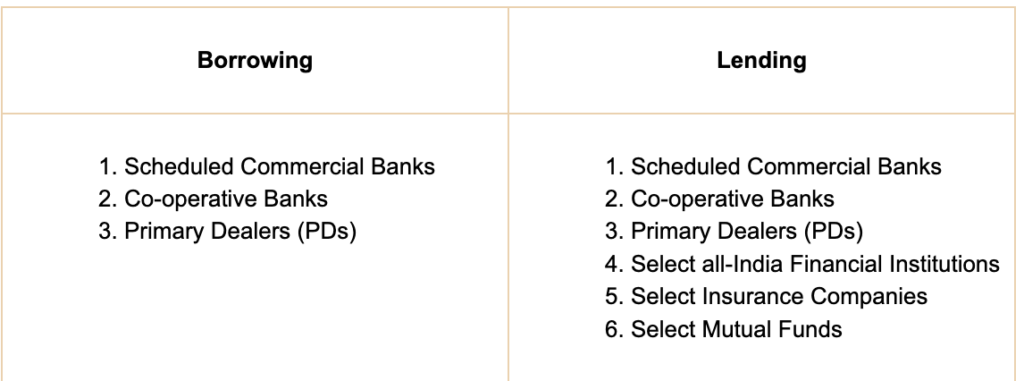

In the call money market, various entities participate to facilitate short-term financial transactions. The participants in this market include Banks, Primary Dealers (PDs), Development Finance Institutions, Insurance companies, and select Mutual Funds. Among these participants, both PDs and banks have the flexibility to play the roles of both borrowers and lenders in the market. However, non-bank institutions that have obtained specific permission to operate in the call money market are limited to acting solely as lenders.

List of Institutions Permitted to Participate in the Call/Notice

How does the Call Money Market work?

Loans are offered by lenders through auctions in the Call Money Market (CMM), and borrowers place bids on them, competing on interest rates. The funds are allocated to the bidder offering the highest interest rate on a particular loan. Trading in the CMM takes place through a Negotiated Dealing System (NDS), which is a regulated electronic trading platform. The call money rate is highly volatile and influenced by factors such as fluctuating corporate demand, the volume of bank deposits, and cyclical fluctuations, among others.

The call money rate or interest rate is influenced by liquidity demand and supply, with a lack of liquidity leading to rate rises and vice versa. It serves as a significant monetary multiplier measurement.

In conclusion, the call money market plays a crucial role in providing short-term funds to banks and institutions, ensuring smooth operations, and maintaining financial equilibrium. As it offers high liquidity and security, it remains a vital aspect of India’s financial landscape, regulated by the RBI to uphold stability and transparency.