White Label ATMs (WLAs) have emerged as a significant component of modern banking, transforming how transactions are conducted. Unlike traditional ATMs, which are primarily operated by banks, WLAs are owned and managed by non-bank entities. This article will explore the development of WLAs in India, their regulatory framework, and notable operators in the sector.

Table of Contents

What Does White Label ATM Means?

White Label ATMs (WLAs) represent a new category of automated teller machines in India that are not associated with any specific bank branding. These ATMs are established, owned, and operated by non-bank entities following the Companies Act of 1956.

In the evolving landscape of banking, WLA companies are crucial as they integrate into the broader banking network, providing a variety of services to customers regardless of their bank affiliation. These services include cash withdrawals, bill payments, and cash deposit options. In exchange for these services, WLA operators charge fees to the banks that issue the cards used at these ATMs.

Under the White Label ATM business model, ATMs are established and operated by non-bank entities that feature the brand name of the WLA operators. These ATMs offer a convenient and accessible banking solution for customers, regardless of which bank they hold accounts with. While they are sometimes referred to as “no name” ATMs, this term is somewhat misleading, as these machines do display the name of the company responsible for their operation.

The Reserve Bank of India (RBI) has authorized non-bank entities to operate WLAs under the Payment & Settlement Systems Act of 2007. This initiative aims to expand ATM accessibility, particularly in rural and semi-urban regions, thereby enhancing financial inclusion and bridging gaps in service availability.

Operations of White Label ATM Operators in India

Operating a White Label ATM (WLA) may appear similar to using any other ATM from the customer’s perspective, but the underlying processes are more intricate. WLA operators engage with three key intermediaries during transactions: a lending bank, a sponsor bank for settlement purposes, and an ATM network provider such as the National Payments Corporation of India (NPCI). These operators adopt a business-to-business (B2B) model by forming partnerships with banks. Their revenue and profitability are closely tied to the transaction volume at their ATMs, which also requires them to establish connections with end customers, akin to a business-to-consumer (B2C) approach.

Building relationships with potential customers is essential for WLA operators. They must foster awareness and trust regarding the safety and convenience of using White Label ATMs. This investment in customer trust is crucial for attracting users, increasing foot traffic at ATMs, and ultimately driving revenue growth. Alongside nurturing customer relationships, WLA operators must also cultivate strong ties with sponsor banks to ensure smooth operations and service delivery.

Usage of White Label ATM

White Label ATMs provide a range of facilities and services, including:

- Universal Access: Customers from any bank can utilize these ATMs.

- Free Transactions: Users are entitled to five free transactions each month.

- 24/7 Availability: These ATMs are operational around the clock, including on holidays.

- Value-Added Services: In addition to cash withdrawals, WLAs offer services such as mobile recharges and utility bill payments.

History of White Label ATM Industry in India

Until 2012, the establishment of ATMs in India was exclusively the domain of banks, with a total of 95,686 ATMs deployed by that time, primarily concentrated in urban and metropolitan areas. To improve ATM access in unbanked and underbanked regions, the Reserve Bank of India (RBI) allowed non-bank entities to set up, own, and operate ATMs in June 2012. This regulatory change led to the rise of White Label ATMs, which specifically target semi-urban and rural areas where there is limited penetration of bank-owned ATMs.

In 2013 and 2014, the RBI granted Certificates of Authorization to eight non-bank entities to establish and operate White Label ATMs across the country.

Read Also: Brown Label ATM – And 5 Other Amazing Types of ATMs You Didn’t Know About

WLA ATM Licenses by RBI

| Entity | Month and Year of Issuance of Certificate | Current Status as of October 2024 |

| Tata Communications Payment Solutions | May 2013 (Valid upto 30 June 2025) | Operational |

| Hitachi Payment Services | November 2013 | Operational |

| Vakrangee Limited | January 2014 | Operational |

| India1 Payments | February 2014 | Operational |

| Muthoot Finance | February 2014 | The company surrendered its certificate of Authorisation in 2020 due to mounting losses |

| SREI Infrastructure Finance | May 2014 | The company surrendered its certificate of Authorisation in 2018 due to viability issues |

| RiddiSiddhi Bullions | May 2014 | RBI revoked the certificate of Authorisation in March 2021 due to Non-compliance with regulatory requirements |

| AGS Transact Technologies | June 2014 | RBI revoked the certificate of Authorisation in March 2021 due to Non-compliance with regulatory requirements |

| Electronic Payment and Services | October 2024 | Operational |

As of October 2024, five WLA ATM operators remain in the industry – India1 Payments (formerly known as BTI Payment), Tata Communications Payment Solutions, Hitachi Payment Services, Vakrangee, and Electronic Payment and Services.

Read Also: TReDS Portal Meaning, Full Form, and all important points you need to know

Regulatory Tailwinds for WLA ATM Operators

In March 2019, the Reserve Bank of India (RBI) implemented a significant change to the business guidelines for White Label ATM (WLA) operators. This update enabled WLAs to directly source cash from the RBI, thereby reducing their dependence on bank withdrawals. As a result of this regulatory shift, the availability of cash in all denominations at these ATMs has improved, enhancing customer convenience and accessibility to cash.

Operating and maintaining ATMs can be quite expensive, with factors such as high interest rates and fuel costs further squeezing profit margins. The installation cost for an ATM typically reaches around INR 5,00,000, while monthly operational expenses hover around INR 50,000. In response to these financial pressures, the Confederation of ATM Industry (CATMI) has advocated for an increase in the interchange fee. They proposed raising the interchange fee to INR 17 for financial transactions and INR 6 for non-financial transactions.

In June 2021, the Reserve Bank of India (RBI) reviewed the ATM interchange fees and provided some relief to White Label ATM (WLA) operators. The RBI approved an increase in the interchange fee per transaction, raising it from INR 15 to INR 17 for financial transactions and from INR 5 to INR 6 for non-financial transactions. These revised fees, effective from August 1, 2021, apply across all regions and serve as an incentive for WLA operators to expand their ATM networks, particularly in rural and semi-urban areas where ATM penetration is currently low. The interchange fees are paid by card-issuing banks to WLA operators in India.

Read Also: What is NACH in Banking and How it is Revolutionizing Interbank Transactions in India

Number of White Label ATMs in India

As seen above, the white label ATM example includes machines installed by four companies. In total, these five companies have deployed over 35,983 ATMs in India. By the end of 2024, it is expected that around 40,000 White Label ATMs will be installed across India.

| WLA operators | License approval date | Number of ATMs (2024) |

| India1 Payments Limited | 12 February 2014 | 13,008 |

| Hitachi Payment Services | 25 November 2013 | 10,300 |

| Tata Communications Payment Solutions | 3 May 2013 | 6,189 |

| Vakrangee | 23 January 2014 | 6,486 |

| Electronic Payment and Services | 4 October 2024 | – |

As of 31 July 2024, India1 Payments holds the distinction of being the largest white-label ATM operator in India, with the deployment of 8,022 WLAs, branded as ‘India1 ATMs’. This achievement becomes more impressive considering that a majority of these ATMs have been installed in semi-urban and rural areas.

Hitachi Money Spot ATM is the brand associated with Hitachi Payment Services’ White Label ATM deployment in India. With a strong focus on deploying WLAs in Tier 3 to Tier 6 towns, the company has experienced remarkable growth in WLA deployment in recent years. Hitachi Money Spot and Indicash are two entities that have deployed a large number of ATMs in semi-urban and rural areas of India, with over 75% of their ATMs in these regions.

Tata Communications Payment Solutions (TCPSL) holds the distinction of being the first company authorized by the RBI to open White Label ATMs in India. It launched its operations under the brand name ‘Indicash’ in June 2013 and notably inaugurated the first ATM in a Tier-5 town.

Vakrangee is currently the smallest of the four White Label ATM players in India. Despite its smaller scale, White Label ATMs remain a critical component of Vakrangee’s business model, unlike other players that have more diversified business interests.

Electronic and Payment Services (EPS), which recently received a white label ATM operator (WLAO) license from the Reserve Bank of India (RBI), is planning to install 9,000 ATMs across the country in three years. The company plans to deploy around 2000 ATMs by March 2025.

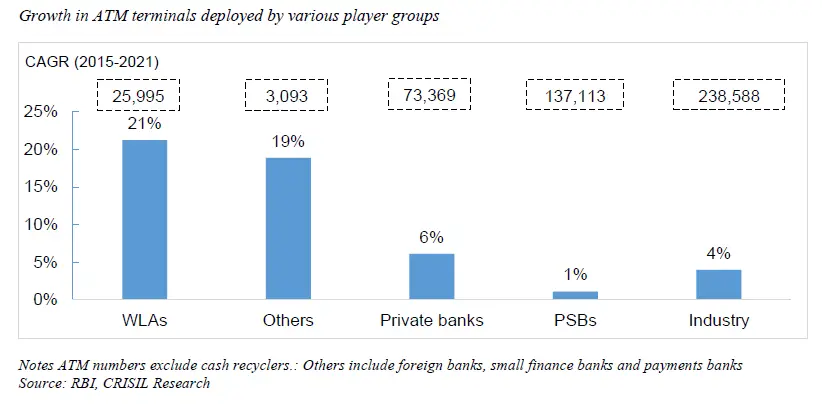

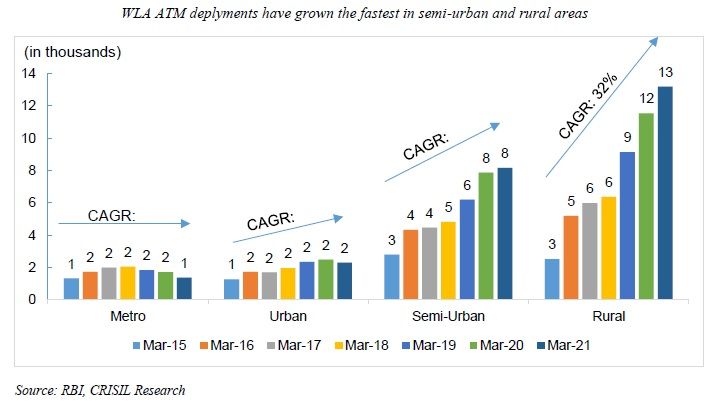

Growth of White Label ATMs in India

The growth of White Label ATMs (WLAs) in India is projected to experience a Compound Annual Growth Rate (CAGR) of 9.2% between 2024 and 2032. This expansion is largely attributed to the increasing demand for accessible banking services, particularly in semi-urban and rural areas where traditional bank-operated ATMs are less prevalent.

Region-wise WLA in India

WLA Operators’ Market Share by ATMs deployed

| India1 Payments | 36% |

| Hitachi Payment Services | 29% |

| Tata Communications Payment Solutions (Indicash) | 17% |

| Vakrangee | 18% |

| Electronic Payment and Services | – |

White Label ATM FAQs

Which is India’s biggest White Label ATM operator?

India1 Payments is the largest white-label ATM operator in India, based on the number of ATMs installed as of 31 July 2024. The company’s network includes 13,008 WLAs.

Which company was first authorized to operate White Label ATMs?

Tata-group entity Tata Communications Payment Solutions (TCPSL) was the first company authorized by the RBI to open White Label ATMs in India. The company launched its ATMs under the ‘Indicash’ brand name in June 2013.

How does White Label ATM operator earn money?

WLA operators depend on intercharge fees for their revenues. This fee is charged to the card-issuing banks on every usage. Currently, the intercharge fee is INR 17 for financial transactions and INR 6 for non-financial transactions. Additionally, White ATM operators can offer value-added services and earn additional revenue.

How many transactions are free for users?

ATM users belonging to any bank can use WLA ATMs five times every month without paying any charges.

I am rent my shop for ATM…..

I am rent my shop for atm

I am rent shop for atm

I have a shop having area 300sq ft. The shop situates at Kotalpur in the District of Bankura and on the main road leading to Kolkata.The shop is very close to Netaji More Bus Stand.