Automated Teller Machines (ATMs) have become essential to contemporary banking, providing easy access to cash and a range of financial services. Among the different types of ATMs, Brown Label ATMs, or BLA ATMs, represent a distinctive concept that has gained considerable traction in India. This article will delve into the workings of Brown Label ATMs and highlight five other fascinating types of ATMs that you may not be familiar with.

Brown Label ATM Means

A Brown Label ATM, also known as a BLA ATM, is an automated teller machine where the bank, referred to as the sponsor bank, manages the money and ensures connectivity to financial systems. However, the actual machine is owned by the manufacturer, also known as a service provider or vendor, and is leased to the bank. While these ATMs display the bank’s branding, they are not owned by the bank itself.

These brown-label ATMs are rented from the service provider, which is responsible for identifying suitable locations for the machines and negotiating placement with property management. Additionally, the service provider must ensure that there is a power supply, network infrastructure, and interior setup for the ATMs.

In India, the ATM system is poised for significant growth in the coming years, largely due to the innovative implementation of the Brown Label ATM concept by major financial institutions. This approach enables banks to establish numerous ATM units quickly. A key advantage of the brown-label atm model is its cost-sharing arrangement between banks and service providers.

Prominent financial institutions such as Axis and ICICI Bank, along with smaller banks like Dhanlaxmi and RBL, have adopted the Brown Label ATM concept. As a result, most ATMs in India now operate under this model, as banks have shifted away from outright purchasing machines and assuming all service costs. The popularity of brown-label ATMs stems from their cost-sharing nature, which offers significant benefits to banks.

Overall, the brown-label atm model has emerged as a viable alternative to both White Label ATMs and traditional bank-owned ATMs. Additionally, SVC Co-operative Bank has pioneered the launch of the first brown-label ATM network in the cooperative banking sector, partnering with Writer Safeguard to implement this initiative.

How are Costs Shared in Brown ATMs?

In the Brown Label ATM (BLA) model, costs are shared between the service provider and the sponsor bank. The service provider is responsible for the initial capital expenditure required to set up the ATM, including hardware and installation costs. In return, the bank compensates the service provider through a pay-per-transaction model or a fixed monthly fee, which allows banks to only pay for the services they utilize.

Additionally, the service provider manages cash logistics, ensuring that the ATM is stocked with cash, while also handling network monitoring and maintenance. This arrangement alleviates the logistical burden on banks and enables them to focus on their core banking services.

In FY 2021, the average number of transactions conducted at an ATM in a single day was approximately 87 transactions. This figure includes both financial transactions, such as cash withdrawals and deposits, as well as non-financial transactions like balance inquiries and mini-statements.

Now, let’s delve into the profitability analysis of Brown-label ATMs in India:

| Parameter | Value in INR |

| Cost per transaction | 7.7 |

| Revenue per transaction | 11.0 |

| Profit per transaction | 3.3 |

| Number of transactions for break-even per day | 70 |

| Coverage of investment after years | 3.8 |

Benefits of Brown Label ATMs

The brown-label ATM concept provides two key advantages to the parties involved. Firstly, by allowing the vendor to handle capital expenditure, banks are freed from the burden of investing their funds in a depreciating asset.

Additionally, there is a significant incentive to ensure the efficient use of these ATMs, as the card-issuing bank incurs a fee for each transaction processed by the vendor. However, some smaller banks with limited national customer bases find it more economical to pay other banks for each transaction instead of investing in their own equipment.

Also Read: White Label ATM – Meaning, Example, Regulations, Operators

Major Brown-Label ATM Operators

Several companies operate Brown Label ATMs across the globe. Some of the major operators include:

- CMS Info Systems (India)

- Fujitsu (Japan)

- GRG Banking (China)

- HESS Terminal Solutions (USA)

- Hitachi Payment Services (Japan)

- Nautilus Hyosung (South Korea)

- NCR Corporation (USA)

- Wincor Nixdorf AG (Germany)

What is the Status of BLA ATMs in India?

Brown Label ATMs (BLAs) have gained significant traction in India, becoming a preferred solution for many banks due to their cost-effective nature and operational efficiency. Here’s an overview of the current status of BLA ATMs in India:

Current Status

- Rapid Growth: The network of Brown Label ATMs is expected to expand rapidly as banks increasingly adopt this model to enhance their ATM presence without incurring high capital costs associated with traditional ATM ownership.

- Cost-Effective Solution: Many banks are opting for BLAs as they allow for a shared cost model. The service provider owns the ATM hardware and manages site selection, while the sponsoring bank provides cash management and network connectivity. This arrangement helps banks reduce operational expenditures significantly.

- Regulatory Compliance: Unlike White Label ATMs, which require direct interaction with the Reserve Bank of India (RBI), Brown Label ATMs operate under a contractual agreement between the service provider and the sponsor bank, simplifying regulatory compliance for banks.

Read Also: TReDS Portal Meaning, Full Form, and all important points you need to know

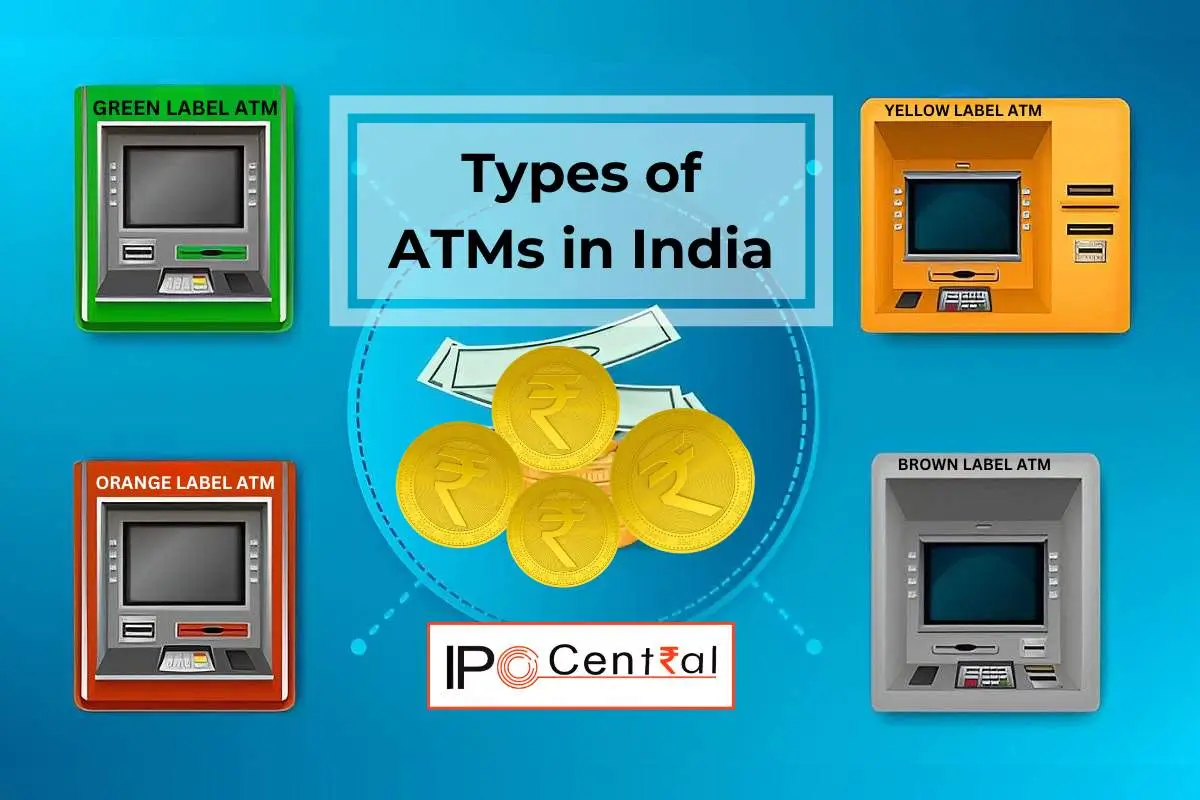

Types of ATMs in India Based on Operation

Apart from Brown Label ATMs, there are various other types of ATMs catering to specific needs. These include:

- WHITE LABEL ATMs

White-label ATMs are set up, owned, and operated by entities other than banks that have received approval from the Reserve Bank of India (RBI) and are incorporated under the Companies Act of 1956. These ATMs facilitate transactions for customers of any bank and do not feature the logo of any specific bank.

Example: Tata Indicash, India1ATM

- GREEN LABEL ATMs

These ATMs are specifically used for agricultural transactions.

- ORANGE LABEL ATMs

ATMs with orange labels are primarily utilized for share transactions.

- YELLOW LABEL ATMs

These ATMs are dedicated to facilitating online shopping transactions.

- PINK LABEL ATMS

Only women are allowed to use these ATMs for banking services.

- BROWN LABEL ATMs

In this sort of ATM, the sponsor bank provides cash management and network connectivity, while the service provider owns the ATM’s hardware and lease.

Brown Label ATM Examples: SBI, HDFC, etc.

- CASH DISPENSER

Cash dispensers (CD) allow users to make cash withdrawals, view mini statements, make account-related requests, and check their balances.

These various types of ATMs cater to different needs and preferences in different locations and regions, ensuring convenient access to cash and banking services anytime, anywhere.

Difference Between White Label ATM and Brown Label ATM

The primary differences between White Label ATMs and Brown Label ATMs are as follows:

| Feature | White Label ATM | Brown Label ATM |

|---|---|---|

| Branding and Logo | No specific bank branding | Carries the sponsor bank’s branding |

| RBI Involvement | Directly involved with RBI approval because these operators have to separately get licensed/permission from the RBI to conduct business | No direct RBI involvement because the outsourcing companies have a contractual obligation with their respective sponsor banks |

| Compulsory Locations | Compulsory to open ATMs in specific areas | No such compulsion for locations |

| Ownership | Owned by NBFCs or non-bank organizations | Owned by the service providers |

Conclusion

Brown Label ATMs have transformed the ATM landscape in India by implementing a cost-sharing model that benefits both banks and service providers. This approach enables financial institutions to quickly expand their ATM networks without incurring substantial capital expenditures. Furthermore, we examined other intriguing types of ATMs that address various banking needs. As the banking sector evolves, the adoption of innovative ATM concepts like Brown Label ATMs is expected to significantly enhance financial accessibility for everyone.

Latest Content From IPO Central

- How Many IPOs Have Withdrawn In India?

- Motilal Oswal Home Finance Q2 FY25 Performance

- The Exciting Upcoming IPOs in December 2024 You Can’t Miss!

- Eleven IPOs Next Week – Market Set to Witness Over INR 18,000 Cr Fundraising Action

- Vishal Mega Mart IPO Analysis

- Sai Life Sciences IPO Analysis

- Emerald Tyre IPO Allotment Today: What to Expect After 530.67X Subscription Surge

- Ullu Digital IPO – INR 135-150 Cr SME IPO to Launch by March 2025

- RBI’s NOD for Canara Robeco AMC IPO and Canara HSBC Life Insurance IPO

- Zepto Surpasses INR 1,000 Crore in Annualized Ad Revenue

- Dhanlaxmi Bank Rights Issue Dates, Price, Allotment, Entitlement

FAQs

What is the main advantage of Brown Label ATMs?

Brown Label ATMs offer significant cost savings to banks as the service provider undertakes the capital expenditure, reducing the bank’s financial burden.

Which are some major Brown Label ATM operators?

Major Brown Label ATM operators include CMS Info Systems, Fujitsu, GRG Banking, HESS Terminal Solutions, Hitachi Payment Services, Nautilus Hyosung, NCR Corporation, and Wincor Nixdorf AG.

What is the average profitability of Brown Label ATMs in India?

The profitability of Brown Label ATMs in India is approximately INR 3.3 per transaction, with a break-even point of around 70 transactions per day.