In India’s fast-evolving financial services landscape, Hero FinCorp has quietly built a reputation as a high-growth, tech-forward, and customer-centric non-banking financial company (NBFC). With an Assets Under Management (AUM) of INR 57,720 crore as of FY25 and a reach that spans 2,000+ locations, 4,600+ touchpoints, and 15,000+ employees, the company is touching over 12 million lives. But what exactly powers this engine?

Let’s unpack how Hero FinCorp makes money, what drives its revenue streams, and the business model that sustains its growth — while also examining the latest financial results and operational levers.

📌 1. Understanding the Hero FinCorp Business Model

Hero FinCorp is structured as a diversified NBFC, meaning it operates across a range of loan products catering to various customer segments, including:

- Retail Finance (Vehicle Loans, Personal Loans, Mortgage Loans)

- MSME Finance (Business Loans, Loans Against Property, Construction Finance, Supply Chain Finance)

- Corporate Lending (CIF loans to large institutions)

It also owns a 99.24% stake in Hero Housing Finance (HHFL), a dedicated housing finance company focused on home loans and loans against property.

This diversified product suite enables the company to monetise the full lifecycle of credit demand across India’s economic spectrum — from the Aspiring India households earning INR 2–10 Lacs per annum to MSMEs and large corporates.

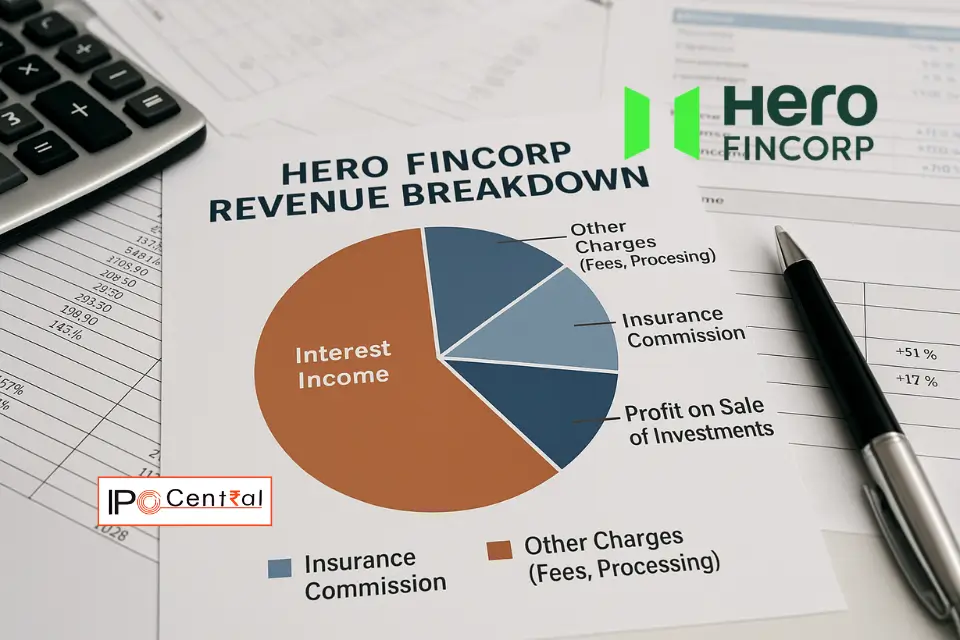

💰 2. How Hero FinCorp Makes Money: Revenue Streams

Hero FinCorp revenue stream is categorised under two broad heads:

A. Core Operating Revenue

According to the FY25 consolidated financials, revenue from operations stood at INR 9,832.73 crore, up 18.6% YoY from FY24.

| Revenue Component | FY24 (INR Cr) | FY25 (INR Cr) | Growth (%) |

|---|---|---|---|

| Interest Income | 7,479.38 | 8,588.67 | +14.8% |

| Insurance Commission | 113.99 | 185.53 | +62.8% |

| Profit on Sale of Investments | 64.70 | 44.62 | -31.0% |

| Derecognition Gains (Amortised) | 21.28 | 134.82 | +533% |

| Other Charges (Fees, Processing) | 610.84 | 879.07 | +43.9% |

| Total Operational Revenue | 8,290.90 | 9,832.73 | +18.6% |

Key Insight: While interest income remains the bedrock (~87% of operating income), ancillary streams like insurance commission and loan processing fees are growing rapidly, indicating Hero FinCorp’s strategy of cross-selling and fee-based monetisation is bearing fruit.

B. Other Income

Other income stood at INR 70.60 crore (FY25), mainly from treasury operations, vs INR 68.82 crore in FY24.

🏦 3. How Lending Drives Profits

The company makes money primarily through net interest margin (NIM) — the spread between what it earns on loans and what it pays on borrowings.

Here’s how it plays out:

➤ Loan Book Composition

- Retail Loans: Two-wheelers, used cars, consumption, mortgage — average ticket size ranging from INR 93,000 (2W) to INR 2.17 lakh (mortgages).

- MSME Loans: INR 1 lakh to INR 5.5 crore — both secured and unsecured.

- Corporate Loans (CIF): INR 50 crore to INR 350 crore, secured against property, shares, or current assets.

➤ Asset Quality & Risks

- GNPA rose from 4.26% to 5.45% YoY in FY25 due to election-related collection disruptions.

- Impairment charges shot up 67% to INR 2,884 crore, sharply compressing profit margins.

📉 4. Profitability Hit in FY25: Why It Matters

Despite revenue growth, Hero FinCorp’s PAT fell 82.7% YoY to INR 109.95 crore due to:

- Elevated credit costs from impaired assets

- Higher finance costs (INR 3,827 crore, up 23.6%)

- Increase in operating expenses and tech investments

| Metric | FY24 (INR Cr) | FY25 (INR Cr) | Change (%) |

|---|---|---|---|

| PBT | 960.55 | 256.09 | ▼73.3% |

| PAT | 637.05 | 109.95 | ▼82.7% |

| EPS (Diluted) (INR) | 49.94 | 8.62 | ▼82.7% |

| Net Profit Margin | 7.62% | 1.11% | ▼ 6.51 pp |

📉 Adjusting for CCPS accounting (as equity, not liability):

- PAT would be INR 390.96 crore

- PBT would rise to INR 531.49 crore

🔌 5. Tech-Driven Scale & Efficiency

Hero FinCorp’s digital and AI integration is central to how it enhances margins, credit assessment, and customer acquisition:

- AI/ML-based underwriting scorecards

- Cloud-based data lake with 102 micro-market variables

- Digital app with 2.79M downloads; 83% collections are digital

- “The Bridge” app to manage partner network (live from Q2 FY25)

💸 6. How Borrowing Funds the Business

Like all NBFCs, Hero FinCorp business model based onborrows to lend. Its strategy is to diversify funding sources and reduce the cost of capital.

| Instrument | FY25 Outstanding (INR Cr) | Growth YoY |

|---|---|---|

| Term Loans | 27,425.07 | +13.5% |

| ECBs | 7,915.43 | +66.3% |

| NCDs | 4,070.56 | +14.5% |

| CPs | 3,954.97 | +7.5% |

- Average Cost of Borrowing: 8.6% (vs 8.4% in FY24)

- CAR: 16.88% (vs RBI requirement of 15%)

🧱 7. Capital Structure & Resilience

- Net worth (adjusted for CCPS as equity): INR 8,596.76 crore

- Total Debt-to-Asset ratio: 81.93%

- LCR: >120% (well above 100% regulatory threshold)

Conclusion

Hero FinCorp revenue streams and business are well-diversified, high-yield loan book supported by deep distribution, sharp credit underwriting, and a growing tech ecosystem.

Yes, FY25 was a tough year — credit costs surged, impairments rose, and profitability dipped. But these are likely transient headwinds. The company’s strategy to expand into underserved markets, cross-sell, leverage digital infrastructure, and optimise its borrowing mix positions it well for sustainable growth.

In essence, how Hero FinCorp makes money? — lending smartly, managing risk proactively, cross-selling financial products effectively, and borrowing strategically — a disciplined approach that positions the company to capitalise on opportunities in India’s evolving credit cycle.