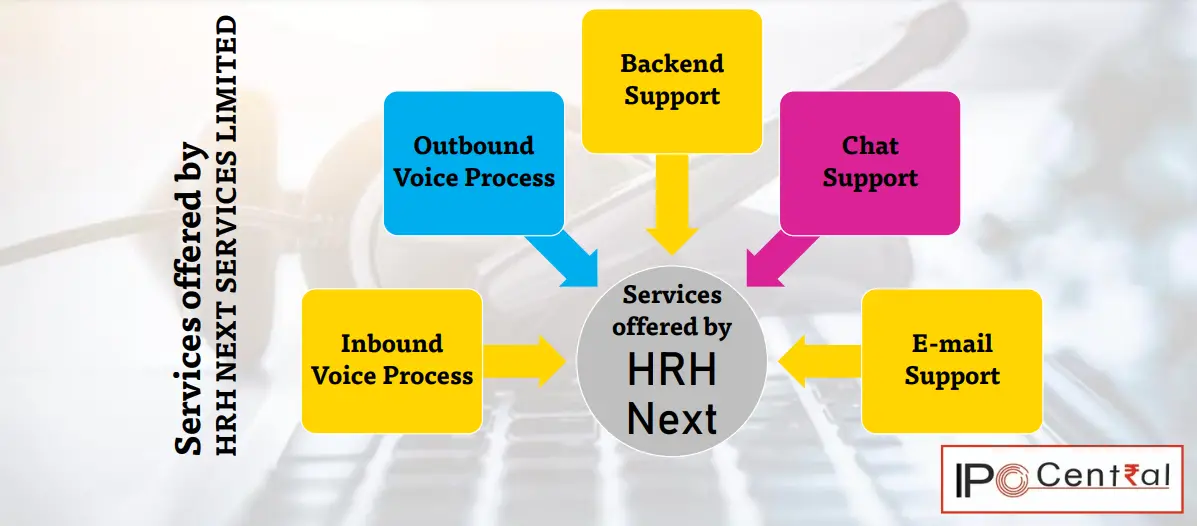

HRH Next IPO description – HRH Next Services operates in the realm of Business Process Outsourcing (BPO) and provides an all-encompassing range of Call Centre Services. These services include Inbound Services, Outbound Services, Backend Support, Chat Support, Email Support, and more. The company excels in delivering streamlined end-to-end solutions to its clients. It tailors its high-quality solutions to align with the specific requirements of businesses, aiding clients in accomplishing their objectives.

HRH Next has undergone exponential growth over the years. As a provider of domestic contact center services, the company maintains an unwavering commitment to fulfilling the requirements of its clientele following their needs. To meet these demands, the company has embraced the industry’s best practices for customer support services.

In addition to the aforementioned services, HRH Next Services plans to establish two Call Centres, each with a seating capacity of 150, in Palakkad, Kerala, and Raichur, Karnataka. The overall estimated cost for operating these two facilities is INR 2.86 crore, encompassing expenses such as 300 computer systems amounting to INR 1.51 crore.

Promoters of HRH Next Services – Ankit Sanjay Shah, and Parikshit Pankaj Shah

Table of Contents

HRH Next IPO Details

| HRH Next IPO Dates | 27 – 29 December 2023 |

| HRH Next Issue Price | INR 36 per share |

| Fresh issue | 2,658,000 shares (INR 9.57 crore) |

| Offer For Sale | Nil |

| Total IPO size | 2,658,000 shares (INR 9.57 crore) |

| Minimum bid (lot size) | 3,000 shares (INR 108,000) |

| Face Value | INR 10 per share |

| Retail Allocation | 50% |

| Listing On | NSE SME |

HRH Next Services Financial Performance

| FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 | |

| Revenue | 24.16 | 44.15 | 51.14 | 21.39 |

| Expenses | 23.87 | 42.87 | 46.31 | 19.51 |

| Net income | 0.25 | 0.93 | 3.48 | 1.51 |

HRH Next Services IPO News

- HRH Next Services RHP

- HRH Next Draft Prospectus

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Allotment Status

HRH Next Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 0.41 | 1.50 | 5.61 |

| PE ratio | – | – | 6.78 |

| RONW (%) | 4.17 | 13.35 | 33.29 |

| NAV | 9.74 | 11.24 | 16.85 |

| ROCE (%) | 10.50 | 23.34 | 46.57 |

| EBITDA (%) | 6.50 | 6.32 | 13.40 |

| Debt/Equity | 6.74 | 11.00 | 12.90 |

HRH Next IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| 2 January 2024 | 9 | – | – |

| 1 January 2024 | 8 | – | – |

| 30 December 2023 | 5 | – | – |

HRH Next IPO Subscription – Live Updates

| Category | Non-retail | Retail | Total |

|---|---|---|---|

| Shares Offered | 1,395,000 | 1,263,000 | 2,658,000 |

| 29 Dec 2023 | 60.67 | 63.42 | 61.98 |

| 28 Dec 2023 | 5.04 | 20.67 | 12.47 |

| 27 Dec 2023 | 1.83 | 9.56 | 5.50 |

HRH Next IPO Allotment Status

HRH Next IPO allotment status is now available on Cameo Corporate Services’ website. Click on Cameo Corporate Services weblink to get allotment status.

HRH Next IPO Dates & Listing Performance

| IPO Opening Date | 27 December 2023 |

| IPO Closing Date | 29 December 2023 |

| Finalization of Basis of Allotment | 1 January 2024 |

| Initiation of refunds | 2 January 2024 |

| Transfer of shares to demat accounts | 2 January 2024 |

| IPO Listing Date | 3 January 2024 |

| Opening Price on NSE SME | INR 41 per share (up 13.89%) |

| Closing Price on NSE SME | INR 43.05 per share (up 19.58%) |

HRH Next Services IPO Lead Manager

FINSHORE MANAGEMENT SERVICES LIMITED

Anandlok Building, Block-A, 2nd Floor, Room No. 207, 227

A.J.C Bose Road, Kolkata-700020, West Bengal, India

Phone: 033 – 2289 5101 / 4603 2561

Email: [email protected]

Website: www.finshoregroup.com

HRH Next Offer Registrar

CAMEO CORPORATE SERVICES LIMITED

No. 01, Club House Road, Mount Road,

Chennai – 600 002, Tamil Nadu

Phone: +91-44 4002 0700, 28460390

Email: [email protected]

Website: www.cameoindia.com

HRH Next IPO Contact Details

HRH NEXT SERVICES LIMITED

4-1-976, Abid Road,

Hyderabad- 500001, Telangana, India

Phone: +91 95536 04777

E-mail: [email protected]

Website: www.hrhnext.com

IPO FAQs

What is the HRH Next Services IPO size?

HRH Next offer size is INR 9.57 crores.

What is the HRH Next Services IPO price band?

HRH Next public offer price is INR 36 per share.

What is the lot size of the HRH Next IPO?

HRH Next offer lot size is 3,000 shares.

What is HRH Next IPO GMP today?

HRH Next IPO GMP today is INR 9 per share.

What is the HRH Next kostak rate today?

HRH Next kostak rate today is NA per application.

What is HRH Next Subject to Sauda rate today?

HRH Next Subject to Sauda rate today is INR NA per application.