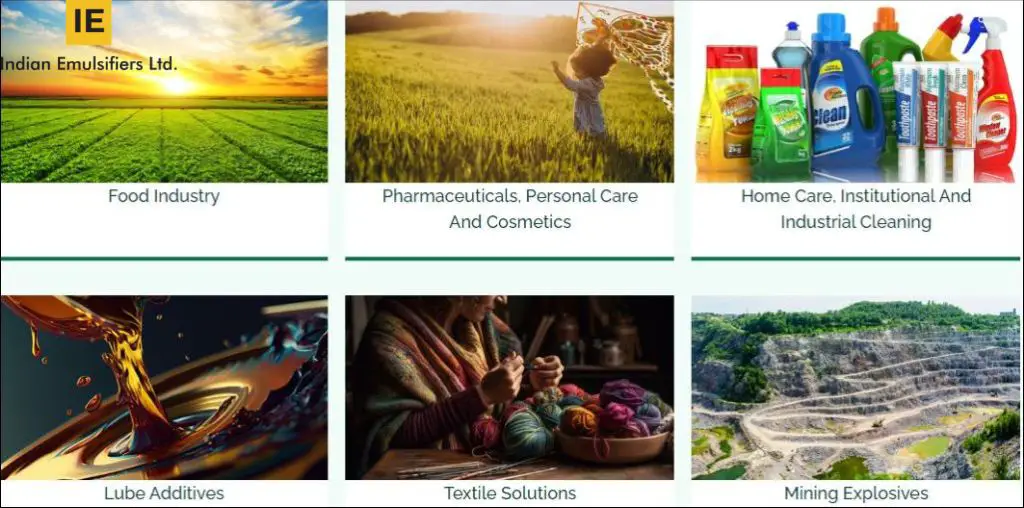

Indian Emulsifiers IPO description – Indian Emulsifiers was established to manufacture and supply specialty chemicals, including esters, amphoterics, phosphate esters, imidazolines, wax emulsions, and SMO & PIBSA emulsifiers. The company provides specialty chemicals to a broad array of industries, such as mining, textiles, cleaning, PVC and rubber, personal care, food, and more.

Since its inception, the company has maintained its manufacturing plant in Ratnagiri, Maharashtra. As of 31 March 2023, the facility has a production capacity of 4,800 metric tons per annum, which was 3,600 metric tons per annum for the period ended 31 December 2023. The plant is equipped with process control, an advanced R&D center, quality control, and application laboratories.

Indian Emulsifiers operates two warehouses, one located in Raigad, Maharashtra, and the other in Ratnagiri, Maharashtra. As of 31 December 2023, the company employs 34 full-time staff members, including key managerial personnel.

Promoters of Indian Emulsifiers – Yash Tikekar

Table of Contents

Indian Emulsifiers IPO Details

| Indian Emulsifiers IPO Dates | 13 – 16 May 2024 |

| Indian Emulsifiers Issue Price | INR 125 – 132 per share |

| Fresh issue | 3,211,000 shares (INR 40.14 – 42.39 crore) |

| Offer For Sale | NIL |

| Total IPO size | 3,211,000 shares (INR 40.14 – 42.39 crore) |

| Minimum bid (lot size) | 1,000 shares (INR 132,000) |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | NSE EMERGE |

Indian Emulsifiers Financial Performance

| FY 2021 | FY 2022 | FY 2023 | 9M FY 2024 | |

| Revenue | – | 17.68 | 41.18 | 48.67 |

| Expenses | (0.004) | 17.56 | 36.55 | 40.56 |

| Net income | (0.004) | 0.04 | 3.89 | 6.75 |

Indian Emulsifiers Offer News

- Indian Emulsifiers RHP

- Indian Emulsifiers Draft Prospectus

- ASBA IPO Forms

- Live IPO Subscription Status

- Highest SME IPO Subscription in 2024

Indian Emulsifiers Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | (0.00) | 0.05 | 4.80 |

| PE ratio | – | – | 26.04 – 27.50 |

| RONW (%) | (58.65) | 0.53 | 32.34 |

| NAV | 6.30 | 10.05 | 14.85 |

| ROCE (%) | (58.65) | 7.19 | 55.50 |

| EBITDA (%) | – | 4.50 | 19.09 |

| Debt/Equity | – | 0.94 | 0.97 |

Indian Emulsifiers IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| 21 May 2024 | 235 | – | 1,93,000 |

| 20 May 2024 | 235 | – | 1,93,000 |

| 18 May 2024 | 235 | – | 1,93,000 |

| 17 May 2024 | 227 | – | 1,76,000 |

| 16 May 2024 | 200 | – | 1,51,000 |

| 15 May 2024 | 175 | – | 1,35,000 |

| 14 May 2024 | 175 | – | 1,35,000 |

| 13 May 2024 | 180 | – | 1,35,000 |

| 11 May 2024 | 200 | – | 1,50,000 |

| 10 May 2024 | 180 | – | 1,50,000 |

| 9 May 2024 | 175 | – | 1,40,000 |

| 8 May 2024 | 155 | – | 1,32,000 |

| 7 May 2024 | 125 | – | 1,10,000 |

Indian Emulsifiers IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Total |

|---|---|---|---|---|

| Shares Offered | 6,10,000 | 4,60,000 | 10,70,000 | 21,40,000 |

| 16 May 2024 | 175.95 | 779.97 | 484.54 | 460.08 |

| 15 May 2024 | 0.47 | 96.81 | 173.74 | 107.81 |

| 14 May 2024 | 0.14 | 29.21 | 61.60 | 37.12 |

| 13 May 2024 | 0.04 | 6.41 | 11.54 | 7.16 |

The market maker reservation portion of 1,61,000 shares is not included in the above calculations.

Indian Emulsifiers IPO Allotment Status

Indian Emulsifiers IPO allotment status is now available on the Maashitla Securities website. Click on Maashitla Securities IPO weblink to get allotment status.

Indian Emulsifiers IPO Dates & Listing Performance

| IPO Opening Date | 13 May 2024 |

| IPO Closing Date | 16 May 2024 |

| Finalization of Basis of Allotment | 17 May 2024 |

| Initiation of refunds | 21 May 2024 |

| Transfer of shares to demat accounts | 21 May 2024 |

| Indian Emulsifiers IPO Listing Date | 22 May 2024 |

| Opening Price on NSE SME | INR 430 per share (up 225.76%) |

| Closing Price on NSE SME | INR 451.50 per share (up 242.05%) |

Indian Emulsifiers Offer Lead Manager

EKADRISHT CAPITAL PRIVATE LIMITED

1102, Summitt Business Bay, Chakala, Andheri Kurla Road,

Andheri East Chakala MIDC, Mumbai, 400 093, Maharashtra

Phone: +91 89286 31037

Email: [email protected]

Website: www.ekadrisht.com

Indian Emulsifiers Offer Registrar

MAASHITLA SECURITIES PRIVATE LIMITED

451, Krishna Apra Business Square,

Netaji Subhash Place, Pitampura, Delhi – 110034

Phone: 011-45121795

Email: [email protected]

Website: www.maashitla.com

Indian IPO Contact Details

INDIAN EMULSIFIERS LIMITED

Shop 206, Foor-2, Sumer Kendra, Shivram Seth Amrutwar Road,

Near Doordarshan Kendra, Off Pandurang Budhwar Marg,

Worli 400 018, Mumbai, Maharashtra, India

Phone: 022-4783 8021

E-mail: [email protected]

Website: www.indianemulsifiers.com

IPO FAQs

What is the Indian Emulsifiers offer size?

Indian Emulsifiers’ offer size is INR 40.14 – 42.39 crores.

What is the Indian Emulsifiers offer price band?

Indian Emulsifiers’ public offer price is INR 125 – 132 per share.

What is the lot size of the Indian Emulsifiers IPO?

Indian Emulsifiers offer lot size is 1,000 shares.

What is Indian Emulsifiers IPO GMP today?

Indian Emulsifiers IPO GMP today is INR 235 per share.

What is the Indian Emulsifiers kostak rate today?

Indian Emulsifiers kostak rate today is INR NA per application.

What are Indian Emulsifiers Subject to the Sauda rate today?

Indian Emulsifiers are Subject to the Sauda rate today is INR 1,93,000 per application.