Last Updated on November 7, 2025 by Rajat Bhati

India’s jewellery industry, valued at over INR 7.3 lakh crore, sits at the confluence of ancient cultural demand and modern financial volatility. Over the past two years, the twin surge in gold and silver prices has recast the economics of adornment.

Gold touched INR 1.24 lakh per 10 grams in 2025, while silver crossed INR 1,52,500 per kg, levels that would have seemed improbable a decade ago. For a country that consumes about 700–800 tonnes of gold annually, the implications are profound.

In this high-bullion environment, organised players like Kalyan Jewellers, Senco Gold, PNG Jewellers, and Titan’s Tanishq have demonstrated resilience through brand strength, hedging, and customer-financing schemes. Meanwhile, smaller regional jewellers face a squeeze as rising inventory costs collide with cautious consumer sentiment.

India’s jewellery trade remains a critical economic engine — contributing ~7% of GDP and employing over 50 lakh workers — but it now operates under the unforgiving scrutiny of both commodity markets and capital markets.

India’s Jewellery Sector Outlook: Rising Prices are Blessing or Burden?

The volatility of precious-metal prices has emerged as the sector’s defining stress test. The surge brings short-term accounting gains but medium-term demand erosion.

- Margin optics: Jewellers holding older inventory benefit from revaluation gains when gold appreciates, temporarily inflating gross margins. For example, when bullion jumped 12% YoY, leading chains like Kalyan Jewellers reported higher quarter-on-quarter profitability despite flat volumes.

- Demand elasticity: A INR 10,000 rise in gold often trims purchase volumes by 5–7%, pushing consumers toward lightweight or 18-carat options. PNG Jewellers Q1 FY26 report still showed 19% retail revenue growth, supported by lighter designs and studded collections.

- Working-capital stress: Costlier bullion locks more capital in inventory; many players depend on Gold Metal Loans (GMLs), exposing them to interest-rate and price-risk cycles.

- Silver’s rebound: Silver, used in mass ornaments and gifting, saw a ~20% YoY price rise, tightening supply for artisanal jewellers across Rajasthan and Gujarat.

In short, high bullion prices inflate profits on paper but compress real-world volumes, challenging unorganised traders and rewarding brands with hedging and data-driven inventory control.

How Jewellers Actually Earn — Beyond the Bullion

Despite the obsession with gold prices, jewellers’ profitability stems from value-addition, not metal appreciation. The core revenue drivers are:

- Making Charges & Design Premiums: Roughly 8–15% of product value; fully retained by the retailer.

- Studded Jewellery Mix: Higher-margin segments (gross margin 20% +) versus 12% for plain gold.

- Gold-Exchange and Savings Schemes: Promote repeat business and ensure liquidity cycles.

- Franchise & FOCO Models: As seen with Kalyan and PNG, allow rapid expansion with lower capex, improving ROCE.

- E-commerce and Digital Sales: PNG’s online revenue grew 126 % YoY in Q1 FY26; BlueStone’s digital-first model captures millennials moving away from wedding-only jewellery.

For instance, PNG Jewellers reported INR 1,714.6 crore revenue, 7.2% EBITDA margin, and 4% PAT margin in Q1 FY26, while discontinuing low-margin refinery bullion sales. Kalyan Jewellers, with a Q1 FY26 EBITDA of INR 508 crore on revenue of INR 7,268.5 crore, highlighted how retail and franchise income, not raw bullion trading, anchor its profitability.

In essence, India’s jewellers are evolving from metal traders to branded lifestyle retailers — earning on craftsmanship, trust, and scale rather than on the daily swing of the London Bullion Market.

Inside the Business: The Real Sources of Profit

Contrary to the myth that jewellers thrive when gold prices rise, profitability depends far more on volume, brand premium, and margin management than on bullion itself.

Organised chains like Kalyan Jewellers and PNG Jewellers have decoupled their income streams from metal trading by expanding retail footprints, building digital channels, and adopting capital-light models.

- Kalyan Jewellers in Q1 FY26 posted revenue of INR 7,268.5 crore, EBITDA of INR 508.0 crore, and PAT of INR 264.1 crore, reflecting robust store productivity despite volatile bullion.

- PNG Jewellers reported INR 1,714.6 crore in revenue and a 7.2% EBITDA margin, having exited low-margin refinery sales to focus purely on consumer retail.

- RBZ Jewellers, a hybrid manufacturer-retailer, maintained a three-year PAT CAGR of 39% with ROCE/ROE of 26%/17%, signalling operating discipline.

Jewellery Sector IPOs Scorecard — Glitter & Reality

India’s jewellery sector IPO wave, which began in 2023, has been a mixed bag of exuberance and consolidation. Below is a snapshot of post-listing performance:

| Company | Listing Year | Issue Price (INR) | CMP (INR) | Current Returns (%) |

|---|---|---|---|---|

| Senco Gold | 2023 | 317 | 332 | 109 |

| Motisons Jewellers | 2023 | 55 | 16* | 198 |

| Manoj Vaibhav Gems | 2023 | 215 | 195 | (9) |

| RBZ Jewellers | 2023 | 100 | 154 | 54 |

| PNG Jewellers | 2024 | 480 | 638 | 34 |

| BlueStone | 2025 | 517 | 618 | 19.6 |

| Shanti Gold | 2025 | 199 | 235 | 18.40 |

| Shringar House | 2025 | 165 | 220 | 33.78 |

The takeaway is clear: investors reward scale, governance, and margin clarity. Pan-India brands with transparent sourcing—like Senco and Kalyan—have delivered triple-digit returns, while regional or manufacturing-heavy players lag once the listing hype fades.

Jewellery sector IPO enthusiasm also mirrors the formalisation wave. Every new listing deepens investor comfort with what was once an opaque, family-run trade. Yet, valuations now hinge on cash-flow conversion, not store count—a sign of market maturity.

Market Leaders — Who’s Setting the Benchmark

Indian Jewellery sector performance is increasingly concentrated in a few national champions:

- Titan Company (Tanishq) remains the bellwether, commanding over 25% EBIT margins and near-zero debt, leveraging design innovation and consumer financing.

- Kalyan Jewellers has built a scalable franchise network—93 new outlets between FY22 and FY24—with return ratios of ROCE ≈ 20% and ROE ≈ 16%.

- Senco Gold recorded 30% YoY revenue growth, expanding beyond its eastern base into Tier-II cities nationwide.

- PNG Jewellers is leaning on e-commerce, where sales jumped 126% YoY, and on franchise expansion for capital efficiency.

- RBZ Jewellers continues to benefit from its export and manufacturing integration, maintaining strong CAGR metrics despite narrower retail reach.

Collectively, these leaders in jewellery sector IPOs illustrate how branding, digital adoption, and disciplined store economics—not bullion speculation—define long-term success.

Indian Jewellery Sector Performance: Growth Levers

Despite bullion volatility, India’s jewellery industry continues to expand on the strength of formalisation, consumption depth, and brand trust.

Key drivers include:

- Formalisation & Hallmarking: Mandatory hallmarking and GST compliance have accelerated the shift toward the organised segment. Organised retailers’ market share has risen from ~31% in FY20 to 38% in FY24, and is projected to cross 43% by FY28, reducing the dominance of informal jewellers.

- Import-Duty Cut: The Union Budget 2024 slashed the basic customs duty on gold from 15% to 6%, expanding gross margins by roughly 150–200 bps for large retailers.

- CEPA Advantage: Under the India–UAE trade pact, 90% of Indian jewellery exports now enjoy duty-free entry, helping exporters like RBZ Jewellers and Senco Gold access Gulf and African markets more profitably.

- Digital & Tier-II Penetration: Online and omnichannel sales are growing at a 25–30% CAGR. PNG Jewellers’ e-commerce segment doubled YoY, and BlueStone’s digital-first approach is converting new-age buyers.

- Franchise and FOCO Models: Players such as Kalyan and PNG use capital-light expansion (FOCO = Franchise Owned, Company Operated), improving return on capital and speeding store rollout.

- Wedding & Festive Demand: Weddings remain India’s second-largest household expenditure (≈ 22 % of total wedding budgets). Each festive season adds 40–60 tonnes of gold demand, underpinning steady volume growth.

These forces are transforming jewellers from local bullion traders into structured retail enterprises with predictable cash-flow cycles.

Challenges — The Tarnish Beneath the Shine

Growth, however, is tempered by structural frictions:

- Bullion Volatility: Gold above INR 1,24,260/10 g can slow discretionary demand and inflate inventory valuations, distorting quarterly margins.

- Working-Capital Intensity: Inventory typically equals 6–8 months of sales, locking capital. Heavy reliance on Gold Metal Loans exposes firms to rate and mark-to-market risk.

- Regulatory Flux: Frequent duty revisions and stricter KYC norms under PMLA increase compliance costs, especially for smaller jewellers.

- Skill Attrition: A shortage of traditional artisans is raising labour costs and constraining capacity for bespoke pieces.

- Shifting Consumer Taste: Millennials prefer lighter, fashion-forward jewellery over heavy wedding sets—pressuring high-carat, high-weight margins.

Government Policy — What the Industry Wants

The sector’s wishlist to policymakers centres on stability and liquidity:

- No Cheaper Credit Access — The inclusion of jewellery retail under priority-sector lending for MSMEs is still pending. This is a crucial step for easing financial availability for smaller businesses in the sector.

- No Revived Gold Monetisation Scheme (GMS) — The original GMS scheme has been largely discontinued except for short-term deposits. The scheme’s incentives for households to deposit idle gold have been reduced, limiting its impact on mobilising domestic gold stock.

- No Simplified Hallmarking & KYC Thresholds — There is currently no single-window compliance platform integrating hallmarking with KYC processes, which could simplify regulatory compliance and foster greater trust in the industry.

Recent reforms have partly met these expectations: duty cuts reduced smuggling incentives, hallmarking strengthened trust, and CEPA widened export avenues.

Industry & Jewellery Sector IPO Outlook

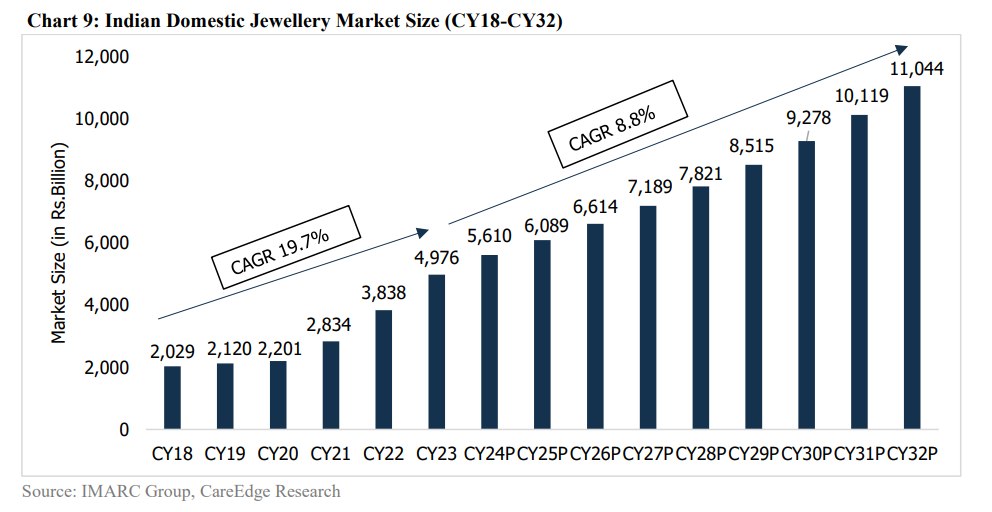

Analysts expect a sector CAGR of 8–9% through FY30, with the organised slice surpassing 40%.

- Upcoming Jewellery IPO: Following PNG Jewellers and BlueStone, prominent players such as PNGS Reva and Priority Jewels are preparing listings, signalling investor confidence in branded retail.

- Operational Focus: The Street now values inventory turns, franchise efficiency, and ROCE, not merely showroom count.

- Investor Lens: “Bet on balance-sheet strength, not bullion speculation.” Companies with steady margins, hedging discipline, and national networks will outperform as the market matures.

The New Alchemy of Gold

India’s jewellery trade is entering its most transparent, data-driven era.

Gold may glisten with sentiment, but sustained shareholder value now comes from governance, efficiency, and innovation.

In the age of INR 1.24 Lakh/10G gold price, the true winners are those who can turn volatility into velocity and trust into traction.

From wedding aisles to stock exchanges, the story of India’s jewellers remains a testament to how tradition and transformation can sparkle together.

For more details related to IPO GMP, SEBI IPO Approval, and Live Subscription stay tuned to IPO Central.