Inox Green Energy IPO description – The company is engaged in the business of providing long-term O&M services for wind farm projects, specifically the provision of O&M services for wind turbine generators (WTGs). It has stable annual income owing to the long-term O&M contracts. It is a subsidiary of Inox Wind Limited (IWL) and part of the Inox GFL group of companies. Its subsidiaries are engaged in the business of power generation through renewable sources of energy.

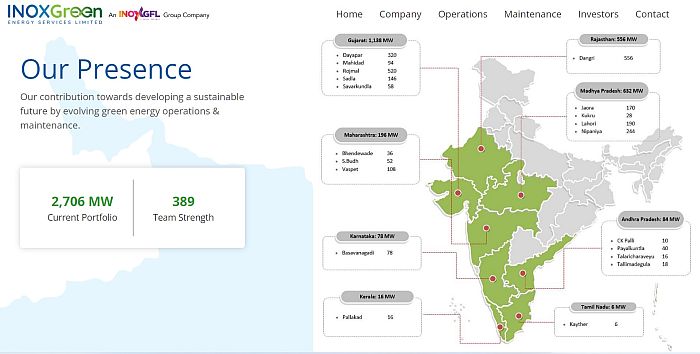

The company’s O&M services portfolio consisted of an aggregate 2,750 MW of wind farm capacity and 1,375 WTGs. This included a total capacity of 1,178 MW for various customers in Mahidad, Rojmal, Sadla, Savarkundla and Dayapar in Gujarat, a total capacity of 632 MW for various customers in Kukru, Nipaniya, Jaora and Lahori in Madhya Pradesh, a total capacity of 560 MW for various customers in Dangri, Rajasthan, and a total capacity of 196 MW for various customers in Vaspet, Bhendewade and South Budh in Maharashtra. Of the 2,750 MW capacity, 1,922 MW was attributable to contracts for comprehensive O&M services and 828 MW was attributable to common infrastructure O&M contracts.

Promoters of Inox Green Energy – Inox Wind Limited

Inox Green Energy IPO Details

| Subscription Dates | 11 – 15 November 2022 |

| Price Band | INR 61 – 65 per share |

| Fresh issue | INR 370 crore |

| Offer For Sale | INR 370 crore |

| Total IPO size | INR 740 crore |

| Minimum bid (lot size) | 230 shares (INR14,950) |

| Face Value | INR 10 per share |

| Retail Allocation | 10% |

| Listing On | NSE, BSE |

Inox Green Energy Financial Performance

| FY 2020 | FY 2021 | FY 2022 | |

| Revenue | 172.2 | 186.3 | 190.2 |

| Expenses | 169.6 | 199.6 | 194.9 |

| Net income | (5.2) | (153.5) | (92.9) |

| Margin (%) | (3.02) | (82.39) | (48.84) |

Inox Green Energy IPO News & Resources

- Inox Green Energy RHP

- Inox Green Energy DRHP

- Inox Green Energy Subscription Status

- IPO subscription status of all IPOs

Inox Green Energy Valuations & Margins

| FY 2020 | FY 2021 | FY 2022 | |

| EPS | 0.20 | (2.29) | (0.25) |

| PE ratio | – | – | – |

| RONW (%) | 1.74 | (64.54) | (0.61) |

| ROCE (%) | 0.15 | (0.10) | 0.04 |

| EBITDA (%) | 55.39 | 41.48 | 52.70 |

| Debt/Equity | 0.73 | 0.67 | 0.99 |

| NAV | – | – | 34.32 |

Inox Green Energy IPO GMP Daily Trend

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 21 Nov 2022 | – | – | – |

| 19 Nov 2022 | – | – | – |

| 18 Nov 2022 | 5 | – | – |

| 17 Nov 2022 | 5 | – | – |

| 16 Nov 2022 | 5 | – | – |

| 15 Nov 2022 | 5 | – | – |

| 14 Nov 2022 | 5 | – | – |

| 12 Nov 2022 | 7 | – | – |

| 11 Nov 2022 | 7 | – | – |

| 10 Nov 2022 | 7 | – | – |

| 9 Nov 2022 | 7 | – | – |

| 8 Nov 2022 | 10 | – | – |

| 7 Nov 2022 | 10 | – | – |

Inox Green Energy IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi –

Antique Stock Broking –

Arihant Capital – Subscribe

Ashika Research –

Asit C Mehta –

BP Wealth – Avoid

Canara Bank Securities – Subscribe

Choice Broking – Subscribe with caution

Elite Wealth – Avoid

Geojit –

GEPL Capital – Avoid

HDFC Securities – Not rated

Hem Securities – Subscribe

ICICIdirect – Not rated

Jainam Broking –

KR Choksey – Subscribe

LKP Research –

Marwadi Financial –

Motilal Oswal –

Nirmal Bang –

Reliance Securities – Not rated

Samco Securities – Avoid

SMC Global – 1.5/5

Swastika Investmart –

Ventura Securities – Subscribe

Inox Green Energy Offer Registrar

Link Intime India Private Limited

C-101, 1st Floor, 247 Park

L.B.S. Marg, Vikhroli West

Mumbai – 400 083, Maharashtra

Phone: +91 22 4918 6200

Email: [email protected]

Website: www.linkintime.co.in

Inox Green Energy Contact Details

INOX GREEN ENERGY SERVICES LIMITED

Survey No. 1837 & 1834 At Moje Jetalpur

ABS Towers, Second Floor

Old Padra Road, Vadodara- 390 007

Gujarat, India

Phone: +91 265 6198 111

Email: [email protected]

Website: www.inoxgreen.com

Inox Green Energy IPO Allotment Status

Inox Green Energy IPO allotment status is now available on Link Intime’s website. Click on this link to get allotment status.

Inox Green Energy IPO Timetable

| IPO Opening Date | 11 November 2022 |

| IPO Closing Date | 15 November 2022 |

| Finalisation of Basis of Allotment | 18 November 2022 |

| Initiation of refunds | 21 November 2022 |

| Transfer of shares to demat accounts | 22 November 2022 |

| Listing Date | 23 November 2022 |

| Opening Price on NSE | INR 60 per share (down 7.69%) |

| Closing Price on NSE | INR 59.25 per share (down 8.85%) |

Inox Green Energy IPO FAQs

How many shares in Inox Green Energy IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 75%, NII – 15%, and Retail – 10%.

How to apply in Inox Green Energy Public Offer?

The best way to apply in Inox Green Energy IPO is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Inox Green Energy IPO GMP today?

Inox Green Energy IPO GMP today is INR NA per share.

What is Inox Green Energy IPO kostak rate today?

Inox Green Energy IPO kostak rate today is INR NA per application.

What is Inox Green Energy Subject to Sauda rate today?

Inox Green Energy Subject to Sauda rate today is INR NA per application.