Inox Green Energy IPO subscription status started on 11 November 2022 and the offer will close on 15 November 2022. Through a mix of fresh shares and sale by existing investors in the price band of INR 61 – 65 per share, the IPO aims to mobilize up to INR740 crore. Check more details of Inox Green Energy IPO.

Inox Green Energy IPO Details

| Subscription Dates | 11 – 15 November 2022 |

| Price Band | INR 61 – 65 per share |

| Fresh issue | INR 370 crore |

| Offer For Sale | INR 370 crore |

| Total IPO size | INR 740 crore |

| Minimum bid (lot size) | 230 shares (INR 14,950) |

| Face Value | INR 10 per share |

| Retail Allocation | 10% |

| Listing On | NSE, BSE |

Inox Green Energy IPO Investor Categories and Reservation

| Investor Category | Reserved shares |

|---|---|

| Qualified Institutional Buyer (QIB) | 75% |

| Non Institutional Investor (NII) | 15% |

| Retail Individual Investor (RII) | 10% |

| Employees | – |

Inox Green Energy IPO Subscription Status Live

Inox Green Energy IPO subscribed 1.55 times on 15 Nov 2022. The public issue has been subscribed 1.05 times in the QIB category, 0.47 times in the NII category and 4.70 times in the retail category.

Inox Green Energy IPO Subscription Status (Daywise)

| Category | QIB | NII | Retail | Total |

| Shares Offered | 3,63,93,442 | 1,81,96,721 | 1,21,31,147 | 6,67,21,310 |

| 15 Nov 2022 | 1.05 | 0.47 | 4.70 | 1.55 |

| 14 Nov 2022 | 0.47 | 0.23 | 2.93 | 0.85 |

| 11 Nov 2022 | 0.47 | 0.05 | 1.03 | 0.46 |

| As on 07:00:00 PM |

Check IPO subscription status of all IPOs here

For retail investors, minimum lot size is 1 lot of 230 shares with application amount of INR 14,950 at cutoff levels. Retail investors can make maximum application of 13 lots (2,990 shares) translating into application amount of INR 194,350.

Inox Green Energy IPO Market Lot

| Application | No. of Lots | Shares | Amount (INR) |

| Retail Minimum | 1 | 230 | 14,950 |

| Retail Maximum | 13 | 2,990 | 194,350 |

| Small HNI | 14 | 3,220 | 209,300 |

| Large HNI | 68 | 15,410 | 1,001,650 |

Inox Green Energy Business Background

The company is engaged in the business of providing long-term operation and maintenance (O&M) services for wind farm projects, specifically the provision of O&M services for wind turbine generators (WTGs). It has stable annual income owing to the long-term O&M contracts. It is a subsidiary of Inox Wind Limited (IWL) and part of the Inox GFL group of companies. Its subsidiaries are engaged in the business of power generation through renewable sources of energy.

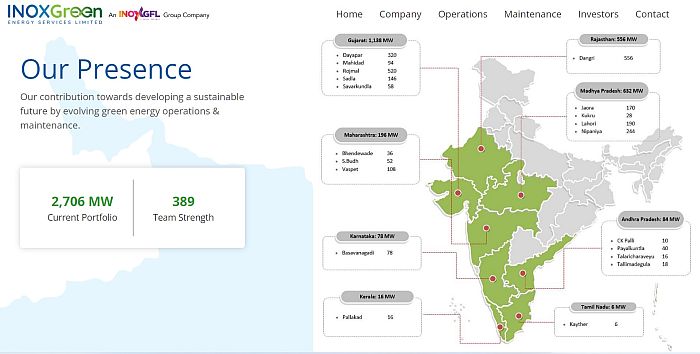

The company’s O&M services portfolio consisted of an aggregate 2,750 MW of wind farm capacity and 1,375 WTGs. This included a total capacity of 1,178 MW for various customers in Mahidad, Rojmal, Sadla, Savarkundla and Dayapar in Gujarat, a total capacity of 632 MW for various customers in Kukru, Nipaniya, Jaora and Lahori in Madhya Pradesh, a total capacity of 560 MW for various customers in Dangri, Rajasthan, and a total capacity of 196 MW for various customers in Vaspet, Bhendewade and South Budh in Maharashtra. Of the 2,750 MW capacity, 1,922 MW was attributable to contracts for comprehensive O&M services and 828 MW was attributable to common infrastructure O&M contracts.

Inox Green Energy IPO Subscription Status FAQs

What is Inox Green Energy IPO Subscription Status?

The Inox Green Energy IPO is subscribed 1.55 times as on 15 Nov 2022 on NSE and BSE.

What is Inox Green Energy IPO Subscription Status in retail category?

The retail category of Inox Green Energy IPO has been subscribed 4.70 times as of 15 Nov 2022.

Where can I check Inox Green Energy IPO live subscription status?

You can visit Inox Green Energy IPO subscription status page for real-time updates of Inox Green Energy IPO Subscription.

What is Inox Green Energy IPO Allotment Date?

The Inox Green Energy IPO allotment status is scheduled to be finalised on 18 November 2022.

When is Inox Green Energy IPO listing expected?

Inox Green Energy is likely to be listed on or before 23 November 2022.