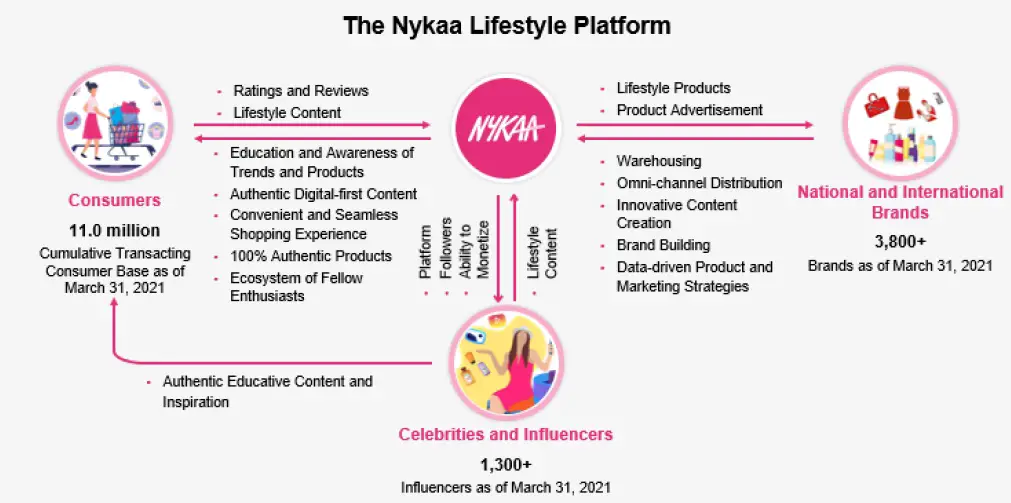

Nykaa IPO description – The company operates a digitally native consumer technology platform, delivering a content-led, lifestyle retail experience to consumers. The company has a diverse portfolio of beauty, personal care and fashion products, including its owned brand products effectively established itself not only as a lifestyle retail platform, but also as a popular consumer brand.

Online: As of 31 March 2021, it had cumulative downloads of 43.7 million across all mobile applications and during the FY2021, 86.7% of its online GMV came through mobile applications.

Offline: Its offline channel comprises of 73 physical stores across 38 cities in India over three different store formats as of 31 March 2021. Its physical stores offer a select offering of products as well as a seamless experience across the physical and digital worlds.

As of 31 March 2021, it offered approximately 2 million SKUs from 3,826 national and international brands to its consumers across business verticals. Its lifestyle portfolio spans across beauty, personal care and fashion products. The company has build business vertical-specific mobile applications, websites and physical stores, allowing it to tailor its content and curation optimally for the convenience of consumers in beauty and personal care & apparel and accessories verticals.

Promoters of FSN E-commerce – Falguni Nayar, Sanjay Nayar, Falguni Nayar Family Trust And Sanjay Nayar Family Trust

Nykaa IPO offer details

| Subscription Dates | 28 October – 1 November 2021 |

| Price Band | INR1,085 – 1,125 per share |

| Fresh issue | INR630 crore |

| Offer For Sale | 41,972,660 shares (INR4,554.03 – 4,721.92 crore) |

| Total IPO size | INR5,184.03 – 5,351.92 crore |

| Minimum bid (lot size) | 12 shares (INR13,020 – 13,500) |

| Face Value | INR1 per share |

| Retail Allocation | 10% |

| Listing On | NSE, BSE |

FSN E-commerce’s Financial Performance (in INR crore)

| FY2019 | FY2020 | FY2021 | Q1 FY2022 | |

| Revenue | 1,116.4 | 1,777.8 | 2,452.6 | 821.7 |

| Expenses | 1,148.1 | 1,790.3 | 2,377.3 | 818.6 |

| Net income | (24.3) | (16.2) | 59.8 | 3.7 |

| Margin (%) | (2.2) | (0.9) | 2.4 | 0.4 |

More about Nykaa IPO Offer

Valuation of FSN E-commerce (as of FY2021)

Earnings Per Share (EPS): INR1.34

Price/Earnings (PE ratio): 809.7 – 839.6

Return on Net Worth (RONW): 12.6%

Net Asset Value (NAV): INR11.0 per share

Nykaa IPO GMP Daily Trend

| Date | Nykaa IPO GMP | Kostak | Subject to Sauda |

| 9 Nov 2021 | INR700 | INR800 | INR7,000 |

| 8 Nov 2021 | INR600 | INR750 | INR6,500 |

| 3 Nov 2021 | INR650 | INR750 | INR6,500 |

| 2 Nov 2021 | INR650 | INR750 | INR6,500 |

| 1 Nov 2021 | INR600 | INR650 | INR6,000 |

| 30 Oct 2021 | INR550 | INR650 | INR6,000 |

| 29 Oct 2021 | INR600 | INR650 | INR6,000 |

| 28 Oct 2021 | INR700 | INR700 | INR6,300 |

| 27 Oct 2021 | INR680 | INR700 | INR6,500 |

| 26 Oct 2021 | INR680 | INR700 | INR6,500 |

| 25 Oct 2021 | INR680 | INR700 | INR6,500 |

| 23 Oct 2021 | INR650 | INR650 | INR6,000 |

| 22 Oct 2021 | INR600 | INR650 | INR5,800 |

| 21 Oct 2021 | INR600 | INR650 | INR5,500 |

| 20 Oct 2021 | INR600 | INR660 | INR5,300 |

| 19 Oct 2021 | INR650 | INR700 | INR6,000 |

| 18 Oct 2021 | INR700 | INR750 | INR6,500 |

| 14 Oct 2021 | INR600 | INR500 | INR4,800 |

Nykaa IPO Live Subscription (no. of times)

| Category | Shares Offered | Day 1 | Day 2 | Day 3 |

| QIB | 1,43,52,511 | 1.39 | 4.72 | 91.18 |

| NII | 71,29,781 | 0.60 | 4.17 | 112.02 |

| Retail | 47,53,187 | 3.50 | 6.32 | 12.24 |

| Employees | 2,50,000 | 0.68 | 1.18 | 1.88 |

| Total | 2,64,85,479 | 1.55 | 4.82 | 81.78 |

Nykaa Offer Reviews – Subscribe or Avoid?

Angel One – Subscribe

Anand Rathi – Subscribe for long term

Antique Stock Broking –

Arihant Capital –

Ashika Research – Subscribe

Asit C Mehta – Subscribe

BP Wealth – Subscribe

Canara Bank Securities – Subscribe

Choice Broking – Subscribe

Elite Wealth – Subscribe

GEPL Capital – Subscribe

Hem Securities – Subscribe

ICICIdirect –

IDBI Capital –

KR Choksey – Subscribe

Marwadi Financial Services – Subscribe with caution

Motilal Oswal – Subscribe

Nirmal Bang – Subscribe

Prabhudas Lilladher – Subscribe

Religare Broking – Subscribe

Samco Securities – Subscribe

SMC Global – 2.5/5

Ventura Securities – Subscribe

Registrar of FSN E-commerce IPO

Link Intime India Private Limited

C-101, 1st Floor,

247 Park Lal Bahadur Shastri Marg,

Vikhroli (West) Mumbai – 400 083

Phone: +91 22 4918 6200

Fax: +91 22 4918 6195

Email: [email protected]

Website: http://www.linkintime.co.in

FSN E-commerce Contact Details

FSN E-Commerce Ventures Limited

A2, 4th Floor, Cnergy IT Park, Appasaheb Marathe Marg, Opposite Tata Motors, Prabhadevi, Mumbai 400 025, Maharashtra

Phone: +91 22 3095 8700

Email: [email protected]

Website: www.nykaa.com

Nykaa IPO Allotment Status

Nykaa IPO allotment is available on Link Intime’s website. Click on this link to get allotment status.

Meanwhile, bank debits have also started. Please check your bank account statement.

Nykaa IPO Timetable

IPO Opening Date: 28 October 2021

IPO Closing Date: 1 November 2021

Finalisation of Basis of Allotment: 8 November 2021

Initiation of refunds: 9 November 2021

Transfer of shares to demat accounts: 10 November 2021

Listing Date: 10 November 2021

Opening Price on NSE: INR2,018 per share (up 79.38% from IPO price)

Closing Price on NSE: INR2,208 per share (up 96.27% from IPO price)

Nykaa IPO FAQs

How many shares HNIs and retail investors are entitled to in FSN E-Commerce IPO?

The investors’ portion for QIB-75%, NII-15%, and Retail-10%.

How to apply in Nykaa Public Offer?

The best way to apply in Nykaa IPO is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is FSN E-Commerce Offer Size?

FSN E-Commerce offer size is INR5,351.92 crore at the upper price band.

What is Nykaa IPO Price Band?

Nykaa IPO Price Band is INR1,085 – 1,125 per share.

What is the lot size of FSN E-Commerce IPO?

FSN E-Commerce offer lot size and the minimum order is 12 shares.

What is Nykaa IPO Allotment Date?

Nykaa public offer allotment date is 8 November 2021. The allotted shares will be credited to demat account by 10 November 2021.

What is Nykaa IPO GMP today?

Nykaa IPO GMP today is INR600 per share.

What is Nykaa IPO kostak rate today?

Nykaa IPO kostak rate today is INR650 per application.

What is Nykaa Subject to Sauda rate today?

Nykaa Subject to Sauda rate today is INR6,000 per application.