India’s eyewear poster child is about to step into the spotlight with an INR 7,200-crore public issue that has already whipped up investor excitement (for better or worse). The company’s ads and founder charisma have crafted an image of a futuristic, tech-driven retailer reinventing how the nation buys spectacles. Lenskart IPO GMP of INR 50 — nearly a 12.4% bump over the issue price band of INR 382–402 — reflects the frenzy.

But strip away the marketing gloss, and a different picture emerges. Roughly 70% of the IPO is Offer for Sale (OFS), meaning that most of the money goes to existing shareholders like SoftBank and Alpha Wave Ventures, not into the company’s growth engine. Only INR 2,150 crore is a fresh issue — and even that is largely earmarked for paying store rents and expanding lease-heavy outlets, not for product innovation or debt reduction.

In short, this IPO looks less like a fundraise for expansion and more like an exit strategy for early investors. The question for retail participants is simple: what exactly are you buying — growth, or someone else’s profits on paper?

Potential Lenskart IPO Red Flags

The Business Model Mirage – Scale Built on Leases and Goodwill

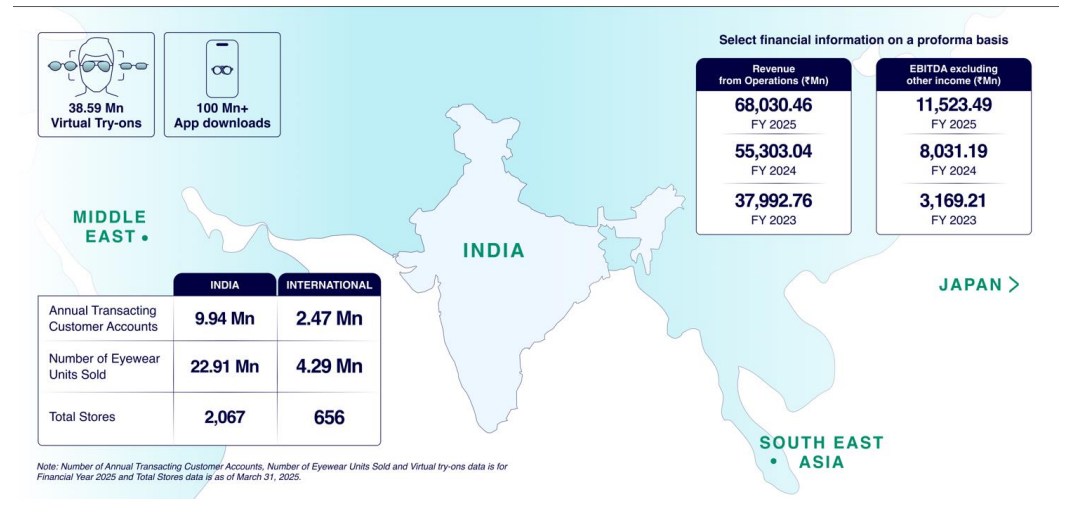

At first glance, Lenskart’s empire of 2,723 stores across India and abroad seems like a success story in scaling. The company proudly calls itself a “tech-driven omnichannel retailer.” Yet the numbers tell a more traditional, rent-heavy story.

- Company-Owned, Company-Operated (CoCo) outlets now account for nearly 82% of the total network. That decision has inflated lease liabilities to INR 2,400 crore, up threefold in just two years.

- Around INR 864 crore (40% of IPO proceeds) will go directly toward store rent and lease payments — hardly the sign of an asset-light digital model.

- The model’s scalability is capped by its fixed-cost structure; every new store brings recurring expenses before profits arrive.

Then there’s the ballooning of goodwill and intangibles to INR 2,780 crore, representing over a quarter of total assets. These are largely the result of overseas acquisitions — Owndays in Asia, Meller in Europe, and Quantduo in India. While acquisitions sound strategic, they also carry the risk of impairment if integration fails or earnings disappoint.

Lenskart calls itself a technology company, but its financial anatomy resembles that of a high-cost retailer. EBITDA margins of 14.6% may appear decent, yet they come from aggressive expansion rather than operating leverage.

The Financial Reality – Profits with Footnotes

Lenskart’s profit turnaround has become its headline story: from an INR 63.7 crore loss in FY 2023 to an INR 29.73 crore profit in FY 2025. On the surface, it’s a fairy-tale rebound. But a deeper look reveals that the rebound is fragile.

- Other income of INR 360 crore contributed roughly 5% of total income in FY 2025 — a meaningful boost that flatters the bottom line but doesn’t stem from core operations.

- Profit margins remain wafer-thin: 4.47% in FY 2025, sliding to 3.23% in Q1 FY 2026 even before listing.

- Inventories have almost doubled in two years, from INR 610 crore to INR 1,080 crore, suggesting slower turnover and capital tied up in stock.

- Lease liabilities and rent expenses continue to erode cash flow, while working capital pressures persist.

Even the apparent deleveraging is cosmetic. Traditional debt has fallen, but right-of-use assets of INR 2,270 crore conceal off-balance-sheet borrowing — the financial equivalent of debt under a different name. With a debt-to-equity ratio of 23.6×, the balance sheet still carries significant leverage risk.

In essence, the profitability looks more like a temporary accounting revival than a structural turnaround. Once lease and marketing costs normalize post-IPO, sustaining such margins could prove difficult.

4. 235× Earnings for a 4% Margin Retailer

At INR 402 per share, the company is asking the market to value it at an eye-watering 235× its FY25 earnings and a price-to-sales ratio of 10.48×. For context, Titan Company — India’s dominant lifestyle retailer with a 10%+ profit margin and a 40-year brand legacy — trades around 88× earnings and a P/S of 5.17×.

So, what justifies Lenskart’s tech-startup valuation when its margins resemble a regular retail chain?

Let’s look at the data:

- Net margin: 4.47% in FY25 — typical of consumer retail, not tech.

- ROCE: 13.84%, RONW: 4.84% — modest returns for a company priced like a disruptor.

- P/B ratio: 11.04×, suggesting investors are paying INR 11 for every INR 1 of book value.

- Debt-to-equity: 23.61× — leverage far higher than what’s comfortable for a consumer-facing business.

Even the market’s short-term excitement — reflected in the INR 50 grey market premium (GMP) — stems from scarcity and hype, not necessarily fundamentals. Given that only 10% is reserved for retail investors, the float is limited, creating artificial demand pressure that pushes up unofficial premiums. Nevertheless, GMP coming down sharply in the recent days paints a not-so-rosy picture.

This isn’t just expensive; it’s irrational exuberance disguised as a consumer-tech play. When a company selling spectacles is valued like a software platform, the investors needs to look beyond the lenses — and check for distortion.

“Lenskart’s valuation isn’t visionary — it’s vanity dressed in venture-capital arithmetic.”

Governance & Transparency Risks

The company’s corporate structure and governance history raise subtle but serious questions — the kind that rarely appear in glossy investor decks but often haunt post-listing performance.

a. The Dealskart Absorption: Before the IPO, Lenskart acquired Dealskart, its former franchise operator. The transaction effectively internalised a related entity, but disclosures on valuation and rationale remain vague. This move consolidated control but also blurred transparency, suggesting related-party transactions that deserve closer scrutiny.

b. Complex Offshore Web: Lenskart’s growing footprint across Singapore, Dubai, and Southeast Asia comes with multi-layered subsidiaries and cross-border cash flows. Such structures can be tax-efficient, but they also make it harder for investors to trace profits, cash movements, and potential transfer pricing risks.

c. Marketing Over Governance: The company spent INR 448 crore on brand marketing in FY25 — almost equal to its net profit for the year. The obsession with image-building contrasts sharply with modest governance disclosures. The result? A business that prioritizes perception over prudence.

d. Offer For Sale (OFS) Signal: SoftBank and other early VCs exiting via OFS — taking home over INR 1,000 crore each — is another warning. When large institutional backers cash out fully instead of staying for post-listing value creation, it suggests limited conviction in long-term compounding potential.

e. Erratic Valuation Moves: In July 2025, Peyush Bansal acquired 4.27 crore shares from investors like Kedara Capital, Chiratae Ventures, Alpha Wave, and IDG Ventures. Three months down the line, the IPO is priced at INR 382 – 402 per share and surprisingly, Peyush Bansal is seen offering a fraction of his shareholding in the OFS! While technically, both the transactions are different, it is difficult to digest that the business underwent a dramatic change to warrant such variations in just 3 months. Equally surprising is that the sellers are well-established private equity players with a keep node for valuations!

Taken together, these governance patterns paint a picture of a company run like a startup but priced like a blue chip. Investors expecting corporate discipline and transparent financial hygiene might instead encounter personality-driven decision-making and aggressive storytelling.

“In Lenskart IPO, control remains concentrated, disclosures are diluted, and optimism is outsourced to the retail investor.”

Sustainability Test – Can Growth Justify This Price?

Lenskart’s growth story looks exciting on the surface: revenue soaring from INR 3,790 crore (FY 2023) to INR 6,650 crore (FY 2025), a healthy 32% CAGR. But sustained growth depends on quality, not just speed — and the numbers hint at cracks beneath the surface.

a. Over-expansion and lease drag

The company’s balance sheet is packed with leases. Total lease liabilities now exceed INR 2,400 crore, up almost 3× in two years. Right-of-use assets (INR 2,270 crore) mirror that exposure, meaning most store expansions are debt in disguise.

Nearly half of the IPO proceeds (INR 864 crore) will fund new Company-Owned Company-Operated (CoCo) stores and related rentals. That’s not “growth capital” — it’s maintenance capital. Every new store adds fixed costs that scale faster than revenue, leaving little room for operating leverage.

b. Efficiency Concerns

Manufacturing utilisation stands at 47.9%, signalling unused capacity. Inventories (INR 1,080 crore) and receivables are swelling even as topline growth slows in FY 2026 Q1. This combination means cash gets locked up in working capital — the classic retail squeeze.

c. Thin Margins & Cost Pressures

Employee costs rose to INR 1,380 crore in FY 2025, a 27% jump year-on-year. With over 22,000 employees worldwide, even modest wage inflation can compress already tight margins. Advertising and promotion spend at INR 448 crore is another drain — every rupee spent on marketing erodes the bottom line further.

d. Global overreach

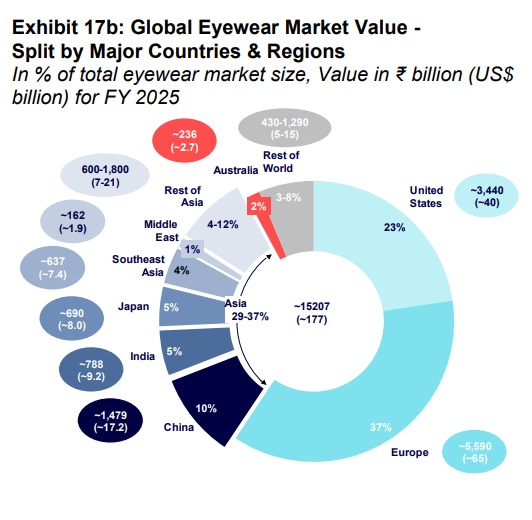

Lenskart runs 656 international stores across Japan, Southeast Asia and the Middle East — markets where its brand equity is limited and unit economics largely unproven. Overseas operations boost headline scale but add complexity, currency risk and lower visibility into returns.

e. Supply-Chain Vulnerability

Around 42% of materials come from China. Any geopolitical or logistics disruption could hit production and margins hard — especially since domestic supplier diversification is still limited.

f. The post-IPO reality check

Once listing hype fades, Lenskart will face the challenge of translating rapid store expansion into sustainable cash flows. With depreciation (INR 800 crore per year) and finance costs (INR 145 crore) rising, net margins may plateau or even recede in FY 2026. The company has yet to prove that its model can generate consistent free cash flow without fresh equity infusions.

Bottom line: Lenskart’s growth is real, but so is its cost gravity. Without margin expansion or asset light pivot, the current trajectory is financially unsustainable at its asking valuation.

Verdict – The Stylish IPO with Fragile Fundamentals

Strip away the glamour, and Lenskart looks like a classic case of “growth sold at any price.” The company deserves credit for building India’s largest eyewear brand and digitising a fragmented market, but investors must separate a good product from a good stock.

Here’s the unfiltered truth:

- The business is asset-heavy, lease-bound and margin-thin.

- The profits are recent, fragile and partly propped up by non-operating income.

- The valuation is extravagant — 235× earnings for a 4% margin retailer.

- The governance framework is founder-centric and opaque, with early investors rushing for the exit.

At INR 402 per share, retail investors aren’t buying into Lenskart’s future — they’re buying out its past VC shareholders. And with the current debt and lease burden, even a moderate dip in demand could shatter the thin profit layer the company is boasting about today.

“Lenskart sells vision — but for investors, clarity is missing.”

For long-term investors looking for durable compounding and predictable returns, this IPO offers neither. It offers momentum, not moat — and that’s a dangerous prescription.

Final Takeaway

Lenskart has revolutionised how Indians buy eyewear, but its financial lenses remain blurred. With ballooning leases, thin cash flows, and a valuation priced for perfection, the IPO looks more like a liquidity event than a value creation opportunity. Investors should consider these Lenskart IPO red flags before making an investment decision.