Lloyds Luxuries IPO description – The company is into salon services and beauty products in India, focused on grooming men to perfection. It owns exclusive franchisee of Truefitt & Hill, which is an international brand offering a wide range of beauty products and salon services for men. Lloyds Luxuries began its relationship with Truefitt & Hill in 2013 and has subsequently expanded its operations to 14 barber stores under the brand as of 31 March 2022. The company holds the Master Franchise Agreement of Truefitt & Hill upto 2043 which gives it exclusive rights to open stores in the brand name of “Truefitt & Hill” either directly or through sub franchisee arrangements in India, Nepal, Sri Lanka, Bhutan, Vietnam, Myanmar and Bangladesh.

In addition, the company has obtained exclusive franchise for MARY COHR in 2019 for 10 years, a French Beauty Salon. Under the exclusive master franchise agreement, it owns exclusive rights to open stores in the brand name of “MARY COHR” either directly or through sub franchisee arrangements in India.

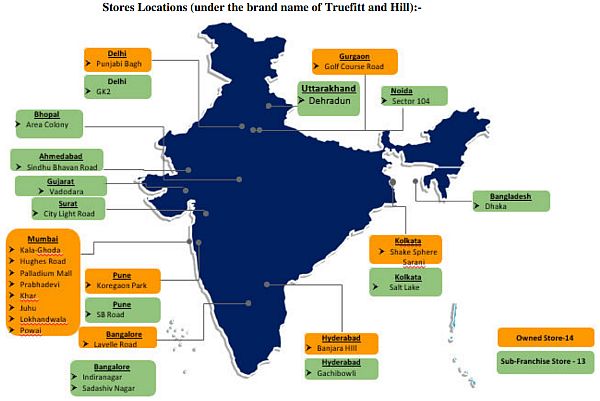

Its retail operations in respect of men grooming products are carried out through owned stores, sub-franchisees as well as through online channels. As of 31 March 2022, it sells the men grooming products through 27 stores, of which 14 are run by us directly and 13 through sub-franchisee.

Promoters of Lloyds Luxuries – Mr Shree Krishna Mukesh Gupta and M/s Plutus Trade & Commodities LLP

Lloyds Luxuries IPO Details

| Lloyds Luxuries IPO Dates | 28 – 30 September 2022 |

| Lloyds Luxuries IPO Price | INR 40 per share |

| Fresh issue | 6,000,000 shares (INR 24 crore) |

| Offer For Sale | Nil |

| Total IPO size | 6,000,000 shares (INR 24 crore) |

| Minimum bid (lot size) | 3,000 shares |

| Face Value | INR 10 per share |

| Retail Allocation | 50% |

| Listing On | NSE SME |

Lloyds Luxuries Financial Performance

| FY 2020 | FY 2021 | FY 2022 | |

| Revenue | 2,751.23 | 1,813.02 | 2,065.62 |

| Expenses | 3,152.53 | 2,170.54 | 3,026.51 |

| Net income | (323.80) | (303.07) | (916.78) |

Lloyds Luxuries Offer News

Lloyds Luxuries Valuations & Margins

| FY 2020 | FY 2021 | FY 2022 | |

| EPS | (16.19) | (15.15) | (35.54) |

| PE ratio | – | – | – |

| RONW (%) | – | – | (67.86) |

| NAV | – | – | 8.19 |

| Debt/Equity ratio | – | – | 0.96 |

| ROCE (%) | 22.88 | 12.45 | (61.30) |

Lloyds Luxuries IPO GMP Daily Trend

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| – | – | – |

Lloyds Luxuries Offer Subscription – Live Updates

| Category | Non-retail | Retail | Total |

| Shares Offered | 3,000,000 | 3,000,000 | 6,000,000 |

| Day 1 | 2.41 | 0.08 | 1.24 |

| Day 2 | 5.04 | 0.25 | 2.64 |

| Day 3 | 11.06 | 1.72 | 6.39 |

Lloyds Luxuries Offer Lead Manager

HEM SECURITIES LIMITED

904, A Wing, Naman Midtown, Senapati Bapat Marg,

Elphinstone Road, Lower Parel, Mumbai-400013, India

Phone: +91- 022- 49060000

Email: [email protected]

Investor Grievance Email: [email protected]

Website: www.hemsecurities.com

Lloyds Luxuries Offer Registrar

BIGSHARE SERVICES PRIVATE LIMITED

Office No. S6 – 2, 6th Floor,

Pinnacle Business Park, Next to Ahura Centre,

Mahakali Cave Road, Andheri (East),

Mumbai – 400093, Maharashtra

Phone: 22 6263 8200

E-mail: [email protected]

Website: www.bigshareonline.com

Lloyds Luxuries Contact Details

LLOYDS LUXURIES LIMITED

B2, Unit No. 3, 2nd Floor,

Madhu Estate, Pandurang Budhkar Marg,

Lower Parel, Mumbai 400013

Phone: +91 022-68238888

E-mail: [email protected]

Website: www.lloydsluxuries.in

Lloyds Luxuries IPO Allotment Status

Lloyds Luxuries IPO allotment status is now available on Bigshare Services’ website. Click on this link to get allotment status.

Lloyds Luxuries IPO Timetable

| Lloyds Luxuries IPO Opening Date | 28 September 2022 |

| Lloyds Luxuries IPO Closing Date | 30 September 2022 |

| Finalisation of Basis of Allotment | 6 October 2022 |

| Initiation of refunds | 7 October 2022 |

| Transfer of shares to demat accounts | 10 October 2022 |

| Lloyds Luxuries IPO Listing Date | 11 October 2022 |

| Opening Price on NSE SME | INR45.15 (up 12.88%) |

| Closing Price on NSE SME | INR42.90 (up 7.25%) |

Lloyds Luxuries IPO FAQs

What is Lloyds Luxuries offer size?

Lloyds Luxuries offer size is INR 24 crore.

What is Lloyds Luxuries IPO Price Band?

Lloyds Luxuries public offer price is INR 40 per share.

What is the lot size of Lloyds Luxuries IPO?

Lloyds Luxuries offer lot size is 3,000 shares.

What is Lloyds Luxuries IPO GMP today?

Lloyds Luxuries IPO GMP today is NA per share.

What is Lloyds Luxuries kostak rate today?

Lloyds Luxuries kostak rate today is NA per application.

What is Lloyds Luxuries Subject to Sauda rate today?

Lloyds Luxuries Subject to Sauda rate today is INR70,000 per application.