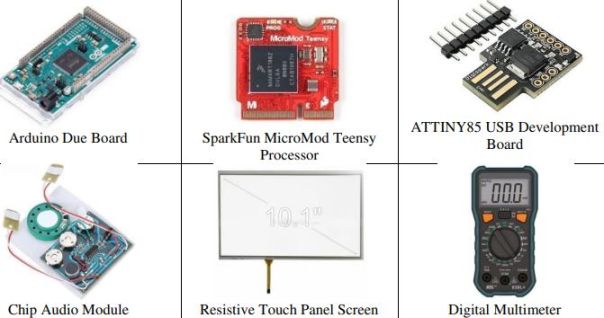

Macfos IPO description – The company sells a broad range of electronic items, including robotic parts, drone parts, E-bike parts, IoT & Wireless items, 3d printers & parts, DIY learning kits, development boards, Raspberry Pi, sensors, motors, motor drivers, pumps, batteries, chargers, electronic modules & displays and various other mechanical and electronic components. The company has an e-commerce website and mobile application, Robu.in.

As on 30 September 2022, the company is connected with over +140 overseas and domestic vendors for sourcing electronic items and parts. It also has a portfolio of 3 owned brands, which are manufactured/procured from third parties.

The company has a fulfillment Centre in Pune, Maharashtra comprising of 7,900 sq. ft. area and third-party logistics services. In FY 2022, the company served over 2 lakh orders from all 28 states of India and 6 Union Territories of India.

Promoters of Macfos – Atul Maruti Dumbre, Binod Prasad, Nileshkumar Purshottam Chavhan

Macfos IPO Details

| Macfos IPO Dates | 17 – 21 February 2023 |

| Macfos IPO Price | INR 96 – 102 per share |

| Fresh issue | Nil |

| Offer For Sale | 23,28,000 shares (INR 22.35 – 23.75 crores) |

| Total IPO size | 23,28,000 shares (INR 22.35 – 23.75 crores) |

| Minimum bid (lot size) | 1,200 shares (INR 122,400) |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | BSE SME |

Macfos Financial Performance

| FY 2020 | FY 2021 | FY 2022 | H1 FY 2023 | |

| Revenue | 1,621.81 | 2,711.92 | 5,551.47 | 3,578.12 |

| Expenses | 1,580.54 | 2,521.89 | 4,782.23 | 3,206.78 |

| Net income | 32.97 | 158.31 | 601.27 | 295.85 |

Macfos Offer News

Macfos Valuations & Margins

| FY 2020 | FY 2021 | FY 2022 | |

| EPS | 0.38 | 1.82 | 6.81 |

| PE ratio | – | – | 14.09 – 14.98 |

| RONW (%) | 62.74 | 50.96 | 65.93 |

| NAV | 0.60 | 3.56 | 10.32 |

| ROCE (%) | 6.79 | 23.96 | 39.68 |

| EBITDA (%) | 7.88 | 10.09 | 15.73 |

| Debt/Equity | 8.24 | 1.13 | 0.66 |

Macfos IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| 28 Feb 2023 | 75 | – | 80,000 |

| 27 Feb 2023 | 72 | – | 75,000 |

| 24 Feb 2023 | 70 | – | 70,000 |

| 23 Feb 2023 | 70 | – | 65,000 |

| 22 Feb 2023 | 70 | – | 65,000 |

| 21 Feb 2023 | 70 | – | 62,000 |

| 20 Feb 2023 | 62 | – | 56,000 |

| 18 Feb 2023 | 60 | – | 55,000 |

| 17 Feb 2023 | 60 | – | 54,000 |

| 16 Feb 2023 | 55 | – | 50,000 |

| 15 Feb 2023 | 45 | – | 50,000 |

| 14 Feb 2023 | – | – | 50,000 |

Macfos IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Total |

| Shares Offered | 444,000 | 448,800 | 775,200 | 1,668,000 |

| 21 Feb 2023 | 53.70 | 488.82 | 268.45 | 270.58 |

| 20 Feb 2023 | 2.50 | 47.96 | 83.26 | 56.00 |

| 17 Feb 2023 | 0.02 | 5.85 | 21.78 | 9.89 |

Macfos Offer Lead Manager

HEM SECURITIES LIMITED

904, A Wing, Naman Midtown,

Senapati Bapat Marg, Elphinstone Road,

Lower Parel, Mumbai-400013, India

Phone : +91- 022- 49060000

Email: [email protected]

Website: www.hemsecurities.com

Macfos Offer Registrar

BIGSHARE SERVICES PRIVATE LIMITED

Office No. S6-2, 6th Floor,

Pinnacle Business Park,

Next to Ahura Centre, Mahakali

Caves Road, Andheri East,

Mumbai – 400 093

Telephone: +91 22 6263 8200

Email: [email protected]

Website: www.bigshareonline.com

Macfos Contact Details

MACFOS LIMITED

S. No. 78/1, Sumant Building,

Dynamic Logistics Trade Park, Dighi,

Bhosari Alandi Road, Pune, Maharashtra, 411015

Phone: +91-20-68197600

E-mail: [email protected]

Website: www.robu.in

Macfos IPO Allotment Status

Macfos IPO allotment status is now available on Bigshare Services’ website. Click on Bigshare Services weblink to get allotment status.

Macfos IPO Dates & Listing Performance

| IPO Opening Date | 17 February 2023 |

| IPO Closing Date | 21 February 2023 |

| Finalisation of Basis of Allotment | 24 February 2023 |

| Initiation of refunds | 27 February 2023 |

| Transfer of shares to demat accounts | 28 February 2023 |

| IPO Listing Date | 1 March 2023 |

| Opening Price on BSE SME | INR 184 per share (up 80.39%) |

| Closing Price on BSE SME | INR 174.80 per share (up 71.37%) |

Macfos IPO FAQs

What is Macfos’ offer size?

Macfos’ offer size is INR 22.35 – 23.75 crores.

What is Macfos IPO Price Band?

Macfos public offer price is INR 96 – 102 per share.

What is the lot size of Macfos IPO?

Macfos offer lot size is 1,200 shares.

What is Macfos IPO GMP today?

Macfos IPO GMP today is INR 75 per share.

What is Macfos kostak rate today?

Macfos kostak rate today is NA per application.

What is Macfos Subject to Sauda rate today?

Macfos Subject to Sauda rate today is INR 80,000 per application.