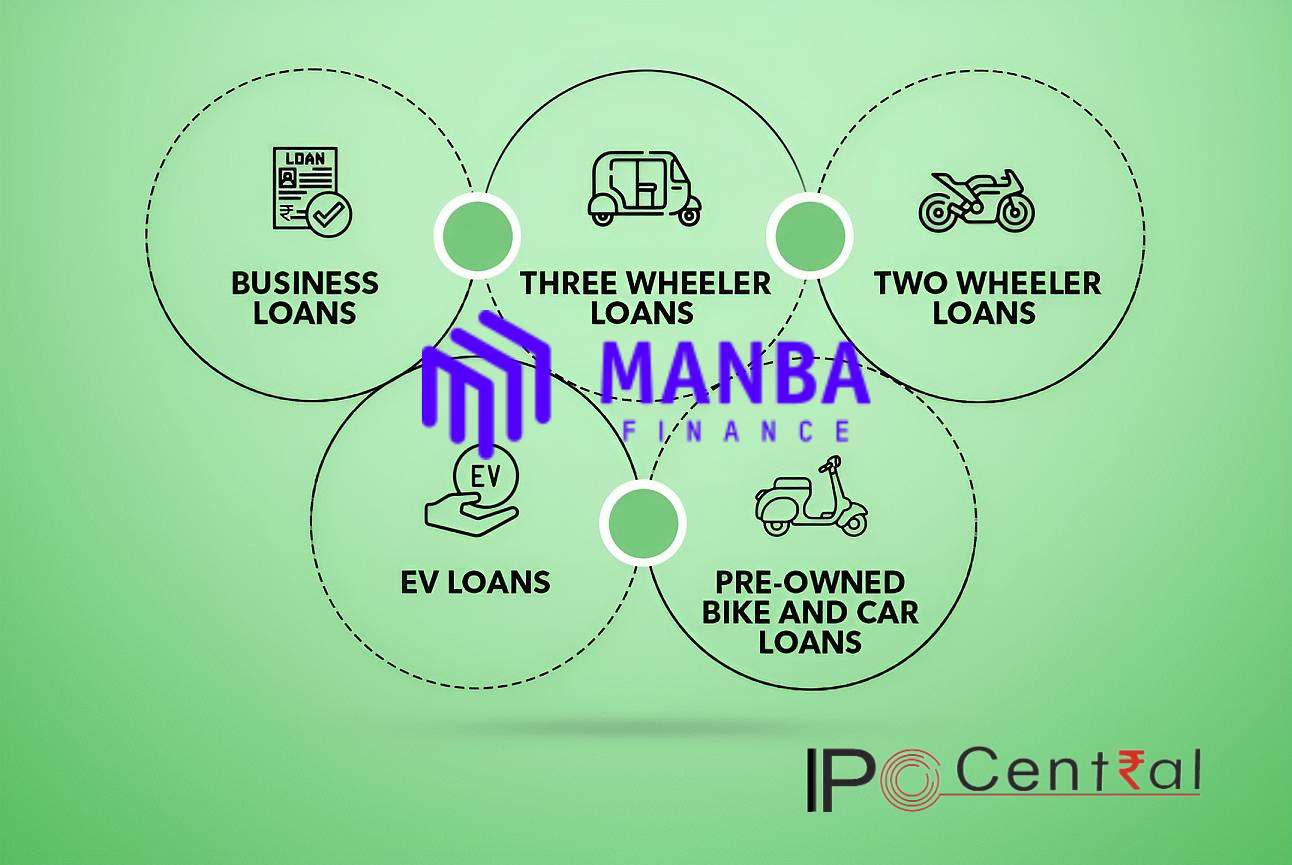

Manba Finance IPO Description – Manba Finance is an NBFC-BL offering financial solutions for new two-wheelers, three-wheelers, electric two-wheelers, electric three-wheelers, used cars, small business loans, and personal loans. As of 31 December 2023, the company has an AUM size of over INR 800 crore. Approximately 99% of its loan portfolio consists of new vehicle loans, with an average ticket size of around INR 0.80 lakhs.

Based in Mumbai, Manba Finance operates out of 65 locations connected to 28 branches across five states in western, central, and northern India. The company has established deep, long-term relationships with over 850 dealers, including more than 60 EV dealers, across Maharashtra, Gujarat, Rajasthan, Chhattisgarh, and Madhya Pradesh. Recently, Manba Finance expanded its loan portfolio to include used car loans, small business loans, and personal loans.

As of 31 January 2024, the company had 1,315 full-time employees.

Promoters of Manba Finance – Manish Kiritkumar Shah, Nikita Manish Shah, Monil Manish Shah, Manba Investments and Securities Private Limited, Avalon Advisory and Consultant Services Private Limited, Manba Fincorp Private Limited, Manba Infotech Llp and Manish Kiritkumar Shah (HUF)

Table of Contents

Manba Finance IPO Details

| Manba Finance IPO Dates | 23 – 25 September 2024 |

| Manba Finance Issue Price | INR 114 – 120 per share |

| Fresh issue | 1,25,70,000 shares (INR 150.84 crore) |

| Offer For Sale | Nil |

| Total IPO size | 1,25,70,000 shares (INR 150.84 crore) |

| Minimum bid (lot size) | 125 shares (INR 15,000) |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Manba Finance Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 106.59 | 133.32 | 191.59 |

| Expenses | 93.96 | 110.53 | 152.74 |

| Net income | 9.74 | 16.58 | 31.42 |

| Margin (%) | 9.14 | 12.44 | 16.40 |

Manba Finance Offer News

Manba Finance Valuations & Margins

| FY 2022 | FY 2023 | FY 2024 (Pre Issue) | FY 2024 (Post-Issue)* | |

| EPS | 2.58 | 4.40 | 8.33 | 6.25 |

| PE Ratio | – | – | 13.68 – 14.4 | 18.25 – 19.21 |

| FY 2022 | FY 2023 | FY 2024 | |

| RONW (%) | 6.42 | 9.84 | 15.66 |

| NAV | 40.25 | 44.68 | 53.21 |

| ROCE (%) | 8.34 | 13.53 | 19.39 |

| EBITDA (%) | 59.14 | 62.90 | 65.38 |

| Debt/Equity | 2.60 | 3.54 | 3.75 |

Manba Finance IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 28 September 2024 | 50 | – | 5,100 |

| 27 September 2024 | 60 | – | 5,500 |

| 26 September 2024 | 60 | – | 5,500 |

| 25 September 2024 | 60 | – | 5,500 |

| 24 September 2024 | 60 | – | 5,500 |

| 23 September 2024 | 50 | – | 3,700 |

| 21 September 2024 | 40 | – | 2,800 |

| 20 September 2024 | 20 | – | 1,500 |

Manba Finance IPO Objectives

The company proposes to utilize the Net Proceeds from the Fresh Issue towards funding the following objects:

- Augmenting the company’s capital base to meet the company’s future capital requirements toward onward lending – INR 138.77 crore

- General corporate purposes.

Manba Finance – Comparison With Listed Peers

| Company | PE ratio | EPS | RONW (%) | NAV | Revenue (Cr.) |

| Manba Finance | 19.21 | 6.25 | 15.66 | 53.21 | 191.63 |

| Baid Finserv | 13.65 | 1.08 | 7.75 | 13.89 | 66.36 |

| Arman Financial Services | 8.57 | 195 | 21.36 | 775.70 | 661.53 |

| MAS Financial Services | 18.13 | 15.31 | 14.25 | 108.71 | 1,285.68 |

Manba Finance IPO Allotment Status

Manba Finance IPO allotment status is now available on Link Intime’s website. Click on Link Intime IPO weblink to get allotment status.

Manba Finance IPO Dates & Listing Performance

| IPO Opening Date | 23 September 2024 |

| IPO Closing Date | 25 September 2024 |

| Finalization of Basis of Allotment | 26 September 2024 |

| Initiation of refunds | 27 September 2024 |

| Transfer of shares to demat accounts | 27 September 2024 |

| Manba Finance IPO Listing Date | 30 September 2024 |

| Opening Price on NSE | INR 145 per share (up 20.83%) |

| Closing Price on NSE | INR 152.25 per share (up 26.88%) |

Manba Finance IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi –

Antique Stock Broking –

Ajcon Global –

Arihant Capital – Subscribe

Axis Capital – Not rated

Ashika Research –

BP Wealth – Subscribe

Capital Market – Neutral

Canara Bank Securities – Subscribe

Choice Broking –

Dalal & Broacha –

Elara Capital –

Elite Wealth – Not rated

GCL Broking –

Geojit –

GEPL Capital – Subscribe

Hem Securities –

Hensex Securities –

HDFC Securities –

ICICIdirect –

IDBI Capital –

Investmentz –

Indsec Securities – Subscribe

Jainam Broking – Subscribe for long term

KR Choksey –

JM Financial – Not rated

Marwadi Financial – Subscribe

Motilal Oswal –

Mehta Equities –

Nirmal Bang – Subscribe

Reliance Securities –

Sushil Finance –

Samco Securities – Not rated

SBI Securities –

SMC Global – 1.5/5

SMIFS – Subscribe

StoxBox – Subscribe

Swastika Investmart – Subscribe

Ventura Securities – Subscribe

Manba Finance Offer Lead Manager

HEM SECURITIES LIMITED

904, A Wing, Naman Midtown, Senapati Bapat Marg,

Elphinstone Road, Lower Parel, Mumbai-400013, India

Phone: +91- 022- 49060000

Email: [email protected]

Website: www.hemsecurities.com

Manba Finance Offer Registrar

LINK INTIME INDIA PRIVATE LIMITED

C-101, 1st Floor, 247 Park L.B.S. Marg,

Vikhroli West, Mumbai – 400 083, Maharashtra

Telephone: +91 810 811 4949

Email: [email protected]

Website: www.linkintime.co.in

Manba Finance Contact Details

MANBA FINANCE LIMITED

IT/ ITES Building, Plot No.A-79, Road No. 16,

Wagle Estate, Thane 400 604, Maharashtra, India

Phone: +91 22 6234 6598

Email: [email protected]

Website: www.manbafinance.com

Manba Finance IPO FAQs

How many shares in Manba Finance IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply for Manba Finance Public Offer?

The best way to apply for Manba Finance public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Manba Finance IPO GMP today?

Manba Finance IPO GMP today is INR 50 per share.

What is Manba Finance’s kostak rate today?

Manba Finance kostak rate today is INR NA per application.

What is Manba Finance Subject to Sauda rate today?

Manba Finance Subject to Sauda rate today is INR 5,100 per application.