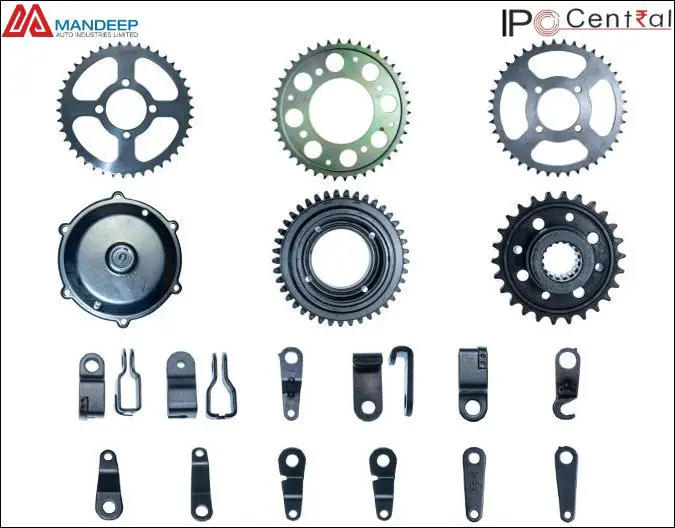

Mandeep Auto IPO description – Mandeep Auto Industries specializes in the manufacturing and supply of sheet metal components, auto parts, various types of sprocket gears, and machined components. These products are utilized across a wide range of industries, including tractors, automobiles, material handling and earth-moving equipment, railways, defense, machine tools, and the DIY industry.

Experienced professionals with extensive expertise in press and machining components support the company. It holds ISO 9001:2015 and ISO 14001:2015 certifications. Mandeep Auto manufactures customized components tailored to meet specific customer requirements, offering high precision in both quality and timing.

The company currently serves customers located throughout North India, including Haryana, Uttar Pradesh, Uttarakhand, Punjab, and Delhi. As of April 2024, the company employs 54 people on its payroll and also has 15 contract laborers.

Promoters of Mandeep Auto Industries – Mr. Gurpal Singh Bedi, Mrs. Nidhi Bedi, and Mr. Rajveer Bedi

Table of Contents

Mandeep Auto Industries IPO Details

| Mandeep Auto IPO Dates | 13 – 15 May 2024 |

| Mandeep Auto Issue Price | INR 67 per share |

| Fresh issue | 3,768,000 shares (INR 25.25 crore) |

| Offer For Sale | NIL |

| Total IPO size | 3,768,000 shares (INR 25.25 crore) |

| Minimum bid (lot size) | 2,000 shares (INR 134,000) |

| Face Value | INR 10 per share |

| Retail Allocation | 50% |

| Listing On | NSE EMERGE |

Mandeep Auto Financial Performance

| FY 2021 | FY 2022 | FY 2023 | 9M FY 2024 | |

| Revenue | 15.63 | 21.90 | 29.09 | 21.53 |

| Expenses | 14.38 | 20.46 | 27.58 | 17.76 |

| Net income | 0.50 | 0.65 | 1.05 | 2.37 |

All Standalone data

Mandeep Auto Offer News

- Mandeep Auto RHP

- Mandeep Auto Draft Prospectus

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Allotment Status

Mandeep Auto Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | 31 Dec 2023 | |

| EPS | – | – | – | 6.60 |

| PE ratio | – | – | – | 10.15 |

| RONW (%) | 17.76 | 15.64 | 23.13 | 25.97 |

| NAV | – | – | – | 12.49 |

| ROCE (%) | 29.13 | 20.07 | 31.59 | 27.94 |

| EBITDA (%) | 8.04 | 6.58 | 7.42 | 20.52 |

| Debt/Equity | 0.54 | 0.74 | 1.83 | 1.00 |

Mandeep Auto IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| 20 May 2024 | 13 | – | 18,000 |

| 18 May 2024 | 23 | – | 31,000 |

| 17 May 2024 | 25 | – | 33,000 |

| 16 May 2024 | 28 | – | 35,500 |

| 15 May 2024 | 24 | – | 32,500 |

| 14 May 2024 | 18 | – | 26,000 |

| 13 May 2024 | 12 | – | 18,000 |

| 11 May 2024 | 12 | – | 18,000 |

| 10 May 2024 | 10 | – | 15,000 |

| 9 May 2024 | 12 | – | 15,000 |

| 8 May 2024 | 15 | – | 17,500 |

Mandeep Auto IPO Subscription – Live Updates

| Category | Non-retail | Retail | Total |

|---|---|---|---|

| Shares Offered | 17,88,000 | 17,90,000 | 35,78,000 |

| 15 May 2024 | 61.68 | 90.49 | 76.09 |

| 14 May 2024 | 3.10 | 12.63 | 7.87 |

| 13 May 2024 | 0.25 | 1.50 | 0.88 |

The market maker reservation portion of 1,90,000 shares is not included in the above calculations.

Mandeep Auto IPO Allotment Status

Mandeep Auto IPO allotment status is now available on Cameo Corporate Services’ website. Click on Cameo Corporate Services weblink to get allotment status.

Mandeep Auto IPO Dates & Listing Performance

| Mandeep Auto Industries IPO Opening Date | 13 May 2024 |

| Mandeep Auto Industries IPO Closing Date | 15 May 2024 |

| Finalization of Basis of Allotment | 16 May 2024 |

| Initiation of refunds | 17 May 2024 |

| Transfer of shares to demat accounts | 17 May 2024 |

| Mandeep Auto IPO Listing Date | 21 May 2024 |

| Opening Price on NSE SME | INR 62.25 per share (down 7.09%) |

| Closing Price on NSE SME | INR 65.35 per share (down 2.46%) |

Mandeep Auto Offer Lead Manager

JAWA CAPITAL SERVICES PRIVATE LIMITED

Plot No. 93, First Floor, Pocket 2,

Near DAV School, Jasola, New Delhi- 110025

Phone:+91-11-47366600

Email: [email protected]

Website: www.jawacapital.in

Mandeep Auto Offer Registrar

CAMEO CORPORATE SERVICES LIMITED

“Subramanian Building”, No. 01, Club House Road,

Mount Road, Chennai – 600 002, Tamil Nadu

Phone: +91-44-40020700

Email: [email protected]

Website: www.cameoindia.com

Mandeep Auto Industries IPO Contact Details

MANDEEP AUTO INDUSTRIES LIMITED

Plot No 26, Nangla,

Faridabad Haryana -121001

Phone: +91-129-2440045

E-mail: [email protected]

Website: www.mandeepautoindustries.com

IPO FAQs

What is the Mandeep Auto offer size?

Mandeep Auto offer size is INR 25.25 crores.

What is the Mandeep Auto offer price band?

Mandeep Auto public offer price is INR 67 per share.

What is the lot size of the Mandeep Auto IPO?

Mandeep Auto offer lot size is 2,000 shares.

What is Mandeep Auto IPO GMP today?

Mandeep Auto IPO GMP today is INR 13 per share.

What is the Mandeep Auto kostak rate today?

Mandeep Auto kostak rate today is INR NA per application.

What is Mandeep Auto Subject to the Sauda rate today?

Mandeep Auto is Subject to the Sauda rate today is INR 18,000 per application.