Muthoot Microfin IPO Description – Muthoot Microfin is dedicated to extending micro-loans, predominantly to women customers, with a primary focus on fostering income generation in rural pockets of India. Employing a joint liability group model, it exclusively caters to women in lower-income households, championing the cause of financial inclusion. As of December 31, 2022, it stands as the fourth-largest Non-Banking Financial Company-Microfinance Institution (NBFC-MFI) in India based on its substantial gross loan portfolio. Furthermore, in South India, it claims the third-largest position among NBFC-MFIs, securing the top spot in Kerala concerning MFI market share and playing a pivotal role in Tamil Nadu with an impressive 16% market share.

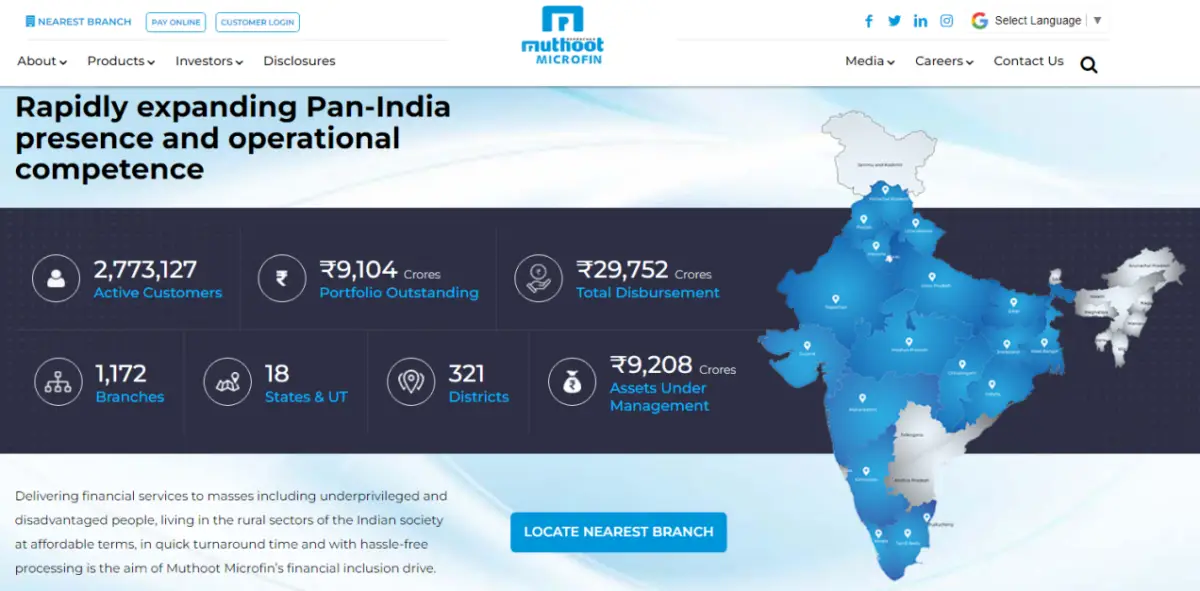

As of March 31, 2023, the company’s gross loan portfolio stands at INR 92,082.96 million, serving a commendable 2.77 million active customers. A dedicated workforce of 10,227 employees operates across 1,172 branches, strategically positioned in 321 districts within 18 states and union territories of India. Muthoot Microfin has meticulously expanded its branch network, with a strategic focus on underserved rural markets with growth potential, ensuring seamless access for its valued customers.

Backing its mission are noteworthy investors, Creation Investments India LLC and Greater Pacific Capital WIV Ltd. Both have demonstrated their commitment since 2016 and 2021, respectively, collectively holding a significant 33.48% of the issued, subscribed, and paid-up pre-offer Equity Share capital. This robust support further solidifies the company’s position in the dynamic landscape of microfinance, reinforcing its commitment to empowering women and fostering financial growth in rural India.

Promoters of Muthoot Microfin – Thomas John Muthoot, Thomas Muthoot, Thomas George Muthoot, Preethi John Muthoot, Remmy Thomas, Nina George and Muthoot Fincorp Limited

Muthoot Microfin IPO Details

| Muthoot Microfin IPO Dates | 18 – 20 December 2023 |

| Muthoot Microfin IPO Price | INR 277 – 291 per share Employee Discount – INR 14 per share |

| Fresh issue | 26,134,205 shares (INR 760 crore) |

| Offer For Sale | 6,872,849 shares (INR 200 crore) |

| Total IPO size | 33,007,054 shares (INR 960 crore) |

| Minimum bid (lot size) | 51 shares (INR 14,841) |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | BSE, NSE |

Muthoot Microfin Financial Performance

| FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 | |

| Revenue | 684.17 | 832.51 | 1,428.76 | 1,042.33 |

| Expenses | 687.23 | 778.22 | 1,233.47 | 772.63 |

| Net income | 7.05 | 47.40 | 163.89 | 205.26 |

| Margin (%) | 1.03 | 5.69 | 11.47 | 19.69 |

Muthoot Microfin Offer News

- Muthoot Microfin IPO Anchor Investors

- Muthoot Microfin RHP

- Muthoot Microfin DRHP

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Subscription Status

Muthoot Microfin Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 0.62 | 3.94 | 11.66 |

| PE ratio | – | – | 23.76 – 24.96 |

| RONW (%) | 0.79 | 3.55 | 10.08 |

| NAV | 77.94 | 97.74 | 112.63 |

| EBITDA (%) | 47.83 | 51.13 | 55.19 |

| Debt/Equity | 3.39 | 2.99 | 3.99 |

Muthoot Microfin IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 23 December 2023 | 25 | – | 1,000 |

| 22 December 2023 | 20 | – | – |

| 21 December 2023 | 20 | – | – |

| 20 December 2023 | 60 | – | 2,400 |

| 19 December 2023 | 70 | – | 2,900 |

| 18 December 2023 | 90 | – | 3,300 |

| 16 December 2023 | 100 | – | 3,500 |

| 15 December 2023 | 110 | – | 3,800 |

| 14 December 2023 | 130 | – | 4,500 |

| 13 December 2023 | 150 | – | – |

Muthoot Microfin IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Employee | Total |

|---|---|---|---|---|---|

| Shares Offered | 68,59,205 | 51,44,404 | 1,20,03,610 | 3,80,228 | 2,43,87,447 |

| 20 Dec 2023 | 17.47 | 13.19 | 7.56 | 4.89 | 11.49 |

| 19 Dec 2023 | 0.46 | 3.12 | 4.06 | 2.87 | 2.83 |

| 18 Dec 2023 | 0.00 | 0.61 | 1.38 | 1.24 | 0.83 |

Muthoot Microfin IPO Allotment Status

Muthoot Microfin IPO allotment status is now available on the KFin Tech website. Click on this link to get allotment status.

Muthoot Microfin IPO Dates & Listing Performance

| Muthoot Microfin IPO Opening Date | 18 December 2023 |

| Muthoot Microfin IPO Closing Date | 20 December 2023 |

| Finalization of Basis of Allotment | 21 December 2023 |

| Initiation of refunds | 22 December 2023 |

| Transfer of shares to demat accounts | 22 December 2023 |

| Muthoot Microfin IPO Listing Date | 26 December 2023 |

| Opening Price on NSE | INR 275.3 per share (down 5.4%) |

| Closing Price on NSE | INR 265.15 per share (down 8.54%) |

Muthoot Microfin IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi – Subscribe

Antique Stock Broking –

Arihant Capital –

Ashika Research – Not Rated

Asit C Mehta –

Axis Capital – Not Rated

BP Wealth – Subscribe

Canara Bank Securities – Subscribe

Choice Broking – Subscribe

Capital Market – May Apply

Dalal & Broacha –

Elite Wealth – Apply

GCL Broking –

Geojit –

GEPL Capital – Subscribe

HDFC Securities – Not Rated

Hem Securities – Subscribe

ICICIdirect –

Jainam Broking –

DR Choksey – Subscribe

LKP Research –

Marwadi Financial –

Motilal Oswal –

Nirmal Bang –

Reliance Securities –

Religare Broking –

Samco Securities – Subscribe

SMC Global – 2/5

SBICAP Securities – Not Rated

Systematix Group – Not Rated

Swastika Investmart – Subscribe

Ventura Securities – Subscribe

Muthoot Microfin IPO Lead Manager

ICICI SECURITIES LIMITED

ICICI Venture House, Appasaheb Marathe Marg

Prabhadevi, Mumbai 400 025, Maharashtra

Phone: +91 22 6807 7100

Email: [email protected]

Website: www.icicisecurities.com

Muthoot Microfin Offer Registrar

KFIN TECHNOLOGIES LIMITED

Selenium Tower – B, Plot 31 & 32, Gachibowli,

Financial District, Nanakramguda, Serilingampally,

Hyderabad – 500 032, Telangana

Tel: +91 40 6716 2222

E-mail: [email protected]

Website: www.kfintech.com

Muthoot Microfin Contact Details

MUTHOOT MICROFIN LIMITED

5th Floor, Muthoot Towers,

M.G. Road, Ernakulam 682 035,

Kerala, India

Phone: +91 48 4427 7500

Email: [email protected]

Website: www.muthootmicrofin.com

Muthoot Microfin IPO FAQs

How many shares in Muthoot Microfin IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply in Muthoot Microfin Public Offer?

The best way to apply in Muthoot Microfin public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Muthoot Microfin IPO GMP today?

Muthoot Microfin IPO GMP today is INR 25 per share.

What is Muthoot Microfin kostak rate today?

Muthoot Microfin kostak rate today is INR NA per application.

What is Muthoot Microfin Subject to Sauda rate today?

Muthoot Microfin Subject to Sauda rate today is INR 1,000 per application.

When is the expected date of the IPO.