Orbis Unlisted Share Price Description – Established in 2009 and headquartered in Gurugram, Haryana, Orbis Financial Corporation is a prominent player in the Indian financial services sector, specializing in securities services. Registered with SEBI and a custodian of securities. This is the heart of our value proposition: to be an end-to-end solution provider to a wide range of institutional and retail investors. This includes Foreign Portfolio Investors (FPIs), Foreign Direct Investments (FDIs), mutual funds, endowments and trusts, high net worth individuals, Alternative Investment Funds (AIFs), stock brokers, private bankers and portfolio managers.

The company is focused on establishing itself as a one-stop solution, providing a comprehensive suite of services specifically designed to cater to the requirements of both domestic and foreign asset managers. To simplify the operations and increase efficiency for our clients in the asset management space. As of 31 March 2024, Orbis Financial Corporation employed a total of 158 individuals, including 44 female employees.

The company has been assigned a credit rating of “ICRA A” [Stable] for our long-term debt and “ICRA A1” for our short-term non-fund-based facilities of INR 800 crores for the year 2024.

Key Segments of Orbis Financial Corporation

Orbis Financial Corporation operates across multiple segments in the financial services space and provides a range of services primarily focused on custodial and related services.

- Trustee Services: Through its subsidiary Orbis Trusteeship Services Private Limited, the company offers trustee services including acting as a debenture trustee under SEBI regulations.

- Fund Accounting: The company provides fund accounting services that support asset managers and institutional clients in managing their portfolios effectively. This includes tracking assets under custody and compliance with regulatory requirements.

- Custody Services: Orbis is a trusted custodian with SEBI registration, and that trust is reflected in the wide range of institutional clients it serves: FPIs, domestic institutional investors and AIFs among them.

- Clearing Services: The company will find Orbis clearing trades across multiple exchanges- NSE and BSE among them. That means smooth transaction processing for clients on equity, commodity and currency derivatives.

- Registrar and Transfer Agency Services (RTA): As a Category I Registrar and Share Transfer Agent with SEBI, Orbis keeps shareholder records up-to-date and facilitates the transfer of securities. That’s where its RTA services come in.

- Escrow Services: When it comes to escrow services for securities transactions, Orbis helps manage funds during trades or other financial agreements-execution and all.

At its heart, Orbis Financial Corporation is a versatile player in the financial services space. That means catering to a wide range of clients-from institutional investors and corporates to high net worth individuals. Innovation and client-specific solutions are at the core of its commitment to delivering excellence in service. And that commitment just got a boost: the company recently raised INR 102 crores with Ashish Kacholia on board as an investor.

Read Also: Nayara Energy Unlisted Share Price

Key Highlights FY 2023 – 24

- Total income surged to INR 431.42 crores, marking a 43.91% increase compared to INR 299.78 crores in FY 2023, showcasing strong revenue growth driven by enhanced service offerings.

- Orbis Financial Corporation reported a net profit of approximately INR 141.28 crore for FY 2024, a significant increase from INR 89.57 crore in FY 2023, reflecting strong operational performance and profitability metrics.

- The company recently raised INR 102 crore to strengthen its market position, with Ashish Kacholia as an investor.

- The company achieved a return on net worth of 25%, slightly down from 27% in the previous year, indicating robust returns despite market fluctuations.

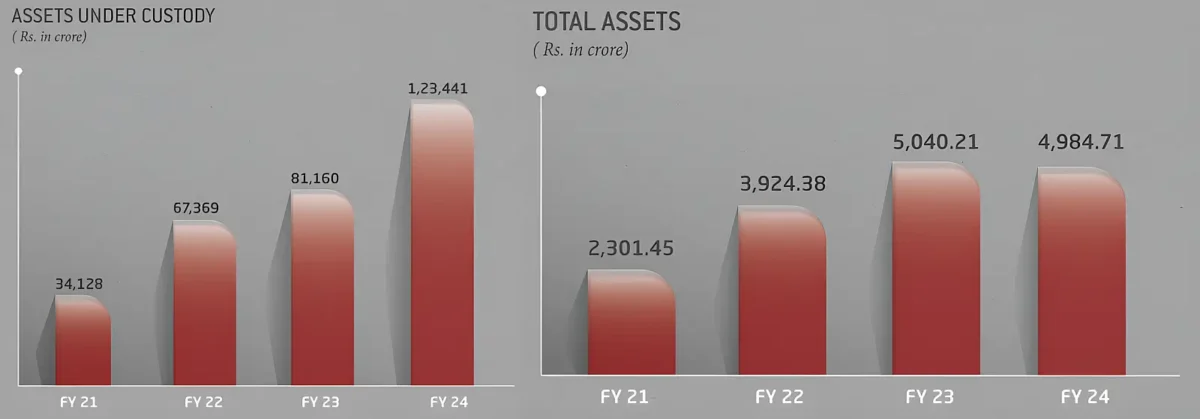

- The Assets Under Custody (AUC) grew to INR 1,23,440.88 crores, representing a 52.10% increase from the prior year, highlighting increased investor trust and demand for the company’s services.

- The company reported a return on capital employed ratio of 36.50%, down slightly from 38.06% in the previous year, indicating effective utilization of capital for generating profits.

- As of 31st March 2024, Orbis Financial Corporation has a strong custody client base with 347 FPIs, 356 FDIs, 363 PMS, 125 AIFs, 2506 HNWI/NRIs, and corporate clients.

Orbis Financial Corporation Subsidiary Companies

- Orbis Trusteeship Services Private Limited (OTSPL)

- Orbis Financial Services (IFSC) Private Limited (OFSPL)

Read Also: Onix Renewable Unlisted Share Price

Orbis Unlisted Share Price Details

| Name | Orbis Financial Unlisted Share Price |

| Face Value | INR 10 per share |

| ISIN Code | INE155K01013 |

| Lot Size | 100 shares |

| Demat Status | NSDL, CDSL |

| Orbis Financial Share Price | INR 504 per share |

| Orbis Market Cap | INR 6,135 crore |

| Total number of shares | 12,17,30,160 shares |

| Website | www.orbisfinancial.in |

Read Also: Hexaware Technologies Unlisted Share Price

Orbis Financial – Board of Directors

- Mr. Atul Gupta, Chairman, and WTD

- Mr. Shyam Agarwal, MD & CEO

- Mr. S.A.R. Acharya, Independent Director

- Mr. Om Prakash Dani, Independent Director

- Mr. Rup Chand Jain, Director

- Ms. Manasi Gupta, Director

Orbis Financial Unlisted Share Price – Shareholding Pattern

Details of shares held by shareholders holding more than 5% of the aggregate shares in the company as of 31 March 2024:

| Shareholder Name | % to Holding | No. of shares |

| Atul Gupta | 21.79 | 2,65,25,601 |

| Arpit Khandelwal | 18.48 | 2,24,98,005 |

| Madhulika Agarwal | 7.87 | 95,77,778 |

| Ashish Kacholia | 7.80 | 94,94,445 |

| Plutus Wealth Management LLP | 6.20 | 75,43,750 |

| Orbis Foundation | 5.77 | 70,18,296 |

Orbis Unlisted Share Price – Financial Metrics

| Particulars | FY 2022 | FY 2023 | FY 2024 |

| Revenue | 154.18 | 296.67 | 424.24 |

| Revenue Growth (%) | 131.68 | 92.42 | 43.00 |

| Expenses | 125.81 | 177.89 | 244.23 |

| Net income | 47.84 | 89.57 | 141.28 |

| Margin (%) | 31.03 | 30.19 | 33.30 |

| EPS | 5.03 | 8.34 | 11.32 |

| ROCE (%) | 42.60 | 38.06 | 36.50 |

| ROE (%) | 24.88 | 27.25 | 25.05 |

| Debt/Equity | 0.004 | 0.029 | 0.015 |

Read Also: Top Solar Energy Stocks in India

Orbis Financial Corporation Annual Reports

Orbis Financial Annual Report FY 2023 – 2024

Orbis Financial Annual Report FY 2022 – 2023

Orbis Financial Annual Report FY 2021 – 2022

Orbis Financial Share Price – Peer Comparison

| Company | 3-yr Sales CAGR (%) | PE Ratio | Net Margin (%) | ROCE (%) | MCap (INR Cr.) |

| Orbis Financial | 85.4 | 44.52 | 33.3 | 36.5 | 6,135 |

| ICICI Securities | 22.6 | 16.1 | 30.65 | 18.2 | 29,149 |

| SMC Global | 16.7 | 11.6 | 8.28 | 14.6 | 1,422 |

Orbis Financial Unlisted Share Price FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is Orbis Unlisted Share price?

Orbis share price today is INR 504 per share. Shares are purchased in lots of 100 shares.

Who determines Orbis Financial share price?

The unlisted share price is determined by a variety of factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

What is the Orbis Financial IPO date?

As of 2025, Orbis Financial Corporation had no plans to go public through an IPO. The company is focused on providing services to its clients and growing sustainably as a private entity.