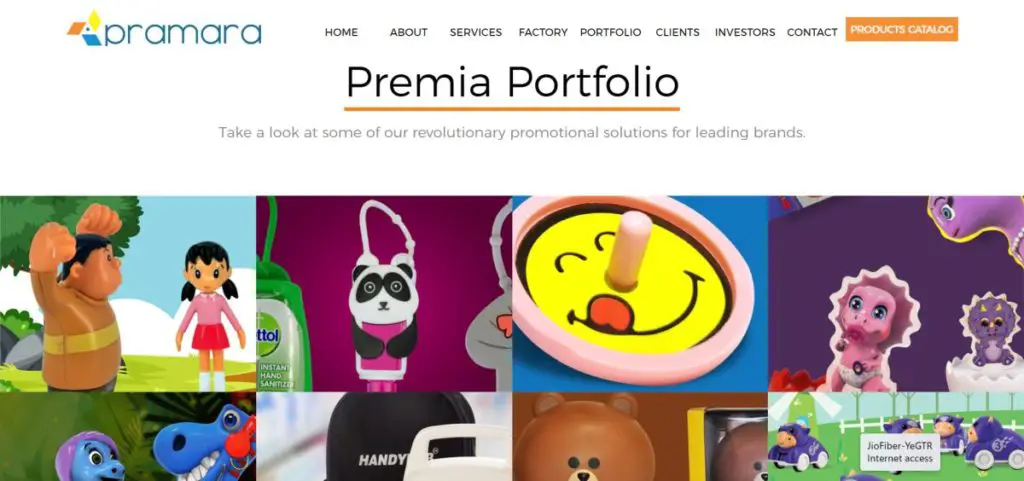

Pramara Promotions IPO description – The company is engaged in the business of ideation, conceptualization, designing and manufacturing and marketing of promotional products and gift items for clients across sectors, such as FMCG, QSR, pharma, beverage companies non-alcoholic and alcoholic, cosmetic, telecom, media and others. It is one of the few players in the promotional marketing merchandise sector, offering a wide range of innovative promotional products and merchandise to help businesses promote their brand and increase sales.

Since inception, Pramara Promotions has designed and manufactured around 5,000 products. Services are an integral part of its manufacturing process and are in the nature of ideation, conceptualization and designing which are critical for sales. The company has also expanded its product offerings by launching own brand “Toyworks” with an aim to foray into the toy retail space. Further, it has also launched “Tribeyoung”, a private label exclusively for ecommerce with product offering of toys, sporting goods and accessories.

Its manufacturing facility is spread over approx. 24,000 sq. ft area. The existing manufacturing facility consists of equipment’s like band sealer machines, flow wrap machines, shrink wrap machines, ultrasonic welding machines, pad printing machine, spray printing machine and full product assembly. Pramara Promotions also outsources a part of its manufacturing activities to third-party partners.

Promoters of Pramara Promotions – Rohit Lamba and Sheetal Lamba

Table of Contents

Pramara Promotions IPO Details

| Pramara Promotions IPO Dates | 1 – 5 September 2023 |

| Pramara Promotions IPO Price | INR 63 per share |

| Fresh issue | 2,424,000 shares (INR 15.27 crore) |

| Offer For Sale | NIL |

| Total IPO size | 2,424,000 shares (INR 15.27 crore) |

| Minimum bid (lot size) | 2,000 shares (INR 126,000) |

| Face Value | INR 10 per share |

| Retail Allocation | 50% |

| Listing On | NSE SME |

Pramara Promotions Financial Performance

| FY 2021 | FY 2022 | FY 2023 | |

| Revenue | 40.78 | 49.16 | 50.06 |

| Expenses | 40.38 | 47.48 | 48.61 |

| Net income | 0.33 | 1.35 | 2.23 |

Pramara Promotions Offer News

- Pramara Promotions RHP

- Pramara Promotions Draft Prospectus

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Allotment Status

Pramara Promotions Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 0.50 | 2.04 | 3.37 |

| PE ratio | – | – | 18.69 |

| RONW (%) | 2.69 | 9.79 | 13.87 |

| NAV | 18.69 | 20.78 | 24.28 |

| ROCE (%) | 11.39 | 15.79 | 15.20 |

| EBITDA (%) | 9.80 | 12.59 | 12.92 |

| Debt/Equity | 2.46 | 2.28 | 2.07 |

Pramara Promotions IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| – | – | – | – |

Pramara Promotions IPO Subscription – Live Updates

| Category | NII | Retail | Total |

|---|---|---|---|

| Shares Offered | 1,274,000 | 1,150,000 | 2,424,000 |

| 5 Sep 2023 | 30.75 | 17.01 | 24.23 |

| 4 Sep 2023 | 0.54 | 3.34 | 1.87 |

| 1 Sep 2023 | 0.07 | 0.86 | 0.44 |

Pramara Promotions IPO Allotment Status

Pramara Promotions IPO allotment status is now available on Bigshare Services’ website. Click on this link to get allotment status.

Pramara Promotions IPO Dates & Listing Performance

| IPO Opening Date | 1 September 2023 |

| IPO Closing Date | 5 September 2023 |

| Finalization of Basis of Allotment | 8 September 2023 |

| Initiation of refunds | 11 September 2023 |

| Transfer of shares to demat accounts | 12 September 2023 |

| IPO Listing Date | 13 September 2023 |

| Opening Price on NSE SME | INR 111 per share (up 76.19%) |

| Closing Price on NSE SME | INR 116.55 per share (up 85%) |

Pramara Promotions Offer Lead Manager

FEDEX SECURITIES PRIVATE LIMITED

B 7, 3rd Floor, Jay Chambers, Dayaldas Road,

Vile Parle – [East], Mumbai – 400 057, Maharashtra

Phone: +91 81049 85249

Email: [email protected]

Website: www.fedsec.in

Pramara Promotions Offer Registrar

BIGSHARE SERVICES PRIVATE LIMITED

S6-2, 6th Floor,

Pinnacle Business Park,

Next to Ahura Centre, Mahakali

Caves Road, Andheri East,

Mumbai – 400 093

Phone: +91 22 6263 8200

Email: [email protected]

Website: www.bigshareonline.com

Pramara Promotions Contact Details

PRAMARA PROMOTIONS LIMITED

A – 208, Boomerang Equity Bussi Park,

CTS No. 4 ETC Chandivali Farm Road, Sakinaka,

Andheri East, Mumbai – 400072, Maharashtra

Phone: +91 7045032201

E-mail: [email protected]

Website: www.pramara.com

IPO FAQs

What is Pramara Promotions IPO offer size?

Pramara Promotions offer size is INR 15.27 crores.

What is the Pramara Promotions offer price band?

Pramara Promotions public offer price is INR 63 per share.

What is the lot size of Pramara Promotions public offer?

Pramara Promotions offer lot size is 2,000 shares.

What is Pramara Promotions IPO GMP today?

Pramara Promotions IPO GMP today is INR NA per share.

What is Pramara Promotions kostak rate today?

Pramara Promotions kostak rate today is INR NA per application.

What is Pramara Promotions Subject to Sauda rate today?

Pramara Promotions Subject to Sauda rate today is INR NA per application.