Systematix Research has turned decisively bullish on Quality Power Electrical Equipments, calling it one of the most promising re-rating stories in India’s industrial equipment space. In its coverage report, the brokerage has set a target price of INR 1,550 per share, implying an upside of nearly 48% from current levels and 264% above its IPO price of INR 425.

The firm’s confidence stems from Quality Power’s expanding presence across high-growth verticals — HVDC, FACTS, and GIS systems — and its strong execution momentum since listing.

Why Systematix is Bullish

According to Systematix Research, Quality Power’s business model combines technical depth, operational integration, and exposure to a multi-decade power infrastructure cycle. The brokerage highlights five structural drivers behind its positive outlook:

- 🔌 Acceleration in Power Transmission Capex: With India’s grid modernization and renewable integration picking up pace, Systematix expects multi-year demand for transformers, switchgear, and substation systems — all core offerings for Quality Power.

- ⚙️ Strategic Acquisition of Mehru Electrical: The company’s acquisition of Mehru Electrical & Engineering has enhanced its backward integration and high-voltage product capabilities, improving both margins and technological depth.

- 📈 Rising Share of HVDC & GIS Projects: These advanced systems carry superior margins and higher entry barriers, giving Quality Power a competitive edge as it scales.

- 💰 Strong Order Book & Operating Leverage: Robust order inflows from utilities and industrial clients are expected to drive revenue visibility, while rising utilization should expand margins in FY26–27.

- 🧾 Healthy Financials Post-IPO: The INR 225 crore fresh issue has fortified the balance sheet, reduced debt, and provided growth capital for expansion. Systematix anticipates a steady improvement in return ratios and cash flows.

“Quality Power is emerging as a full-spectrum player in India’s power equipment value chain. Its execution track record, sector tailwinds, and improving financial strength position it for sustained earnings growth,” the report notes.

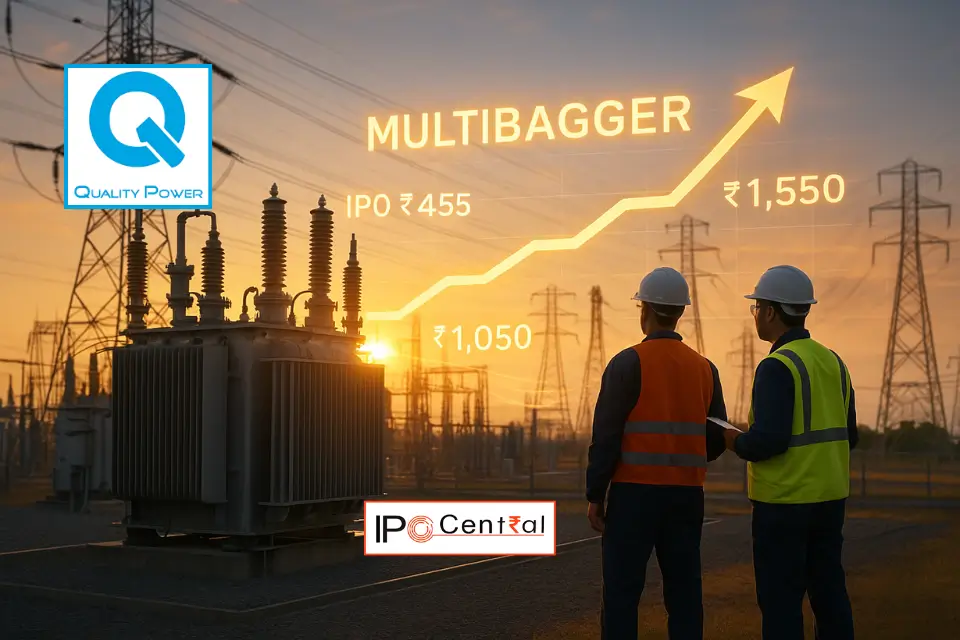

From Soft Start to Strong Surge

Quality Power’s journey began with a INR 858.7 crore IPO on 14 February 2025 — a mix of INR 225 crore fresh issue and INR 633.7 crore OFS. The stock debuted at a discount of 8.73% to its issue price of INR 425, and initially fell to INR 273 by 9 April 2025.

However, strong order inflows and renewed investor confidence quickly reversed the trend. Within months, the stock surged nearly 296% from its lowests, reaching an all-time high of INR 1,082 per share. It currently trades at around INR 1,050, representing 1.5× gains from its IPO price.

The Bigger Picture: Powering India’s Grid Growth

Systematix believes Quality Power is well placed to capitalize on India’s transmission expansion, driven by government push for renewable energy integration, cross-border interconnections, and urban electrification. The firm expects revenue and profit CAGR in double digits over FY25–27, supported by operational synergy from Mehru and strong execution in HVDC and GIS verticals.

In a sector where only a few companies possess both engineering depth and execution scale, Quality Power’s integrated capabilities — spanning transformers, substations, and grid solutions — make it a standout candidate for re-rating.

Bottom Line

Systematix’s bullish stance reinforces the transformation of Quality Power from a hesitant debutant to a serious sector contender. Its combination of strategic acquisitions, improving margins, healthy balance sheet, and a robust order pipeline provides a foundation for sustained growth.

For investors, Quality Power may not just be a stock that recovered — it could well be a core play on India’s power infrastructure revolution.