As investors look for promising opportunities in the Indian stock market, the upcoming IPO of Sagility India stands out due to its unique positioning in the healthcare sector. With a focus on technology-enabled healthcare solutions, Sagility is set to make a significant impact. Here is our 10 point Sagility India IPO Analysis that investors should read before subscribing to this IPO.

Table of Contents

#1 Sagility India IPO Analysis: A Healthcare-Focused Solutions Provider

Established in 2000, Sagility India stands out as a technology-enabled, pure-play healthcare solutions provider, focusing on US-based Payers (health insurers) and Providers (hospitals, physicians, and diagnostic companies). With specialized services in claims management, clinical management, and revenue cycle management (RCM), Sagility India aids Payers in claims processing and Providers in optimizing billing, making it a unique player with a healthcare-centric approach.

For Payers, its services span from claims management to clinical services, including support for core benefits administration and payment integrity. The breadth of these services enables Payers to reduce costs, process claims accurately, and ensure timely payments. On the Provider side, Sagility’s RCM services cover the entire revenue cycle, from insurance verification to denials management, helping Providers streamline billing and recover payments efficiently.

#2 Sagility India IPO Analysis: Growth Potential and Market Position

Sagility operates in a rapidly growing segment of the healthcare industry. The US healthcare market is expected to grow at a CAGR of 8.7% from 2023 to 2028, driven by an aging population and increasing prevalence of chronic diseases. Specifically:

- The payer outsourcing market is forecasted to grow at 7.0% CAGR.

- The provider operations outsourcing market is expected to expand at a robust 12.5% CAGR.

This growth trajectory positions Sagility favorably to capitalize on increasing demand for its services.

With all clients based in the US, Sagility India has positioned itself as a trusted partner to some of the nation’s largest health insurers. As of January 2024, it served five of the top 10 Payers by enrollment in the US, highlighting its appeal to major industry players. The company boasts a high client retention rate, with recurring revenue contributing to 110.75% of its FY 2024 revenue retention rate. Long-term relationships with clients are another noteworthy feature; Sagility India’s top five client groups boast an average tenure of 17 years.

#3 Sagility India IPO Analysis: IPO Structure

The Sagility India IPO will consist entirely of an offer for sale (OFS), encompassing up to 70,21,99,262 equity shares held by its promoter, Sagility B.V., an affiliate of EQT Private Capital Asia. This means that no fresh capital will be raised by the company; instead, existing shareholders will liquidate their holdings. The total issue size is around INR 2,106 crores, making it one of the significant IPOs in recent times. The IPO, priced at INR 28 – 30 per share, will be listed on both BSE and NSE.

Read Also: The Rise & Fall of Abdul Karim Telgi: A Counterfeiter’s Tale

#4 Sagility India IPO Analysis: Strong Claims Processing and Interaction Volume

Sagility India’s scale is illustrated by its impressive operational metrics. In FY 2024 alone, the company helped Payer clients process approximately 105 million claims and handle over 75 million Member and Provider interactions. Such scale in claims processing and engagement highlights the robust technological infrastructure and the manpower Sagility deploys, providing confidence in its capacity to handle high volumes—a vital factor given the transaction-heavy nature of healthcare services.

#5 Sagility India IPO Review: Strong Financial Performance and Revenue Growth

Sagility has demonstrated robust financial performance, with a 12.69% revenue growth from INR 4,218.41 crore in FY2023 to INR 4,753.56 crore in FY2024. This growth is attributed to an expanding client base and deeper service penetration among existing clients. For instance, the company’s revenue from its third-largest client, a top-10 national payer, grew at a CAGR of 20.58% between July 2021 and March 2024, showcasing Sagility’s ability to capitalize on growing client needs and increase its wallet share.

| Stub FY 2022* | FY 2023 | FY 2024 | |

| Revenue | 923.40 | 4,218.40 | 4,753.53 |

| Expenses | 733.82 | 3,191.19 | 3,665.46 |

| Net income | 4.67 | 143.57 | 228.26 |

| Margin (%) | 0.50 | 3.40 | 0.59 |

* Stub period: From 28 July 2021 – 31 March 2022

IN the latest financial year, the company’s Earnings Per Share increased to INR 0.53 from INR 0.33 a year ago. It has maintained operational efficiency with an EBITDA margin of approximately 23.48%, despite a slight dip from the previous year.

| FY 2023 | FY 2024 | |

| EPS | 0.33 | 0.53 |

| PE Ratio | – | 52.83 – 56.60 |

| RONW (%) | 2.31 | 3.54 |

| NAV | 14.48 | 15.03 |

| EBITDA (%) | 24.77 | 23.48 |

| Debt/Equity | 0.37 | 0.34 |

#6 Sagility India IPO Analysis: Proprietary Tools and Platforms

Sagility has invested in a suite of proprietary platforms and tools that enhance the efficiency of its services. Among these tools, Sagility’s Aging in Place platform supports care management for aging members, helping healthcare providers handle chronic conditions and risks associated with aging. Additionally, its Provider Forward platform enables smooth interactions with healthcare providers for verification and validation processes, while the Nurse Assist tool employs generative AI to annotate and summarize medical documents, improving the efficiency and accuracy of clinical decision-making.

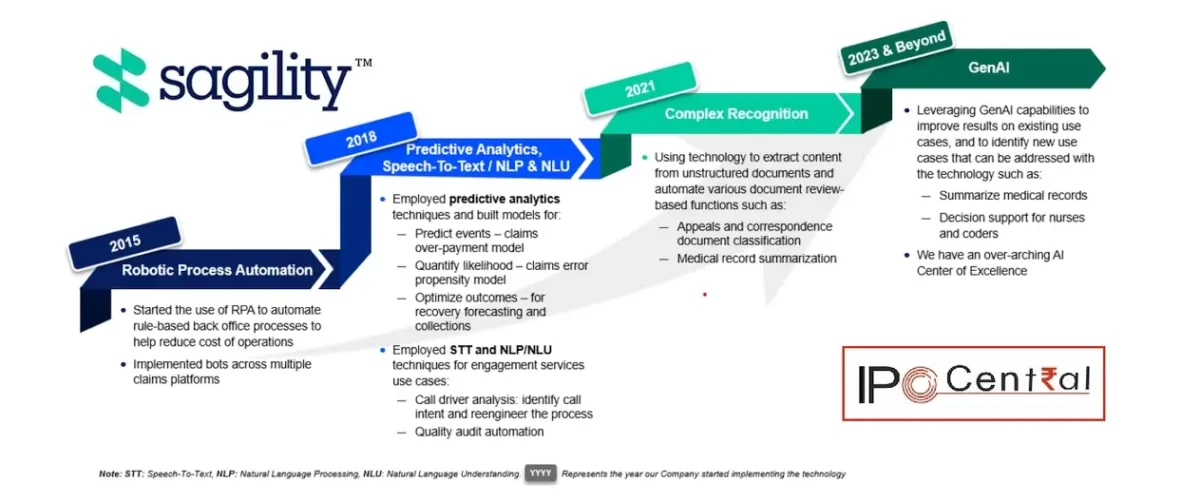

#7 Sagility India IPO Review: Strong Technological Edge with Gen AI Integration

Sagility leverages a range of advanced technologies such as robotic process automation (RPA), predictive analytics, natural language processing (NLP), and AI-driven speech-to-text capabilities. The company’s recent acquisition of BirchAI, a cloud-based generative AI tech provider, further strengthens its ability to reduce client operational costs and streamline complex transactions. These tools allow Sagility to optimize various aspects of claims management, payment integrity, and member engagement, providing clients with data-driven insights to improve cost efficiency and operational performance.

#8 Sagility India IPO Analysis: Flexible, Multi-Shore Service Delivery Model

Sagility has a flexible and scalable delivery model, offering services from 30 global locations across five countries, including the US, Colombia, Jamaica, India, and the Philippines. As of March 2024, Sagility employed 35,044 employees, of whom 60.52% are women, underscoring its commitment to diversity. The company’s multi-shore approach allows it to scale as needed based on client requirements, enabling efficient resource management and consistent service delivery.

#9 Sagility India IPO Review: Expanding Client Base and Strategic Growth

Sagility India has demonstrated its ability to attract and retain clients while expanding its portfolio through acquisitions. Since its incorporation in 2021, it has grown organically and acquired subsidiaries in March 2024, indicating a strategy that blends organic and inorganic expansion. Adding 20 new clients over the past two fiscal years has further diversified its revenue base and highlighted its adaptability in meeting varied client requirements.

#10 Sagility India IPO Analysis: Risks Factors

- Regulatory Changes: Changes in US healthcare policies could adversely impact operations and revenue.

- Client Concentration: The top three clients contribute around 68.32% of total revenue, posing a risk if any are lost.

- Market Dependency: Reliance on the US healthcare sector makes Sagility vulnerable to economic fluctuations.

- Competitive Landscape: Intense competition in healthcare outsourcing may lead to pricing pressures and reduced profit margins.

- Operational Risks: Disruptions in technology or infrastructure could hinder service delivery and affect client satisfaction.

Read Also: Muhurat Trading 2024: A Time-Honored Tradition

Conclusion

Sagility India’s upcoming IPO offers investors an opportunity to participate in a high-growth healthcare solutions provider with deep expertise in the US healthcare outsourcing market. With its proprietary technology, strong client relationships, high revenue retention, and significant backing from EQT, Sagility is positioned well to capitalize on the growing demand for healthcare outsourcing in the U.S. healthcare sector. For investors, the IPO represents a promising avenue to gain exposure to a resilient industry driven by demographic shifts and regulatory support, coupled with Sagility’s proven ability to innovate and maintain operational excellence.

Check the latest IPO GMP and discussion about Sagility India on our page.