Bangalore-based staffing company TeamLease Services has filed its draft red herring prospectus (DRHP) with market regulator SEBI for its initial public offering (IPO). The company plans to raise anywhere from INR450 crore to INR500 crore through a combination of issue of fresh shares and offer for sale (OFS) by existing investors. The issue will be managed by IDFC Securities, Credit Suisse Securities (India) and ICICI Securities.

TeamLease aims to receive INR150 crore from the sale of new shares while private equity investors including Gaja Capital and India Advantage Fund plan to sell 32.19 lakh shares. Important among the selling shareholders are India Advantage Fund (15.33 lakh shares), GPE (India) (11.8 lakh shares), Gaja Capital India Fund (2.75 lakh shares), and HR Offshoring Ventures (1.53 lakh shares). The IPO will also have reservation of 10,000 shares for employees.

TeamLease aims to receive INR150 crore from the sale of new shares while private equity investors including Gaja Capital and India Advantage Fund plan to sell 32.19 lakh shares. Important among the selling shareholders are India Advantage Fund (15.33 lakh shares), GPE (India) (11.8 lakh shares), Gaja Capital India Fund (2.75 lakh shares), and HR Offshoring Ventures (1.53 lakh shares). The IPO will also have reservation of 10,000 shares for employees.

Read Also: Staffing player Teamlease eyes listing with INR500 crore IPO

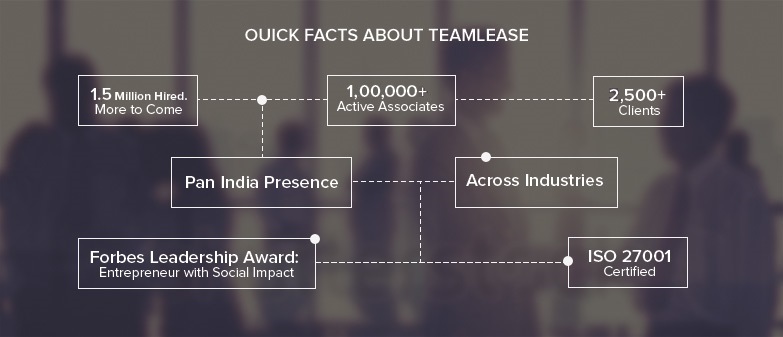

The Bangalore-based company claims to have placed 15 lakh employees to more than 2,500 clients across the country in its history. Started in 2002, the company has grown its network to eight regional offices now. Although it has roots in temporary staffing which continues to a big revenue driver, TeamLease has diversified into permanent recruitment, payroll processing, and learning services.

TeamLease’s competitor Bangalore-based Quess Corporation is also working to launch INR700 crore IPO, although it is yet to file paperwork with SEBI.

As revealed in its IPO prospectus, TeamLease registered a profit of INR30.7 crore on total revenue of INR2,021.88 crore in the financial year ended 31 March 2015. This is worth highlighting that the staffing company’s financial performance increased steadily in each of the previous four years.

The timing of the IPO application is noteworthy as a spate of recently listed IPOs did not perform well as secondary market has turned extremely volatile. However, it will take some time for SEBI to clear the IPO, following which the company will have one year to bring the public issue.

Read Also: Weak listings for Pennar Engineered Building and Shree Pushkar

We intend to analyze the IPO in greater length once the issue is cleared and the company reveals the pricing. To keep updated about TeamLease IPO, simply follow us on Facebook and Twitter or subscribe to receive our newsletter below.

Hope this helps the Company! IPO seems to be good.