Over the last five years, India’s automobile industry has gone through its most transformative phase yet — from BS-IV to BS-VI emission standards, from traditional engines to hybrid and low-emission technologies. But behind these regulatory shifts lies an equally powerful business story — the rise of component manufacturers who turn compliance into cash flow.

Tenneco Clean Air India, a subsidiary of global mobility giant Tenneco Inc. (USA), is one of those stories. Tenneco India IPO review goes beyond headline numbers. It unpacks how Tenneco makes money, where its revenues come from, and how its model turns engineering precision into shareholder returns.

Table of Contents

Tenneco India IPO Review: Company Overview & Promoter Lineage

Tenneco Clean Air India, part of the Tenneco Inc. (USA) group, operates as a Tier-I automotive component manufacturer specializing in emission control and clean air technologies. The company designs and manufactures exhaust systems, catalytic converters, mufflers, shock absorbers, bearings, and sealing components, primarily catering to leading OEMs (Original Equipment Manufacturers) across passenger vehicles (PVs), commercial vehicles (CVs), two/three-wheelers (2W/3W), and off-highway (OH) equipment.

Its Indian promoters include:

- Tenneco Mauritius Holdings (82.69%),

- Tenneco (Mauritius) (6.62%),

- Federal-Mogul Investments B.V. (2.63%),

- Federal-Mogul (3.59%), and

- Tenneco LLC (1.73%).

The company operates as a Tier-I supplier, directly partnering with Original Equipment Manufacturers (OEMs) such as Maruti Suzuki, Tata Motors, Hyundai, Mahindra, Ashok Leyland, and JCB. As of 30 June 2025, Tenneco Clean Air India employed 2,017 people, including 512 unionized staff under stable long-term labor agreements — a crucial differentiator in a manufacturing-heavy business.

The INR 3,600 crore IPO (entirely Offer for Sale) is scheduled between 12–14 November 2025, with listing on BSE and NSE. Issue price: INR 378–INR 397 per share, with JM Financial, Citi, Axis Capital, and HSBC as book-running lead managers.

Tenneco India IPO Analysis: Business Model

A. Tier-I Supplier Positioning

Tenneco Clean Air India sits at the Tier-I level in the automotive supply chain — meaning it supplies directly to OEMs that manufacture two-wheelers, passenger vehicles (PV), commercial vehicles (CV), tractors, and off-highway equipment (OH). Tier-I players hold high entry barriers because:

- OEMs rely on them for design, validation, and integration of complex components.

- Product approval cycles last 3–7 years, ensuring multi-year revenue lock-ins.

- Switching costs are high due to quality, logistics, and co-engineering dependencies.

This leads to high customer stickiness — once a product is approved, it continues to generate business across multiple vehicle generations.

B. Value Chain Role

Tenneco plays a complete-system role rather than being a mere parts supplier. Its core operations include:

- Design & Engineering: Tailoring exhaust and after-treatment systems to meet emission norms.

- Manufacturing: Precision fabrication of stainless-steel assemblies, mufflers, and converters.

- Assembly & Integration: Combining catalytic canning, sensor housing, and final testing for OEM delivery.

Because Tenneco Clean Air India adds design and technology value at each stage, its average realization per product is higher than Tier-II vendors — contributing to a healthy EBITDA margin of 16.7% in FY25, which improved to 17.8% in Q1 FY26.

C. Technology-Driven Cost Leadership

- The company benefits from global tech transfer from Tenneco Inc. USA, leveraging decades of R&D in emission control systems.

- At the same time, it maintains >80% localization, giving it a strong cost advantage over imported parts.

- This dual strategy — global R&D + Indian manufacturing efficiency — is what underpins its pricing power and margin stability even during commodity volatility.

Tenneco India IPO Review: Revenue Streams

A. Product Segmentation

Tenneco Clean Air India’s revenue is diversified across five main product categories:

| Segment | Core Product Line | FY25 Contribution | Growth Outlook (FY25–30 CAGR) |

|---|---|---|---|

| Clean Air Systems | Exhaust, catalytic converters, DPF, SCR | ~60% | 8–10% |

| Ride Performance (Suspension) | Shock absorbers, struts | ~15% | 6–8% |

| Sealings & Bearings | Engine gaskets, bearings | ~10% | 5–6% |

| Ignition Systems | Spark plugs, coils | ~8% | 6–8% |

| Aftermarket & Exports | Replacement & remanufactured parts | ~7% | >10% |

The dominance of the Clean Air division is the company’s defining feature — directly linked to the rise in emission regulation intensity. Every phase of Bharat Stage norms or CPCB compliance expands the system’s complexity, thereby increasing revenue per vehicle.

B. Market Segmentation

Tenneco Clean Air India’s revenues are spread across multiple end markets:

| Market | Key Vehicle Segments | Demand Source |

|---|---|---|

| OEM (Domestic) | PV, CV, OH, tractors | ~80% |

| Aftermarket | 2W/3W, PV, SCV | ~10–12% |

| Export | Industrial & global OEMs | ~8–10% |

The OEM business ensures stability and volume visibility, while the aftermarket and export segments provide margin cushioning. Replacement cycles for catalytic converters, filters, and suspension parts drive repeat demand — particularly after 5–7 years of vehicle life.

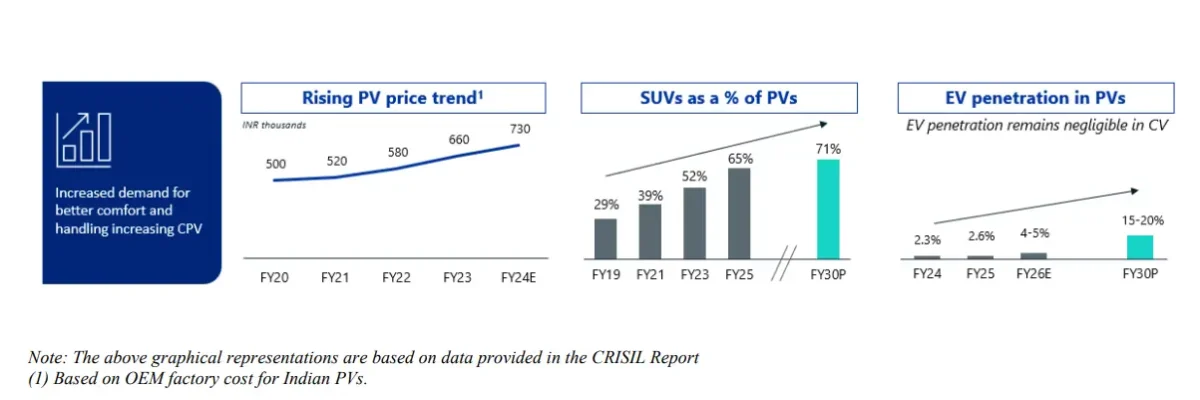

C. End-Market Trends

- Passenger Vehicles (PV): INR 3,481.3 crore clean-air market in FY25 → INR 4,650–5,100 crore by FY30 (6–8% CAGR).

- Commercial Vehicles (CV): Growth of 13–15% CAGR, driven by stricter emission rules and highway construction.

- Off-Highway (OH) & Tractors: INR 1,381.5 crore (FY25) → INR 2,540–2,780 crore (FY30).

- Industrial Gensets: INR 150.1 crore → INR 200–220 crore by FY30.

D. Margin Drivers by Segment

- Clean Air Systems: High R&D content → better pricing power → margins of ~18–20%.

- Suspension: Competitive, but cost-efficient → margins ~12–13%.

- Aftermarket: Smaller scale but high margin (~22–25%) due to replacement demand.

- Sealing & Bearings: Moderate volume but stable OEM stickiness (~10–12% margins).

This diversified margin mix gives the company a steady blended EBITDA of ~17%, consistent over the past three years despite commodity volatility.

E. Contribution of Regulation to Revenue

Each new emission standard increases the per-vehicle value of Tenneco’s system:

- BS-VI transition: ~2.5x jump in clean-air component value per vehicle.

- CEV-V norms: 20–30% higher per-unit realization for off-highway vehicles.

- TREM-IV/V (tractors): Adds catalytic systems to previously unregulated categories.

This means Tenneco’s growth isn’t dependent on just vehicle sales — it’s tied to regulation-driven content expansion, ensuring resilience even in flat demand cycles.

Tenneco India IPO Analysis: Financial Performance

| Metric | FY25 | Q1 FY26 | Trend |

|---|---|---|---|

| Revenue | 4,890.4 | 1,285.6 | +1.17 % QoQ growth |

| EBITDA | 815.2 | 228.9 | Margin expanding |

| EBITDA Margin (%) | 16.67 | 17.80 | ↑ 1.1 pp |

| PAT | 553.1 | 168.1 | +11.8 % QoQ growth |

| PAT Margin (%) | 11.31 | 13.07 | ↑ 1.7 pp |

| ROE/ROCE (%) | 42.65 / 56.78 | — | Industry-leading |

| Net Debt/EBITDA | -0.33× | -1.52× (Q1) | Debt-free status |

These data points underline strong operational consistency and a steady uptick in profitability even amid moderate top-line growth — a hallmark of a mature Tier-I component player.

Industry Tailwinds & Growth Outlook

The clean-air systems industry in India is expected to grow 8–10% CAGR (FY25–30) to INR 8,750 crore by FY30. Key demand triggers:

- BS-VI Stage II and upcoming BS-VII norms tightening NOx and PM limits.

- CPCB IV+ and CEV-V standards are expanding emission control in gensets and construction vehicles.

- TREM-IV/V norms regulating agricultural tractors (>50 HP).

- CAFE III/IV emission targets reducing CO₂ from 91.7 g/km → 70 g/km (2032–37).

These regulatory escalations increase content per vehicle — directly boosting Tier-I suppliers like Tenneco.

Tenneco Clean Air India vs Peers

| Company | EBITDA Margin FY25 | PAT Margin FY25 | ROE FY25 |

|---|---|---|---|

| Tenneco India | 16.7% | 11.3% | 42.6% |

| Bosch | 12.8% | 11.1% | 15.6% |

| SKF India | 17.2% | 11.5% | 21.4% |

| Gabriel India | 9.6% | 6.0% | 22.4% |

| Sona BLW | 27.5% | 16.9% | 17.7% |

While Sona BLW operates in a high-margin EV drivetrain niche, Tenneco’s margins are top-quartile among traditional auto-component manufacturers, backed by robust cost controls and localization efficiency.

Verdict – A Clean, Profitable, and Scalable Play

From every measurable angle — business model, industry positioning, and financial execution — Tenneco Clean Air India represents a rare Tier-I story with both stability and scalability.

Key Takeaways

- Robust Balance Sheet: Net cash, zero leverage, strong liquidity.

- Operational Excellence: Negative working capital and fast cash cycle.

- Growth Visibility: Regulatory-driven, multi-segment demand ensures longevity.

- Valuation Comfort: Profit CAGR of ~20%+ and ROCE >50% justify premium multiples.

- Positive Outlook: Ideal combination of technology, regulation, and execution strength.

“Tenneco Clean Air India isn’t just participating in India’s emission-control transformation — it’s engineering it.” For investors seeking long-term exposure to India’s clean mobility value chain, this IPO offers a compelling mix of growth, governance, and global-grade manufacturing excellence.

Conclusion

As India’s automotive sector evolves under stricter environmental frameworks, the demand for clean air and efficient component systems is becoming non-negotiable. Tenneco Clean Air India, backed by a century of global expertise and localized cost efficiency, stands poised to capture this megatrend.

Its fundamentals — double-digit ROE, lean working capital, expanding EBITDA margins, and diversified demand base — make it one of the most fundamentally strong IPOs in the automotive component space in recent years.

In essence, this is not merely an IPO — it’s an entry into India’s next growth orbit of cleaner, smarter, and more sustainable mobility manufacturing. For more details related to IPO GMP, SEBI IPO Approval, and Live Subscription, stay tuned to IPO Central.