Abdul Karim Telgi became infamous for leading one of India’s biggest financial scams, rising from modest beginnings to running a massive counterfeit operation. His scheme exposed serious flaws in the systems meant to protect against fraud.

By exploiting these weaknesses, Telgi showed how easily corrupt practices could bypass oversight, underscoring the need for stronger regulations and enforcement. Abdul Karim Telgi’s actions caused significant economic damage and a loss of trust in financial institutions, serving as a clear warning of what can happen when proper supervision is lacking.

Table of Contents

Early Life of Abdul Karim Telgi: Overcoming Adversity

Abdul Karim Telgi was born on 29 July 1961, in Khanapur, Mysore State, and lived an uncomfortable life from a young age. His father worked for the Indian Railways. When Telgi was still a child, his father passed away, leaving the family in financial crisis. To continue his education, Telgi sold fruits and vegetables on trains. Regardless of these struggles, he completed his schooling and earned a Bachelor of Commerce degree from Gogte College of Commerce in 1984.

After completing his education, Telgi went to Saudi Arabia for a better future. He worked abroad for seven years before returning to India. Abdul Karim Telgi started his company, Arabian Metro Travels. The company dealt with fake passports, to help workers migrate to Saudi Arabia. This business involved creating fake documents that allowed labourers to bypass immigration checks, particularly those with issues like an emigration check required a stamp on their passports. This practice, known as “pushing,” was common among manpower exporters and allowed Telgi to profit significantly from the labour market.

During his time in Saudi Arabia, Telgi honed skills that would later aid him in his counterfeiting operations. He learned how to navigate bureaucratic systems and exploit loopholes, which proved invaluable when he returned to India. This small-scale forgery operation would soon grow into a syndicate.

Read Also: Freedom 251 Scam: The Rise and Fall of Infamous Smartphone Scam

The Rise of a Counterfeit Empire

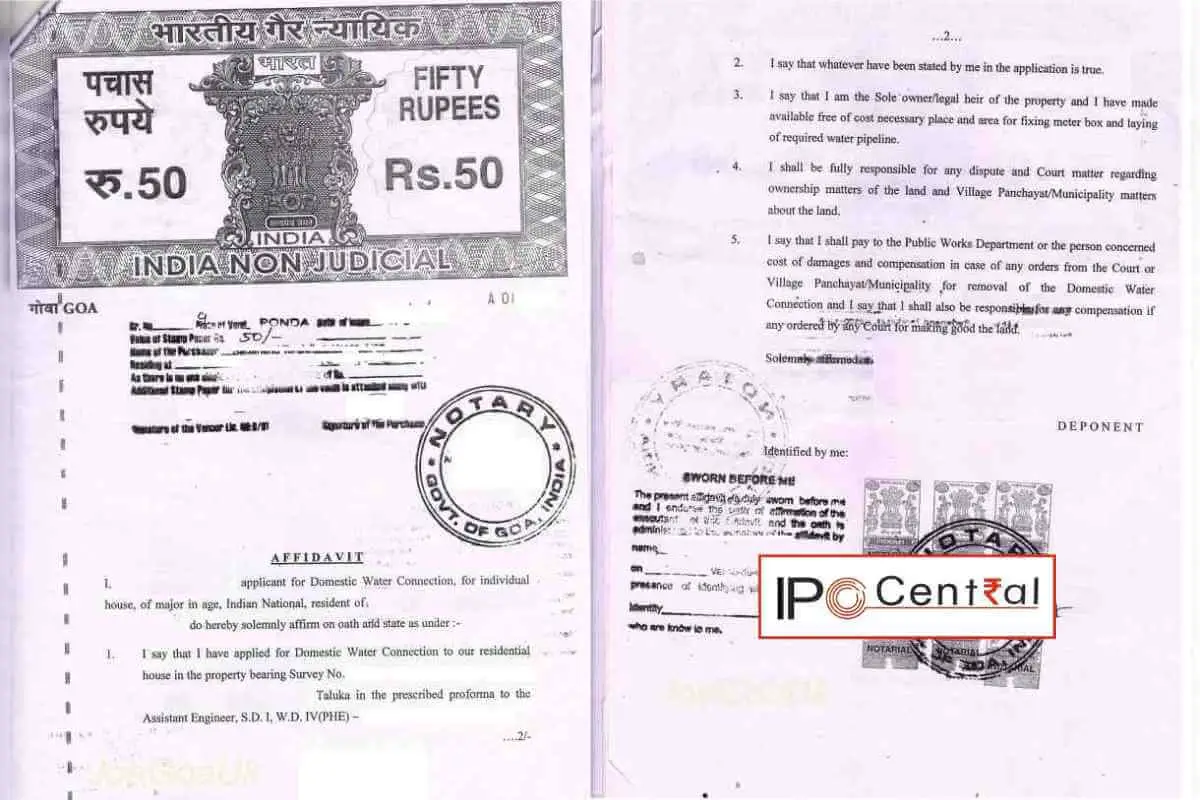

With time, Telgi moved from forging passports to a far bigger scam of counterfeiting stamp papers. He built an intricate network of over 300 agents who distributed fake stamp papers to banks and financial institutions at reduced prices. At its peak, the scam was estimated to be worth around INR 30,000 crore.

Telgi’s operations were highly organized. He obtained printing equipment through government auctions and developed close ties with officials in the Nashik Security Press, enabling him to produce fake stamp papers that were nearly identical to legitimate ones. Bribery helped him avoid detection for years, as corrupt officials turned a blind eye to his activities.

The Scam Unraveled

The combination of his meticulous planning and prevailing corruption in the system allowed this scam to continue for approximately 10 years. However, the scheme began to fall apart in August 2000, when two men caught with counterfeit stamp papers were arrested in Bengaluru. Their confession exposed the vast network Telgi had created. Although initially one among several suspects, Telgi managed to remain out of the authorities’ reach until November 2001, when he was arrested while on a pilgrimage.

As investigations progressed, it became evident that Telgi had not acted alone. Many high-level government and law enforcement officials were implicated. A special investigation team (SIT) revealed extensive corruption that had enabled the scam to continue unchecked for so long. The scam is also better known as stamp paper ghotala.

Stamp Paper Ghotala: The Legal Fallout and Conviction

After a lengthy trial, Telgi was sentenced to 30 years of rigorous imprisonment in January 2006 for his role in the scam, along with a hefty fine of INR 202 crore. His conviction highlighted deep flaws in India’s regulatory framework and led to calls for reform in how stamp papers were issued and monitored.

Reports of Telgi receiving preferential treatment in prison—ranging from access to luxuries to hiring aides for personal care—emerged, raising further controversy about the fairness of his punishment.

Abdul Karim Telgi Wife and Personal Life

Telgi’s personal life was as tumultuous as his professional one. Known for his lavish spending, particularly at dance bars, he reportedly once gifted INR 90 lakh in a single night to bar dancer Tarannumn Khan, a relationship that made headlines.

He was married to Shahida Telgi, who also faced legal repercussions due to her involvement in the scam. Abdul Karim Telgi had one daughter named Sana. In 2017, following Telgi’s death, Abdul Karim Telgi’s wife Shahida expressed her desire to donate their properties worth INR 100 crores to the government. These properties included agricultural land and commercial complexes that were not seized during the investigations due to being registered under her name. However, no further update is available if the properties were indeed taken over by the government.

Abdul Karim Telgi Death

Abdul Karim Telgi’s health got worse while he was in prison. He suffered from several health issues like diabetes, high blood pressure, and kidney failure. On 23 October 2017, due to serious health complications, Telgi took his last breath at Bangalore Medical College. Abdul Karim Telgi death reason was meningitis. The death of Telgi not only ended a controversial life but also left a lasting impact on how people talked about financial frauds in India.

Lessons From the Telgi Scam

The Telgi scam revealed big weaknesses in India’s financial system and showed how badly changes were needed. After the scandal, the government started making stamp paper processes digital and tried to make things more transparent.

Telgi’s life is a reminder of how unchecked ambition and corruption can lead to destruction. His story has been portrayed in movies and web series, but the lessons from his downfall are still relevant today, warning us about what can happen when public institutions aren’t properly watched over.