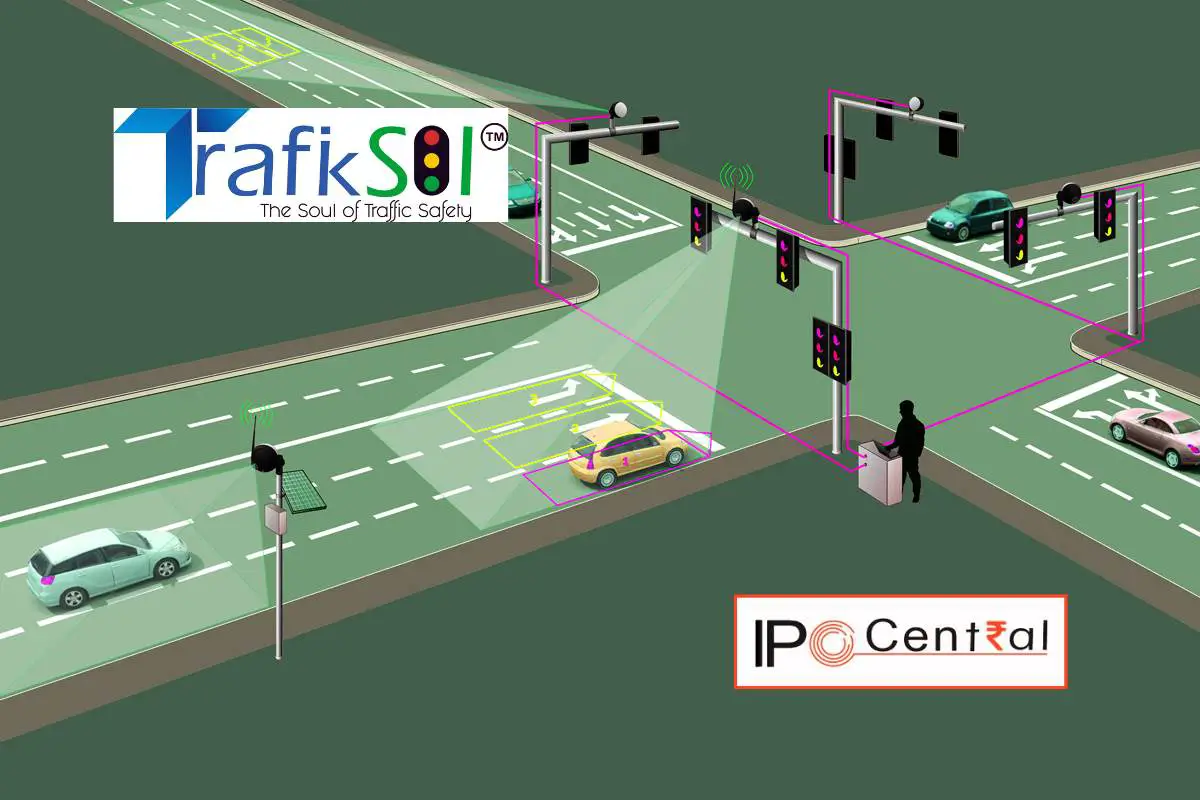

Trafiksol ITS IPO description – TrafikSol ITS Technologies has established a wide range of consulting and design services, the company specializes in designing, managing, and integrating Intelligent Transportation Systems (ITS) for roads and tunnels. These solutions are known for their security, resilience, and scalability, tailored to meet the specific requirements of clients in the areas of road infrastructure, tunnel management, and urban environments.

Trafiksol is a specialized Engineering, Procurement, and Construction (EPC) contractor that takes on various projects in fields such as Advanced Traffic Management Systems (ATMS), Toll Management Systems (TMS), and Tunnel Management Systems. As an EPC contractor, Trafiksol offers a comprehensive range of services, including design, engineering, procurement, and construction for large-scale infrastructure projects. Trafiksol ITS Technologies contracts in traffic management, toll management, and tunnel management involve the design, implementation, and construction of infrastructure projects aimed at enhancing transportation efficiency, safety, and revenue collection. The Advanced Traffic Management System (ATMS) focuses on designing, installing, and integrating Intelligent Transportation Systems (ITS) to improve traffic flow, safety, and efficiency on roadways.

Promoters of Trafiksol ITS – Jitendra Narayan Das and Poonam Das

Table of Contents

Trafiksol ITS IPO Details

| Trafiksol ITS IPO Dates | 10 – 12 September 2024 |

| Trafiksol ITS Issue Price | INR 66 – 70 per share |

| Fresh issue | 64,10,000 shares (INR 42.31 – 44.87 crore) |

| Offer For Sale | NIL |

| Total IPO size | 64,10,000 shares (INR 42.31 – 44.87 crore) |

| Minimum bid (lot size) | 2,000 shares (INR 1,40,000) |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | BSE SME |

Trafiksol ITS Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 27.91 | 36.30 | 65.81 |

| Expenses | 25.89 | 31.98 | 49.09 |

| Net income | 2.05 | 4.78 | 12.09 |

Trafiksol ITS Offer News

- Trafiksol ITS RHP

- Trafiksol ITS Draft Prospectus

- ASBA IPO Forms

- Live IPO Subscription Status

- Highest SME IPO Subscription in 2024

Trafiksol ITS Valuations & Margins

| FY 2022 | FY 2023 | FY 2024 | |

| EPS | 1.15 | 2.68 | 6.77 |

| PE ratio | – | – | 9.75 – 10.34 |

| RONW (%) | 28.07 | 39.53 | 35.44 |

| NAV | 19.11 | 4.10 | 6.77 |

| ROCE (%) | 21.08 | 30.71 | 26.23 |

| EBITDA (%) | 8.86 | 13.83 | 27.02 |

| Debt/Equity | 0.69 | 0.66 | 0.31 |

Trafiksol ITS Technologies IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| 16 September 2024 | 82 | – | 1,15,000 |

| 14 September 2024 | 82 | – | 1,15,000 |

| 13 September 2024 | 82 | – | 1,15,000 |

| 12 September 2024 | 82 | – | 1,15,000 |

| 11 September 2024 | 78 | – | 1,08,000 |

| 10 September 2024 | 75 | – | 1,02,000 |

| 9 September 2024 | 72 | – | 95,000 |

| 7 September 2024 | 50 | – | 68,000 |

| 6 September 2024 | 50 | – | 68,000 |

Trafiksol ITS Technologies IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Total |

| Shares Offered | 12,18,000 | 9,14,000 | 21,34,000 | 42,66,000 |

| 12 Sep 2024 | 129.22 | 699.75 | 317.66 | 345.72 |

| 11 Sep 2024 | 0.00 | 71.84 | 116.29 | 73.57 |

| 10 Sep 2024 | 0.00 | 21.07 | 36.72 | 22.88 |

The market maker reservation portion of 3,22,000 shares and anchor allocation of 18,22,000 shares are not included in the above calculations.

Trafiksol ITS Technologies IPO Allotment Status

Trafiksol ITS IPO allotment status is now available on the Maashitla Securities website. Click on Maashitla Securities IPO weblink to get allotment status.

Trafiksol ITS IPO Dates & Listing Performance

| IPO Opening Date | 10 September 2024 |

| IPO Closing Date | 12 September 2024 |

| Finalization of Basis of Allotment | 13 September 2024 |

| Initiation of refunds | 16 September 2024 |

| Transfer of shares to demat accounts | 16 September 2024 |

| IPO Listing Date | Listing postponed |

| Opening Price on BSE SME | Coming soon |

| Closing Price on BSE SME | Coming soon |

Trafiksol ITS Technologies Offer Lead Manager

EKADRISHT CAPITAL PRIVATE LIMITED

406, Summitt Business Bay, Chakala, Andheri Kurla Road, Andheri

East, Chakala MIDC, Mumbai, 400 093, Maharashtra, India.

Phone: +91 89286 31037 / +91 83838 78744

Email: [email protected]

Website: www.ekadrisht.com

Trafiksol ITS Technologies Offer Registrar

MAASHITLA SECURITIES PRIVATE LIMITED

451, Krishna Apra Business Square,

Netaji Subhash Place, Pitampura, Delhi – 110034

Phone: 011-45121795

Email: [email protected]

Website: www.maashitla.com

Trafiksol ITS Technologies Issue Contact Details

TRAFIKSOL ITS TECHNOLOGIES LIMITED

2nd Floor, B 68, Sector 63, Noida, Gautam Buddha Nagar,

Noida 201 301, Uttar Pradesh, India

Phone: +91 – 8744050058

E-mail: [email protected]

Website: www.trafiksol.com

IPO FAQs

What is Trafiksol ITS offer size?

Trafiksol ITS offer size is INR 42.31 – 44.87 crores.

What is Trafiksol ITS offer price band?

Trafiksol ITS public offer price is INR 66 – 70 per share.

What is the lot size of Trafiksol ITS IPO?

Trafiksol ITS IPO lot size is 2,000 shares.

What is Trafiksol ITS IPO GMP today?

Trafiksol ITS IPO GMP today is INR 82 per share.

What is Trafiksol ITS kostak rate today?

Trafiksol ITS kostak rate today is INR NA per application.

What is Trafiksol ITS Subject to Sauda rate today?

Trafiksol ITS is Subject to Sauda rate today is INR 1,15,000 per application.