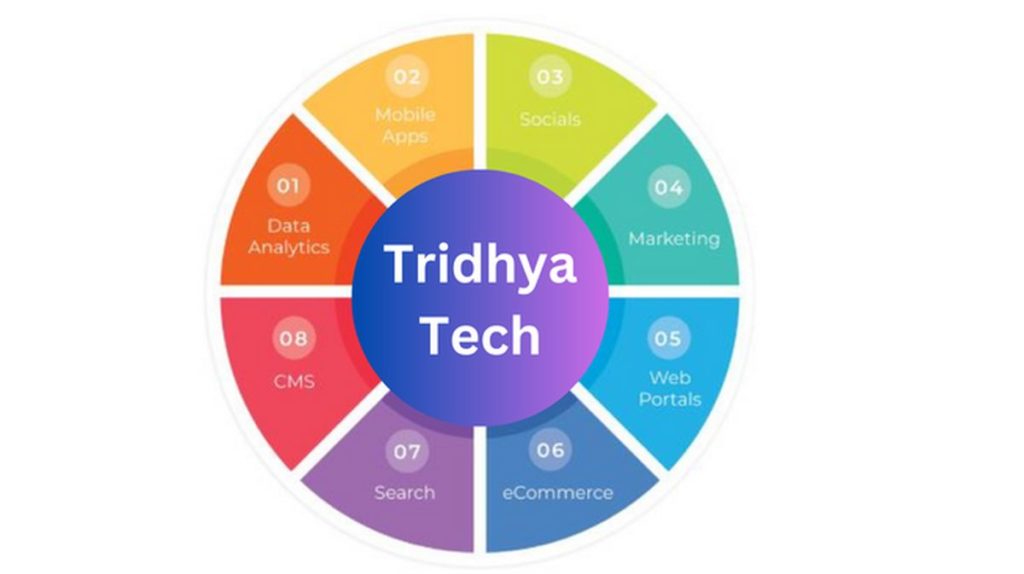

Tridhya Tech IPO description – Incorporated in 2018, Tridhya Tech is engaged in full-service Software Development which includes all IT services and resources. It provides turnkey consultancy services to various industries like e-commerce, Real estate, transport, Logistics, Insurance, and other sectors.

The company provides services related to e-commerce development, Enterprise Content Management, Bespoke Web Management, Mobile App, Development, API Development, Product Support & Maintenance, Front End Development, and Graphic design. As on 31 January 2023, its employee strength stood at 164 including permanent and on-call software professionals/technicians in the company.

The company has adopted an inorganic growth strategy for the growth of the business. In the month of January 2022, the company acquired Concentric IT Services Private Limited (Concentric), a software development company by acquiring 100 % equity. In the month of December 2022, the company acquired Basilroot Technologies Private Limited (BTPL), and also Vedity Software Private Limited (Vedity) software development companies by acquiring 100% equity.

Tridhya Tech has a strong presence in the international market i.e., Australia, Canada, Estonia, France, Germany, Israel, Italy, Japan, Mauritius, Netherlands, Qatar, Singapore, Switzerland, UAE, UK, USA. In the domestic market, its customers are based in Maharashtra, Gujarat, Punjab, Telangana, and Karnataka.

Promoters of Tridhya Tech – Ramesh Marand and Vinay Dangar

Table of Contents

Tridhya Tech IPO Details

| Tridhya Tech IPO Dates | 30 Jun – 5 Jul 2023 |

| Tridhya Tech Offer Price | INR 35 – 42 per share |

| Fresh issue | 62,88,000 shares (INR 26.41 crore) |

| Offer For Sale | NIL |

| Total IPO size | 62,88,000 shares (INR 26.41 crore) |

| Minimum bid (lot size) | 3,000 shares (INR 1,26,000) |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | NSE SME |

Tridhya Tech Financial Performance

| FY 2022 | 9M FY 2023 | |

| Revenue | 13.72 | 13.71 |

| Expenses | 9.55 | 11.26 |

| Net income | 3.39 | 2.85 |

Tridhya Tech Offer News

- Tridhya Tech RHP

- Tridhya Tech Draft Prospectus

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Allotment Status

Tridhya Tech Valuations & Margins

| FY 2020 | FY 2021 | FY 2022 | |

| EPS | 2.41 | 8.59 | 2.36 |

| PE ratio | – | – | 14.83 – 17.80 |

| RONW (%) | 156.45 | 84.78 | 22.37 |

| NAV | 15.43 | 50.66 | 4.94 |

| ROCE (%) | 55.83 | 19.38 | 26.40 |

| EBITDA (%) | – | – | 41.47 |

| Debt/Equity | 4.34 | 6.78 | 0.49 |

Tridhya Tech IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| 12 July 2023 | 2 | – | – |

| 11 July 2023 | 2 | – | – |

| 10 July 2023 | 5 | – | 20,000 |

| 8 July 2023 | 10 | – | 25,000 |

| 7 July 2023 | 10 | – | 15,000 |

| 6 July 2023 | 15 | – | 15,000 |

| 5 July 2023 | 10 | – | 7,500 |

| 4 July 2023 | 10 | – | 7,500 |

| 3 July 2023 | 10 | – | 7,500 |

| 1 July 2023 | 10 | – | 7,500 |

| 30 June 2023 | 10 | – | 7,500 |

Tridhya Tech IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Total |

|---|---|---|---|---|

| Shares Offered | 1,554,000 | 1,212,000 | 2,091,000 | 4,857,000 |

| 5 Jul 2023 | 15.62 | 134.82 | 67.61 | 67.75 |

| 4 Jul 2023 | 1.63 | 2.65 | 10.76 | 5.81 |

| 3 Jul 2023 | 0.39 | 0.67 | 1.99 | 1.30 |

| 30 Jun 2023 | 0.00 | 0.33 | 0.57 | 0.33 |

Tridhya Tech IPO Allotment Status

Tridhya Tech IPO allotment status is now available on Link Intime’s website. Click on this link to get allotment status.

Tridhya Tech IPO Dates & Listing Performance

| IPO Opening Date | 30 June 2023 |

| IPO Closing Date | 5 July 2023 |

| Finalization of Basis of Allotment | 10 July 2023 |

| Initiation of refunds | 11 July 2023 |

| Transfer of shares to demat accounts | 12 July 2023 |

| IPO Listing Date | 13 July 2023 |

| Opening Price on NSE SME | INR 42 per share (no change) |

| Closing Price on NSE SME | INR 44.10 per share (up 5%) |

Tridhya Tech Offer Lead Manager

INTERACTIVE FINANCIAL SERVICES LIMITED

612, 6th Floor, Shree Balaji Heights,

Kokilaben Vyas Marg, Ellisbridge,

Ahmedabad – 380 009, Gujarat, India

Phone: 079 46019796

Email: [email protected]

Website: www.ifinservices.in

Tridhya Tech Offer Registrar

LINK INTIME INDIA PRIVATE LIMITED

C-101, 1st Floor, 247 Park

L.B.S. Marg, Vikhroli West

Mumbai – 400 083, Maharashtra

Phone: +918108114949

Email: [email protected]

Website: www.linkintime.co.in

Tridhya Tech Contact Details

TRIDHYA TECH LIMITED

401, One World West, Near Ambli T-Junction

200′ S. P. Ring Road, Bopal Ahmedabad – 380058

Phone: +919571831080

E-mail: [email protected]

Website: www.tridhyatech.com

IPO FAQs

What is Tridhya Tech IPO offer size?

Tridhya Tech’s offer size is INR 26.41 crores.

What is the Tridhya Tech offer price band?

Tridhya Tech’s public offer price is INR 35 – 42 per share.

What is the lot size of Tridhya Tech’s public offer?

Tridhya Tech offer lot size is 3,000 shares.

What is Tridhya Tech IPO GMP today?

Tridhya Tech IPO GMP today is INR 2 per share.

What is Tridhya Tech kostak rate today?

Tridhya Tech kostak rate today is INR NA per application.

What is Tridhya Tech Subject to Sauda rate today?

Tridhya Tech Subject to Sauda rate today is INR NA per application.