Afcons Infrastructure, a prominent player in the construction and engineering sector, is set to launch its initial public offering (IPO) from October 25 to October 29, 2024. With a price band of INR 440 to INR 463 per share, the IPO aims to raise a total of INR 5,430 crores through a combination of fresh issues and an offer for sale. As investors weigh their options, this Afcons Infrastructure IPO review delves into the company’s fundamentals, financial health, and market positioning to assess whether this IPO is a worthy investment.

Table of Contents

Afcons Infrastructure IPO Review: Company Overview

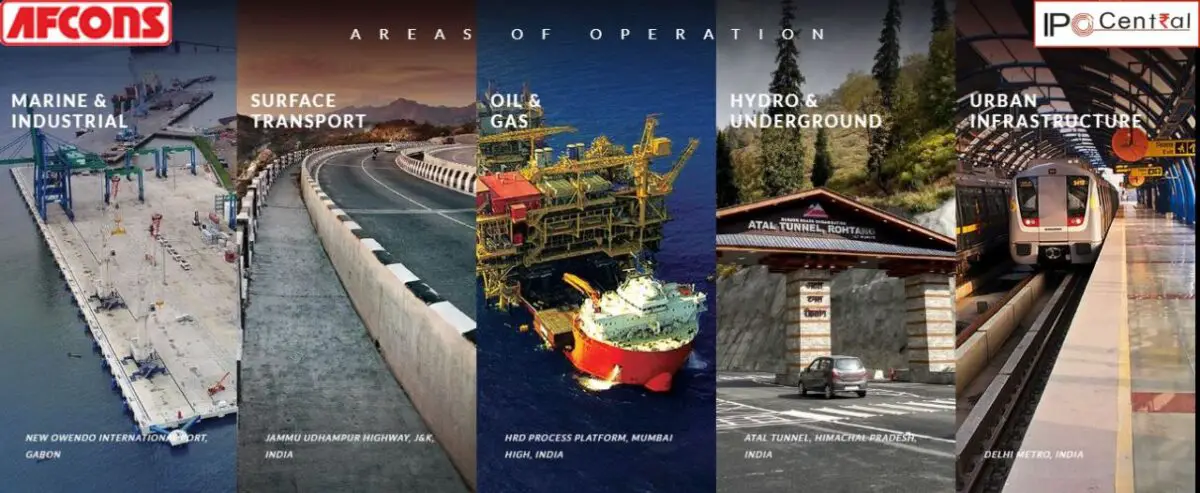

Founded in 1959 as part of the Shapoorji Pallonji Group, Afcons Infrastructure has established itself as a key player in the infrastructure sector. The company operates across multiple verticals including marine and industrial infrastructure, urban infrastructure, and transportation. Notably, it has executed several landmark projects both domestically and internationally, showcasing its capability to handle complex engineering challenges.

The company’s diversified portfolio not only enhances its revenue streams but also positions it favorably against competitors. Afcons has been involved in numerous first-of-their-kind projects in India and abroad, which speaks volumes about its innovative approach and technical expertise.

Afcons Infrastructure IPO Review: Financial Performance

Afcons Infrastructure’s financial metrics present a compelling case for potential investors. The company reported revenues of INR 13,646.87 crores for FY24, up from INR 11,269.54 crores in FY22—an impressive growth trajectory that reflects strong demand for its services. Profit after tax (PAT) also saw a significant increase from INR 357.60 crores to INR 449.73 crores during the same period.

Key financial highlights include:

Revenue Growth: The company has consistently increased its revenue over the past three years.

Profitability: Afcons recorded a PAT margin of 3.30%, placing it second among its peers like L&T.

Return on Capital Employed (ROCE): With ROCE of 20.18%, Afcons demonstrates efficient utilization of capital.

Debt Management: The debt-to-equity ratio stands at a manageable 0.91, indicating prudent financial management despite operating in a capital-intensive industry.

The order book is another positive indicator; it stood at INR 31,747.42 crores as of Q1 FY25, ensuring a solid pipeline for future revenue generation.

Afcons Infrastructure IPO Review: Industry Positioning

In terms of market positioning, Afcons Infrastructure is noteworthy for its operational efficiency relative to peers. While it may be the second smallest by revenue among competitors, its strong financial metrics—including superior ROCE and PAT margins—underscore its operational prowess.

The construction sector in India is poised for growth due to increased government spending on infrastructure projects and urbanization trends. As such, Afcons is well-positioned to capitalize on these opportunities given its established reputation and robust project execution capabilities.

Here is a comparison of Afcons with its closest competitors which highlights the company’s performance on key operational parameters.

| Parameter | Afcons Infrastructure | Kalpataru | Dilip Buildcon |

| Revenue (INR cr) | 13,267.49 | 19,626.43 | 12,011.90 |

| RONW (%) | 12.58 | 10.17 | 4.44 |

| PE Ratio | 37.86 | 40.1 | 40.3 |

Afcons Infrastructure IPO Review: Objectives of the IPO

The proceeds from the IPO will be allocated towards several strategic initiatives:

Capital Expenditure: INR 1,250 crores will be directed towards purchasing construction equipment.

Working Capital: INR 320 crores will support long-term working capital requirements.

Debt Repayment: INR 600 crores will be used for prepayment or scheduled repayment of outstanding borrowings.

These allocations indicate that Afcons is focused on strengthening its operational capacity while managing its debt effectively—an essential strategy in a capital-intensive industry.

Afcons Infrastructure IPO Analysis: Valuation Considerations

At the upper end of the price band (INR 463 per share), Afcons’ post-listing market capitalization would be approximately INR 17,029 crores. Given the company’s consistent revenue growth and profitability metrics, this valuation appears reasonable when compared with industry standards.

However, potential investors should consider the implications of rising debt levels alongside ambitious expansion plans. While the current debt-to-equity ratio is manageable, any significant increase in borrowings could impact financial stability if not matched with corresponding revenue growth.

Afcons Infrastructure IPO Review: Market Sentiment

Investor sentiment towards infrastructure stocks can be volatile due to macroeconomic factors such as government policies and economic cycles. However, with India’s focus on infrastructure development as part of its economic strategy, companies like Afcons are likely to benefit from favorable government initiatives.

Investor confidence will also hinge on the company’s ability to maintain its growth trajectory post-IPO. Given that infrastructure projects often have long gestation periods, Afcons must effectively communicate its long-term vision to reassure investors about sustained performance. At the same time, the importance of infrastructure in India’s growth story is well-documented.

Afcons Infrastructure IPO Analysis Conclusion: Should You Invest?

The Afcons Infrastructure IPO presents an intriguing opportunity for investors seeking exposure to India’s burgeoning infrastructure sector. The company’s robust financial performance, strong order book, and strategic use of IPO proceeds make it an attractive proposition.

However, potential investors should remain cautious about rising debt levels and ensure they are comfortable with the inherent risks associated with investing in capital-intensive sectors like construction. Overall, it comes across as an interesting bet on a key sector so investors may apply for medium to long term.

In summary:

Pros:

– Strong revenue growth and profitability.

– Efficient capital utilization (high ROCE).

– Solid order book providing future revenue visibility.

Cons:

– Rising debt levels warrant scrutiny.

– Market sentiment can be influenced by broader economic factors.