Alkem Laboratories IPO opens on 8 December, marking the second biggest public offering in India this year. The company has set the price band of its IPO between INR1,020 and INR1,050 per share. At the upper end of the price band, the public offer of 12.85 million shares will mobilize INR13.5 billion. Alkem Laboratories is one of the largest pharmaceutical players of India and the public issue will be India’s second largest IPO this year after InterGlobe Aviation that raised INR30 billion in October.

As mentioned in the draft red herring prospectus, Alkem Laboratories IPO will not involve issue of new shares and thus, all issue proceeds will go to existing shareholders. Promoted by Samprada Singh and his brother B N Singh, this Mumbai-based company will see its shares listed on the BSE and the NSE post the IPO. The public issue will be managed by Nomura Financial Advisory and Securities (India), Axis Capital, J P Morgan India and Edelweiss Financial Services.

Read Also: Alkem Laboratories gets SEBI approval for IPO

Issue Details

| IPO dates | 8-10 December 2015 |

| Price Band | INR1,020-1,050 per share |

| Issue Size | INR13.11 – 13.5 billion |

| Offer for Sale | 12,853,442 shares |

| Lot size | 14 shares |

Promoters hold 53.7% in the company while another 17% is held by promoter group. Among the prominent shareholders tendering their shares are Nawal Kishore Singh (2.39 million shares), Jayanti Sinha (1.43 million shares), Rajesh Kumar (1.19 million shares), Anju Singh (1.19 million shares), Rekha Singh (1.19 million shares), and Anita Singh (1.18 million shares).

Read Also: Top Pharma Stocks in India

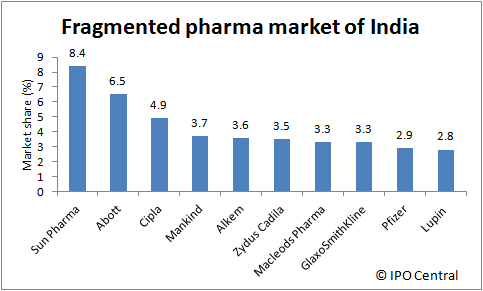

A major player with 3.6% market share

Alkem is a major player in the pharma industry and is engaged in the production and sale of branded generics, generic drugs, active pharmaceutical ingredients (APIs) and Nutraceuticals. As on March 2015, it held a market share of 3.6% in the domestic formulations market. This is possible due to the highly fragmented nature of the market which means the top 10 players in the industry account for just 42.9% market. Even the leader Sun Pharma holds less than 10% market share.

Ok, why should I care?

Prospective investors should care because a puny market share in a big industry translates into serious business. This is the case with Alkem whose 3.6% market share means annual turnover of INR28.3 billion in India. And this has been growing at a healthy double-digit annual rate. Alkem generates nearly 75% of its revenues from the domestic market while the rest comes from international markets. This means Alkem’s annual consolidated revenues stand at INR37.88 billion. Now we are talking serious business.

Pharma is hit or miss, right?

Right and wrong! New drug programs are known to be risky and it is not wrong that it is a high stakes game. Regulatory approvals (and their absence) can make or break fortunes for investors in small companies.

However, Alkem is a sweet spot as it plays the generics game. Generic drugs are pharmaceutical products that are not protected by patents. These are drugs marketed by different companies but which contain the same active ingredients. Since we are talking about products without patents, the cost structure to develop these drugs is considerably lower. At the same time, regulations don’t play spoilsport here as these products are already selling in the market.

Between 2015 and 2017, drugs worth USD43.8 billion in annual sales are expected to come out of patent protection, providing serious opportunity to generic players like Alkem.

Financial review

No rhetoric is required here to persuade someone to believe that Alkem’s business is rock solid. The figures speak for themselves. As highlighted below, the company has been registering higher sales and profits year after year. This uptrend has continued in the six months of FY2016 as well as revenues jumped 36% to INR25.7 billion while profits more than doubled to 4.3 billion.

This is worth highlighting that Alkem’s margins have come under pressure in recent years. However, not too much should be read here as intense competition and lower profit margins dictate success in the generics segment. As long as the growth in the overall business outpaces the margin erosion, I’m a happy investor.

| Alkem’s consolidated financial performance (in INR million) | |||||

| FY 2011 | FY 2012 | FY 2013 | FY 2014 | FY 2015 | |

| Revenue from operations | 16,907 | 20,156 | 24,952 | 31,260 | 38,887 |

| Profit before tax | 3,313 | 4,333 | 4,016 | 4,299 | 5,167 |

| Net profit | 2,955 | 4,065 | 3,838 | 4,353 | 4,625 |

| Net margin (%) | 17.5 | 20.2 | 15.4 | 13.9 | 11.9 |

Source: Alkem’s DRHP

Conclusion

Considering the strong business performance of the company in recent years, investors have a chance to own a winner through this IPO. The relevant question here is related to IPO pricing. We have seen some crazy valuations this year in IPOs and surprisingly, some of these eventually went on to reward investors. This indicates that risk appetite is rising in India, especially on plays that have demonstrated profitability track record.

Going by this standard, Alkem Laboratories IPO is eligible for a steep premium over its listed peers. Thankfully, IPO investors are saved in this case as the price at the upper end of the band values the shares at a price by earnings (PE) ratio of 27.1. While this is based on earnings for FY2015, Alkem has posted a strong performance in the six months ended 30 September 2015, resulting in consolidated earnings per share (EPS) to INR36.1. A simple analysis reveals that even if the company just replicates the first-half, its full year EPS will be INR72.2 which will bring down the PE ratio to just 14.5 times. This is more than reasonable valuation for a successful company with a high degree of earnings visibility.

Considering these factors, Alkem Laboratories IPO appears to be a safe bet for investors even though there is no discount for retail investors.

Good like alkem

very good for financial helth

well for all