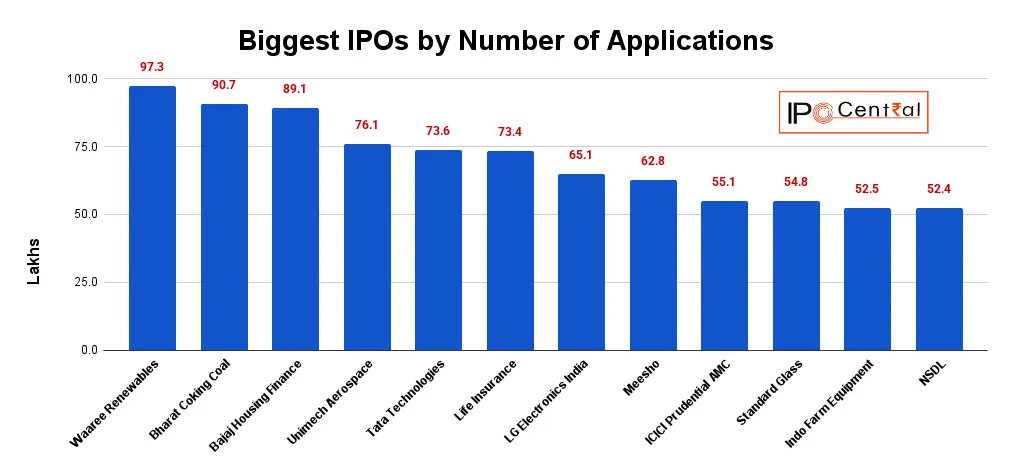

The Indian primary markets have seen a strong inflow of funds through IPOs in recent years and some of these public offers have made records of sorts in terms of demand from investors. Here, we present you the list of the biggest IPOs by applications in India. This most popular IPO list contains all mainboard public offers on NSE and BSE.

Please note that this article deals with the IPOs that received the most number of applications. On similar lines, we have an article about the biggest IPOs in India by issue size.

In recent years, there has been a surge in IPO activities within India’s primary market. IPOs hold a special significance for investors, representing a company’s initial issuance of shares to the general public. Despite concerns among some investors about the potential impact of substantial IPOs on market liquidity, recent developments indicate that the market is adequately equipped to manage such significant offerings. Let’s delve into the biggest IPOs by applications that have played a significant role in shaping the market.

Table of Contents

List of Largest IPOs by Applications in India

#1 Waaree Energies IPO: Leading Among the Biggest IPOs by Applications – 97.33 Lakh Applications

Waaree Energies is a leading solar energy solutions provider in India. The company offers a wide range of products and services, including solar modules, solar power plants, and energy storage systems. Their commitment to sustainability and innovation has made them a trusted name in the renewable energy industry.

The IPO attracted a record 97.33 lakh applicants at the upper end of its price band, which is the highest number for any Indian IPO to date. On its first day, the offering was oversubscribed by 3.47 times. Overall, the IPO received bids totaling INR 2.41 lakh crore, resulting in a total demand of 76.34 times. Specifically, the quota for qualified institutional buyers (QIBs) was subscribed 208.63 times, while the allocation for non-institutional investors (NIIs) saw a subscription of 62.49 times. The retail portion was subscribed 10.79 times, garnering bids of INR 16,788 crore. Additionally, company employees submitted bids for a total of INR 354.15 crore, for the reserved INR 65 crore for them.

#2 Bharat Coking Coal IPO: Runner Up in Biggest IPOs by No. of Applications – 90.68 Lakh Applications

Bharat Coking Coal is a subsidiary of Coal India and a Mini Ratna PSU. The company is India’s largest coking coal producer, which accounted for 58.50% of domestic coking coal production in Fiscal 2025 and holds approximately 7.91 billion tonnes of coking coal reserves as of 1 April 2024, positioning it as the only prime coking coal source in the country.

The IPO met with an exceptional response, achieving full subscription within the first hour of launch and concluding with an overall subscription of 146x. The institutional segment saw the highest demand, with Qualified Institutional Buyers (QIBs) oversubscribing by 310.8x, followed closely by High Net-worth Individuals (HNIs) at 258x. The retail and shareholder categories recorded robust participation at 49.2x and 87.2x, respectively, while the employee portion was subscribed approximately 5.2x

#3 Bajaj Housing Finance IPO: Another 2024 Entry Among the Most Popular IPOs by Applications – 89.07 Lakh Applications

Bajaj Housing Finance – a subsidiary of Bajaj Finserv and Bajaj Finance – is among India’s fastest-growing housing finance companies. The company focuses on individual retail housing loans, complemented by an assortment of lease rental discounting and developer loans, serving a broad customer base from individual homebuyers to large developers.

The IPO was fully subscribed within hours and eventually got subscribed 63.5 times. QIBs led the charge with 209.3X subscriptions while the HNI quota was covered 41.4 times. Retail investor’s quota was subscribed 6.9 times and the Employee portion was covered nearly 2X. The IPO went on to reward investors well with a listing day gain of 135.7%.

#4 Unimech Aerospace: 76.1 Lakh Applications

Unimech Aerospace, the Bengaluru-based manufacturer of high-precision airframe/airport tooling used in maintenance, repair and overhaul (MRO) for aircraft and aircraft engine manufacturers, was launched in December 2024.

Given its unique business model of low-volume but high-margin products, the IPO turned out to be quite popular on Dalal Street. It attracted over 76 lakh applications while the QIB and NII portions were subscribed 317.63 and 263.78 times, respectively. On listing, Unimech rewarded IPO investors with 75% gains.

#5 Tata Technologies: 73.6 Lakh Applications

Tata Technologies is a global leader in engineering, digital services, product development, and outsourcing. The company has a diversified global presence across Asia Pacific, Europe, and North America and partners with many of the largest manufacturing enterprises in the world.

Tata Technologies IPO was a highly anticipated one and generated significant interest among the general public. Despite the IPO size of INR 3,042 crore, the offering received a decent subscription at nearly 69X over three days, with full subscriptions in all five categories.

The shares went on to reward investors even further and closed the first day at INR 1,313 per share, showing a growth of 162.60% on retail investors’ IPO price.

#6 Life Insurance Corporation of India: 73.4 Lakh Applications

LIC is the largest life insurer in India with a 64.1% market share in terms of Gross Written Premium (GWP), a 66.2% market share in terms of New Business Premium (NBP), a 74.6% market share in terms of the number of individual policies issued, an 81.1% market share in terms of the number of group policies issued for Fiscal 2021, as well as by the number of individual agents (1.35 million), which comprised 55% of all individual agents in India as at 31 March 2021.

#7 LG Electronics India: Biggest IPOs by Applications in 2025 – 65 Lakh+ Applications

LG Electronics India IPO received over 65 lakh (6.5 million) applications, making it one of the most heavily subscribed IPOs in Indian history for 2025. The overall subscription stood at 54.02 times, with more than 385 crore shares applied for against the 7.13 crore shares on offer. LG India is a market leader in home appliances and consumer electronics with a strong presence in 54 countries across Asia, Africa, and Europe. This IPO attracted record-breaking bids worth INR 4.4 lakh crore, reflecting strong investor interest and making it one of the largest in terms of applications and subscription value.

#8 Meesho: 62.75 Lakh Applications

Meesho’s December 2025 IPO drew strong investor interest, attracting 62.75 lakh applications. On the final day, the issue was subscribed 79.02x overall, led by QIBs at 120.18x, NIIs at 38.15x, and Retail at 19.04x, underscoring broad-based demand across investor categories. Meesho’s IPO listed at INR 162.50 per share, 53.23% gains from IPO allotment price of INR 111 per share. The stock’s post-listing performance has remained robust—as of 22 December 2025, Meesho is trading at INR 215.79, representing an ~94.4% gain over its allotment price.

#9 ICICI Prudential AMC: 55 Lakh Applications

ICICI Prudential AMC, India’s largest asset management company, is the sole entry in this list from the famed and old ICICI group. The IPO, launched in December 2025, was well received with over 55 lakh applications and an overall subscription of 39.17 times. The offer was a hit with anchor investors and several of the top mutual funds, insurance companies and marquee investors featured among the backers.

The icing on the cake was the shareholder reservation for ICICI Bank investors which also received a healthy subscription of nearly 10 times.

#10 Standard Glass: 54.8 Lakh Applications

Standard Glass Lining launched its IPO in December 2025. The IPO witnessed overwhelming investor appetite, drawing a total of 54.8 lakh applications. By the close of the bidding period, the issue was subscribed 183.2x overall, driven by massive interest from QIBs at 331.6x, followed by NIIs at 268.5x, and the Retail segment at 64.9x. This strong subscription profile highlights robust confidence in the company’s specialized industrial manufacturing capabilities. The stock debuted at INR 163.28 per share, marking a 16.6% premium over its allotment price of INR 140.00.

#11 Indo Farm Equipment: 52.5 Lakh Applications

The Indo Farm Equipment IPO concluded in January 2025, securing a staggering 229.68x overall subscription. This massive demand was spearheaded by Non-Institutional Investors (NIIs) with an overwhelming 503.83x subscription, followed by QIBs at 242.40x and Retail investors at 104.92x. Such high subscription levels reflect intense market confidence in the company’s dual presence in the agricultural tractor and industrial crane segments. The stock made a powerful entry on the exchanges, listing at INR 273.69 per share, delivering a 27.30% listing premium over the upper price band of INR 215.00.

#12 NSDL: 52.4 Lakh Applications

The National Securities Depository (NSDL) IPO, which debuted in August 2025, witnessed strong participation from the investor community, attracting a total of 52.4 lakh applications. On the final day of bidding, the issue was subscribed 41.01x overall, primarily driven by QIBs at 103.97x, followed by NIIs at 34.98x, and Retail investors at 7.73x. NSDL’s stock made its market debut at INR 936 per share, representing a 17% listing gain over its allotment price of INR 800.00.

#13 Reliance Power: 48 Lakh Applications

Reliance Power is a part of the Reliance Group, one of India’s largest business houses. Reliance Power has been established to develop, construct, and operate power projects both in India as well as internationally. The company on its own and through its subsidiaries has a large portfolio of power generation capacity, both in operation as well as capacity under development.

#14 DOMS: 44 Lakh Applications

Valsad-based stationary major DOMS approached the primary market at the end of 2023 when the secondary market was in full bloom. The strong fundamentals of the company, coupled with the buoyant market conditions, resulted in healthy demand for the IPO even though it was priced at a PE ratio of 43.

Nevertheless, the company received an overwhelming response, and over 44 lakh applications were filed by investors, most notably by QIBs and retailers.

#15 HDB Financial Services: 42.7 Lakh Applications

Being an HDFC Bank-subsidiary, the offer of HDB Financial Services was eagerly awaited. The company didn’t disappoint investors with its pricing which was kept at INR 740 per share. This was much lower than the price the stock was commanding in the unlisted market. Its post-issue PE ratio of 28 meant that it scored well in terms of valuations too.

Naturally, this drove investors to subscribe heavily to the offer and the overall demand stood at over 42 lakh applications despite five other mainboard IPOs being active around the time.

List of Biggest IPOs by Applications

| IPO Name | No. of Applications |

|---|---|

| Waaree Renewables | 97.3 |

| Bharat Coking Coal | 90.7 |

| Bajaj Housing Finance | 89.1 |

| Unimech Aerospace | 76.1 |

| Tata Technologies | 73.6 |

| Life Insurance Corporation | 73.4 |

| LG Electronics India | 65.1 |

| Meesho | 62.8 |

| ICICI Prudential AMC | 55.1 |

| Standard Glass | 54.8 |

| Indo Farm Equipment | 52.5 |

| NSDL | 52.4 |

| Reliance Power | 48.0 |

| Highway Infrastructure | 46.6 |

| Urban Company | 45.2 |

| Quadrant Future Tek | 44.8 |

| GNG Electronics | 44.4 |

| Aequs | 44.2 |

| DOMS | 44.0 |

| HDB Financial Services | 42.7 |

| Corona Remedies | 42.4 |

| Tenneco Clean Air | 40.8 |

| Aditya Infotech | 41 |

| Glenmark Life Sciences | 39.5 |

| SBI Cards | 39.0 |

| Stallion India Fluorochemicals | 38.8 |

| Denta Water and Infra | 38.7 |

| Devyani International | 38.4 |

| Anthem Biosciences | 38.2 |

| Latent View Analytics | 37.6 |

| Paras Defence | 36.2 |

| FSN E-commerce | 35.7 |

| Rolex Rings | 34.9 |

HONARARY MENTIONS

#16 Glenmark Life Sciences: 39.5 Lakh Applications

Glenmark Life Sciences – a wholly-owned subsidiary of Glenmark Pharmaceuticals – is a developer and manufacturer of select high-value, non-commoditized active pharmaceutical ingredients (APIs) in chronic therapeutic areas, including cardiovascular disease (CVS), central nervous system disease (CNS), pain management and diabetes. It also manufactures and sells APIs for gastro-intestinal disorders, anti-infectives, and other therapeutic areas.

#17 SBI Cards: 39.0 Lakh Applications

SBI Cards started operations in 1998 and now offers an extensive credit card portfolio to individual cardholders and corporate clients which includes lifestyle, rewards, travel and fuel, shopping, banking partnership cards, and corporate cards covering all major cardholder segments in terms of income profiles and lifestyles.

#18 Devyani International: 38.4 Lakh Applications

The company’s business is broadly classified into three verticals that include stores of KFC, Pizza Hut, and Costa Coffee operated in India (‘Core Brands’); stores operated outside India primarily comprising KFC and Pizza Hut stores operated in Nepal and Nigeria (‘International Business’); and certain other operations in the F&B industry, including stores of its brands such as Vaango and Food Street (‘Other Business’).

#19 Latent View Analytics: 37.6 Lakh Applications

The company is a leading pure-play data analytics services company in India, based on its expertise in the entire value chain of data analytics from data and analytics consulting to business analytics and insights, advanced predictive analytics, data engineering, and digital solutions. Across industries, data and analytics are being leveraged by enterprises to guide business strategy and optimize spending decisions amid growing financial uncertainties.

Latent View Analytics engages and provides services to blue chip companies in Technology, BFSI, CPG & Retail, Industrials, and other industries.

#20 Paras Defence: 36.2 Lakh Applications

Engaged in the designing, developing, and manufacturing of defense and space engineering products and solutions, Paras Defence was among the most popular IPOs in India. It is one of the leading ‘Indigenously Designed Developed and Manufactured’ (IDDM) category private sector companies in India, which caters to four major segments of the Indian defense sector i.e. Defence and space optics, Defence electronics, Electro-magnetic pulse (EMP) protection solution and Heavy engineering.

Paras Defence is one of the leading providers of optics for various Indian defense and space programmes, and the only Indian company with the design capability for space-optics and opto-mechanical assemblies.

#21 FSN E-commerce (Nykaa): 35.7 Lakh Applications

The company operates a digitally native consumer technology platform, delivering a content-led, lifestyle retail experience to consumers. The company has a diverse portfolio of beauty, personal care, and fashion products, including its owned brand products effectively established itself not only as a lifestyle retail platform but also as a popular consumer brand.

#22 Rolex Rings: 34.9 Lakh Applications

Rolex Rings is a manufacturer and global supplier of hot rolled forged and machined bearing rings, and automotive components for segments of vehicles including two-wheelers, passenger vehicles, commercial vehicles, off-highway vehicles, electric vehicles), industrial machinery, wind turbines, railways, among other segments.

Biggest IPOs by Applications FAQs

Which is the largest IPO by applications in India?

Waaree Energies IPO is India’s biggest IPO by applications to date. Launched in October 2024, the INR 4,321 crore offering received 97.33 lakh applications.

Which is the biggest IPO by applications in India in 2026?

Bharat Coking Coal IPO received over 90.68 lakh applications and was subscribed 146 times, marking one of India’s biggest IPOs by the number of applications in 2026.