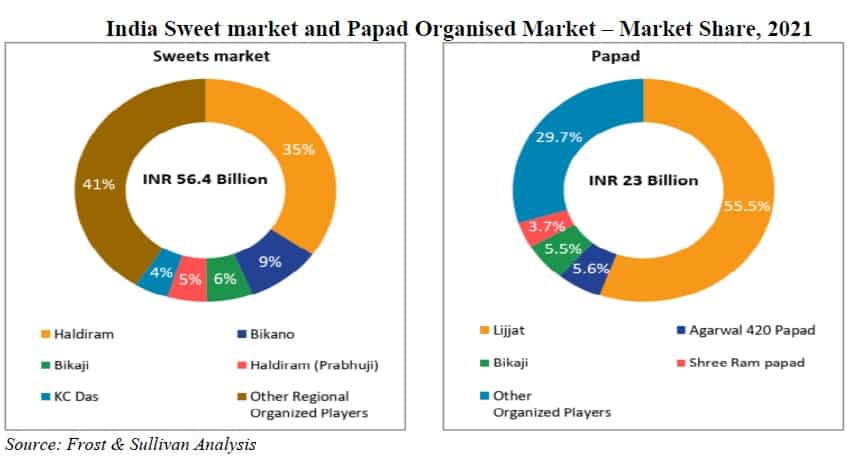

Bikaji Foods IPO description – The company is one of India’s largest fast-moving consumer goods (FMCG) brands with an international footprint, selling Indian snacks and sweets, and is among the fastest growing companies in the Indian organised snacks market. In Fiscal 2021, it was largest manufacturer of Bikaneri bhujia with annual production of 26,690 tonnes, and it was the second largest manufacturer of handmade papad with an annual production capacity of 9,000 tonnes.

Bikaji Foods is also one of the largest manufacturers of packaged rasgulla with the annual capacity of 24,000 tonnes and one of the largest manufacturers of Soan Papdi and Gulab Jamun with annual capacity of 23,040 tonnes and 12,000 tonnes respectively. In the six months ended 30 September 2021, it sold more than 250 products under the Bikaji brand.

Over the years, the company has established market leadership in the ethnic snacks market in its core states of Rajasthan, Assam and Bihar with extensive reach, and has gradually expanded its footprint across India, with operations across 22 states and three union territories as of 30 September 2021. As of 30 September 2021, it had exported its products to 35 international countries, including countries in North America, Europe, Middle East, Africa, and Asia Pacific, representing 4.60% of its sales of food products in such period.

Promoters of Bikaji Foods – Shiv Ratan Agarwal, Deepak Agarwal, Shiv Ratan Agarwal (HUF) and Deepak Agarwal (HUF)

Bikaji Foods IPO Details

| Bikaji Foods IPO Dates | 3 – 7 November 2022 |

| Bikaji Foods IPO Price | INR 285 – 300 |

| Fresh issue | Nil |

| Offer For Sale | 29,373,984 shares (INR 837.16 – 881.22 crore) |

| Total IPO size | 29,373,984 shares (INR 837.16 – 881.22 crore) |

| Minimum bid (lot size) | 50 shares (INR 15,000) |

| Face Value | INR 1 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Bikaji Foods Financial Performance

| FY 2019 | FY 2020 | FY 2021 | FY 2022 | |

| Revenue | 901.4 | 1,074.6 | 1,310.7 | 1,611.0 |

| Expenses | 834.8 | 1,019.3 | 1,202.1 | 1,516.4 |

| Net income | 50.3 | 65.2 | 81.5 | 82.0 |

| Margin (%) | 5.58 | 6.07 | 6.22 | 5.09 |

Bikaji Foods Offer News

- Bikaji Foods IPO: Here is all you need to know

- Bikaji Foods RHP

- Bikaji Foods DRHP

- IPO subscription status of all IPOs

Bikaji Foods Valuations & Margins

| FY 2019 | FY 2020 | FY 2021 | FY 2022 | |

| EPS | 2.11 | 2.32 | 3.71 | 3.15 |

| PE ratio | – | – | – | 90.48 – 95.24 |

| RONW (%) | 10.84 | 10.65 | 14.93 | 9.51 |

| NAV | – | – | 24.85 | 32.83 |

| ROCE (%) | 16.55 | 12.79 | 20.88 | – |

| EBITDA (%) | 10.35 | 8.80 | 11.04 | 8.66 |

| Debt/Equity | 0.15 | 0.10 | 0.14 | 0.19 |

Bikaji Foods IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 15 Nov 2022 | 20 | 300 | 500 |

| 14 Nov 2022 | 30 | 300 | 500 |

| 12 Nov 2022 | 35 | 300 | 500 |

| 11 Nov 2022 | 35 | 300 | 500 |

| 10 Nov 2022 | 35 | 300 | 600 |

| 9 Nov 2022 | 30 | 250 | 800 |

| 8 Nov 2022 | 20 | 220 | 1,000 |

| 7 Nov 2022 | 30 | 250 | 1,500 |

| 4 Nov 2022 | 40 | 300 | 1,800 |

| 3 Nov 2022 | 70 | 320 | 2,200 |

| 2 Nov 2022 | 75 | 350 | 2,800 |

| 1 Nov 2022 | 75 | 350 | 2,800 |

| 31 Oct 2022 | 85 | 400 | 3,000 |

| 29 Oct 2022 | 85 | 400 | 3,000 |

| 28 Oct 2022 | 80 | – | – |

Bikaji Foods IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Employee | Total |

|---|---|---|---|---|---|

| Shares Offered | 58,24,797 | 43,68,598 | 1,01,93,395 | 250,000 | 2,06,36,790 |

| 3 Nov 2022 | 0.01 | 0.58 | 1.10 | 0.52 | 0.67 |

| 4 Nov 2022 | 0.03 | 1.65 | 2.44 | 1.47 | 1.58 |

| 7 Nov 2022 | 80.63 | 7.10 | 4.77 | 4.38 | 26.67 |

Bikaji Foods IPO Reviews – Subscribe or Avoid?

Angel One – Subscribe

Anand Rathi –

Antique Stock Broking –

Arihant Capital –

Ashika Research –

Asit C Mehta –

BP Wealth – Subscribe for listing gains

Canara Bank Securities – Subscribe

Choice Broking – Subscribe with caution

Dalal & Broacha –

Elite Wealth – Subscribe

Geojit –

GEPL Capital – Subscribe

Hem Securities – Subscribe

ICICIdirect – Unrated

Jainam Broking – Subscribe

KR Choksey –

LKP Research –

Marwadi Financial –

Motilal Oswal –

Nirmal Bang – Subscribe for long term

Reliance Securities –

Religare Broking –

Samco Securities – Subscribe for listing gains

SMC Global – 2/5

Swastika Investmart –

Ventura Securities – Subscribe

Bikaji Foods Offer Registrar

Link Intime India Private Limited

C-101, 1st Floor, 247 Park

L.B.S. Marg, Vikhroli West

Mumbai – 400 083, Maharashtra

Phone: +91 22 4918 6200

Email: [email protected]

Website: www.linkintime.co.in

Bikaji Foods Contact Details

Bikaji Foods International Limited

Plot No. E-558-561,

C -569-572, E -573-577,

F-585-592, Karni Extension,

RIICO Industrial Area,

Bikaner – 334 004 Rajasthan

Phone: +91 151 2259914

Email: [email protected]

Website: www.bikaji.com

Bikaji Foods IPO Allotment Status

Bikaji Foods IPO allotment status is now available on Link Intime’s website. Click on this link to get allotment status.

Bikaji Foods IPO Dates & Listing Performance

| Bikaji Foods IPO Opening Date | 3 November 2022 |

| Bikaji Foods IPO Closing Date | 7 November 2022 |

| Finalisation of Basis of Allotment | 11 November 2022 |

| Initiation of refunds | 11 November 2022 |

| Transfer of shares to demat accounts | 14 November 2022 |

| Bikaji Foods IPO Listing Date | 16 November 2022 |

| Opening Price on NSE | INR 322.8 per share (up 7.6%) |

| Closing Price on NSE | INR 317.45 per share (up 5.82%) |

Bikaji Foods IPO FAQs

How many shares in Bikaji Foods IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply in Bikaji Foods Public Offer?

The best way to apply in Bikaji Foods public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Bikaji Foods IPO GMP today?

Bikaji Foods IPO GMP today is INR 20 per share.

What is Bikaji Foods kostak rate today?

Bikaji Foods kostak rate today is INR 300 per application.

What is Bikaji Foods Subject to Sauda rate today?

Bikaji Foods Subject to Sauda rate today is INR 500 per application.

Good

this is great IPO I also apply this IPO Very good feature return

I got the allotment

Next time you can also alloted……