Last Updated on September 22, 2021 by Team IPOCentral

Chennai-based Data Patterns India Ltd has filed its draft red herring prospectus (DRHP) with market regulator SEBI. The company supplies electronic systems to defence and aerospace sector and counts DRDO, Electronics Corporation of India and BrahMos Aerospace among its clients. Data Patterns IPO is likely to mobilize INR600-700 crore through a mix of a fresh issue and an offer for sale.

According to the draft prospectus of the upcoming IPO, the company plans to raise as much as INR300 crore through fresh issue of shares while 60,70,675 equity shares are planned to be sold by promoters and existing shareholders. Data Patterns may also undertake a pre-IPO placement of up to INR60 crore. Accordingly, the fresh issue component will be reduced by this amount if such placement is undertaken.

The OFS includes sale of up to 1.97 million shares each by Srinivasagopalan Rangarajan and Rekha Murthy Rangarajan, up to 75,000 by Sudhir Nathan, up to 414,775 equity shares by G.K. Vasundhara and up to 1.65 million shares by other existing shareholders.

Data Patterns IPO – Issue objectives

The company plans to use IPO proceeds towards the following objectives:

- Prepayment or repayment of certain outstanding borrowings – INR54.3 crore

- Funding working capital requirements – INR95.2 crore

- Upgrading and expanding existing facilities at Chennai – INR62.7 crore

- General corporate purposes

Incorporated in 1998, the company’s promoters are Srinivasagopalan Rangarajan and Rekha Murthy Rangarajan who have over 3 decades of sector experience. Florintree Capital Partners, floated by former Blackstone head Matthew Cyriac, is also a major shareholder with 12.8% equity capital in the company. Florintree acquired the stake from Oman India Joint Investment Fund (OIJIF) in June 2021.

Data Patterns is a vertically integrated defence and aerospace electronics solutions provider catering to requirements across space, air, land and the sea. Its core competencies include design and development across electronic hardware, software, firmware, mechanical, product prototype besides its testing, validation and verification. Data Patterns product portfolio ranges from building blocks to end systems. Its involvement has been found across Radars, Underwater Electronics, Communication and Other Systems, Electronic Warfare Suites, Avionics, Small Satellites, Automated Test Equipment, COTS and programmes catering to Tejas Light Combat Aircraft, Light Utility Helicopter, BrahMos and other Communication and Electronic Intelligence Systems.

DPIL IPO – On a strong financial footing

The company has posted impressive financial performance in recent years with revenues growing from INR132.5 crore in FY2019 to INR226.6 crore in FY2021. During these years, its net income jumped from INR7.7 crore to INR55.6 crore. In the last 4 years, the company’s order book has grown at a CAGR of 40.7% and stood at INR582.30 crore as on 31 July 2021.

Data Patterns’ Financial Performance (in INR crore)

| FY2019 | FY2020 | FY2021 | |

| Revenue | 132.5 | 160.2 | 226.6 |

| Expenses | 122.2 | 131.8 | 152.0 |

| Net income | 7.7 | 21.0 | 55.6 |

| Margin (%) | 5.8 | 13.1 | 24.5 |

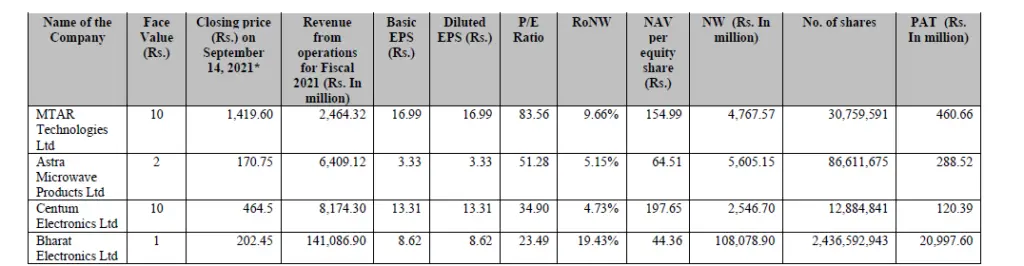

As on the date of writing this article, another company from this sector – Paras Defence and Space Technologies has its IPO open for subscription. Earlier this year, its peer MTAR Technologies launched its IPO successfully which has rewarded investors very well. As such, Data Patterns IPO will be closely watched by investors.

It also helps to know that Data Patterns is favorably placed against its competitors with RONW of 26.8% in FY2021.