Paras Defence and Space Technologies (Paras Defence) is a defence and space-based company and is engaged in designing, developing, manufacturing, and testing defence and space engineering products and solutions. The company is launching its maiden offer on 21 September. Through Paras Defence IPO review, we aim to dive deeper in its operations. The company has sustained business growth of 40 years and operates in the following business verticals:

- Defence & Space Optics – Infrared lenses for thermal imaging systems and night vision cameras, Diffractive gratings for space cameras, Large size optics for space imaging systems, Optical domes for missile systems

- Defence Electronics – Control systems for land and naval defence applications, Naval and shelter mounted command and control systems, Displays for land and naval defence applications, Panel personal computers for land, naval and avionic defence applications, Communication systems for land and naval defence applications, Consoles and wired cabinets for land and naval defence applications, Non-contact proximity sensor for naval applications

- Heavy Engineering – Flow formed tubes for rocket and missile applications, Vacuum brazed cold plates for radar applications Remotely controlled border defence system for land defence application, Titanium structures and assemblies for naval applications,

- Electromagnetic Pulse Protection (EMP) Solutions – EMP shielding of a site or control rooms or data centers or command centers, EMP racks and cabinets, High performance EMP filters for power and data, Onsite installation, commissioning and testing.

- Niche Technologies – Large deployable antennas for space applications, Carbon fiber reinforced polymer (CFRP) structures for space applications, Avionic suites for commercial and military avionic applications, Capsule size drones for defence and HLS applications.

Paras Defence IPO Review – Offer details and objectives

| Subscription Dates | 21 – 23 September 2021 |

| Price Band | INR165 – 175 per share |

| Fresh issue | INR140.6 crore |

| Offer For Sale | 1,724,490 shares (INR28.45 – INR30.18 crore) |

| Total IPO size | INR169.05 – 170.78 crore |

| Minimum bid (lot size) | 85 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Paras Defence and Space Technologies is launching its IPO for completion of the following objectives-

- Purchase of machinery and equipment – INR34.7 crore

- Funding working capital requirements – INR60 crore

- Repayment/prepayment of borrowings – INR12 crore

- General corporate purposes

Paras Defence IPO – Manufacturing Infrastructure

The company has two manufacturing units in Ambernath in Thane Nerul and in Navi Mumbai in Maharastra. Here is a quick snapshot of the facilities with their production:

Ambernath, Thane – Engaged in production of heavy engineering products such as flow-formed motor tubes, vacuum brazed cold plates, titanium structures and assemblies, large and heavy dynamic structures.

Nerul, Navi Mumbai – Advanced nano technology machining centre for producing high quality optics and ultra-precision components and is engaged in manufacturing of Optics, Design, Development, Manufacturing and Integration of Electronics and EMP protection products and solutions.

The company plans to expand both facilities at a cost of INR48 crore.

Paras Defence IPO Review – Industry overview

Global spending on the defence sector increased by 2.6% and touched USD1.98 trillion in 2020 as compared to 2019. India is third largest spender on the defence sector, following the United States and China and ahead of Saudi Arabia, and Russia.

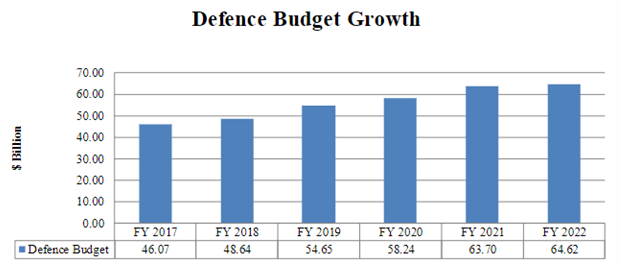

Over the last 5 years, India’s defence budget has grown at a CAGR of 7% and is likely to scale USD64 billion in FY2022. Going forward too, this growth rate is likely to remain intact given the continued skirmishes with Pakistan and China and the continued focus on modernization of the defence sector through use of technology.

FIGURE – Defence Budget Growth of India over past years

While the industry outlook is positive, the situation is extra positive for domestic players like Paras Defence due to the government’s impetus on localization through “Atmanirbhar Bharat” and “Make in India” initiatives. The company has a healthy order book of INR305 crore, with majority in Defence and Space Optics segment.

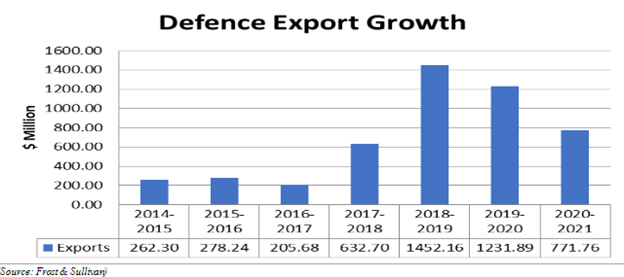

During 2012-2016, India was the largest importer of defence equipment but the trend changed in the past few years with a decrease of 33% in imports and a gradual increase in exports in the period of 2016-2020. This is the area dominated by specialist players like Paras Defence which counts several foreign companies among its clients.

Paras Defence IPO Review – Key Strengths

- The company is one of the few players with specialized technology capabilities like manufacturing EMP protection. The company is expected to win big in defence and space optics and EMP protection solutions.

- Main clients of the company include reputed companies like ISRO, Defence R&D Organisation (DRDO), Bharat Electronics, Hindustan Aeronautics Limited, Bharat Dynamics Ltd, Israel Aerospace Industries, Rafael Advanced Defence Systems, L & T, Godrej & Boyce, Tata Consultancy Services (TCS), and Tata Power.

- The company is the only supplier of critical imaging components like large size optics and diffractive gratings for space applications in India and utilizes optomechanical assemblies.

- Paras Defence is the sole Indian supplier of critical imaging components such as large-sized optics for space applications.

Paras Defence IPO Review – Key Risk Factors

- Major revenue of the company is generated through the Government of India and its associates. The decline in the Indian defence budget, reduction of orders, cancelation of existing contracts will have an adverse effect on the revenue of the company.

- The company has certain agreements and partnerships with other companies. These collaborations may restrict them from doing certain things and have an adverse effect on the termination of these agreements.

- Working capital intensive business

Paras Defence IPO Review – Financial Performance

Despite the industry’s positive outlook, defence remains a lumpy business with delays at several levels. Since majority of orders are issued by government and associated companies, any change in policies poses a big challenge in not just new business but also payments for existing orders. Against this backdrop, Paras Defence’s declining topline isn’t particularly concerning.

Read Also: Paras Defence Listing Estimate: Retail happy, HNIs on brink

Instead, it is the high working capital requirement which poses a challenge. In the last 3 years, the company’s working capital has increased from INR91.3 crore to INR161.7 crore. Accordingly, its Return on Net Worth (RONW) has also declined from 15.9% in FY2019 to 9.1% in FY2021. The saving grace here is profitability which has remained intact in the recent years despite the various challenges including Covid-19 outbreak.

Paras Defence Financial Performance (in INR crore)

| FY2019 | FY2020 | FY2021 | |

| Revenue | 157.2 | 149.0 | 144.6 |

| Expenses | 130.4 | 127.3 | 122.0 |

| Net income | 18.5 | 20.3 | 16.1 |

| Margin (%) | 11.8 | 13.6 | 11.1 |

Paras Defence IPO Review – Should you subscribe?

If you have read this far, you must have realized that defence is a tricky business as long as it is focused on only one market. While the government is the biggest customer for Paras accounting for nearly 51%, the remaining sizeable chunk is aided by private entities and exports. Paras Defence aims to ramp up this business while also getting into newer areas like unmanned aircraft systems (drones) which are likely to find applications in areas beyond defence.

The current financial situation of the company may not present the best version of its operations. Nevertheless, it should not be ignored that last couple of years have seen major upheavals and do not represent normal business conditions. As the situation eases from here, it is only natural that Paras Defence’s financial performance improves. It is also noteworthy that the company has leadership position in the products it makes.

In terms of valuations, the company’s pricing of INR165 – 175 per share values the business at a PE ratio range of 29.7 – 31.5. There are no listed peers with a similar product portfolio. However, most listed defence players such as Astra Microwave Products and Apollo Micro Systems trade at similar valuations.

Overall, Paras Defence IPO review reveals the story of a capable business mired into difficult times in a sector which is likely to receive lots of tailwinds going forward. Since valuations are in line with the rest of the market, an investment call has to be based on investors’ risk appetite.