Surat-based Ami Organics is all set to launch its maiden public offer on 1 September for subscription. The company is a specialty chemicals player and is among major manufacturers of Pharma Intermediates for certain key APIs, including Dolutegravir, Trazodone, Entacapone, Nintedanib and Rivaroxaban. Here is the summary of Ami Organics IPO in 10 points.

#1 Ami IPO price and Lot Size

Along with Vijaya Diagnostics, Ami Organics will launch September’s first IPO and it is priced in the range of INR603 – 610 per share. Investors can place orders for minimum 24 shares and in multiples thereafter.

#2 Offer Structure

Ami Organics IPO will result in cash inflow of INR200 crore for the company through issue of new shares. Out of this, the company has already raised INR100 crore through a pre-IPO placement. These funds are proposed to be used towards the following objectives:

- Repayment/prepayment of certain financial facilities (INR140 crore)

- Funding working capital requirements (INR90 crore)

- General corporate purposes

In addition, existing shareholders will offer 6,059,600 shares through OFS route, amounting to as much as INR 369.64 crore.

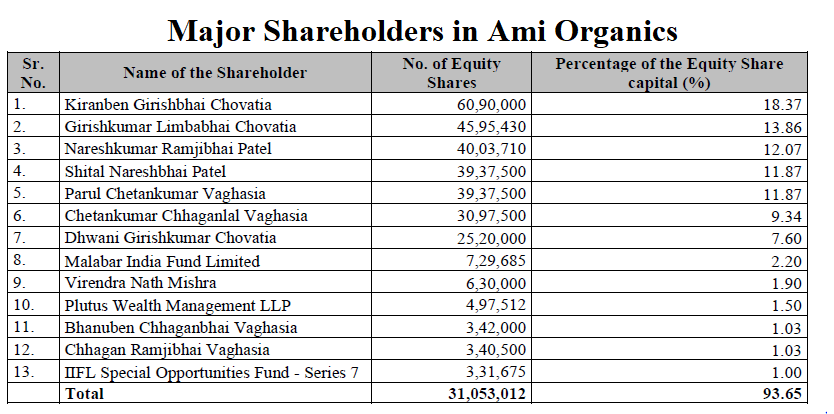

#3 Ami Organics IPO Summary – Major Shareholders

#4 Business overview

The company has developed and commercialized over 450 Pharma Intermediates for APIs across 17 key therapeutic areas since inception. The Pharma Intermediates business is the mainstay of the company generating INR301.1 crore in FY2021 and accounting for 88.4% of its top line.

Beyond Pharma Intermediates, Ami Organics has presence in Speciality Chemicals, albeit at a much smaller level. The division contributed just INR16.6 crore or 4.9% to the company’s top line in FY2021.

#5 Focus on Specialty Chemicals

Despite the small size of specialty chemicals business, it is interesting to note that the business has more than doubled in each of the last three years. The company’s focus is on further expanding this business and it has recently acquired two manufacturing facilities operated by Gujarat Organics Limited in this regard.

The acquisition has added preservatives (parabens and parabens formulations which have end usage in cosmetics, animal food and personal care industries) and other specialty chemicals (with end usage in cosmetics, dyes polymers and agrochemicals industries) in Ami Organics’ existing product portfolio. The acquisition is also in line with the company’s inorganic growth strategy of foraying further into the specialty chemicals sector. Expect more acquisitions!

#6 Manufacturing Infrastructure

The company has three manufacturing units in Gujarat with following

- GIDC, Sachin – Aggregate land area of 8,250 sq. mtrs. and installed capacity of 2,460 MTPA

- GIDC, Ankleshwar – Aggregate land area of 10,644 sq. mtrs. and installed capacity of 1,200 MTPA

- GIDC Industrial Estate, Jhagadia – Aggregate land area of 56,998.35 sq. mtrs. and installed capacity of 2,400 MTPA

Ankleshwar and Jhagadia facilities have been acquired from Gujarat Organics Limited.

#7 Intellectual Property

Since the company claims to be Research & Development (R&D) driven, intellectual property is a key area of focus for the organization. In this regard, it has done well with eight process patent applications (in respect of intermediates used in the manufacture of Apixaban, Rivaroxaban, Nintedanib, Vortioxetine, Selexipag, Pimavanserin, Efinaconazole and Eliglustat) which have been published in the Official Journal of the Patent Office in India and three additional pending process patent applications filed recently in March 2021. It is noteworthy that these are only applications and not patents granted to the company.

#8 Exports & Customers

Exports is a major revenue driver for Ami Organics and it contributed 51.6% to total revenues in FY2021. Not only this a high figure, it is also good to know that the figure is up from previous years (45.9% in FY2020). Europe, China, Japan, Israel, UK, Latin America and the USA are among the biggest export markets for the company.

The company counts several multi-national pharmaceutical companies among its clients and the names include Laurus Labs Limited, Cadila Healthcare Limited and Cipla Limited in the domestic market and Organike s.r.l.a Socio Unico, Fermion Oy, Fabbrica Italiana Sintetici S.p.A, Chori Co. Ltd., Medichem S.A. and Midas Pharma GmbH in the overseas markets. The company has established long standing relationships with some of these key customers, dating back to 10 years.

#9 Financial Performance

Ami Organics has put up a robust show in terms of financial performance with revenues growing consistently, even during pandemic-marked FY2020. Net profit has also grown in recent years and the company is clearly benefitting through better margins.

Ami Organics’ Financial Performance (in INR crore)

| FY2019 | FY2020 | FY2021 | |

| Revenue | 238.9 | 242.5 | 342.0 |

| Expenses | 203.8 | 207.7 | 270.3 |

| Net income | 24.7 | 29.6 | 53.1 |

| Margin (%) | 10.3 | 12.2 | 15.5 |

As of 30 June 2021, the company’s indebtedness stood at INR146.4 crore and this figure is scheduled to come down to practically zero after payment of INR140 crore financial facilities.

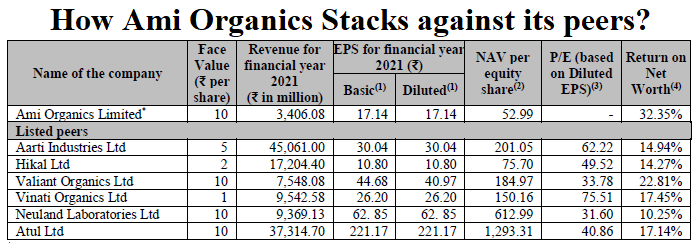

#10 Valuation & Peer Comparison

The company is offering its shares at a PE ratio of 35.6 which is somewhat lower than most of its competitors. Considering its superior performance on Return on Net Worth (RONW) front, the offer pricing becomes attractive and offers a certain level of comfort.

This comfort is also recognized by the grey market which has put a premium of nearly INR 60 per share on this IPO, although this could change very quickly as it happened in the past IPOs.

We hope you liked our 10 point summary of Ami Organics IPO. Please share this summary with your friends and your feedback in comments.