Given the scorching summers being the norm in India, air conditioners (ACs) have gradually gone from being luxury to necessity-based products. But while we all know the big AC brands, have you ever wondered who actually makes them? One key player behind your cool comfort is EPACK Durable! This Indian company designs and manufactures ACs for some of the top brands you know and love.

In fact, they’re the second biggest ODM (Original Design Manufacturer) for room ACs in India, meaning they craft both indoor and outdoor units under other brands’ names. This powerhouse is about to IPO later this week! Through EPACK Durable IPO Analysis, IPO Central will dive deep into the company’s story, its IPO, and more details. Keep reading to know more!

EPACK Durable IPO Review: Company Profile

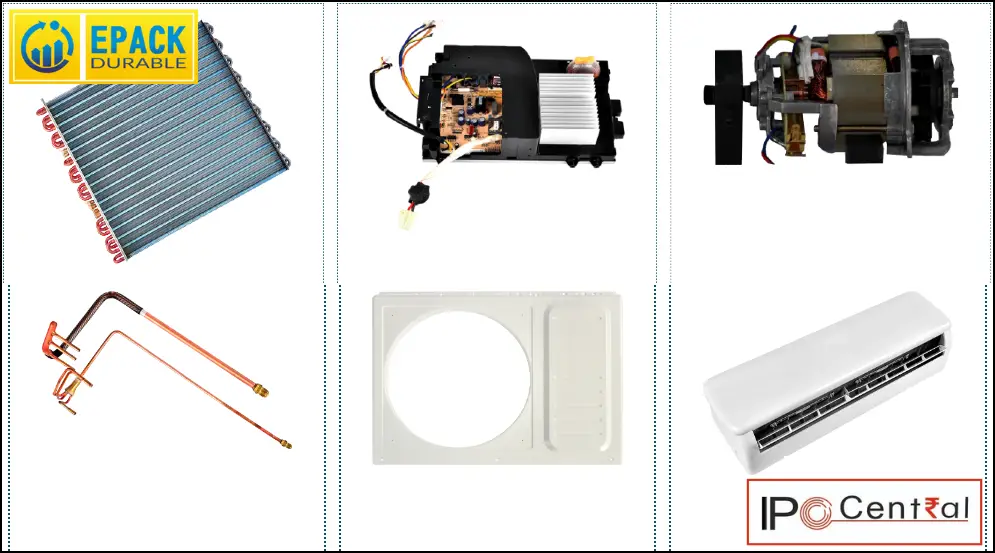

EPACK Durable is a leading Original Design Manufacturer (ODM) of Room Air Conditioners (RAC) with a substantial 29% market share in terms of volume produced during FY 2023. Established in 2019, the company initially started as an AC components or entire units supplier for other RAC brands. Later, it developed into an ODM brand by designing and building custom AC solutions for brands. EPACK Durable also manufactures components for the production of RACs such as sheet metal parts, injection moulded parts, cross-flow fans, and PCBA components that are actively utilized.

The company has started expanding its operations in the small domestic appliances (SDA) market. Currently, it designs and manufactures induction cooktops, mixer grinders, and water dispensers. EPACK Durable has a dedicated R&D team of 57 members and has research centers located in Greater Noida, Bhiwadi, and Dehradun.

EPACK Durable IPO Analysis: Manufacturing Excellence

EPACK Durable has four production facilities in Dehradun, Uttarakhand, and one manufacturing facility in Bhiwadi, Rajasthan. As of March 31, 2023, the company had an annual capacity to produce 0.90 million indoor units, 0.66 million outdoor units, 0.36 million outdoor unit kits, and 0.42 million window air conditioners. Additionally, the company has the capacity to produce 0.11 million water dispensers, 1.24 million induction hobs, and 0.30 million mixers annually along with their components.

The company also commenced operations at the Sri City Manufacturing Facility (Andhra Pradesh) in December 2023 with a manufacturing capacity of 0.66 million indoor units, 0.66 million outdoor units, and 0.65 million induction cooktops, and components thereof.

EPACK Durable IPO Analysis: Financial Performance

EPACK Durable has shown strong financials with its revenue doubling from INR 736 crore in 2021 to INR 1,538 crore in 2023, and profits increasing from INR 7.8 crore in 2021 to INR 31.9 crore in 2023. However, expenses have also increased due to the operationalization of Dehradun Unit IV pursuant to the acquisition of EPACK Components Private Limited.

| Particulars (in crore) | FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 |

| Revenue | 736.25 | 924.16 | 1,538.83 | 614.80 |

| Expenses | 728.78 | 901.04 | 1,493.84 | 611.78 |

| Net income | 7.80 | 17.43 | 31.97 | 2.65 |

| Margin (%) | 1.06 | 1.89 | 2.08 | 0.43 |

On the positive side, the company has been reducing its debt-to-equity ratio from 3.47 in 2021 to 1.58 in 2023. This indicates that the company is relying less on borrowed funds, which is a good sign for investors.

EPACK Durable IPO Review: Competitive Edge

EPACK Durable benefits from its single-site manufacturing capabilities, where the production of components and product assembly takes place in one location. The company manufactures a larger portion of the components for its RACs directly at its facility compared to any other single facility in India.

EPACK Durable has long-standing relationships with its customers, which include four of the top six RAC brands in the Indian market. Its top customers include Blue Star, Daikin Airconditioning India, Carrier Midea India, Voltas, Havells India, Haier Appliances (India), Infiniti Retail, and Godrej and Boyce Manufacturing Company, among others. For Small Domestic Appliances, the company counts Bajaj Electricals Limited, BSH Household Appliances Manufacturing Private Limited, and Usha International Limited among its major clients.

The demand for RACs typically peaks during the first half of the calendar year and reduces in the second half of the calendar year due to seasonality. To make up for this, EPACK Durable manufactures home gadgets as well as components for RACs, making different revenue streams and creating a high barrier for new entrants.

EPACK Durable IPO Review: Peer Comparison

Competition in the Indian room air conditioner market is fierce, with EPACK Durable facing established players offering both OEM and ODM services. While EPACK has seen promising revenue growth CAGR 44.5% in its short lifespan of 3 years, its valuation appears on the higher side compared to peers. Its PE ratio of 49.5 stands significantly higher, despite a lower market cap. Additionally, the company’s margins remain thin, with EBITDA at 6.66% and EPS at INR 4.71. However, EPACK’s expanding product portfolio and profitability offer potential for future returns.

EPACK Durable IPO Analysis: Issue Structure

EPACK Durable plans to raise INR 640 crore through its upcoming IPO, offering both fresh equity of INR 400 crore and existing share worth up to INR 240 crore. Notably, 35% of the shares are reserved for retail investors. The company intends to use INR 230 crore from the IPO proceeds to expand or set up new manufacturing facilities. The remaining INR 80 crore will be used to repay existing bank loans.

EPACK Durable IPO Review: Should You Invest?

Despite the pandemic’s impact, India’s RAC market is booming and this is offering tailwinds to local manufacturing. Domestic production is expected to grow at 13% and is projected to reach 14.7 million units by 2028. This surge in demand, driven by an increasing desire for cool comfort in Indian homes, creates fertile ground for domestic players like EPACK Durable. Meanwhile, government regulations such as a ban on imported AC units have also helped domestic production and manufacturers.

EPACK Durable is riding this wave with its upcoming IPO, setting a price band of INR 218-230 per share. While its financial performance reflects positive growth with increasing revenue, a high PE ratio of 49.5 raises concerns about potential overvaluation compared to its net margin of 2.08% and ROCE of 11.85%. However, this concern could be mitigated if the company consistently generates robust revenue and profits in the future.

To its credit, EPACK Durable is strategically navigating the ups and downs of the market through portfolio diversification. It manufactures RAC components during peak seasons and home gadgets and components during the off-season, ensuring a steady flow of revenue and production throughout the year. This thoughtful approach, coupled with a focus on continuous expansion and a diverse product portfolio, positions EPACK Durable to carve a unique niche in the booming Indian AC market.

Overall, the EPACK Durable IPO review tells us that the company has a robust and likable business model although valuations could have been more attractive.