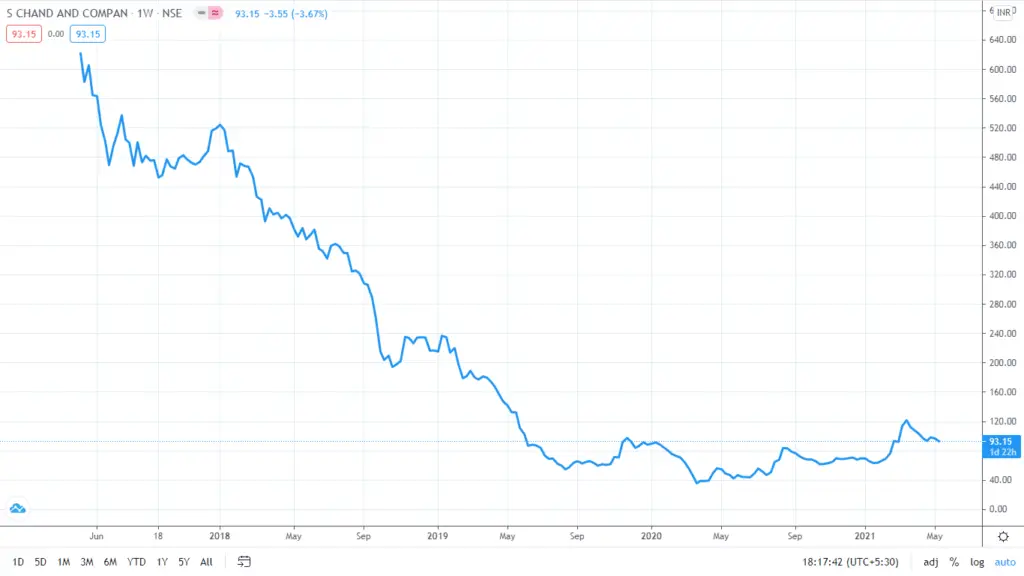

New Delhi-based publisher S Chand & Company came up with its IPO in April 2017 and got listed on 9 May. The company, backed by private equity firms Everstone Capital and World Bank’s International Finance Corporation (IFC), had its IPO subscribed a massive 59.2X. At listing, shares opened at INR700 per share with gains of 4.5% from IPO price of INR670 per share. Although the stock slid in the next few hours, it still closed the day with a gain of 0.9%. However, the subsequent days were painful for investors as S Chand stock performance started on a roller coaster ride that only went down!

S Chand stock performance: Down, down and down!

By the end of the first week since listing, the stock had lost 8.2% of its value but the losses further ballooned to 25% by the end of 6 weeks. Shares held by anchor investors are subject to a lock-in of 30 days from the date of allotment and thus, the timeframe of 6 weeks presents a realistic picture of price discovery following the selling pressure.

| Timeframe | Closing price | % change from IPO price |

| Listing Day | 676 | 0.9 |

| 1 Week | 615 | -8.2 |

| 6 Weeks | 502.35 | -25.0 |

| 1 Year | 391.80 | -41.5 |

| 2 Years | 141.30 | -78.9 |

However, S Chand stock performance continued the same way even after the 6 week timeframe and had lost 41.5% value by the first anniversary of its listing. Just in case you thought it couldn’t get worse than this, the next one year had more pain for investors as they saw value of their IPO investment eroding by 78.9% as the stock closed at INR141.3 on 9 May 2019. Although the stock staged a recovery in 2021 but its overall performance in the four years has been disappointing to say the least!

A crisis is a terrible thing to waste: Valuable lessons from the fiasco

There are valuable lessons in this episode for investors who put their money in this IPO as well as those who didn’t.

Big names don’t guarantee success, look for signs of overpricing

The company counted two heavyweight private equity names – Everstone Capital and International Finance Corporation (IFC) among its investors. The two investors jointly held 41.67% equity stake in the company with Everstone Capital owning 32.27% alone, although the PE firm sold nearly half of its shares in the IPO. IFC on the other hand, didn’t participate in the Offer For Sale (OFS). Despite the continued presence of these two big names, the company’s performance on the bourses has been underwhelming.

PE firms often make large sized bets at reasonable or attractive valuations with time on their side. As such, their cost of acquisition is often significantly less than the IPO price which allows them to sell their shareholding in open markets at lower prices and still make profits on their investments. In this case, Everstone Capital’s average cost of acquisition was INR270 per share against the IPO price of INR670 per share!

Brands are transitory, well-known name isn’t a moat

Without a doubt, S Chand is a well-known brand and it enjoys an advantage by associating itself early in a student’s academic lifecycle. However, this is hardly a competitive advantage or a moat as Warren Buffett would call it. This is what we wrote about it in our IPO review four years back:

“Mostly, students and their parents go by what the school decides. With little loyalty in the K-12 textbook business, the associated lines of competitive exams and early learning are getting strong competition from online and digital channels. S Chand is expanding its footprint in these areas as well but as it happens with new lines, past performance is no guarantee of future.”

Online and digital are big forces, no point in resisting

Online and digital learning are very strong trends and represent transformative market forces. These kind of forces often start as a small trend and grow on to become major treats for established players who choose to ignore these forces.

However, S Chand has done well on this front! Instead of resisting the onslaught of digital product offerings, it has embraced the change and has made several acquisitions in this area to maintain its presence and benefit from the expansion of this category.

Acquisitions are resource draining if not outright dangerous

S Chand has made good use of the PE funding in making acquisitions in the core areas of publishing and digital content. However, acquisitions are often messy and time-consuming for management. Mostly, acquisitions also force the acquirer to take on debt and unknown liabilities of the acquired company. This often has a detrimental impact on earnings and margins.

In S Chand’s case, this is indeed true which has consistently posted lower margins and higher interest costs than its competitor Navneet Education. It is important to highlight that Navneet hasn’t made any big-ticket acquisition in the recent years except buying out Indiannica Learning Pvt Ltd (formerly known as Encyclopaedia Britannica (India) Pvt Ltd in 2016.

Valuations are important, never overpay

It helps to know that S Chand priced its IPO at a PE ratio of 39.2 while Navneet was available at more attractive multiples. From our analysis:

“We find this ratio quite high even for a fast growing business. In comparison, Navneet is available at a P/E ratio of 31.6 which is not cheap by any stretch but looks better than S Chand.”

Another indication of possible overpricing was the fact that the company had allotted shares to IFC at much lower rates just 17 months before the IPO. This aggressive pricing was similar to ICICI Prudential Life Insurance IPO which remained below its allotment price for long after listing. This indeed turned out a good indicator of the poor IPO performance. Again a few lines from our IPO review to put things in perspective:

“Another important aspect we found in S Chand IPO review is that it sold shares to IFC at the rate of INR392 apiece. Although IFC is not participating in the IPO, we find it difficult to understand how this IPO has been priced at nearly 71% mark-up over the last transaction in a gap of just 17 months.”

In conclusion, what has played out in case of S Chand IPO is a double whammy of aggressive IPO pricing (which warranted a correction) and sectoral PE compression (something Navneet Education has also witnessed). At the same time, there were enough warning signs! Investors need to pay close attention to avoid such poor IPO performance.