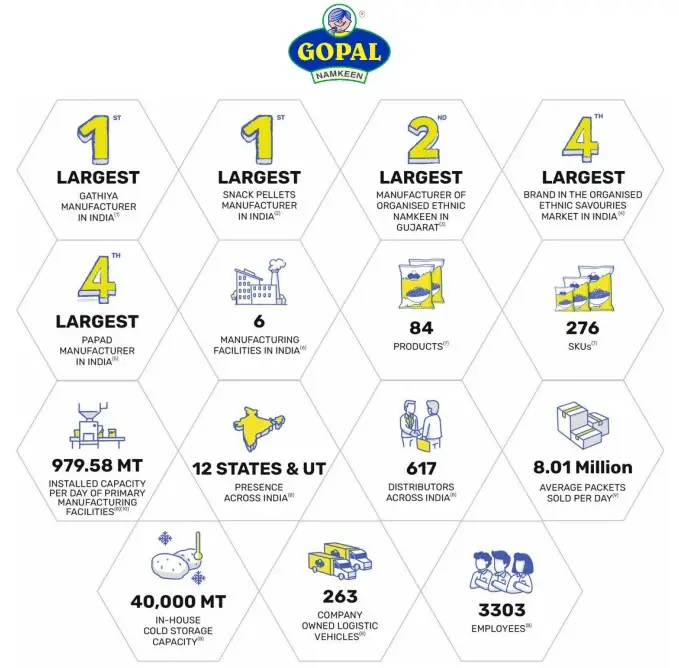

Gopal Snacks IPO Description – Gopal Snacks is a major player in India’s snacks industry with a leadership position in gathiya segment. In Fiscal 2023, it ranked fourth in market share among organized sector brands for ethnic savories in India. It holds the top position in gathiya production volume and sales revenue, as well as snack pellets production volume nationally. The company is the second-largest ethnic namkeen manufacturer in Gujarat and the fourth-largest packaged ethnic namkeen manufacturer in India based on sales revenue.

Additionally, Gopal Snacks is the fourth largest papad manufacturer in India by sales revenue. Their product range includes 84 items with 276 SKUs, catering to diverse tastes. The company operates in ten states and two union territories, selling through 523 locations, supported by 617 distributors and a sales team of 741 employees as of September 30, 2023. It utilizes various sales channels including e-commerce, modern trade, and exports.

The company owns six manufacturing facilities, with three primary ones in Nagpur, Maharashtra; Rajkot, Gujarat; and Modasa, Gujarat. These facilities primarily focus on finished product manufacturing. They also have three ancillary facilities producing raw materials for captive consumption. As of September 30, 2023, their total annual installed capacity across all facilities was 404,728.76 MT. Gopal Snacks also collaborates with third-party manufacturers for certain products when necessary.

Promoters of Gopal Snacks – Bipinbhai Vithalbhai Hadvani, Dakshaben Bipinbhai Hadvani and Gopal Agriproducts Private Limited

Table of Contents

Gopal Snacks IPO Details

| Gopal Snacks IPO Dates | 6 – 11 March 2024 |

| Gopal Snacks Issue Price | INR 380 – 401 per share Employee Discount – INR 38 per share |

| Fresh issue | Nil |

| Offer For Sale | INR 650 crore |

| Total IPO size | INR 650 crore |

| Minimum bid (lot size) | 37 shares (INR 14,837) |

| Face Value | INR 1 per share |

| Retail Allocation | 35% |

| Listing On | BSE, NSE |

Gopal Snacks Financial Performance

| FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 | |

| Revenue | 1,128.86 | 1,352.16 | 1,394.65 | 676.19 |

| Expenses | 1,103.34 | 1,302.42 | 1,246.69 | 602.99 |

| Net income | 21.12 | 41.54 | 112.37 | 55.56 |

| Margin (%) | 1.87 | 3.07 | 8.06 | 8.22 |

Gopal Snacks Offer News

- Gopal Snacks IPO Subscription Status

- Gopal Snacks IPO Review: A Savory Investment Opportunity

- Gopal Snacks RHP

- Gopal Snacks DRHP

- Gopal Snacks IPO: All You Need to Know

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Allotment Status

Gopal Snacks Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 1.70 | 3.33 | 9.02 |

| PE ratio | – | – | 42.13 – 44.46 |

| RONW (%) | 15.56 | 23.38 | 38.63 |

| NAV | 10.89 | 14.26 | 23.34 |

| ROCE (%) | 13.48 | 18.69 | 43.08 |

| EBITDA (%) | 5.35 | 7.01 | 14.07 |

| Debt/Equity | 1.02 | 0.92 | 0.37 |

Gopal Snacks IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 13 March 2024 | – | – | – |

| 12 March 2024 | 15 | – | 500 |

| 11 March 2024 | 21 | – | 800 |

| 9 March 2024 | 23 | – | 800 |

| 8 March 2024 | 25 | – | 900 |

| 7 March 2024 | 50 | – | 1,700 |

| 6 March 2024 | 80 | – | 2,400 |

| 5 March 2024 | 120 | – | 3,500 |

| 4 March 2024 | 135 | – | 3,700 |

| 2 March 2024 | 150 | – | 4,500 |

Gopal Snacks – Comparison With Listed Peers

| Company | PE ratio | EPS | RONW (%) | NAV | Revenue (Cr.) |

| Gopal Snacks | 44.46 | 9.02 | 38.63 | 23.34 | 1,394.65 |

| Bikaji Foods | 106.69 | 5.14 | 14.15 | 38.22 | 1,966.07 |

| Prataap Snacks | 94.77 | 8.51 | 3.10 | 288.33 | 1,652.93 |

Gopal Snacks IPO Allotment Status

Gopal Snacks IPO allotment status is now available on Link Intime’s website. Click on Link Intime IPO weblink to get allotment status.

Gopal Snacks IPO Dates & Listing Performance

| IPO Opening Date | 6 March 2024 |

| IPO Closing Date | 11 March 2024 |

| Finalization of Basis of Allotment | 12 March 2024 |

| Initiation of refunds | 13 March 2024 |

| Transfer of shares to demat accounts | 13 March 2024 |

| Gopal Snacks IPO Listing Date | 14 March 2024 |

| Opening Price on NSE | INR 351 per share (down 12.47%) |

| Closing Price on NSE | INR 362.70 per share (down 9.55%) |

Gopal Snacks IPO Reviews – Subscribe or Avoid?

Ashika Research – Not rated

Anand Rathi – Subscribe

BP Wealth – Subscribe

Capital Market – Avoid

Canara Bank Securities – Subscribe

Choice Broking – Subscribe with Caution

Elite Wealth – Apply for listing gains

GEPL Capital – Subscribe

Hem Securities – Subscribe for long term

ICICIdirect –

Investmentz –

Jainam Broking – Subscribe for long term

DR Choksey –

Marwadi Financial – Subscribe

Mehta Equities –

Motilal Oswal –

Nirmal Bang – Subscribe for long term

Reliance Securities – Subscribe

Religare Broking –

Samco Securities – Subscribe

SBI Securities – Subscribe for long term

SMC Global – 2/5

Swastika Investmart – Subscribe for long term

Ventura Securities – Subscribe

Gopal Snacks Offer Lead Manager

INTENSIVE FISCAL SERVICES PRIVATE LIMITED

914, 9th Floor, Raheja Chambers Free Press Journal Marg

Nariman Point, Mumbai – 400 021

Maharashtra, India

Phone: +91 22 2287 0443

Email: [email protected]

Website: www.intensivefiscal.com

Gopal Snacks Offer Registrar

LINK INTIME INDIA PRIVATE LIMITED

C-101, 1st Floor, 247 Park L.B.S. Marg,

Vikhroli West, Mumbai – 400 083, Maharashtra

Telephone: +91 810 811 4949

Email: [email protected]

Website: www.linkintime.co.in

Gopal Snacks Contact Details

GOPAL SNACKS LIMITED

Plot Nos. G2322, G2323 and G2324,

GIDC Metoda, Taluka Lodhika,

Rajkot – 360 021, Gujarat

Phone: +91 28 2728 7370

Email: [email protected]

Website: www.gopalnamkeen.com

Gopal Snacks IPO FAQs

How many shares in Gopal Snacks IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply for Gopal Snacks Public Offer?

The best way to apply for Gopal Snacks’ public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Gopal Snacks IPO GMP today?

Gopal Snacks IPO GMP today is INR NA per share.

What is Gopal Snacks’ kostak rate today?

Gopal Snacks kostak rate today is INR NA per application.

What is Gopal Snacks Subject to Sauda rate today?

Gopal Snacks Subject to Sauda rate today is INR NA per application.