Gopal Snacks Limited, a prominent Rajkot-based ethnic snack company, renowned for its diverse range of namkeen, western snacks, and other delectable offerings, has taken a significant step forward for a public market listing. The company has recently filed its Draft Red Herring Prospectus (DRHP) with capital market regulator SEBI, signaling its intent to raise funds through an initial public offering (IPO).

Gopal Snacks IPO: Diverse Offerings in the Limelight

Namkeen, Western Snacks, and Beyond

Gopal Snacks IPO features an offer for sale (OFS) of equity shares, valuing up to INR 650 crore. Notably, this offering doesn’t introduce new shares but involves the sale of existing shares by promoters and other stakeholders. The shares, with a face value of INR 1, present an intriguing investment opportunity for discerning investors.

Stakeholder Breakdown

The offer for sale includes up to INR 100 crore by Bipinbhai Vithalbhai Hadvani, up to INR 540 crore by Gopal Agriproducts Private Limited (Promoter Selling Shareholders), and up to INR 10 crore by Harsh Sureshkumar Shah (Other Selling Shareholder). Additionally, there’s a provision for eligible employees to participate in Gopal Snacks IPO.

Book-Building Dynamics

The offering follows a book-building process. Qualified institutional buyers stand to receive not more than 50% of the net offer, non-institutional investors have a 15% allocation, and retail individual investors are allocated a minimum of 35%. This strategic allocation aims to ensure a balanced and diversified investment landscape.

Gopal Snacks: A Flavorful Journey to IPO

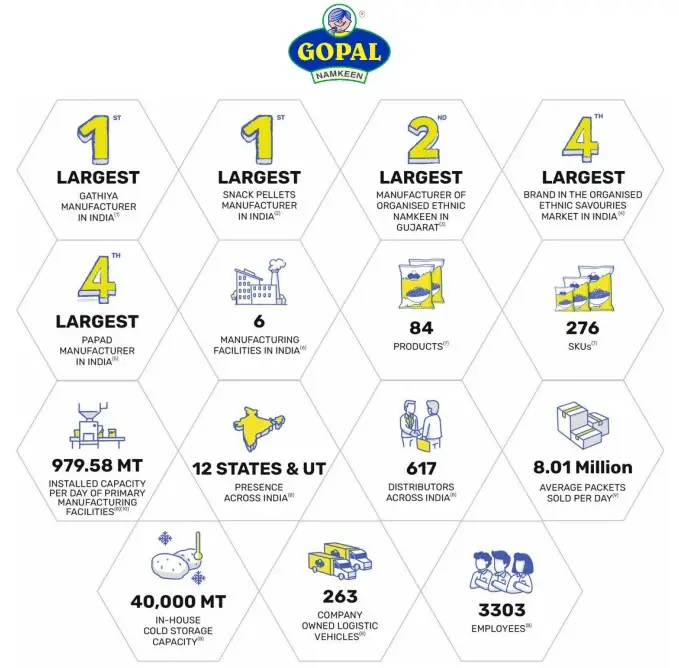

Founded in 1999 by Mr. Bipin Hadvani, Gopal Snacks began as Gopal Gruh Udyog, a partnership firm dedicated to satisfying Indian palates with tantalizing namkeen and snacks. Today, it stands as the largest manufacturer of snack pellets and gathiya, securing its position as the fourth-largest brand in the organized sector of ethnic savories in India.

Product Prowess

Under the “Gopal” brand, the company boasts an impressive array of 84 products with 276 SKUs. These include fast-moving consumer goods like papad, spices, gram flour (besan), noodles, rusk, and soan papdi. The product portfolio extends to ethnic snacks such as namkeen and gathiya, as well as western snacks like wafers, extruded snacks, and snack pellets.

Nationwide Presence

As of September 30, 2023, Gopal Snacks’ products were available in 10 states and 2 Union Territories. The company operates through a robust network of 3 depots and 617 distributors, solidifying its market reach and accessibility. An extensive network is a crucial factor in consumption businesses and Gopal Snacks IPO scores full marks here.

Read Also: Top Drone Stocks in India

Gopal Snacks IPO: Robust Financial Performance

Gopal Snacks has exhibited remarkable financial growth. From Fiscal 2021 to Fiscal 2023, revenue from operations surged at a Compound Annual Growth Rate (CAGR) of 11.15%, reaching INR 1,394.65 crore. The profit witnessed an extraordinary CAGR of 130.65%, escalating from INR 21.12 crore to INR 112.37 crore during the same period. EBITDA also saw a substantial increase, rising from INR 60.35 crore in Fiscal 2021 to INR 196.23 crore in Fiscal 2023, marking an 80.31% CAGR.

For the six months ended September 30, 2023, revenue from operations stood at INR 676.19 crore, with a commendable profit after tax of INR 55.56 crore.

Industry Accolades

In Fiscal 2022, Gopal Snacks led the pack among key snacks companies in India, boasting the highest fixed asset turnover ratio, return on equity, and return on capital employed. This placed the company ahead of competitors like Bikaji Foods, Haldiram, Bikanervala Foods, and others.

Read Also: Ashish Dhawan Net Worth, Portfolio and More Details

Market Outlook

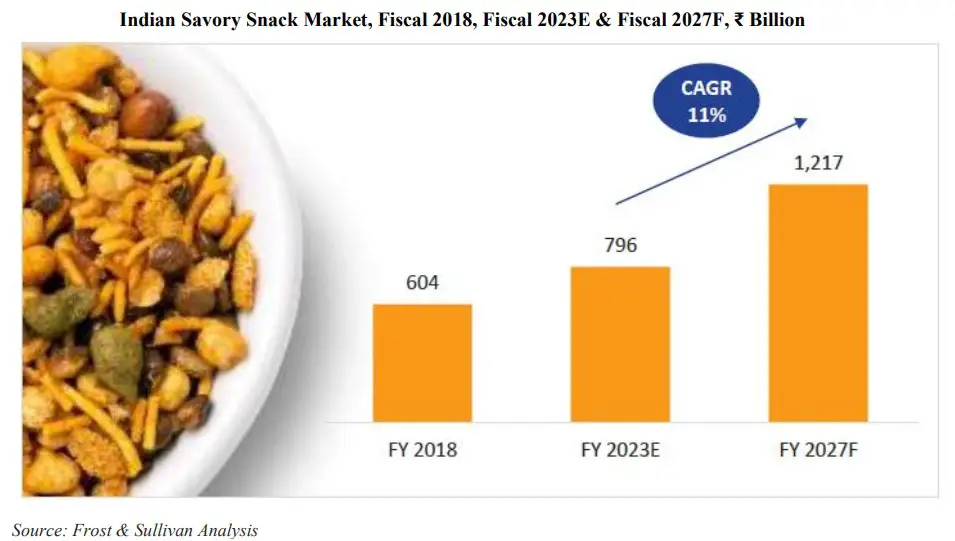

The Indian savory snacks market, including both western snacks and ethnic savories like gathiya, was valued at INR 79,600 crores in Fiscal 2023. Projections indicate a promising 11% CAGR, reaching INR 1,21,700 crores by Fiscal 2027. The organized market currently commands a substantial 57% market share and is poised to grow at an impressive 11.7% CAGR from Fiscal 2023 to 2027.

Intensive Fiscal Services Private Limited, Axis Capital Limited, and JM Financial Limited are the appointed book-running lead managers, while Link Intime India Private Limited takes charge as the registrar of the offer. The equity shares are set to be listed on both the BSE and NSE, opening doors for investors to partake in the exciting journey of Gopal Snacks IPO.