The IPO market is often a battleground between optimism and reality. In the last 365 days, half of the listed IPOs are trading below their allotment price. However, on the listing day, many of the IPOs deliver handsome returns to the investors. The main reason for this seems to be the decline in the stock market.

The Indian stock market is falling due to weak corporate earnings, foreign investor withdrawals, economic slowdown concerns, overvalued mid-cap stocks, and global uncertainties, including geopolitical tensions and trade policy shifts.

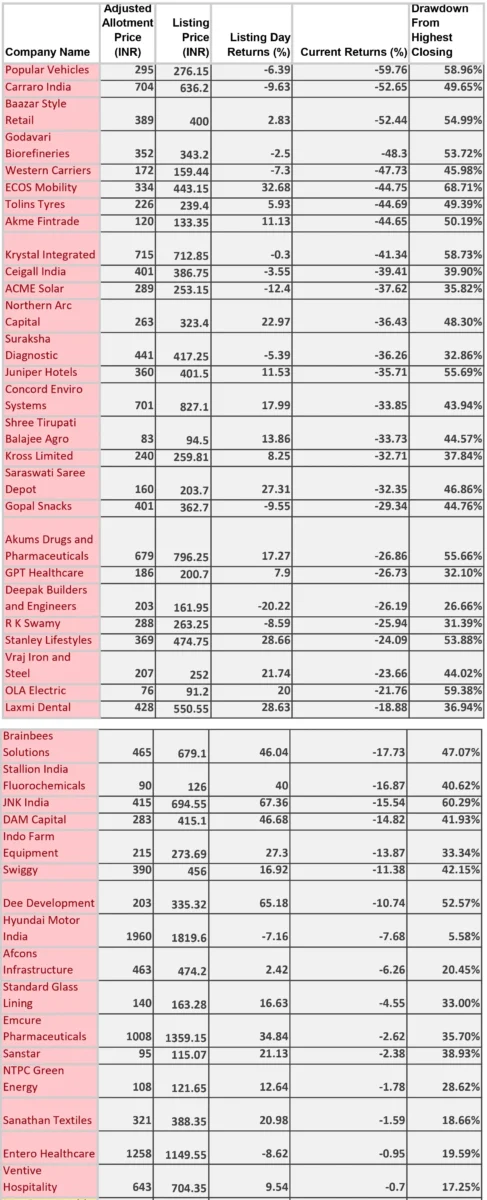

List of IPOs Below Allotment Price

Why Are So Many IPOs Underperforming?

Several factors contribute to this lacklustre post-listing performance:

- Market Uncertainty: Global economic conditions, inflationary pressures, and geopolitical risks have weighed on stocks, including newly listed ones.

- Overvaluation at IPO: Some companies set aggressive listing prices, only to see market forces correct them later.

- Weak Fundamentals: Businesses with inconsistent earnings or limited growth potential struggle to maintain investor confidence.

- Profit Booking: Many investors exit early, cashing in on listing-day gains. This selling pressure can drive prices down.

The Numbers Tell a Stark Story

When we look into last year’s IPO data, it reveals a troubling pattern. Despite the excitement surrounding new listings, 43 IPOs are trading below the IPO allotment price. Stocks like Popular Vehicles, Carraro India, and Baazar Style Retail have seen sharp declines. Popular Vehicles is down by a staggering 59.76%, while Carraro India has plummeted 52.65% from its IPO price.

This isn’t an isolated case. Many IPOs lose steam after the initial surge, leaving retail investors questioning whether they fell for the hype

The Other Side of the Coin: IPO Success Stories

Not all IPOs have disappointed. Some stocks have defied the broader trend, delivering substantial gains. Bharti Hexacom, for instance, has surged 133.54%, while KRN Heat Exchanger has skyrocketed 238.89%. These cases prove that, with the right research, IPO investing can still be highly profitable.

How Investors Can Avoid the Hype Trap

Given the mixed performance of IPOs, a calculated approach is essential. Here’s how investors can improve their odds:

- Diversify Investments: Relying solely on IPOs can be risky. A balanced portfolio minimizes potential losses.

- Look Beyond the Hype: Analyze financials, revenue models, and growth prospects before investing.

- Watch for Overvaluation: If an IPO is priced aggressively, waiting for a post-listing correction may be wise.

- Monitor Lock-In Expirations: When pre-IPO investors sell after their lock-in period, share prices often dip.

Final Thoughts

IPOs are no exception, there are always winners and losers in the stock market. Some IPOs soar to new heights while many of them struggle to maintain their listing momentum. With over half of last year’s IPOs trading below their allotment price, investors must approach new listings with a critical eye.

Understanding market trends and focusing on fundamentals can help investors make better decisions. Whether you are a seasoned trader or new to the game, staying informed and disciplined is the key to navigating the IPO market successfully.

For more details related to IPO GMP, SEBI IPO Approval, and Live Subscription stay tuned to IPO Central.