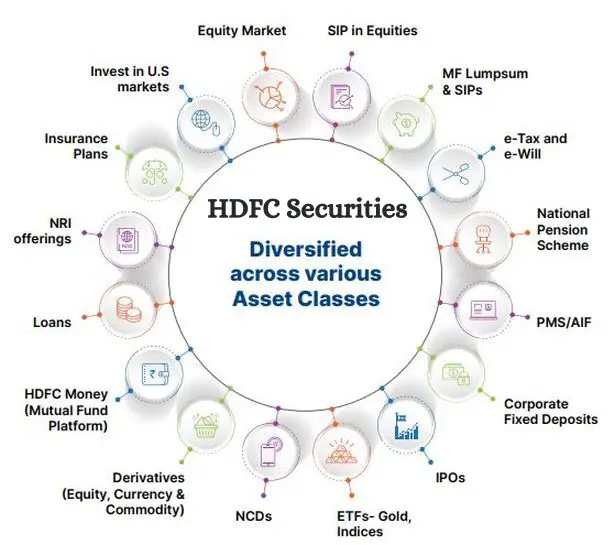

HDFC Securities Unlisted Share Description – Headquartered in Mumbai, HDFC Securities has a strong presence across India’s major cities and towns. That presence—now 129 branches across 104 cities—gives clients plenty of options for where and how they want to do business. As a full-service stockbroker, the company offers a wide array of financial services: equities, currencies, derivatives, mutual funds, NCDs, IPOs, basket investing, global investing, PMS/AIF, bonds and fixed deposits.

To make trading easy and effective for its retail and institutional clients, it provides a variety of trading platforms: web-based, mobile apps and a call-and-trade facility. HDFC Securities’ research and advisory services help investors make informed decisions. The company provides research reports, market analysis, stock recommendations and the tools clients need to understand market trends and make their own investment choices.

HDFC Securities ranked among India’s top broking companies, with over 1.65 million active customers. The company is a corporate member of both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

Read Also: Axles India Unlisted Share Price

Products & Services of HDFC Securities

HDFC Securities provides a 4-in-1 Online Investment Account, which is a combination of funds and securities within savings, demat, and trading accounts.

HDFC Securities New Platform – HDFC SKY

HDFC Securities launched a new discount broking platform called HDFC SKY, offering trading and investing at a flat fee of INR 20, on par with platforms like Groww, 5Paisa, and Zerodha. What sets HDFC SKY apart is its margin trading facility at a competitive 12% interest rate, significantly lower than the 18–21% charged by its rivals. Aimed at Gen-Z, millennials, and new-age investors, HDFC SKY is open to all users, unlike HDFC Securities’ main platform, which limits demat account opening, trading, and investing to HDFC Bank customers only.

Read Also: Capgemini Technology Services Unlisted Share Price

HDFC Securities Q2 FY26 Results – Key Highlights

- 94.05% stake held by HDFC Bank as of 31 December 2025, marginally lower than 94.11% in Q2 FY26

- 76 lakh customers serviced through a network of 129 branches across 104 cities

- Around 97% of active clients transacted through the company’s digital platforms, reflecting strong digital adoption

- Net revenue of INR 830 crore, up 5% YoY, indicating a modest recovery after two weak quarters

- Net profit of INR 220 crore, down 17% YoY, as margin pressures continued despite revenue growth

- EPS of INR 123, improved from INR 118 in Q2 FY26

- Book value per share at INR 1,999 as of 31 December 2025, continuing an upward trend

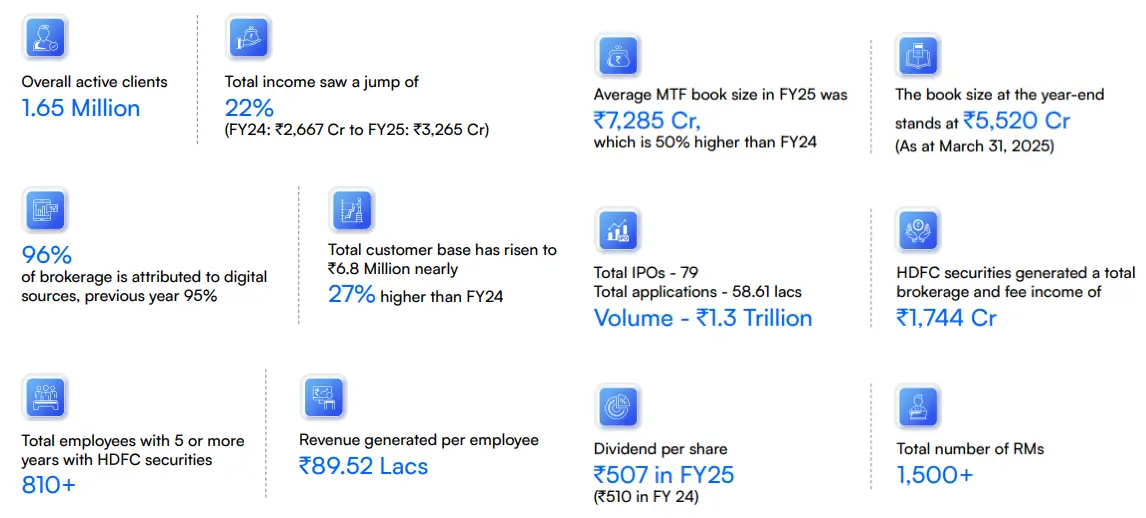

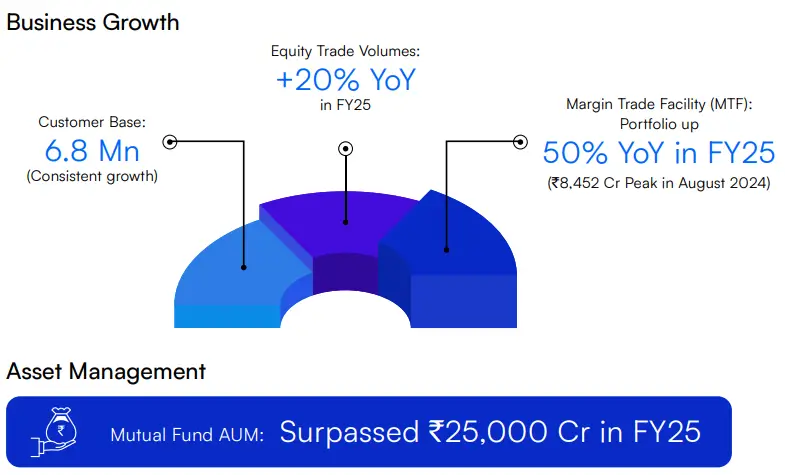

Key Highlights – FY 2024 – 25

- As of 31 March 2025, HDFC Securities’ total income amounted to INR 3,263.80 crore, up 22.69% from the previous year.

- HDFC Securities generated a total brokerage and fee income of INR 1,744.20 crore during FY 2025, with 84% of this brokerage coming from digital sources.

- The average book size under Margin Trade Funding (MTF) for FY 2025 stood at INR 8,343 crores, marking a 71.84% increase from INR 4,855 crores in the previous financial year.

- As of FY 2025, HDFC Securities facilitated a total of 79 IPOs, receiving 58.61 lakh applications and handling a transaction volume of INR 1.3 trillion.

Read Also: Biggest Unlisted Companies in India

HDFC Securities Business Performance Highlights

HDFC Securities Board of Directors

- Mr. Dhiraj Relli, CEO & Managing Director

- Mr. Ashish Kamalkishore Rathi, Whole Time Director

- Dr. (Mrs.) Amla Samanta, Independent Director

- Mr. Tarun Balram, Independent Director

- Mr. Neeraj Swaroop, Independent Director

- Mr. Malay Yogendra Patel, Independent Director

- Mr. Arvind Vohra, Nominee Director

- Mr. Samir Bhatia, Independent Director

Read Also: Hero FinCorp Unlisted Share Price

HDFC Securities Unlisted Share Details

| Name | HDFC Securities Unlisted Share Details |

| Face Value | INR 10 per share |

| ISIN Code | INE700G01014 |

| Lot Size | 4 shares |

| Demat Status | NSDL, CDSL |

| HDFC Securities Share Price | INR 9,600 per share |

| Market Cap | INR 17,061 crores |

| Total number of shares | 1,77,71,969 shares |

| Website | www.hdfcsec.com |

HDFC Securities Unlisted Share Details – Shareholding Pattern

The details of Shareholders holding more than 1% of shares as of 31 March 2025:

| Shareholder Name | % to Holding | No. of shares |

| HDFC Bank | 94.55 | 1,68,03,220 |

| Others | 5.45 | 9,68,749 |

Read Also: NSE Unlisted Share Price

HDFC Securities Unlisted Share Details – Financial Performance

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 1,891.27 | 2,660.12 | 3,263.80 |

| Revenue Growth (%) | (4.27) | 40.65 | 22.69 |

| Brokerage and Fee Income | 1,182.40 | 1,597.17 | 1,744.20 |

| Expenses | 849.73 | 1,389.30 | 1,768.96 |

| Net income | 777.22 | 950.89 | 1,124.46 |

| Margin (%) | 41.10 | 35.75 | 34.45 |

| ROCE (%) | 19.0 | – | – |

| ROE (%) | 43.0 | 50.0 | – |

| Debt/Equity | 2.92 | 4.70 | 2.37 |

| EPS | 489.84 | 597.35 | 635.21 |

HDFC Securities Annual Reports

HDFC Securities Annual Report FY 2024 – 2025

HDFC Securities Annual Report FY 2023 – 2024

HDFC Securities Annual Report FY 2022 – 2023

HDFC Securities Annual Report FY 2021 – 2022

HDFC Securities Unlisted Share Peer Comparison

| Company | 3-yr Sales CAGR (%) | Debt/Equity | PE Ratio | Net Margin (%) | MCap (INR crore) |

| HDFC Securities | 18.22 | 2.37 | 15.11 | 34.45 | 17,061 |

| ICICI Securities | 22.6 | 4.43 | 17.4 | 30.65 | 29,149 |

| Motilal Oswal Financial Services | 24.7 | 1.22 | 23.1 | 30.08 | 46,831 |

| Angel One | 31.7 | 0.77 | 29.8 | 22.37 | 22,975 |

HDFC Securities Unlisted Share FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is HDFC Securities unlisted share price?

HDFC Securities share price in grey market today is INR 9,600 per share. Shares are purchased in lots of 4 shares.

Who determines HDFC Securities unlisted share price?

HDFC Securities share price is determined by various factors, including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

When is the HDFC Securities IPO date planned?

There is no current information about the planned IPO of HDFC Securities, but here is some information about HDFC Bank’s subsidiary, HDB Financial Services.